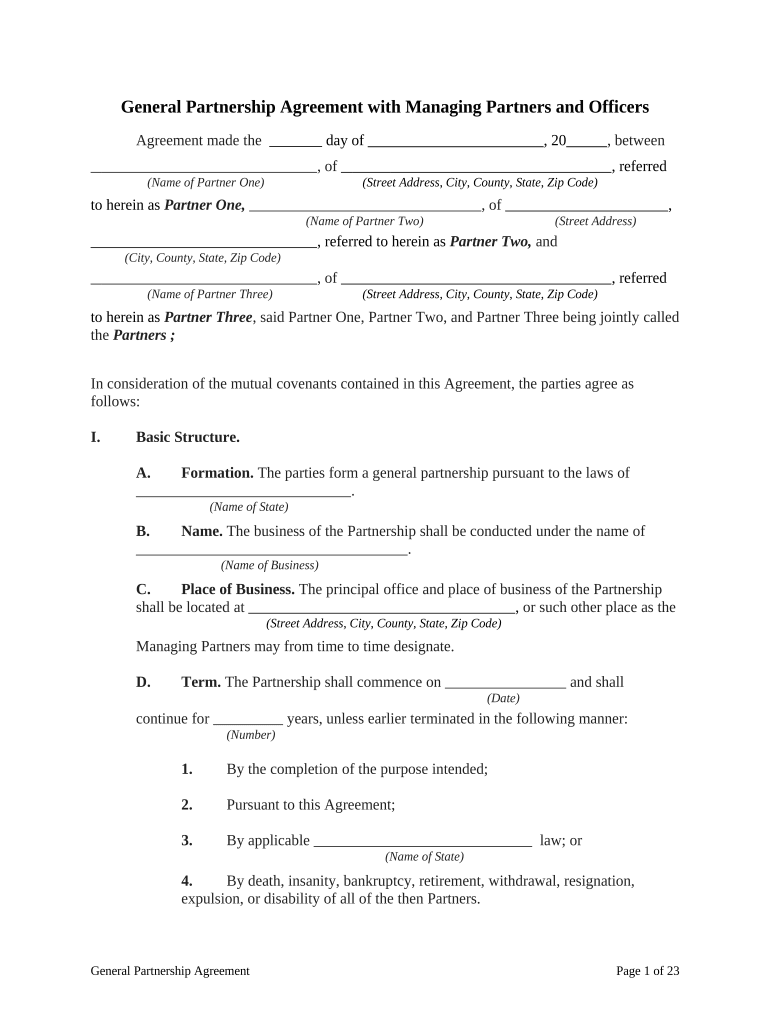

General Partnership Agreement with Managing Partners and Officers

Agreement made the day of , 20 , between

, of , referred

(Name of Partner One) (Street Address, City, County, State, Zip Code)

to herein as Partner One, , of ,

(Name of Partner Two) (Street Address)

, referred to herein as Partner Two, and

(City, County, State, Zip Code)

, of , referred

(Name of Partner Three) (Street Address, City, County, State, Zip Code)

to herein as Partner Three , said Partner One, Partner Two, and Partner Three being jointly called

the Partners ;

In consideration of the mutual covenants contained in this Agreement, the parties agree as

follows:

I. Basic Structure.

A. Formation. The parties form a general partnership pursuant to the laws of

.

(Name of State)

B. Name. The business of the Partnership shall be conducted under the name of

.

(Name of Business)

C. Place of Business. The principal office and place of business of the Partnership

shall be located at , or such other place as the

(Street Address, City, County, State, Zip Code)

Managing Partners may from time to time designate.

D. Term. The Partnership shall commence on and shall

(Date)

continue for years, unless earlier terminated in the following manner:

(Number)

1. By the completion of the purpose intended;

2. Pursuant to this Agreement;

3. By applicable law; or

(Name of State)

4. By death, insanity, bankruptcy, retirement, withdrawal, resignation,

expulsion, or disability of all of the then Partners.

General Partnership Agreement Page 1 of 23

E. Purpose. The purpose for which the Partnership is organized is

.

( Description of Purpose)

F. Investment Representations of Partners. Each Partner represents and warrants

that he or she is acquiring his or her interest in the Partnership for his or her own account,

for investment, and not with a view to the sale or distribution of the same.

G. Tax Matters Partner. The Partners agree that Partner One shall serve as the Tax

Matters Partner. Nothing in this Agreement shall be construed to restrict the Partnership

from engaging accountants or other professionals to assist the Tax Matters Partner in

discharging his or her duties under this Agreement.

II. Economic and Tax Arrangements.

A. Initial Contributions of Partners. Each Partner has contributed to the initial

capital of the Partnership property in the amount and form indicated on Exhibit A

attached to and made a part of this Agreement.

B. Partners' Percentage Share of Capital. The Initial Percentage Share of Capital

of each Partner shall be as follows:

.

(List of names of partners and corresponding percentage shares)

C. Interest. No interest shall be paid on any contribution to the capital of the

Partnership.

D. Return of Capital Contributions. No Partner shall have the right to demand the

return of his or her capital contributions except as provided in this Agreement.

E. Rights of Priority. The individual Partners shall have no right to any priority

over each other as to the return of capital contributions except as provided in this

Agreement.

F. Additional Capital Contributions. If at any time during the existence of the

Partnership it shall become necessary to increase the capital with which the Partnership is

doing business, then (upon the vote of the Managing Partners) each party to this

Agreement shall contribute to the capital of this Partnership, within days

(Number)

after notice of written request for the same, an amount according to his or her then

Percentage Share of Capital as called for by the Managing Partners.

G. Maintenance of Capital Accounts.

1. The Managing Partners shall allocate, for purposes of determining the

relative economic relationship among the Partners, the economic contributions to,

distributions from, income of and losses of the Partnership in accordance with the

Partners' Percentage Share of Capital.

General Partnership Agreement Page 2 of 23

2. The Managing Partners shall allocate, for tax purposes, the contributions

to, distributions from, income, losses, deductions and credits of the Partnership in

accordance with the Partners' Percentage Share of Capital.

H. Distributions. Each of the Partners may withdraw from the Partnership, for his or

her own use, a sum not to exceed $ per month. If, at the close of each fiscal

year, it is found that any Partner's share withdrawn by him or her is in excess of his or her

distributive share for that fiscal year, he or she shall immediately refund the difference

within a period not exceeding days from the time of such determination.

(Number)

Distributions to the Partners of net operating profits of the Partnership, as defined below,

shall be made at least monthly. Such distributions shall be made to the Partners

simultaneously. For the purpose of this Agreement, net operating profit for any

accounting period shall mean the gross receipts of the Partnership for such period, less

the sum of all cash expenses of operation of the Partnership, and such sums as may be

necessary to establish a reserve for operating expenses. In determining net operating

profit, deductions for depreciation, amortization, or other similar charges not requiring

actual current expenditures of cash shall not be taken into account . In any case,

% of Partnership income shall be left in the Partnership as a further

contribution of capital by each Partner.

I. Rights of the Partners upon Default of a Partner. Upon the refusal of any

Partner to make a capital contribution as required in this Agreement:

1. The Managing Partners shall notify, in writing, the remaining Partners of

any default no later than days following the date upon which the

(Number)

defaulted Partner's payment was originally due.

2. Any Partner, other than the defaulted Partner may, within days

(Number)

after the default, purchase the Partnership interest of the defaulted Partner by

notifying the Managing Partners and by making payment:

a. To the defaulted Partner, an amount equal to % of such

defaulted Partner's then capital, less the expenses incurred in the sale; and

b. To the Partnership, the amount of the capital contribution required

upon which the defaulting Partner defaulted.

3. Should more than one Partner notify the Managing Partners of an intention

to purchase the Partnership interest of the defaulting Partner, then each such

Partner desiring to purchase the defaulted Partner's interest may purchase that

portion according to such purchasing Partner's then percentage share of capital.

General Partnership Agreement Page 3 of 23

The purchase shall be made in accordance with the provisions of Subparagraph

2 above.

4. If no Partner desires to purchase the Partnership interest of the defaulted

Partner, the Managing Partners shall arrange for a private sale of such interest.

The defaulted Partner shall receive from the proceeds of the sale the sale amount

(but in any case not an amount which exceeds the book value of his or her capital

account on the date of sale of his or her interest) less any expenses incurred by the

Partnership in connection with the sale. The Partnership shall receive the

remainder of the proceeds of the sale, if any.

J. Compliance with Internal Revenue Code Section 704. Nothing in this

Agreement to the contrary withstanding, the rules of Internal Revenue Code Section

704(b) and of Regulation Section 1.704-1 shall be followed in determining the partner's

capital accounts.

III. Management.

A. Managing Partners

1. The Managing Partners shall be

.

(list of names of managing partners)

2. The Tax Matters Partner shall be Partner One.

B. Voting. All Managing Partners shall have the right to vote as to the management

and conduct of the business of the Partnership according to their then percentage share

of capital. Except as otherwise set forth in this Agreement, a majority of such capital

shall control.

C. Rights, Powers and Restrictions of Payments. No Partner without the consent

of all the other partners shall:

1. Do any act in contravention of this Agreement;

2. Do any act which would make it impossible to carry on the ordinary

business of the Partnership;

3. Confess judgment against the Partnership; or

4. Possess Partnership property, or assign his or her interest or rights in

specific Partnership property, for other than a Partnership purpose.

D. Powers. The Managing Partners shall have the following authority:

General Partnership Agreement Page 4 of 23

1. To purchase, invest in, reinvest in, or otherwise acquire, and to retain,

whether originally a part of the Partnership or subsequently acquired, any and all

stocks, bonds, notes, or other securities, or any variety of real or personal

property, including stocks or interests in investment trusts and common trust

funds operated and managed by a corporate trustee, as he or she may deem

advisable.

2. To obtain, sell and convey, mortgage, encumber, lease, exchange, pledge,

partition, plat, subdivide, improve, repair, surrender, abandon or otherwise deal

with or dispose of any and all property of any character and wherever situated

forming a part of this Partnership, at such time or times and in such manner and

upon such terms as, in the absolute and uncontrolled discretion of the Managing

Partners may be deemed expedient and proper; to give options for the same; to

execute deeds, transfers, leases, pledges, mortgages, and other instruments of any

kind. Any leases and contracts may extend beyond the term of the Partnership.

3. To borrow money upon terms acceptable from any person or corporation,

and to pledge or mortgage any property as security for the same and to renew any

indebtedness incurred by the Managing Partners.

4. To lend moneys to any person for any purpose related to the Partnership's

operations and investments upon any terms and conditions, provided that the same

shall:

a. As to loans secured by first liens on real estate and fixtures, not be

(i) for an amount in excess of % of fair market value; (ii) based

on a rate less than the then Applicable Federal Rate; or (iii) for a period of

longer than years.

(Number)

b. As to loans secured by tangible personal property and accounts

receivable less than days overdue, not be (i) for an amount in

(Number)

excess of % of fair market value; (ii) based on a rate less than

the then Applicable Federal Rate; or (iii) for a period of longer than

years.

(Number)

c. As to other loans, not be (i) for an amount in excess of

% of fair market value; (ii) based on a rate less than the then

Applicable Federal Rate; or (iii) for a period of longer than

(Number)

years.

5. To open and to close checking or savings accounts, in banks or similar

financial institutions, or safety deposit boxes in the name of a Managing Partner

or in the name of a nominee, with or without indication of any fiduciary capacity;

to deposit cash in and withdraw cash from such accounts or boxes, with or

General Partnership Agreement Page 5 of 23

without indication of any fiduciary capacity; to hold such accounts and securities

in bearer form, or in the name of a Managing Partner or in the name of a nominee

with or without indication of any fiduciary capacity.

6. To give general or special proxies or powers of attorney for voting or

acting in respect of shares or securities, which may be discretionary and with

power of substitution; to deposit shares or securities with, or transfer them to,

protective committees or similar bodies; and to join in any reorganization and to

pay assessments or subscriptions called for in connection with shares or securities

held by the Partnership.

7. To adjust, arbitrate, compromise, sue or defend, abandon or otherwise deal

with and settle any and all claims in favor of or against the Partnership as the

Managing Partners shall deem proper.

8. To employ investment counsel, brokers, accountants, attorneys, and any

other agents to act in his or her behalf; and generally to do any act or thing and

execute all instruments necessary, incidental or convenient to the proper

administration of the Partnership property.

9. To make payments, division, or distribution of the Partnership property

wholly or partly in kind.

10. To make employment contracts and pay pensions and establish pension

and other incentive plans for any or all of its employees; provided, that no

contract shall be made in favor of the Partners without the consent of

% of the Partners.

E. Liability. No Partner shall incur any liability for any mistakes or errors in

judgment made in good faith and in the exercise of due care in connection with the

Partnership business, and no Partner shall be deemed to have violated any of the

provisions of this Partnership Agreement for any such mistakes or errors in judgment.

F. Indemnification of Managing Partners and Tax Matters Partner. The

Managing Partners and Tax Matters Partner, when acting in their capacity as such, shall

be entitled to indemnity from the Partnership for any act performed by them within the

scope of the authority conferred on them by this Agreement, except for acts of

malfeasance or gross negligence or for damages arising from any misrepresentations;

provided, however, that any indemnity under this Section shall be provided out of and to

the extent of Partnership assets only, and no Partner shall have any personal liability with

regard to the indemnity.

G. Extent of Services. The Managing Partners shall devote their entire time,

attention, and energies to the business of the Partnership, and shall not during the term of

this Agreement be engaged in any other business activity whether or not such business

activity is pursued for gain, profit, or other pecuniary advantage, without the prior written

General Partnership Agreement Page 6 of 23

consent of the Partner first obtained; but this shall not be construed as preventing the

Managing Partners from investing, when such investment will not interfere with the

Managing Partners full time employment by the Partnership.

H. Removal.

1. Some or all of the Managing Partners may be removed as

Managing Partners by the Partners, but only if:

(description of circumstances

; provided, however, that

justifying removal of managing partner)

a -day notice must be given to the Managing Partners spelling out to

(Number)

the Managing Partners those acts which have caused such removal. The moving

Partner shall, in writing, submit to all of the Partners the basis upon which he or

she seeks removal of the Managing Partner and the name of another person or

corporation as the proposed successor Managing Partner of the Partnership. If,

within days after the submission of the allegation and the proposal of

(Number)

substitution to all of the Partners, the Partners owning an aggregate of at least

of the total capital approve such removal and

(fraction of ownership)

proposed Partner substitution in writing, the person so proposed shall be admitted

as a Managing Partner.

2. The Tax Matters Partner may be removed as Tax Matters Partner by the

Partners, but only if ;

(description of circumstances justifying removal of tax matters partner)

provided, however, that a -day notice must be given to the Tax Matters

(Number)

Partner spelling out to the Tax Matters Partner those acts which have caused such

removal. The moving Partner shall, in writing, submit to all of the Partners the

basis upon which he or she seeks removal of the Tax Matters Partner and the

name of another person as the Tax Matters Partner. If, within days

(Number)

after the submission of the allegation and the proposal of substitution to all of the

Partners, the Partners owning an aggregate of at least of the

(fraction of ownership)

total approve such removal and proposed Partner substitution in

(capital)

writing, the person so proposed shall be admitted as the Tax Matters Partner.

IV. Meetings of Partners.

A. Annual Meetings of Partners. Annual meetings of Partners, if actually held,

shall be held on such date and time as shall be designated from time to time by the

General Partnership Agreement Page 7 of 23

Partners and stated in the notice of the meeting, at which they shall transact such other

business as may properly be brought before the meeting. Written notice of the annual

meeting stating the place, date and hour of the meeting shall be given to each Partner

entitled to vote at such meeting not less than nor more than days

(Number) (Number)

before the date of the meeting.

B. Special Meetings. Special meetings of Partners, for any purpose or purposes, may

be held by waiver of notice and consent or may be called by a Managing Partner and

shall be called by a Managing Partner at the request in writing of a Partner owning not

less than % of the entire capital or profit interest of the Partnership. Such

request shall state the purpose or purposes of the proposed meeting. Written notice of a

special meeting stating the place, date and hour of the meeting and the purpose or

purposes for which the meeting is called, shall be given not less than nor

(Number)

more than days before the date of the meeting, to each Partner entitled to

(number of days)

vote at such meeting. Business transacted at any special meeting of Partners shall be

limited to the purposes stated in the notice unless all of the Partners agree otherwise.

C. Voting. Whenever the vote of Partners at a meeting of the Partners is required or

permitted to be taken for or in connection with any action, a majority shall control and

the meeting and vote of Partners may be dispensed with if all of the Partners who would

have been entitled to vote upon the action if such meeting were held shall consent in

writing to such action taken.

V. Managing Partners. Managing Partner vacancies shall be filled by a vote of the

A. Vacancies. Partners at a special meeting called for such purpose.

B. Voting. A Managing Partner who is either present at a meeting of the Managing

Partners at which action on any matter is taken, or who is absent but has notice of such

action by certified mail, shall be presumed to have assented to the action taken unless his

or her dissent shall be entered in the minutes of the meeting or unless he or she shall file

his or her written dissent to such action with the person acting as the secretary of the

meeting before the adjournment of the meeting or shall forward such dissent by certified

mail to the other Managing Partners immediately after the adjournment of the meeting or

within days after written notification of such action by certified mail. The

(Number)

objection shall be deemed made when mailed by certified mail. Such right to dissent shall

not apply to a Managing Partner who voted in favor of such action.

C. Managing Partner Meetings. The Managing Partners may hold meetings, both

regular and special, either within or without . Regular

(Name of State)

General Partnership Agreement Page 8 of 23

meetings of the Managing Partners may be held without notice at such time and at such

place as shall from time to time be determined by the Managing Partners. Special

meetings of the Managing Partners may be called by the secretary on day's

(Number)

notice to each Managing Partner, either personally or by mail or by telegram; special

meetings shall be called by the secretary in like manner and on like notice on the written

request by of the Managing Partners. At all meetings of the Managing

(Number)

Partners, a majority of the Managing Partners shall constitute a quorum for the

transaction of business and the act of a majority of the general Partners present at any

meeting at which there is a quorum shall be the act of the Managing Partners. If a quorum

shall not be present at any meeting the Managing Partners present may adjourn the

meeting from time to time, without notice other than announcement at the meeting, until

a quorum shall be present. Any action required or permitted to be taken at any meeting of

the Managing Partners may be taken without a meeting, if all the Managing Partners

consent in writing.

D. Officers.

1. Each year the Managing Partners shall elect from their number a

president, a secretary and a treasurer. The term of office of all officers shall be

one year or until their respective successors are chosen, but any officer may be

removed from office, with or without cause.

2. The president shall execute all authorized conveyances, contracts, or other

obligations in the name of the Partnership except where the signing and execution

shall be delegated by the Managing Partners to some other officer or agent. He or

she shall preside at all meetings of the Partners and Managing Partners.

3. The secretary shall attend all meetings of the Partnership and record all

votes and the minutes of all proceedings in a book to be kept for that purpose and

shall perform like duties for the standing committees when required. He or she

shall give, or cause to be given, notice of all meetings of the Partners and

Managing Partners. He or she shall execute with the president all authorized

conveyances, contracts or other obligations in the name of the Partnership except

as otherwise directed by the Managing Partners. The secretary shall keep a

register of the post office address of each Partner. The address shall be furnished

to the secretary by such Partner and the responsibility for keeping the address

current shall be upon the Partner.

4. The treasurer shall have custody of and keep account of all money, funds

and property of the Partnership unless otherwise determined by the Managing

Partners, and he or she shall render such accounts and present such statements to

the Managing Partners and president as may be required of him or her. He or she

shall deposit funds of the Partners which may come into his or her hands in such

bank or banks as the Managing Partners may designate. He or she shall keep his

General Partnership Agreement Page 9 of 23

or her bank accounts in the name of the Partnership and shall exhibit his or her

books and accounts at all reasonable times to any Managing Partner. If required

by the Managing Partners, he or she shall give the Partnership a bond in such sum

and with such surety or sureties as shall be satisfactory to the Managing Partners

for the faithful performance of the duties of his or her office and for the

restoration to the Partnership, in case of his or her death, resignation or removal

from office, of all books, papers, vouchers, money and other property of whatever

kind in his or her possession or under his or her control belonging to the

Partnership.

E. Right to Admit Partners. There shall be no right to admit additional Partners,

except by unanimous consent of all of the Partners.

F. Removal of Managing Partners. Some or all of the Managing Partners may be

removed as Managing Partners by the Partners if:

(description of circumstances justifying

; provided, however, that a -days' notice

removal of managing partner) (Number)

must be given to the Managing Partners spelling out to the Managing Partners those acts

necessarily constituting violation of at which time

( citation of statute)

the Managing Partner may, within the notice period, take the necessary steps to cure any

violation or default and remain as Managing Partner.

G. Tax Matters Partner.

1. Name. The Tax Matters Partner shall be ,

(Name)

who shall be succeeded upon death or unwillingness or inability to act as shall be

determined by the Managing Partners.

2. Duties. The Tax Matters Partner shall have the following rights and

duties:

a. To provide to the Internal Revenue Service any or all information

which is within the knowledge of the Tax Matters Partner as to the

organization, operations or liquidation of the Partnership.

b. To adjust, arbitrate, negotiate, compromise, sue or defend, abandon

or otherwise deal with and settle any and all claims in favor of or against

the Partners and the Partnership as the Tax Matters Partner shall deem

proper which shall directly relate to the organization, operations and/or

liquidation of the Partnership.

General Partnership Agreement Page 10 of 23

c. To do all other things which may be granted to the Tax Matters

Partner by Internal Revenue Code Sections 6221 through 6232, as they

may be now or are in the future amended or supplemented.

VI. Right to Assign Partnership Interest

A. Partner's Right of Assignment of Profits and Losses. Except as provided in this

Agreement, the Partnership interest shall not be assigned.

B. Transfers. The Partners shall not sell, assign, pledge or otherwise transfer or

encumber in any manner or by any means whatever, and share in all or any part of the

interests of the Partnership now owned or later acquired by them without having first

obtained the consent of or offered it to the other Partners and to the Partnership in

accordance with the terms and conditions of this Agreement.

C. Spouses Bound by Agreement. The following spouses shall be obligated as

follows: . Upon a triggering event, the

(list of names of spouses)

Partner's respective spouse shall be obligated to give to the Partnership or the Partners, as

the case may be, an option (whether or not the Partner is required to be bought out) to

purchase the capital interest of the relevant spouse on the same terms and conditions as

are set forth in this Agreement, given the triggering event in question. For these purposes,

insurance paid in connection with this Agreement shall not be used for a purchase

pursuant to this Section or taken into account in determining the payment terms to be

used in buying out the spouse.

D. Joint Ownership. It is understood by the parties that the interest owned by some

of the Partners is owned jointly by the Partner and his or her spouse. The parties agree

that the spouses of the respective Partners shall in all respects be bound by this

Agreement and that if a Partner is required to sell his or her interest pursuant to this

Agreement, the respective spouse must comply with this Agreement and shall execute

any and all documents consequently required. It is further understood that the provisions

of this Agreement which trigger an option or obligation to sell an interest of the

Partnership refer only to events relating to the Partners and will have no force or effect

upon events relating to their respective spouses.

E. Offer to Partner.

1. Bona Fide Offer. If any Partner is in receipt of a bona fide offer to

purchase his or her interest, and shall desire to sell, assign, transfer or otherwise

dispose of his or her interest without the prior written consent of the other

Partners, he or she shall serve notice to such effect upon the other Partners and the

Partnership by registered or certified mail, return receipt requested, and the notice

shall indicate the name and address of the person desiring to purchase the same

and the price and terms of payment upon which the sale is proposed. The notice

shall also imply an offer to sell such interest to the other Partners and to the

General Partnership Agreement Page 11 of 23

Partnership upon the same payment terms as the proposed sale, or upon the same

payment terms as the proposed sale, or upon the following price and terms.

2. Price. The purchase price paid for such interest shall be as set forth in

Paragraph K, below.

3. Terms. The purchase price of the interest of a Partner shall be paid as set

forth in Paragraph L, below.

4. Mechanics. Upon such event, the Partnership shall have the rights and

duties and the Partners shall have the rights and duties to purchase the interests of

the relevant Partners using the mechanics set forth in Paragraph M, below.

F. Partner Desires to Sell.

1. Notice of Desire to Sell. If any Partner, not in receipt of a bona fide offer,

shall desire to dispose of his or her interest, dissolve, make an assignment for the

benefit of creditors, be adjudicated bankrupt or legally incapacitated, then at least

days prior to the date he or she is to dispose of his or her interest, he

(Number)

or she shall serve notice upon the other Partners and upon the Partnership by

registered or certified mail, return receipt requested. The notice must contain an

offer to sell such interest to the other Partners and to the Partnership upon the

following price and terms.

2. Price. The purchase price paid for such interest shall be as set forth in

Paragraph K, below.

3. Terms. The purchase price of the interest of a Partner shall be paid as set

forth in Paragraph L, below.

4. Mechanics. Upon such event, the Partnership shall have the rights and

duties and the Partners shall have the rights and duties to purchase the interests of

the relevant Partners using the mechanics set forth in Paragraph M, below.

G. Disability.

1. If any Partner is, by reason of illness, injury or disability, unable to carry

on his or her normal duties in the conduct of the Partnership business, then such

inactive Partner shall be deemed permanently disabled and shall be deemed to

have offered his or her capital interest as follows. Such disability shall be deemed

to have occurred upon the following event:

( E.G. The Partner receives disability benefits

.

under the terms of any disability income policy held on his or her health)

2. Price. The purchase price paid for such interest shall be as set forth in

Paragraph K, below.

General Partnership Agreement Page 12 of 23

3. Terms. The purchase price of the interest of a Partner shall be paid as set

forth in Paragraph L, below.

4. Mechanics. Upon such event, the Partnership shall have the rights and

duties and the Partners shall have the rights and duties to purchase the interests of

the relevant Partners using the mechanics set forth in paragraph M, below.

H. Death.

1. Sale. Upon the death of any Partner, the entire interest of such

deceased. Partner, and the estate of the decedent in the Partnership, shall be

offered for sale as follows.

2. Life Insurance.

a. Insured Partners. Since the Partnership has arranged to provide

funds needed to acquire the interest of any of the Partners through life

insurance policies on their respective lives, it is agreed that the Partnership

shall secure life insurance at its own expense, on the lives of the Partners

and in the amounts set forth in the attached Exhibit A. It is understood

that the policies shall represent a source of funds necessary to cover, in the

event of death, the purchase price of the interest respectively owned by

each Partner, as provided in this Section. The owner shall pay all

premiums due on the policies and shall be the sole owner of the policies.

Any party shall have the right to insure at any time the life of a Partner, or

anyone who may become, or be deemed to be, a party to this Agreement,

for an amount or amounts in excess of the amount or amounts needed to

fully purchase his or her respective interest.

b. Uninsured Partners.

(Name of uninsured partner)

is not being insured because it is understood that (he/she) is uninsurable.

If should die, the cash value

(Name of uninsured partner)

of the policies, if any, on the lives of the other Partners shall be available

as a source of liquidity toward the purchase of the capital interest of

.

(Name of uninsured partner)

c. Modification of Insurance. The owner shall only modify or

impair the rights or values under such policies with the mutual consent of

the parties to this Agreement.

d. Applicable Insurance. Only insurance policies listed in this

Agreement, or written amendments or written supplements to this

General Partnership Agreement Page 13 of 23

Agreement, shall be included as insurance held pursuant to this

Agreement.

3. Price. The redemption or purchase price paid for such interest shall be as

set forth in Paragraph K, below.

4. Terms. The purchase price of the interest of a Partner shall be paid as set

forth in Paragraph L, below.

5. Mechanics. Upon such event, the Partnership shall have the rights and

duties and the Partners shall have the rights and duties to purchase the interests of

the relevant Partners using the mechanics set forth in Paragraph M, below.

I. Retirement or Withdrawal before Normal Retirement.

1. If any Partner's employment with the Partnership voluntarily or

involuntarily is terminated before age , then such

(Normal Age of Retirement)

event shall constitute an implied offer to sell his or her interest under the

following price and terms.

2. Price. The purchase price paid for such capital interest shall be as set forth

in Paragraph K, below.

3. Terms. The purchase price of the interest of a Partner shall be paid as set

forth in Paragraph L, below.

4. Mechanics. Upon such event, the Partnership shall have the rights and

duties and the Partners shall have the rights and duties to purchase the relevant

Partner's interest using the mechanics set forth in Paragraph M, below.

5. Expulsion. If in the opinion of a majority in interest of the Partners, any

Partner shall be guilty of misconduct of such character as to render it

impracticable for the then Partners to carry on the Partnership business together,

the offending Partner may be expelled from the Partnership.

J. Retirement or Withdrawal after Age .

(Normal Age of Retirement)

1. If any Partner voluntarily or involuntarily terminates employment with the

Partnership after age , such event shall constitute

(Normal age of retirement)

an implied offer to sell his or her interest under the following price and terms.

2. Price. The purchase price paid for such interest shall be as set forth in

Paragraph K, below.

General Partnership Agreement Page 14 of 23

3. Terms. The purchase price of the interest of a Partner shall be paid as set

forth in Paragraph L, below.

4. Mechanics. Upon such event, the Partnership shall have the rights and

duties and the Partners shall have the rights and duties to purchase the interest of

the relevant Partners as set forth in paragraph M, below.

K. Price.

1. The purchase price paid for an interest pursuant to the terms of this

Agreement shall be calculated as follows:

a. The Partner's Partnership Value shall be determined by

multiplying the Partner's Percentage Share of capital by the total

Partnership Value determined by the process set forth below.

b. From such Partnership Value shall be subtracted any adjustments

to be made pursuant to this Partnership Agreement to such Partner's

Capital Account upon the liquidation of the Partnership or upon the sale or

redemption of a Partnership interest for the fiscal year of the Partnership in

question .

2. Book Value. The book value of the Partnership shall be computed in

accordance with generally accepted accounting practices as consistently used by

the Partnership in preparation of its financial statements, as of the close of

business on the last day of the month preceding the month in which the triggering

event occurs, to reflect the fair market value of all assets of the Partnership,

accounts receivable and current liabilities not reflected on the books of the

Partnership, other than goodwill, if any.

3. Tax Reserve. The above sum shall be reduced by a reserve equal in

amount to % of the Partnership's accountant's reasonable estimate of

the federal and state income taxes which will be payable by the purchaser as a

result of the fact that the purchaser will not receive a deduction for the purchase

of the selling Partner's interest.

4. Loan Payment. In addition to such purchase price, there shall be a

repayment by the Partnership of the then outstanding balance of any sum then

loaned to the Partnership by the withdrawing Partner (plus accrued interest, if

any) whether or not the sums shall be then due and owing.

5. Unbooked Work. Such purchase price shall take into account the

Partner's pro rata share of profit to be derived from unbilled and unbooked work,

whether or not in process (based on the results of fiscal year.

(e.g., the last)

General Partnership Agreement Page 15 of 23

6. Allocation of Assets to be Distributed upon a Triggering Event

under Section 736 of the Internal Revenue Code. Upon a triggering event, the

selling Partner shall receive the following sums which shall be divided by his or

her share of Partnership capital:

For his or her Partnership assets: ;

(description of amount or formula)

For Partnership goodwill: ;

( description of amount or formula)

For his or her share of Partnership income:

(description of formula which is

; and

conditioned upon partnership income)

As a payment in the form of mutual insurance (i.e., a guaranteed payment

not for assets): .

(description of amount or formula)

L. Terms.

1. The purchase price of the capital interest of a Partner shall be paid in the

following manner:

a. Years Certain. In the event of a purchase of the interest of a

Partner, a down payment of % of the purchase price shall be

made in the year of sale. The balance of the purchase price shall be paid

in of equal monthly payments interest on the

(Number) (including or plus)

unpaid balance over years. Interest shall commence

(Number) (Number)

days after the Partnership or the remaining Partners are required to buy the

interest of the selling Partner.

b. Payment Amount Certain. In the event of a purchase of the

interest of a Partner, a down payment of % of the purchase

price shall be made in the year of sale. The balance of the purchase price

shall be paid in equal monthly installments of $ per month,

interest on the unpaid balance at the rate of %

(including or plus)

per annum. Interest shall commence days after the Partnership

(Number)

or the remaining Partners are required to buy the interest of the selling

Partner.

2. Substantial Transfer. Provided, however, that if the purchasing Partner

shall transfer or cause to be transferred substantially all of the assets of the

Partnership or the interest owned by him or her or if he or she shall take a salary

such as shall jeopardize the payment of the sums owed under this Agreement

General Partnership Agreement Page 16 of 23

(without making arrangements to insure the payments) then the remainder of the

purchase price shall become fully due and payable.

M. Mechanics.

1. Mandatory Purchase. Offers made to the Partnership and Partners upon

shall be subject to the following

(description of triggering event)

mechanics: the selling Partner or his or her representative shall give notice of such

event, and for a period of days after the mailing of such notice, the

(Number)

Partnership shall have the right to notify the selling Partner of its exercise of the

option to purchase the interest so offered even in such cases where the Partnership

shall not be obligated to act and shall notify the party that it will purchase in the

event of death. If the Partnership has the option and does not elect to redeem the

full amount of the interest, then the other Partners shall be required to purchase all

of the interest so offered in proportion to their respective capital interests, unless

they otherwise agree to a different percentage, within days after the

(Number)

termination of the Partnership's option to buy. In all cases, the closing shall take

place within of days after the date on which the Partnership or the

(Number)

other Partners become obligated to purchase the interest of the selling Partner at

.

2. Optional Purchase. Offers made to the Partnership and Partners in the

event of shall be subject to the

(description of event)

following mechanics: the selling Partner or his or her representative shall give

notice of such event and for a period of days after the mailing of such

(Number)

notice, the Partnership shall have the right to notify the selling Partner of its

exercise of the option to redeem the interest so offered. If the Partnership does not

elect to redeem the full amount of the interest offered, the other Partners shall

have the option to purchase all (but not part) of the interest so offered in b to their

respective capital interests, unless they refuse to exercise their option or otherwise

agree to a different percentage, within days after the termination of the

(Number)

Partnership's option to buy. If none of the other Partners or the Partnership shall

exercise the option to purchase as provided in this Section, the offering Partner

shall be free to dispose of his or her interest subject to the following restrictions:

a. Effect on Transferor. The transferor shall continue to be bound

by the terms and provisions of this Agreement to the extent to which

triggering events which relate to the transferor shall trigger the offer or

sale of the interest.

General Partnership Agreement Page 17 of 23

b. Effect on Transferee. The transferee shall be bound by the terms

and provisions of this Agreement to the extent to which triggering events

which relate to the transferee shall trigger the offer or sale of the interest.

For purposes of determining who shall be entitled to purchase or is bound

to purchase the interest offered or to be sold, the transferee shall be so

entitled or bound. In all cases, the closing shall take place days

(Number)

from the date on which the Partnership or the other Partners become

obligated to purchase the interest of the selling Partner at

.

(Street Address, City, County, State, Zip Code)

N. Substitution of Additional Partners. Notwithstanding anything in this

Agreement to the contrary, the assignee (including, but not limited to, any transferee or

purchaser) of the whole or any part of the Partnership interest shall not be substituted as a

Partner without prior written consent of the Managing Partners. In no event shall the

consent of the Managing Partners be given unless such assignee, as a condition precedent

to such consent, has:

1. Accepted and assumed, in a form satisfactory to the Managing Partners,

all terms and provisions of this Agreement;

2. Provided a certified copy of a resolution of its board of directors

approving the terms and provisions of this Agreement (if the assignee is a

corporation);

3. Executed such other documents or instruments as may be required in order

to effectuate its admission as a Partner; provided an opinion of counsel, in form

and substance satisfactory to counsel for the Partnership, that neither the offering

nor the assignment of the Partnership interest violates any provision of any federal

or state securities law; and executed a statement that he or she is acquiring his or

her interest in the Partnership for his or her own account for investment, and not

with a view to sale or distribution;

4. Executed such other documents or instruments as the Managing Partners

may reasonably require in order to effectuate the admission of such assignee as a

Partner; and

5. Paid such reasonable expenses, which expenses are estimated to be

$ , as may be incurred in connection with such admission as a

Partner.

O. Death, Dissolution, Withdrawal, Etc. The death, dissolution, withdrawal,

assignment for the benefit of creditors, retirement, adjudication of bankruptcy or legal

incapacity of a Partner shall not dissolve or terminate the Partnership. Upon any such

event the financial interest of such Partner and all rights and obligations under this

General Partnership Agreement Page 18 of 23

Agreement shall descend to and invest in the heirs, legatees or legal representatives of

such Partner. Such heirs, legatees or legal representatives may be

in accordance with the provisions of this

(admitted as substituted Partners or bought out)

Agreement.

P. Sale of More Than 50% in Any 12-Month Period. No assignment of any

Partnership interest shall be effective if such assignment would result in there having

occurred within a 12-month period a sale or exchange of 50% or more of the total interest

in the Partnership capital and profits.

VII. Liquidation.

A. Dissolution. If the Partnership is dissolved for any reason, a full and general

account of its assets, liabilities and transactions shall at once be taken. Such assets may

be sold and turned into cash as soon as possible and all debts and other amounts due the

Partnership collected. The proceeds then shall be applied as follows:

1. To discharge the debts and liabilities of the Partnership and the expenses

of liquidation;

2. To pay each Partner or his or her legal representative any unpaid salary,

drawing account, interest or profits to which he or she shall then be entitled and,

in addition, to repay to any Partner his or her capital contributions in excess of his

or her original capital contribution;

3. To divide the surplus, if any, among the Partners or their representatives as

follows:

a. First (to the extent of each Partner's then capital account) in

proportion to their then capital accounts;

b. Then according to each Partner's then Percentage Share of capital .

B. Special Allocations. Notwithstanding anything in this Agreement to the

contrary, Internal Revenue Code Section 704 and Regulation Section 1.704, as

amended, shall be followed upon liquidation of the Partnership.

C. Right to Demand Property. No Partner shall have the right to demand and

receive property in kind for his or her distribution.

VIII. Miscellaneous Substantive Provision.

A. Fiscal Year; Books; Annual Financial Statements. The Partnership's fiscal year

shall commence on of each year and end on

(beginning date of fiscal year)

General Partnership Agreement Page 19 of 23

of each year. Full and accurate books of account shall

(end date of fiscal year)

be kept at such place as the Managing Partners may from time to time designate, showing

the condition of the business and finances of the Partnership; and each Partner shall have

access to such books of account and shall be entitled to examine them at any time during

ordinary business hours. At the end of each year, the Managing Partners shall cause the

Partnership's accountant to prepare a balance sheet setting forth the financial position of

the Partnership as of the end of that year and a statement of operations (income and

expenses) for that year. A copy of the balance sheet and statement of operations shall be

delivered to each Partner as soon as it is available. Each Partner shall be deemed to have

waived all objections to any transaction or other facts about the operation of the

Partnership disclosed in such balance sheet or statement of operations unless he or she

shall have notified the Managing Partners in writing of his or her objectives within

days of the date on which such statement is mailed. The Partnership books

(Number)

shall be kept on the basis and in accordance with generally accepted

(cash or accrual)

accounting principles consistent with those employed for determining its income for

federal income tax purposes. Upon the transfer of any existing interest in the Partnership,

the Partnership shall terminate its tax year as of the day after such transfer.

B. Partnership's Agents. Pursuant to the Partnership's day to day activity the

Managing Partners shall have the power to employ investment counsel, brokers,

accountants, attorneys, and any other agents to act in the Partnership's behalf, generally to

do any act or thing and execute all instruments necessary, incidental or convenient to the

proper administration of the Partnership property; otherwise the employment shall only

be made if agreed to by all the Partners.

C. Transfers to Living Trusts. For purposes of this Agreement, any Partner may

transfer his or her interest to the Partner's living trust. Upon such transfer, legal title shall

rest in such living trust but such interest shall be subject to the same events and

circumstances as if the transferring Partner continued to own such interest. Further, the

transferring Partner shall continue to exercise all rights and be liable for all duties

imposed by this Agreement.

D. Checks. All checks or demands for money and notes of the Partnership shall be

signed by the Managing Partners or such other person or persons as the Managing

Partners may from time to time designate.

E. Conflicts of Interest. Partners may engage in or possess an interest in other

business ventures of every kind and description for their own accounts. Neither the

Partnership nor any of the Partners shall have any rights by virtue of this Agreement in

such independent business ventures or to the income or profits derived from such

businesses. All Partners are to devote their full employment time to the business and

affairs of the Partnership.

General Partnership Agreement Page 20 of 23

F. Use of Name. The name “ ” shall belong

(Name of Partnership)

to and may be used by the Partnership and shall not be sold or disposed of so long as the

Partnership shall continue in existence. In the event of the death, retirement, or

withdrawal of any of the Partners during the term of the Partnership, the deceased,

retiring or withdrawing Partner shall have no interest in the firm name and shall have no

right to receive any payment for the name. Upon dissolution or termination of the

Partnership, the Partnership name [may be disposed of or shall become the property of

] .

(Name of Partner)

G. Use of Individual Name in Firm Name.

(Name of Partner)

agrees that will permit the Partnership to continue the use of

(he/she) (his/her)

name within the name of the firm; provided, however, the name is so used as not to make

liable for or chargeable with any of the liabilities

(Name of Partner)

of the business to be conducted by the Partnership. The Partnership shall fully indemnify

and hold harmless from any such liabilities,

(Name of Partner)

including any legal fees to defend the same.

IX. Other Miscellaneous Provisions.

A. Execution in Counterpart. This Partnership Agreement may be executed

in any number of counterparts, each of which shall be taken to be an original. Valid

execution shall be deemed to have occurred when a Partnership signature page is

executed by the Partner in question and countersigned by a Managing Partner.

B. Indemnification. The Partnership shall indemnify any person who is made, or

threatened to be made, a party to any action, suit or proceeding (whether civil, criminal,

administrative or investigative) by reason of the fact that he or she, his or her testator or

intestate is or was a manager, employee or agent of the Partnership or serves or served

any other enterprise at the request of the Partnership as follows:

(e.g., to the full extent permitted by law/to the extent to which such Partner was not acting with gross

;

negligence or willful or wanton disregard of either this partnership Agreement or the criminal statutes)

provided, however, that any indemnity under this paragraph shall be provided out of and

to the extent of partnership assets only, and no partner shall have any personal liability

with regard to the indemnity.

C. Notice. Any and all notices provided for in this Agreement shall be given in

writing by registered or certified mail, return receipt requested, which shall be addressed

to the last address known to the sender or delivered to the recipient in person.

General Partnership Agreement Page 21 of 23

D. Modifications. No modification of this Agreement shall be valid unless such

modification is in writing and signed by the parties to this Agreement.

E. Opinion of Counsel. The doing of any act or the failure to do any act by any

Partner (the effect of which may cause or result in loss or damage to the Partnership), if

pursuant to opinion of legal counsel employed by the Managing Partners on behalf of the

Partnership, shall not subject such Partner to any liability. Further, the Managing Partners

shall not be liable for any error in judgment or any mistake of law or fact or any act done

in good faith in the exercise of powers and authority conferred upon them, but shall be

liable only for gross negligence or willful default.

F. Additional Instruments. This Agreement shall be binding upon the parties to this

Agreement and upon their heirs, executors, administrators, successors or assigns, and the

parties agree for themselves and their heirs, executors, administrators, successors and

assigns to execute any and all instruments in writing which are or may become necessary

or proper to carry out the purpose and intent of this Agreement.

G. Amendments. This Agreement may be altered at any time by the decision of

Partners holding not less than of the then capital of the

(three-quarters or two-thirds)

Partnership confirmed by an instrument in writing, which instrument the Partners now

agree to execute.

H. Banking. The Partnership shall maintain a bank account in the Partnership's name

in a national or state bank in . Checks and drafts shall be

(Name of State)

drawn on the Partnership's bank account for Partnership purposes only and shall be

signed by the Managing Partners, or their designated agent.

I. Titles and Subtitles. Titles of the Sections, paragraphs and subparagraphs of this

Agreement are for convenient reference only and shall not to any extent have the effect of

modifying, amending or changing the express terms and provisions of this partnership

Agreement.

J. Words and Gender or Number. As used in this Agreement, unless the context

clearly indicates the contrary, the singular number shall include the plural, the plural the

singular, and the use of any gender shall be applicable to all genders.

K. Severability. If any parts of this Agreement are found to be void, the remaining

provisions of this Agreement shall remain binding with the same effect as though the

void parts were deleted.

L. Effective Date. This Agreement shall be effective only upon execution by all of

the proposed Partners.

General Partnership Agreement Page 22 of 23

M. Execution. This Agreement may be executed by each of the Partners on a

separate signature page.

N. Waiver. No waiver of any provisions of this Agreement shall be valid unless in

writing and signed by the person or party against whom charged.

O. Applicable Law. This Agreement shall be subject to and governed by the laws of

.

(Name of State)

P. Agreement Binding. This Agreement shall be binding upon and inure to the

benefit of the parties and their respective heirs, legal representatives, executors,

administrators, successors and assigns.

Q. Arbitration. No civil action concerning any dispute arising under this Agreement

shall be instituted before any court and all such disputes shall be submitted to final and binding

arbitration under the auspices of the American Arbitration Association, ,

(Name of City)

. Such arbitration shall be conducted in accordance with the rules

(Name of State)

of such association before a single arbitrator. The parties agree that the capital interests of the

Partnership cannot be readily sold in the open market, and for that reason among others, the

parties will be irreparably damaged if this Agreement is not specifically enforced. Therefore, in

addition to any award of damages, any such award may, in the discretion of the arbitrator,

specify specific performance of this Agreement. All costs and expenses of the arbitration,

including actual attorney's fees, shall be allocated among the parties according to the arbitrator's

discretion. The arbitrator's award resulting from such arbitration may be confirmed and entered

as a final judgment in any court of competent jurisdiction and enforced accordingly.

WITNESS our signatures as of the day and date first above stated.

By: By:

(Signature of Partner) (Signature of Partner)

(P rinted Name of Partner) (P rinted Name of (Partner)

(Signature of Partner)

(P rinted Name of Partner)

(Attachment of exhibits)

General Partnership Agreement Page 23 of 23