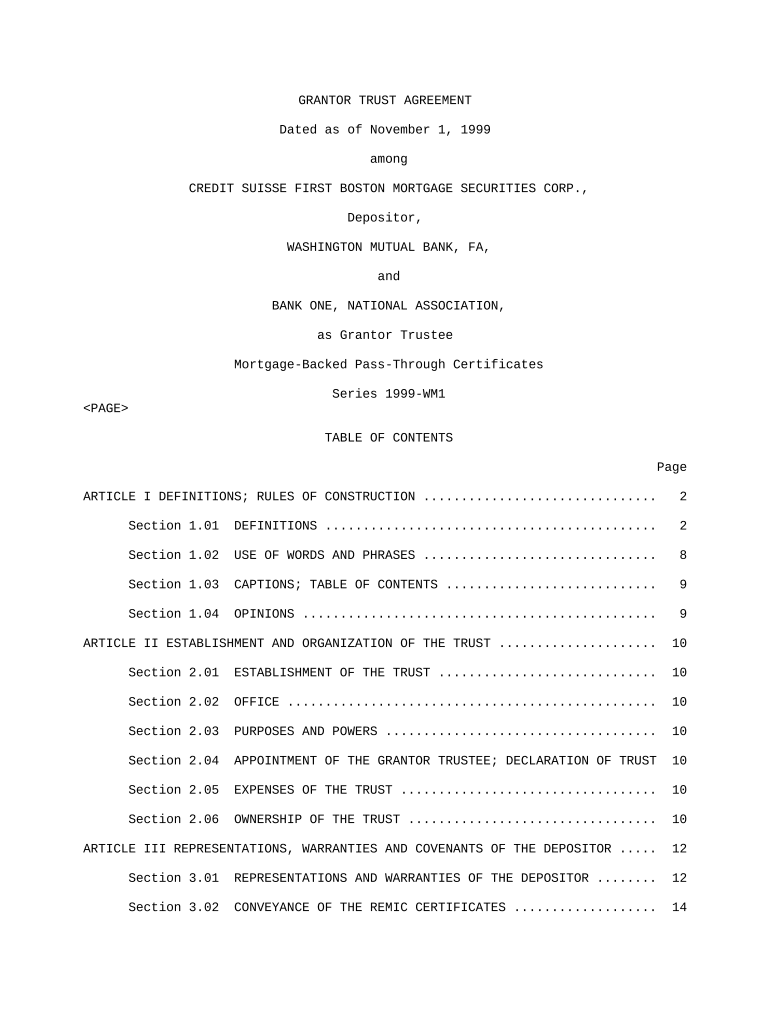

GRANTOR TRUST AGREEMENT

Dated as of November 1, 1999

among

CREDIT SUISSE FIRST BOSTON MORTGAGE SECURITIES CORP.,

Depositor,

WASHINGTON MUTUAL BANK, FA,

and

BANK ONE, NATIONAL ASSOCIATION,

as Grantor Trustee

Mortgage-Backed Pass-Through Certificates

Series 1999-WM1

TABLE OF CONTENTS

Page

ARTICLE I DEFINITIONS; RULES OF CONSTRUCTION ............................... 2

Section 1.01 DEFINITIONS ............................................ 2

Section 1.02 USE OF WORDS AND PHRASES ............................... 8

Section 1.03 CAPTIONS; TABLE OF CONTENTS ............................ 9

Section 1.04 OPINIONS ............................................... 9

ARTICLE II ESTABLISHMENT AND ORGANIZATION OF THE TRUST ..................... 10

Section 2.01 ESTABLISHMENT OF THE TRUST ............................. 10

Section 2.02 OFFICE ................................................. 10

Section 2.03 PURPOSES AND POWERS .................................... 10

Section 2.04 APPOINTMENT OF THE GRANTOR TRUSTEE; DECLARATION OF TRUST 10

Section 2.05 EXPENSES OF THE TRUST .................................. 10

Section 2.06 OWNERSHIP OF THE TRUST ................................. 10

ARTICLE III REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE DEPOSITOR ..... 12

Section 3.01 REPRESENTATIONS AND WARRANTIES OF THE DEPOSITOR ........ 12

Section 3.02 CONVEYANCE OF THE REMIC CERTIFICATES ................... 14

Section 3.04 ACCEPTANCE BY TRUSTEE .................................. 15

ARTICLE IV ISSUANCE AND SALE OF CERTIFICATES ............................... 16

Section 4.01 ISSUANCE OF CERTIFICATES ............................... 16

Section 4.02 SALE OF CERTIFICATES ................................... 16

ARTICLE V CERTIFICATES AND TRANSFER OF INTERESTS ........................... 17

Section 5.01 TERMS .................................................. 17

Section 5.02 FORMS .................................................. 17

Section 5.03 EXECUTION, AUTHENTICATION AND DELIVERY ................. 17

Section 5.04 REGISTRATION AND TRANSFER OF CERTIFICATES .............. 17

Section 5.05 MUTILATED, DESTROYED, LOST OR STOLEN FLOATING RATE

CERTIFICATES ........................................... 19

Section 5.06 PERSONS DEEMED OWNERS .................................. 20

Section 5.07 CANCELLATION ........................................... 20

Section 5.08 ASSIGNMENT OF RIGHTS ................................... 20

-i-

TABLE OF CONTENTS

(continued)

Page

ARTICLE VI COVENANTS ....................................................... 21

Section 6.01 DISTRIBUTIONS .......................................... 21

Section 6.02 WITHHOLDING ............................................ 21

Section 6.03 PROTECTION OF TRUST ESTATE ............................. 21

Section 6.04 PERFORMANCE OF OBLIGATIONS ............................. 22

Section 6.05 NEGATIVE COVENANTS ..................................... 22

Section 6.06 NO OTHER POWERS ........................................ 23

Section 6.07 LIMITATION OF SUITS .................................... 23

Section 6.08 UNCONDITIONAL RIGHTS OF HOLDERS TO RECEIVE

DISTRIBUTIONS........................................... 24

Section 6.09 RIGHTS AND REMEDIES CUMULATIVE ......................... 24

Section 6.10 DELAY OR OMISSION NOT WAIVER ........................... 24

Section 6.11 CONTROL BY HOLDERS ..................................... 24

Section 6.12 ACCESS TO CERTIFICATEHOLDERS' NAMES AND ADDRESSES ...... 24

ARTICLE VII ACCOUNTS, DISBURSEMENTS AND RELEASES............................ 26

Section 7.01 COLLECTION OF MONEY .................................... 26

Section 7.02 ESTABLISHMENT OF ACCOUNTS .............................. 26

Section 7.03 FLOW OF FUNDS .......................................... 26

Section 7.04 INVESTMENT OF ACCOUNTS ................................. 27

Section 7.05 ELIGIBLE INVESTMENTS ................................... 27

Section 7.06 ACCOUNTING AND DIRECTIONS BY GRANTOR TRUSTEE ........... 28

Section 7.07 REPORTS BY GRANTOR TRUSTEE TO HOLDERS .................. 29

Section 7.08 REPORTS BY GRANTOR TRUSTEE ............................. 29

ARTICLE VIII SERVICING AND ADMINISTRATION OF ASSETS....................... 30

Section 8.01 TERMINATION OF SWAP AGREEMENTS ......................... 30

Section 8.02 TRANSFER OF SWAP AGREEMENTS ............................ 30

ARTICLE IX TERMINATION OF TRUST ............................................ 33

Section 9.01 TERMINATION OF TRUST ................................... 33

Section 9.02 DISPOSITION OF PROCEEDS ................................ 33

ARTICLE X THE GRANTOR TRUSTEE............................................... 34

-ii-

TABLE OF CONTENTS

(continued)

Page

Section 10.01 CERTAIN DUTIES AND RESPONSIBILITIES .................... 34

Section 10.02 CERTAIN RIGHTS OF THE GRANTOR TRUSTEE .................. 35

Section 10.03 NOT RESPONSIBLE FOR RECITALS OR ISSUANCE OF CERTIFICATES 36

Section 10.04 MAY OWN CERTIFICATES ................................... 36

Section 10.05 MONEY HELD IN TRUST .................................... 36

Section 10.06 CORPORATE GRANTOR TRUSTEE REQUIRED; ELIGIBILITY ........ 36

Section 10.07 RESIGNATION AND REMOVAL; APPOINTMENT OF SUCCESSOR ...... 37

Section 10.08 ACCEPTANCE OF APPOINTMENT BY SUCCESSOR GRANTOR TRUSTEE . 38

Section 10.9 MERGER, CONVERSION, CONSOLIDATION OR SUCCESSION TO

BUSINESS OF THE GRANTOR TRUSTEE ........................ 38

Section 10.10 LIABILITY OF THE GRANTOR TRUSTEE ....................... 38

Section 10.11 APPOINTMENT OF CO-GRANTOR TRUSTEE OR SEPARATE GRANTOR

TRUSTEE ................................................ 39

ARTICLE XI MISCELLANEOUS.................................................... 41

Section 11.01 COMPLIANCE CERTIFICATES AND OPINIONS ................... 41

Section 11.02 FORM OF DOCUMENTS DELIVERED TO THE GRANTOR TRUSTEE ..... 41

Section 11.03 ACTS OF HOLDERS ........................................ 42

Section 11.04 NOTICES, ETC. TO GRANTOR TRUSTEE ....................... 42

Section 11.05 NOTICES AND REPORTS TO HOLDERS; WAIVER OF NOTICES ...... 43

Section 11.06 RULES BY GRANTOR TRUSTEE ............................... 43

Section 11.07 SUCCESSORS AND ASSIGNS ................................. 43

Section 11.08 SEVERABILITY ........................................... 43

Section 11.09 BENEFITS OF AGREEMENT .................................. 43

Section 11.10 LEGAL HOLIDAYS ......................................... 44

Section 11.11 GOVERNING LAW .......................................... 44

Section 11.12 COUNTERPARTS ........................................... 44

Section 11.13 USURY .................................................. 44

-iii-

TABLE OF CONTENTS

(continued)

Page

Section 11.14 AMENDMENT .............................................. 44

Section 11.15 ADDITIONAL LIMITATION ON ACTION AND IMPOSITION OF TAX .. 45

Section 11.16 NOTICES ................................................ 45

Exhibit A: Form of Floating Rate Certificates

-iv-

GRANTOR TRUST AGREEMENT, relating to WASHINGTON MUTUAL BANK, FA SERIES

1999-WM1 GRANTOR TRUST (the "Trust"), dated as of November 1, 1999 by and among

CREDIT SUISSE FIRST BOSTON MORTGAGE SECURITIES CORP., a Delaware corporation, in

its capacity as depositor (the "Depositor"), WASHINGTON MUTUAL BANK, FA

("Washington Mutual") and BANK ONE, NATIONAL ASSOCIATION, a national banking

association, in its capacity as the grantor trustee (the "Grantor Trustee").

WHEREAS, the Depositor wishes to establish the Trust and provide for the

allocation and sale of the beneficial interests therein and the maintenance and

distribution thereof;

WHEREAS, the Depositor wishes to transfer to the Trust the Washington

Mutual Bank, FA Mortgage-Backed Pass-Through Certificates, Series 1999-WM1 Class

4 A-2, Class 5 A-3 and Class 6 A-3 (the "Class 4 A-2 REMIC Certificates," "Class

5 A-3 REMIC Certificates" and Class 6 A-3 REMIC Certificates," respectively, and

collectively, the "REMIC Certificates") which, along with each swap agreement

dated December 3, 1999 between Credit Suisse Financial Products (the "Swap

Counterparty") and the Grantor Trustee (each, a "Swap Agreement") constitute the

principal assets of the Trust Estate;

WHEREAS, pursuant to each Swap Agreement the Grantor Trustee will

distribute to the Swap Counterparty on each Distribution Date all amounts in

respect of interest received on each Class of REMIC Certificates on each REMIC

Distribution Date and shall have the right to receive from the Swap Counterparty

on the related Swap Payment Date an amount equal to interest due on such

Distribution Date on the related Class of Floating Rate Certificates at the

related Floating Pass-Through Rate, subject to the netting provisions set forth

in each Swap Agreement;

WHEREAS, all things necessary to make the Floating Rate Certificates, when

executed and authenticated by the Grantor Trustee, valid instruments, and to

make this Agreement a valid agreement, in accordance with their and its terms,

have been done; and

WHEREAS, Bank One, National Association is willing to serve in the

capacity of Grantor Trustee hereunder;

NOW, THEREFORE, in consideration of the premises and the mutual agreements

herein contained, the Depositor, Washington Mutual and the Grantor Trustee

hereby agree as follows:

CONVEYANCE

To provide for the distribution of the interest on and/or principal of the

Floating Rate Certificates in accordance with their terms, all of the sums

distributable under this Agreement with respect to the Floating Rate

Certificates and the performance of the covenants contained in this Agreement,

(i) the Depositor hereby sells, sets over, assigns, transfers and otherwise

conveys to the Trust, without recourse and for the exclusive benefit of the

Holders of the Floating Rate Certificates, all of its right, title and interest

in and to (a) the REMIC Certificates issued pursuant to a Pooling and Servicing

Agreement dated November 1, 1999 among Credit Suisse First Boston Mortgage

Securities Corp., as Depositor, Washington Mutual Bank, FA, as Seller and

Servicer, and Bank One, National Association, as Trustee (the "Pooling and

Servicing Agreement"); and (b) proceeds of all the foregoing (including, but not

by way of limitation, cash

1

proceeds, accounts, accounts receivable, notes, drafts, acceptances, chattel

paper, checks, deposit accounts, rights to payment of any and every kind, and

other forms of obligations and receivables which at any time constitute all or

part of or are included in the proceeds of any of the foregoing) to pay the

Certificates as specified herein; and (ii) the Grantor Trustee hereby enters

into each Swap Agreement on behalf of the Trust for the benefit of the related

Class of Floating Rate Certificates; ((i) and (ii) above shall be collectively

referred to herein as the "Trust Estate").

The Grantor Trustee acknowledges such sale, accepts the Trust hereunder in

accordance with the provisions hereof and agrees to perform its duties in

accordance with the terms of this Agreement.

ARTICLE I

DEFINITIONS; RULES OF CONSTRUCTION

Section 1.01 DEFINITIONS.

For all purposes of this Agreement, the following terms shall have the

meanings set forth below, unless the context clearly indicates otherwise:

"Account": Any account established in accordance with Section 7.02 hereof.

"Accrual Period": With respect to the Floating Rate Certificates and any

Distribution Date, the period commencing on the 23rd calendar day of the month

immediately preceding the month in which such Distribution Date occurs, to and

including the 22nd calendar day of the month in which such Distribution Date

occurs. All calculations of interest on the Floating Rate Certificates will be

made on the basis of twelve 30-day months and a 360-day year.

"Agreement": This Grantor Trust Agreement, as it may be amended from time

to time, including any Exhibits hereto.

"Authorized Officer": With respect to any Person, any officer of such

Person who is authorized to act for such Person in matters relating to the

Agreement, and whose action is binding upon such Person; with respect to the

Depositor, the President and any Vice President, and with respect to the Grantor

Trustee, any Vice President, Assistant Vice President, Trust Officer or any

other officer of the Grantor Trustee customarily performing functions similar to

those performed by any of the above designated officers and also, with respect

to a particular matter, any other officer to whom such matter is referred

because of such officer's knowledge of and familiarity with the particular

subject located at the Corporate Trust Office.

"Business Day": Any day other than (i) a Saturday or a Sunday, or (ii) a

day on which banking institutions in the States of New York or Washington or the

state in which the Corporate Trust Office is located are authorized or obligated

by law or executive order to be closed.

2

"Calculation Agent": The Swap Counterparty or such other Person as may be

specified in the related Swap Agreement.

"Certificateholder or Holder": The Person in whose name a Floating Rate

Certificate is registered in the Register.

"Certificate Rate": As defined in the Pooling and Servicing Agreement.

"Class 4 A-2 Certificate Principal Balance": As of any time of

determination, the Certificate Principal Balance as of the Startup Day of all

Class 4 A-2 Floating Rate Certificates less any amounts actually distributed on

such Class 4 A-2 Floating Rate Certificates with respect to principal thereon

pursuant to Section 7.03(d) and less any amounts of Realized Losses allocated to

reduce the outstanding principal balance of the related Class of REMIC

Certificates pursuant to the Pooling and Servicing Agreement prior to the REMIC

Distribution Date immediately preceding such date of determination.

"Class 5 A-3 Certificate Principal Balance": As of any time of

determination, the Certificate Principal Balance as of the Startup Day of all

Class 5 A-3 Floating Rate Certificates less any amounts actually distributed on

such Class 5 A-3 Floating Rate Certificates with respect to principal thereon

pursuant to Section 7.03(d) and less any amounts of Realized Losses allocated to

reduce the outstanding principal balance of the related Class of REMIC

Certificates pursuant to the Pooling and Servicing Agreement prior to the REMIC

Distribution Date immediately preceding such date of determination.

"Class 6 A-3 Certificate Principal Balance": As of any time of

determination, the Certificate Principal Balance as of the Startup Day of all

Class 6 A-3 Floating Rate Certificates less any amounts actually distributed on

such Class 6 A-3 Floating Rate Certificates with respect to principal thereon

pursuant to Section 7.03(d) and less any amounts of Realized Losses allocated to

reduce the outstanding principal balance of the related Class of REMIC

Certificates pursuant to the Pooling and Servicing Agreement prior to the REMIC

Distribution Date immediately preceding such date of determination.

"Class": The Class 4 A-2 Floating Rate Certificates, Class 5 A-3 Floating

Rate Certificates or Class 6 A-3 Floating Rate Certificates, as applicable.

"Class 4 A-2 Floating Rate Certificate": Any one of the Certificates

designated on the face thereof as a Class 4 A-2 Grantor Trust Certificate,

substantially in the form annexed hereto as Exhibit A, authenticated and

delivered by the Grantor Trustee, representing the right to distributions as set

forth herein. The Class 4 A-2 Floating Rate Certificates represent an interest

in the Class 4 A-2 REMIC Certificates and the Swap Agreement relating to the

Class 4 A-2 Floating Rate Certificates.

"Class 5 A-3 Floating Rate Certificate": Any one of the Certificates

designated on the face thereof as a Class 5 A-3 Grantor Trust Certificate,

substantially in the form annexed hereto as Exhibit A, authenticated and

delivered by the Grantor Trustee, representing the right to

3

distributions as set forth herein. The Class 5 A-3 Floating Rate Certificates

represent an interest in the Class 5 A-3 REMIC Certificates and the Swap

Agreement relating to the Class 5 A-3 Floating Rate Certificates.

"Class 6 A-3 Floating Rate Certificate": Any one of the Certificates

designated on the face thereof as a Class 6 A-3 Grantor Trust Certificate,

substantially in the form annexed hereto as Exhibit A, authenticated and

delivered by the Grantor Trustee, representing the right to distributions as set

forth herein. The Class 6 A-3 Floating Rate Certificates represent an interest

in the Class 6 A-3 REMIC Certificates and the Swap Agreement relating to the

Class 6 A-3 Floating Rate Certificates.

"Closing": As defined in Section 4.02 hereof.

"Code": The Internal Revenue Code of 1986, as amended.

"Conversion Date": The latest date on which a Swap Agreement terminates,

which shall be the Distribution Date in January 2002, in the case of the Swap

Agreement relating to the Class 4 A-2 Certificates, April 2003, in the case of

the Swap Agreement relating to the Class 5 A-3 Certificates, February 2004, in

the case of the Swap Agreement relating to the Class 6 A-3 Certificates.

"Corporate Trust Office": The designated office of the Grantor Trustee in

the State of Illinois at which any particular time its corporate trust business

shall be administered, which office at the date of the execution of this

Agreement is located is located at 1 Bank One Plaza, Suite 1L1-0126, Chicago,

Illinois 60670-0126.

"Current Interest": With respect to each Class of Floating Rate

Certificates, on any Distribution Date, the amount of interest paid on the

related REMIC Certificate on the immediately preceding REMIC Distribution Date.

"DCR": Duff & Phelps Credit Rating Company, or any successor thereto.

"Depositor": Credit Suisse First Boston Mortgage Securities Corp., a

Delaware corporation, or any successor thereto.

"Depository": The Depository Trust Company, 7 Hanover Square, New York,

New York 10004, and any successor Depository hereafter named.

"Direct Participant" or "DTC Participant": Any broker-dealer, bank or

other financial institution for which the Depository holds Floating Rate

Certificates from time to time as a securities depository.

"Distribution Date": Any date on which the Grantor Trustee is required to

make distributions to the Holders, which shall be the 23rd calendar day of each

month, or if such day is not a Business Day, the next Business Day, commencing

in December, 1999.

4

"Eligible Account": Either (i) an account or accounts maintained with a federal

or state-chartered depository institution or trust company (which may be

Washington Mutual or an affiliate of Washington Mutual or which may be the

Grantor Trustee or an affiliate of the Grantor Trustee) the short-term unsecured

debt obligations of which (or, in the case of a depository institution or trust

company that is the principal subsidiary of a holding company, the short-term

unsecured debt obligations of such holding company) are rated by each Rating

Agency not lower than P-1 in the case of Moody's and A-1+ in the case of DCR;

provided that so long as Washington Mutual is the Servicer, any account

maintained with the Servicer shall be an Eligible Account if the long-term

unsecured debt obligations of Washington Mutual are rated not lower than A2 by

Moody's, (ii) an account or accounts the deposits in which are fully insured by

the FDIC, provided that any such deposits not so insured shall be otherwise

maintained such that (as evidenced by an Opinion of Counsel delivered to the

Grantor Trustee and the Rating Agencies) the applicable Certificateholders have

a claim with respect to the funds in such account or a perfected first priority

security interest against any collateral (which shall be limited to Eligible

Investments) securing such funds that is superior to claims of any other

depositors or creditors of the depository institution or trust company with

which such account is maintained, (iii) a trust account or accounts maintained

with the Grantor Trustee or the trust department of a federal or state chartered

depository institution or trust company acting in its fiduciary capacity,

provided that any such state chartered depository institution is subject to

regulation regarding funds on deposit substantially similar to the regulations

set forth in 12 C.F.R. Section 9.10(b) or (iv) any account maintained at any

Federal Home Loan Bank.

"Eligible Investments": Those investments so designated pursuant to

Section 7.05 hereof.

"Fannie Mae": Federal National Mortgage Association, a federally-chartered

and privately-owned corporation existing under the Federal National Mortgage

Association Charter Act, as amended, or any successor thereof.

"FDIC": The Federal Deposit Insurance Corporation, a corporate

instrumentality of the United States, or any successor thereto.

"Floating Pass-Through Rate": For any Distribution Date and the Class 4

A-2 Floating Rate Certificates, Class 5 A-3 Floating Rate Certificates and Class

6 A-3 Floating Rate Certificates, LIBOR plus 0.54%, 0.22% and 0.26% per annum,

respectively, plus the Certificate Rate for the related Class of REMIC

Certificates for the immediately preceding REMIC Distribution Date, minus the

Certificate Rate for such Class of REMIC Certificates for the initial REMIC

Distribution Date.

"Floating Rate Certificate": Any of the Class 4 A-2 Floating Rate

Certificates, Class 5 A-3 Floating Rate Certificates or Class 6 A-3 Floating

Rate Certificates.

"Floating Rate Certificate Principal Balance": The Class 4 A-2 Certificate

Principal Balance, the Class 5 A-3 Certificate Principal Balance or the Class 6

A-3 Certificate Principal Balance, as applicable.

5

"Freddie Mac": The Federal Home Loan Mortgage Corporation, a corporate

instrumentality of the United States created pursuant to the Emergency Home

Finance Act of 1970, as amended, or any successor thereof.

"Grantor Trust Account": The certificate account established in accordance

with Section 7.02 hereof and maintained in the corporate trust department of the

Grantor Trustee; provided that the funds in such account shall not be commingled

with other funds held by the Grantor Trustee.

"Grantor Trustee": Bank One, National Association, a national banking

association, not in its individual capacity but solely as Grantor Trustee under

this Agreement, and any successor hereunder.

"Highest Lawful Rate": As defined in Section 11.13.

"Indirect Participants": Entities, such as banks brokers, dealers and

trust companies, that clear through or maintain a custodial relationship with a

DTC Participant, either directly or indirectly.

"Interest Carry Forward Amount": With respect to each Class of Floating

Rate Certificates, on any Distribution Date, the amount, if any, by which (i)

the sum of (A) the related Interest Distribution Amount as of the immediately

preceding Distribution Date and (B) any related unpaid Interest Carry Forward

Amount from all previous Distribution Dates exceeds (ii) the amount of the

actual distribution with respect to interest made to the Holders of the related

Floating Rate Certificates on such immediately preceding Distribution Date.

"Interest Distribution Amount": For each Class of Floating Rate

Certificates, as of any Distribution Date on or prior to the date on which the

related Swap Agreement terminates, interest accrued during the related Accrual

Period on the Floating Rate Certificate Principal Balance of such Class at the

Floating Pass-Through Rate for such Class and Distribution Date, minus any

Realized Losses applied to reduce interest payable on the related class of REMIC

Certificates on the immediately preceding REMIC Distribution Date. For each

Class of Floating Rate Certificates, as of any Distribution Date after the date

on which the related Swap Agreement terminates, interest payable on the related

Class of REMIC Certificates pursuant to the terms of the Pooling and Servicing

Agreement.

"LIBOR": With respect to any Accrual Period for the Floating Rate

Certificates, the rate determined by the Calculation Agent on the related LIBOR

Determination Date on the basis of the offered rate for one-month U.S. dollar

deposits as such rate appears on Telerate Page 3750 as of 11:00 a.m. (London

time) on such date; provided that if such rate does not appear on Telerate Page

3750, the rate for such date and Class of Floating Rate Certificates will be

determined on the basis of the rates at which one-month U.S. dollar deposits in

amounts equal to the Floating Rate Certificate Principal Balance of the related

Class to leading European banks are offered by the Reference Banks at

approximately 11:00 a.m. (London time) on such date to prime banks in the London

interbank market. In such event, the Calculation Agent will request the

principal

6

London office of each of the Reference Banks to provide a quotation of its rate.

If at least two such quotations are provided, the rate for that date will be the

arithmetic mean of the quotations (rounded upwards if necessary to the nearest

whole multiple of 1/16%). If fewer than two quotations are provided as

requested, the rate for that date will be the arithmetic mean of the rates

quoted by major banks in New York City, selected by the Calculation Agent, at

approximately 11:00 a.m. (New York City time) on such date for one-month U.S.

dollar loans in amounts equal to the Floating Rate Certificate Principal Balance

of the related Class to leading European banks.

"LIBOR Determination Date": With respect to any Accrual Period for the

Certificates, two London and New York Banking Days preceding the commencement of

such Accrual Period.

"London and New York Banking Day": Any day on which commercial banks are

open for business (including dealings in foreign exchange and foreign currency

options) in London and New York City.

"Moody's": Moody's Investors Service, Inc. or any successor thereto.

"Officer's Certificate": A certificate signed by any Authorized Officer of

any Person delivering such certificate delivered hereunder.

"Opinion of Counsel": A written opinion of counsel, who may be counsel to

the Depositor or the Servicer, reasonably acceptable to the Grantor Trustee.

"Outstanding": With respect to all Certificates of a Class, as of any date

of determination, all such Floating Rate Certificates theretofore executed and

delivered hereunder except:

(i) Floating Rate Certificates theretofore canceled by the

Registrar or delivered to the Registrar for cancellation;

(ii) Floating Rate Certificates or portions thereof for which

full and final payment of money in the necessary amount has been theretofore

deposited with the Grantor Trustee in trust for the Holders of such Floating

Rate Certificates;

(iii) Floating Rate Certificates in exchange for or in lieu of

which other Floating Rate Certificates have been executed and delivered pursuant

to this Agreement, unless proof satisfactory to the Grantor Trustee is presented

that any such Floating Rate Certificates are held by a bona fide purchaser;

(iv) Floating Rate Certificates alleged to have been

destroyed, lost or stolen for which replacement Floating Rate Certificates have

been issued as provided for in Section 5.05 hereof; and

(v) Floating Rate Certificates as to which the Grantor Trustee

has made the final distribution thereon, whether or not such Floating Rate

Certificate is ever returned to the Grantor Trustee.

7

"Percentage Interest": With respect to a Class of the Floating Rate

Certificates, a fraction, expressed as a percentage, the numerator of which is

the initial Floating Rate Certificate Principal Balance represented by such

Certificate and the denominator of which is the aggregate initial Floating Rate

Certificate Principal Balance represented by all the Floating Rate Certificates

in such Class.

"Person": Any individual, corporation, partnership, joint venture,

association, joint-stock company, trust, unincorporated organization or

government or any agency or political subdivision thereof.

"Pooling and Servicing Agreement": The Pooling and Servicing Agreement,

dated as of November 1, 1999, among the Depositor, Washington Mutual, as seller

and servicer, and Bank One, National Association, as trustee.

"Principal Distribution Amount": For each Class, as of any Distribution

Date, the payment received by the Trust in respect of principal of the related

Class of REMIC Certificates on the immediately preceding REMIC Distribution

Date.

"Rating Agencies": Collectively, Moody's, DCR or any successors thereto.

"Realized Losses": As defined in the Pooling and Servicing Agreement.

"Record Date": With respect to any Distribution Date, the close of

business on the last Business Day of the month preceding the month in which the

applicable Distribution Date occurs.

"Reference Banks": Any four major banks in the London interbank market

selected by the Calculation Agent.

"Register": The register maintained by the Registrar in accordance with

Section 5.04 hereof, in which the names of the Holders are set forth.

"Registrar": The Grantor Trustee, acting in its capacity as Registrar

appointed pursuant to Section 5.04 hereof.

"REMIC Distribution Date": The 19th calendar day of each month, commencing

December 19, 1999, or if such day is not a Business Day, the next Business Day.

"Servicer": Washington Mutual Bank, FA, as servicer under the Pooling and

Servicing Agreement.

"Startup Day": December 3, 1999.

"Swap Payment": On each Swap Payment Date and with respect to each Swap

Agreement, (A) the amount that is payable to the Grantor Trustee from the Swap

Counterparty equal to the Interest Distribution Amount on the related Class of

Floating Rate Certificates on the

8

related Distribution Date or (B) the amount that is payable to the Swap

Counterparty from the Grantor Trustee, equal to the Current Interest received on

such Distribution Date on the related Class of REMIC Certificates, in each case

in accordance with the terms of the related Swap Agreement.

"Swap Payment Date": Each Distribution Date.

"Tax Return": The federal income tax return to be filed on behalf of the

Trust together with any and all other information reports or returns that may be

required to be furnished to the Holders of the Certificates or filed with the

Internal Revenue Service as any other governmental taxing authority under any

applicable provision of federal, state or local tax laws.

"Telerate Page 3750": The display designated as page "3750" on the Dow

Jones Telerate Service (or such other page as may replace page 3750 on that

report for the purpose of displaying London interbank offered rates of major

banks).

"Trust": Washington Mutual Bank, FA Series 1999-WM1 Grantor Trust, the

trust created under this Agreement.

"Trust Estate": As defined in the conveyance clause under this Agreement.

"Voting Rights": The portion of the aggregate voting rights of all the

Floating Rate Certificates evidenced by a Floating Rate Certificate, which will

be allocated to the Floating Rate Certificates (without regard to Class) in

proportion to their respective initial Floating Rate Certificate Principal

Balances.

"Washington Mutual": Washington Mutual Bank, FA, and its successors and

assigns.

Section 1.02 USE OF WORDS AND PHRASES.

"Herein", "hereby", "hereunder", "hereof", "hereinbefore", "hereinafter"

and other equivalent words refer to this Agreement as a whole and not solely to

the particular section of this Agreement in which any such word is used. The

definitions set forth in Section 1.01 hereof include both the singular and the

plural. Whenever used in this Agreement, any pronoun shall be deemed to include

both singular and plural and to cover all genders.

Section 1.03 CAPTIONS; TABLE OF CONTENTS.

The captions or headings in this Agreement and the Table of Contents are

for convenience only and in no way define, limit or describe the scope and

intent of any provisions of this Agreement.

Section 1.04 OPINIONS.

Each opinion with respect to the validity, binding nature and

enforceability of documents or Floating Rate Certificates may be qualified to

the extent that the same may be limited by

9

applicable bankruptcy, insolvency, reorganization, moratorium or other similar

laws affecting the enforcement of creditors' rights generally and by general

principles of equity (whether considered in a proceeding or action in equity or

at law) and may state that no opinion is expressed on the availability of the

remedy of specific enforcement, injunctive relief or any other equitable remedy.

Any opinion required to be furnished by any Person hereunder must be delivered

by counsel upon whose opinion the addressee of such opinion may reasonably rely,

and such opinion may state that it is given in reasonable reliance upon an

opinion of another, a copy of which must be attached, concerning the laws of a

foreign jurisdiction.

10

ARTICLE II

ESTABLISHMENT AND ORGANIZATION OF THE TRUST

Section 2.01 ESTABLISHMENT OF THE TRUST.

The parties hereto do hereby create and establish, pursuant to the laws of

the State of New York and this Agreement, the Trust, which, for convenience,

shall be known as "Washington Mutual Bank, FA Series 1999-WM1 Grantor Trust".

Section 2.02 OFFICE.

The office of the Trust shall be in care of the Grantor Trustee, addressed

to 1 Bank One Plaza, Chicago, Illinois 60670, Attention: Global Corporate Trust

Services, or at such other address as the Grantor Trustee may designate by

notice to the Depositor and the Servicer.

Section 2.03 PURPOSES AND POWERS.

The purpose of the Trust is to engage in the following activities and only

such activities: (i) the issuance of the Floating Rate Certificates and

distribution of payments thereon, the acquiring, owning and holding of the REMIC

Certificates, executing each Swap Agreement and making and receiving payments

thereunder in connection therewith; (ii) activities that are necessary, suitable

or convenient to accomplish the foregoing or are incidental thereto or connected

therewith, including the investment of moneys in accordance with this Agreement;

and (iii) such other activities as may be required in connection with

conservation of the Trust Estate and distributions to the Holders.

Section 2.04 APPOINTMENT OF THE GRANTOR TRUSTEE; DECLARATION OF TRUST.

The Depositor hereby appoints the Grantor Trustee as Grantor Trustee of

the Trust effective as of the Startup Day, to have all the rights, powers and

duties set forth herein. The Grantor Trustee hereby acknowledges and accepts

such appointment, represents and warrants its eligibility as of the Startup Day

to serve as Grantor Trustee pursuant to Section 10.06 hereof and declares that

it will hold the Trust Estate in trust upon and subject to the conditions set

forth herein for the benefit of the Holders.

Section 2.05 EXPENSES OF THE TRUST.

The expenses of the Trust, including any fees payable to the Grantor

Trustee, shall be paid by Washington Mutual pursuant to a separate agreement

between Washington Mutual and the Grantor Trustee.

Section 2.06 OWNERSHIP OF THE TRUST.

11

On the Startup Day the ownership interests in the Trust shall be

transferred as set forth in Section 4.02 hereof, such transfer to be evidenced

by sale of the Floating Rate Certificates as described therein. Thereafter,

transfer of any ownership interest shall be governed by Sections 5.04 hereof.

ARTICLE III

REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE DEPOSITOR

Section 3.01 REPRESENTATIONS AND WARRANTIES OF THE DEPOSITOR.

The Depositor hereby represents, warrants and covenants to the Grantor

Trustee and the Holders that as of the Startup Day:

(a) The Depositor is a corporation duly organized, validly existing

and in good standing under the laws governing its creation and existence and is

in good standing as a foreign corporation in each jurisdiction in which the

nature of its business, or the properties owned or leased by it make such

qualification necessary. The Depositor has all requisite corporate power and

authority to own and operate its properties, to carry out its business as

presently conducted and as proposed to be conducted and to enter into and

discharge its obligations under this Agreement.

(b) The execution and delivery of this Agreement by the Depositor

and its performance and compliance with the terms of this Agreement have been

duly authorized by all necessary corporate action on the part of the Depositor

and will not violate the Depositor's Certificate of Incorporation or Bylaws or

constitute a default (or an event which, with notice or lapse of time, or both,

would constitute a default) under, or result in a breach of, any material

contract, agreement or other instrument to which the Depositor is a party or by

which the Depositor is bound or violate any statute or any order, rule or

regulation of any court, governmental agency or body or other tribunal having

jurisdiction over the Depositor or any of its properties.

(c) Assuming due authorization, execution and delivery by the other

parties hereto, this Agreement each constitutes a valid, legal and binding

obligation of the Depositor, enforceable against it in accordance with the terms

hereof, except as the enforcement thereof may be limited by applicable

bankruptcy, insolvency, reorganization, moratorium or other similar laws

affecting creditors' rights generally and by general principles of equity

(whether considered in a proceeding or action in equity or at law).

(d) The Depositor is not in default with respect to any order or

decree of any court or any order, regulation or demand of any federal, state,

municipal or governmental agency, which default would materially and adversely

affect the condition (financial or other) or operations of the Depositor or its

properties or the consequences of which would materially and adversely affect

its performance hereunder.

12

(e) No litigation is pending with respect to which the Depositor has

received service of process or, to the best of the Depositor's knowledge,

threatened against the Depositor which litigation might have consequences that

would prohibit its entering into this Agreement or that would materially and

adversely affect the condition (financial or otherwise) or operations of the

Depositor or its properties or might have consequences that would materially and

adversely affect its performance hereunder.

It is understood and agreed that the representations and warranties set

forth in this Section 3.01 shall survive delivery of the REMIC Certificates to

the Grantor Trustee.

Section 3.02 CONVEYANCE OF THE REMIC CERTIFICATES.

On the Startup Day the Depositor, concurrently with the execution and

delivery hereof, hereby sells, transfers, assigns, delivers, sets over and

otherwise conveys, without recourse, to the Trust all of its respective right,

title and interest in and to the Trust Estate. It is the express intent of the

Depositor and the Grantor Trustee that the conveyance by the Depositor to the

Grantor Trustee of the Depositor's right, title and interest in and to the Trust

Estate be, and be construed as, an absolute sale and assignment by the Depositor

to the Grantor Trustee of the Trust Estate for the benefit of the

Certificateholders. Further, it is not intended that the conveyance be deemed to

be a pledge of the Trust Estate by the Depositor to the Grantor Trustee to

secure a debt or other obligation. However, in the event that the Trust Estate

is held to be property of the Depositor, or if for any reason this Agreement is

held or deemed to create a security interest in the Trust Estate, then it is

intended that (i) this Agreement shall also be deemed to be a security agreement

within the meaning of Articles 8 and 9 of the New York Uniform Commercial Code

and the Uniform Commercial Code of any other applicable jurisdiction; (ii) the

conveyances provided for herein shall be deemed to be a grant by the Depositor

to the Grantor Trustee on behalf of the Certificateholders, to secure payment in

full of the Secured Obligations (as defined below), of a security interest in

all of the Depositor's right (including the power to convey title thereto),

title and interest, whether now owned or hereafter acquired, in and to the Trust

Estate including all accounts, general intangibles, chattel paper, instruments,

documents, money, deposit accounts, certificates of deposit, goods, letters of

credit, advices of credit and investment property and all cash and non-cash

proceeds of any of the foregoing; (iii) the possession or control by the Grantor

Trustee or any other agent of the Grantor Trustee of the Trust Estate or such

other items of property as constitute instruments, money, documents, advices of

credit, letters of credit, goods, certificated securities or chattel paper shall

be deemed to be a possession or control by the secured party, or possession or

control by a purchaser, for purposes of perfecting the security interest

pursuant to the Uniform Commercial Code (including, without limitation, Sections

9-305 or 9-115 thereof); and (iv) notifications to persons holding such

property, and acknowledgments, receipts or confirmations from persons holding

such property, shall be deemed notifications to, or acknowledgments, receipts or

confirmations from, securities intermediaries, bailees or agents of, or persons

holding for, the Grantor Trustee, as applicable, for the purpose of perfecting

such security interest under applicable law. "Secured Obligations" means (i) the

rights of each Certificateholder to be paid any amount owed to it under this

Agreement, (ii) all other obligations of the Depositor under this Agreement and

(iii) the right of the Certificateholders to the Trust Estate.

13

The Depositor, and, at the Depositor's direction, the Grantor Trustee,

shall, to the extent consistent with this Agreement, take such reasonable

actions as may be necessary to ensure that, if this Agreement were deemed to

create a security interest in the Trust Estate and the other property described

above, such security interest would be deemed to be a perfected security

interest of first priority as applicable. The Depositor shall file, at its

expense, all filings necessary to maintain the effectiveness of any original

filings necessary under the Uniform Commercial Code as in effect in any

jurisdiction to perfect the Grantor Trustee's security interest in the Trust

Estate, including without limitation (i) continuation statements, (ii) such

other statements as may be occasioned by any transfer of any interest of the

Depositor in the Trust Estate; and (iii) filings necessary as a result in any

change in the Uniform Commercial Code.

Section 3.03 ACCEPTANCE BY TRUSTEE

The Grantor Trustee hereby acknowledges receipt of each of the REMIC

Certificates and each Swap Agreement and declares that it will hold such

documents and any amendments, replacement or supplements thereto, as well as any

other assets included in the definitions of Trust Estate and delivered to the

Trustee, as Trustee in trust upon and subject to the conditions set forth herein

for the benefit of the Holders.

ARTICLE IV

ISSUANCE AND SALE OF CERTIFICATES

Section 4.01 ISSUANCE OF CERTIFICATES.

On the Startup Day the Grantor Trustee, pursuant to the written request of

the Depositor executed by an officer of the Depositor, shall execute and cause

the Floating Rate Certificates to be authenticated and delivered to or upon the

order of the Depositor in authorized denominations.

Section 4.02 SALE OF CERTIFICATES.

At 11 a.m. New York City time on the Startup Day (the "Closing"), at the

offices of Orrick Herrington & Sutcliffe LLP, 666 Fifth Avenue, New York, New

York, the Depositor will sell and convey the REMIC Certificates to the Grantor

Trustee, and the Grantor Trustee will deliver to the Depositor each Class of the

Floating Rate Certificates each with a Percentage Interest equal to 100%,

registered in the name of Cede & Co., or in such other names as the Depositor

shall direct.

14

ARTICLE V

FLOATING RATE CERTIFICATES AND TRANSFER OF INTERESTS

Section 5.01 TERMS.

(a) The Floating Rate Certificates are pass-through securities

having the rights described therein and herein. Notwithstanding references

herein or therein with respect to the Floating Rate Certificates to "principal"

and "interest", no debt of any Person is represented thereby, nor are the

Floating Rate Certificates guaranteed by any Person. Each Class of the Floating

Rate Certificates is payable solely from payments received on or with respect to

the Class 4 A-2 REMIC Certificates and the related Swap Agreement, in the case

of the Class 4 A-2 Floating Rate Certificates, the Class 5 A-3 REMIC

Certificates and the related Swap Agreement, in the case of the Class 5 A-3

Floating Rate Certificates, and the Class 6 A-3 REMIC Certificates and the

related Swap Agreement, in the case of the Class 6 A-3 Floating Rate

Certificates, moneys in the Grantor Trust Account, and the proceeds of property

held as a part of the Trust Estate. Each Floating Rate Certificate entitles the

Holder thereof to receive monthly on each Distribution Date, in order of

priority of distributions with respect to such Floating Rate Certificates as set

forth in Section 7.03, a specified portion of such payments, pro rata in

accordance with such Holder's Percentage Interest in such Class.

(b) The Grantor Trustee will notify each Holder of the final

distribution on such Holder's Certificate, and such final payment shall be made

upon presentation and surrender of such Certificate.

Section 5.02 FORMS.

The Floating Rate Certificates shall be in substantially the form set

forth in Exhibit A hereof with such appropriate insertions, omissions,

substitutions and other variations as are required or permitted by this

Agreement or as may in the Depositor's judgment be necessary, appropriate or

convenient to comply, or facilitate compliance, with applicable laws, and may

have such letters, numbers or other marks of identification and such legends or

endorsements placed thereon as may be required to comply with the rules of any

applicable securities laws.

Section 5.03 EXECUTION, AUTHENTICATION AND DELIVERY.

Each Floating Rate Certificate shall be executed and authenticated by the

manual or facsimile signature of one of the Grantor Trustee's Authorized

Officers. Upon proper authentication by the Grantor Trustee, the Certificates

shall bind the Trust.

The initial Floating Rate Certificates shall be dated as of the Startup

Day and delivered at the Closing to the parties specified in Section 4.02

hereof. Subsequently issued Certificates will be dated as of the issuance of the

Certificate.

15

No Certificate shall be valid until executed and authenticated as set

forth above.

Section 5.04 REGISTRATION AND TRANSFER OF CERTIFICATES.

(a) The Grantor Trustee shall cause to be kept a register (the

"Register") in which, subject to such reasonable regulations as it may

prescribe, the Grantor Trustee shall provide for the registration of Floating

Rate Certificates and the registration of transfer of Floating Rate

Certificates. The Grantor Trustee is hereby appointed Registrar for the purpose

of registering Floating Rate Certificates and transfers of Floating Rate

Certificates as herein provided.

(b) At the option of any Holder, Floating Rate Certificates of any

Class owned by such Holder may be transferred or exchanged for other Floating

Rate Certificates authorized of like Class and tenor and a like aggregate

original principal amount or Percentage Interest and bearing numbers not

contemporaneously outstanding, upon surrender of the Floating Rate Certificates

to be transferred or exchanged at the office designated as the location of the

Register. Whenever any Floating Rate Certificate is so surrendered for exchange,

the Grantor Trustee shall execute, authenticate and deliver the Floating Rate

Certificate or Certificates which the Holder making the exchange is entitled to

receive. Any transfer of a Floating Rate Certificate is subject to the transfer

restrictions set forth in Section 5.04(d).

(c) All Floating Rate Certificates issued upon any registration of

transfer or exchange of Floating Rate Certificates shall be valid evidence of

the same ownership interests in the Trust and entitled to the same benefits

under this Agreement as the Floating Rate Certificates surrendered upon such

registration of transfer or exchange.

(d) Every Floating Rate Certificate presented or surrendered for

registration of transfer or exchange shall be duly endorsed, or be accompanied

by a written instrument of transfer in form satisfactory to the Registrar duly

executed by the Holder thereof or his attorney duly authorized in writing. No

transfer of a Floating Rate Certificate shall be made to any employee benefit or

other plan that is subject to the Employee Retirement Income Security Act of

1974, as amended ("ERISA"), or Section 4975 of the Code, to a trustee or other

person acting on behalf of any such plan, or to any other person using "plan

assets" to effect such acquisition (each, a "Plan Investor"), unless the

prospective transferee of a Certificateholder desiring to transfer its Floating

Rate Certificate provides the Grantor Trustee with either (A) an Opinion of

Counsel acceptable to and in form and substance satisfactory to the Grantor

Trustee and the Depositor to the effect that the purchase or holding of such

Floating Rate Certificate is permissible under applicable law, will not

constitute or result in any non-exempt prohibited transaction under Section 406

of ERISA, or Section 4975 of the Code (or comparable provisions of any

subsequent enactments), and will not subject the Grantor Trustee, the Depositor

or the Servicer to any obligation or liability (including obligations or

liabilities under ERISA or Section 4975 of the Code) in addition to those

undertaken in this Agreement or the Pooling and Servicing Agreement, which

Opinion of Counsel shall not be an expense of the Grantor Trustee, the Depositor

or the Servicer; or (B) the prospective transferee shall be required to provide

the Grantor Trustee and the Depositor with a certification, which the Grantor

Trustee and the Depositor may rely upon without further inquiry or

investigation, or such other certifications as

16

the Grantor Trustee or the Depositor may deem desirable or necessary in order to

establish that such transferee or the Person in whose name such registration is

requested either (a) is not a Plan Investor or (b) one or more of the following

class exemptions are applicable to the holding by the prospective transferee of

the Floating Rate Certificates by or with Plan Assets of a Plan: (i) Prohibited

Transaction Class Exemption ("PTCE") 96-23, (ii) PTCE 95-60, (iii) PTCE 91-38,

(iv) PTCE 90-1; or (v) PTCE 84-14. Notwithstanding the foregoing, an Opinion of

Counsel or certification will not be required with respect to the transfer of

any Floating Rate Certificate for so long as such Floating Rate Certificate is

held in the name of a Depository or its nominee (each such Floating Rate

Certificate, a "Book-Entry Certificate"). Any transferee of a Book-Entry

Certificate will be deemed to have represented by virtue of its purchase or

holding of such Book-Entry Certificate (or interest therein) that either (a)

such transferee is not a Plan Investor or (b) one or more of the following class

exemptions are applicable to the holding by the prospective transferee of the

Floating Rate Certificates by or with Plan Assets of a Plan: (i) Prohibited

Transaction Class Exemption ("PTCE") 96-23, (ii) PTCE 95-60, (iii) PTCE 91-38,

(iv) PTCE 90-1; or (v) PTCE 84-14. If any Book-Entry Certificate (or any

interest therein) is acquired or held in violation of the provisions of clause

(b) above, then the last preceding transferee that either (i) is not a Plan

Investor or (ii) whose holding is exempt as provided in clause (b) above shall

be restored, to the extent permitted by law, to all rights and obligations as

Certificateholder thereof retroactive to the date of such transfer of such

Book-Entry Certificate. Any purported Certificateholder whose acquisition or

holding of any Book-Entry Certificate (or interest therein) was effected in

violation of the restrictions in this Section 5.04(d) shall indemnify and hold

harmless the Depositor, the Grantor Trustee, the Servicer, and the Trust from

and against any and all liabilities, claims, costs or expenses incurred by such

parties as a result of such acquisition or holding. The Grantor Trustee shall be

under no liability to any Person for making any payments due on any Certificate

to such preceding transferee that is not a Plan Investor or whose holding is

exempt as provided in clause (b) above.

(e) No service charge shall be made to a Holder for any registration

of transfer or exchange of Floating Rate Certificates, but the Registrar or

Grantor Trustee may require payment of a sum sufficient to cover any tax or

other governmental charge that may be imposed in connection with any

registration of transfer or exchange of Floating Rate Certificates; any other

expenses in connection with such transfer or exchange shall be an expense of the

Trust.

(f) It is intended that the Floating Rate Certificates be registered

so as to participate in a global book entry system with the Depository, as set

forth herein. The Floating Rate Certificates shall, except as otherwise provided

in Subsection (g), be initially issued in the form of a single fully registered

Certificate of such Class. Upon initial issuance, the ownership of each such

Certificate shall be registered in the Register in the name of Cede & Co., or

any successor thereto, as nominee for the Depository.

The Floating Rate Certificates will be in fully-registered form only in

minimum denominations of $25,000 Certificate Principal Balance and integral

multiples of $1 in excess thereof.

17

With respect to the Certificates registered in the Register in the name of

Cede & Co., as nominee of the Depository, the Depositor, the Servicer and the

Grantor Trustee shall have no responsibility or obligation to Direct or Indirect

Participants or beneficial owners for which the Depository holds Floating Rate

Certificates from time to time as a Depository. Without limiting the immediately

preceding sentence, the Depositor, the Servicer and the Grantor Trustee shall

have no responsibility or obligation with respect to (i) the accuracy of the

records of the Depository, Cede & Co., or any Direct or Indirect Participant

with respect to the ownership interest in the Certificates, (ii) the delivery to

any Direct or Indirect Participant or any other Person, other than a registered

Holder of a Certificate as shown in the Register, of any notice with respect to

the Floating Rate Certificates or (iii) the payment to any Direct or Indirect

Participant or any other Person, other than a registered Holder of a Certificate

as shown in the Register, of any amount with respect to any distribution of

principal or interest on the Floating Rate Certificates. No Person other than a

registered Holder of a Certificate as shown in the Register shall receive a

certificate evidencing such Certificate.

Upon delivery by the Depository to the Grantor Trustee of written notice

to the effect that the Depository has determined to substitute a new nominee in

place of Cede & Co., and subject to the provisions hereof with respect to the

payment of interest by the mailing of checks or drafts to the registered Holders

of Floating Rate Certificates appearing as registered Holders in the

registration books maintained by the Grantor Trustee at the close of business on

a Record Date, the name "Cede & Co." in this Agreement shall refer to such new

nominee of the Depository.

(g) In the event that (i) the Depository or the Depositor advises

the Grantor Trustee in writing that the Depository is no longer willing or able

to discharge properly its responsibilities as nominee and depository with

respect to the Floating Rate Certificates and the Depositor or the Grantor

Trustee is unable to locate a qualified successor or (ii) the Depositor at its

sole option elects to terminate the book-entry system through the Depository,

the Floating Rate Certificates shall no longer be restricted to being registered

in the Register in the name of Cede & Co. (or a successor nominee) as nominee of

the Depository. At that time, the Depositor may determine that the Floating Rate

Certificates shall be registered in the name of and deposited with a successor

depository operating a global book-entry system, as may be acceptable to the

Depositor and at the Depositor's expense, or such depository's agent or designee

but, if the Depositor does not select such alternative global book-entry system,

then the Floating Rate Certificates may be registered in whatever name or names

registered Holders of the Floating Rate Certificates transferring the Floating

Rate Certificates shall designate, in accordance with the provisions hereof.

(h) Notwithstanding any other provision of this Agreement to the

contrary, so long as any of the Floating Rate Certificates is registered in the

name of Cede & Co., as nominee of the Depository, all distributions of principal

or interest on such Floating Rate Certificates and all notices with respect to

such Floating Rate Certificates shall be made and given, respectively, to the

Depository.

Section 5.05 MUTILATED, DESTROYED, LOST OR STOLEN FLOATING RATE

CERTIFICATES.

18

If (i) any mutilated Floating Rate Certificate is surrendered to the

Grantor Trustee, or the Grantor Trustee receives evidence to its satisfaction of

the destruction, loss or theft of any Floating Rate Certificate, and (ii) in the

case of any mutilated Floating Rate Certificate, such mutilated Floating Rate

Certificate shall first be surrendered to the Grantor Trustee, and in the case

of any destroyed, lost or stolen Floating Rate Certificate, there shall be first

delivered to the Grantor Trustee such security or indemnity as may be reasonably

required by it to hold the Grantor Trustee harmless, then, in the absence of

notice to the Grantor Trustee or the Registrar that such Floating Rate

Certificate has been acquired by a bona fide purchaser, the Depositor shall

execute and the Grantor Trustee shall authenticate and deliver, in exchange for

or in lieu of any such mutilated, destroyed, lost or stolen Floating Rate

Certificate, a new Floating Rate Certificate of like Class, tenor and aggregate

principal amount, bearing a number not contemporaneously outstanding.

Upon the issuance of any new Floating Rate Certificate under this Section,

the Registrar or Grantor Trustee may require the payment of a sum sufficient to

cover any tax or other governmental charge that may be imposed in relation

thereto; any other expenses in connection with such issuance shall be an expense

of the Trust.

Every new Floating Rate Certificate issued pursuant to this Section in

exchange for or in lieu of any mutilated, destroyed, lost or stolen Floating

Rate Certificate shall constitute evidence of a substitute interest in the

Trust, and shall be entitled to all the benefits of this Agreement equally and

proportionately with any and all other Floating Rate Certificates of the same

Class duly issued hereunder and such mutilated, destroyed, lost or stolen

Floating Rate Certificate shall not be valid for any purpose.

The provisions of this Section are exclusive and shall preclude (to the

extent lawful) all other rights and remedies with respect to the replacement or

payment of mutilated, destroyed, lost or stolen Floating Rate Certificates.

Section 5.06 PERSONS DEEMED OWNERS.

The Grantor Trustee and any agent of the Grantor Trustee may treat the

Person in whose name any Floating Rate Certificate is registered as the owner of

such Floating Rate Certificate for the purpose of receiving distributions with

respect to such Floating Rate Certificate and for all other purposes whatsoever

and neither the Grantor Trustee, the Servicer nor any agent of the Grantor

Trustee or the Servicer shall be affected by notice to the contrary.

Section 5.07 CANCELLATION.

All Floating Rate Certificates surrendered for registration of transfer or

exchange shall, if surrendered to any Person other than the Grantor Trustee, be

delivered to the Grantor Trustee and shall be promptly canceled by it. No

Floating Rate Certificate shall be authenticated in lieu of or in exchange for

any Floating Rate Certificate canceled as provided in this Section, except as

expressly permitted by this Agreement. All canceled Floating Rate Certificates

may be held by the Grantor Trustee in accordance with its standard retention

policy.

19

Section 5.08 ASSIGNMENT OF RIGHTS.

A Holder may pledge, encumber, hypothecate or assign all or any part of

its right to receive distributions hereunder, but such pledge, encumbrance,

hypothecation or assignment shall not constitute a transfer of an ownership

interest sufficient to render the transferee a Holder of the Trust without

compliance with the provisions of Section 5.04 hereof.

20

ARTICLE VI

COVENANTS

Section 6.01 DISTRIBUTIONS.

On each Distribution Date, the Grantor Trustee will withdraw amounts from

the Grantor Trust Account and make the distributions with respect to the

Floating Rate Certificates and each Swap Agreement in accordance with the terms

of the Floating Rate Cer