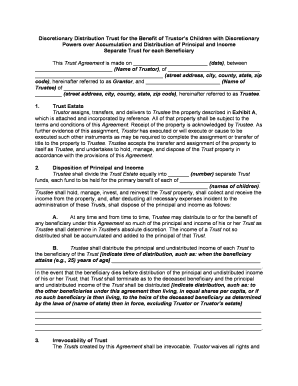

Discretionary Distribution Trust for the Benefit of Trustor’s Children with Discretionary

Powers over Accumulation and Distribution of Principal and Income

Separate Trust for each Beneficiary

This Trust Agreement is made on _________________________ (date), between

__________________________ (Name of Trustor), of _______________________________

___________________________________________ (street address, city, county, state, zip

code), hereinafter referred to as Grantor, and _________________________ (Name of

Trustee) of __________________________________________________________________

_________ (street address, city, county, state, zip code), hereinafter referred to as Trustee.

1.

Trust Estate

Trustor assigns, transfers, and delivers to Trustee the property described in Exhibit A,

which is attached and incorporated by reference. All of that property shall be subject to the

terms and conditions of this Agreement. Receipt of the property is acknowledged by Trustee. As

further evidence of this assignment, Trustor has executed or will execute or cause to be

executed such other instruments as may be required to complete the assignment or transfer of

title to the property to Trustee. Trustee accepts the transfer and assignment of the property to

itself as Trustee, and undertakes to hold, manage, and dispose of the Trust property in

accordance with the provisions of this Agreement.

2.

Disposition of Principal and Income

Trustee shall divide the Trust Estate equally into _______ (number) separate Trust

funds, each fund to be held for the primary benefit of each of ___________________________

__________________________________________________________ (names of children).

Trustee shall hold, manage, invest, and reinvest the Trust property, shall collect and receive the

income from the property, and, after deducting all necessary expenses incident to the

administration of these Trusts, shall dispose of the principal and income as follows:

A.

At any time and from time to time, Trustee may distribute to or for the benefit of

any beneficiary under this Agreement so much of the principal and income of his or her Trust as

Trustee shall determine in Trustee's absolute discretion. The income of a Trust not so

distributed shall be accumulated and added to the principal of that Trust.

B.

Trustee shall distribute the principal and undistributed income of each Trust to

the beneficiary of the Trust [indicate time of distribution, such as: when the beneficiary

attains (e.g., 25) years of age] __________________________________________________

____________________________________________________________________________.

In the event that the beneficiary dies before distribution of the principal and undistributed income

of his or her Trust, that Trust shall terminate as to the deceased beneficiary and the principal

and undistributed income of the Trust shall be distributed [indicate distribution, such as: to

the other beneficiaries under this agreement then living, in equal shares per capita, or if

no such beneficiary is then living, to the heirs of the deceased beneficiary as determined

by the laws of (name of state) then in force, excluding Trustor or Trustor's estate]

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________.

3.

Irrevocability of Trust

The Trusts created by this Agreement shall be irrevocable. Trustor waives all rights and

�powers, whether alone or in conjunction with others, to alter, amend, revoke, or terminate the

Trusts, or the terms of this Agreement, in whole or in part. By this Agreement, Trustor

relinquishes absolutely and forever any Trust, either vested or contingent, including any

reversionary right or possibility of reverter, in the principal and income of the Trusts, and any

power to determine or control, by alteration, amendment, revocation, or termination, or

otherwise, the beneficial enjoyment of the principal or income of the Trusts. Any distribution to

or for the benefit of any beneficiary or any other person under the terms of this Agreement is not

intended to be, and shall not be, made in discharge of or in lieu of any parental obligation of

Trustor. No part of the principal or income of the Trusts shall be applied to the payment of

premiums of policies of insurance on the life of Trustor.

4.

Additions to Trust Estate

Trustor, and any other person, shall have the right at any time to add to the principal of

any of the Trusts any property that is acceptable to Trustee. The property, when received and

accepted by Trustee, shall be administered, held, controlled and distributed by Trustee in

accordance with the terms and conditions of this Agreement.

5.

Distribution to Minors

Whenever principal or income of a Trust is distributable to a minor, Trustee shall retain

possession of the principal and income until the beneficiary attains the age of (e.g., 21 years)

________________. In the meantime, Trustee shall use and expend so much of the principal

and income of the Trust as Trustee deems necessary or desirable for the support, education,

care, and general welfare of the beneficiary. Any income not so expended shall be accumulated

and added to the principal of that Trust.

6.

Powers of Trustee

In addition to all other powers and discretions granted by law or by this Agreement,

Trustee shall have the following powers and discretions, all of which shall be exercised in a

fiduciary capacity:

A.

To arrange for the automatic application of dividends in reduction of premium

payments, with regard to all policies of insurance held in the Trust Estate. Otherwise, the

dividends shall be treated as income and shall be applied to the payment of the premiums.

B.

The Trustee shall have power to invest and reinvest the Trust property in bonds,

stocks, notes, or other property, real or personal, suitable for the investment of Trust funds; to

register property in the name of a nominee without restriction; to vote in person or by general or

limited proxy, or refrain from voting, any corporate securities for any purpose, except that any

security as to which the Trustee's possession of voting discretion would subject the issuing

company or the Trustee to any law, rule, or regulation adversely affecting either the company or

the Trustee's ability to retain or vote company securities, shall be voted as directed by the

Trustor, if living, otherwise by the beneficiaries then entitled to receive or have the benefit of the

income from the Trust; to lease (for any period of time though commencing in the future or

extending beyond the term of the Trust), sell, exchange, mortgage, or pledge any or all of the

Trust property as the Trustee deems proper; to borrow from any lender, including a Trustee

individually; to employ agents, attorneys and proxies; to compromise, contest, prosecute or

abandon claims; to divide or distribute in cash or in kind, or partly in each, or in undivided

interests or in different assets or disproportionate interests in assets, to value the Trust property

for such purposes, and to sell any property in order to make division or distribution.

�C.

The Trustee is authorized to establish out of income and credit to principal

reasonable reserves for depreciation, obsolescence and depletion.

D.

The Trustee may transfer the situs of any Trust property to any other jurisdiction

as often as the Trustee deems it advantageous to the Trust, appointing a substitute Trustee to

itself to act with respect to it. In connection with that the Trustee may delegate to the substitute

Trustee any or all of the powers given to the Trustee, which may elect to act as advisor to the

substitute Trustee and shall receive reasonable compensation for so acting. The Trustee may

remove any acting substitute Trustee and appoint another, or reappoint itself, at will.

7.

Limitation on Powers

Notwithstanding the foregoing and any other provision of this Trust Agreement, no power

exercisable by Trustee shall be construed so as to enable Trustee, Trustor, or any other person

to purchase, exchange, or otherwise deal with or dispose of the principal of the Trust Estate or

the income from the Trust Estate for less than an adequate consideration in money or money's

worth, or to enable Trustor to borrow the principal or income, directly or indirectly, without

adequate interest or security. No person other than Trustee acting in a fiduciary capacity shall

have the power to vote or direct the voting of stock or other securities, to control the investment

of Trust funds either by directing investments or reinvestments or by vetoing proposed

investments or reinvestments, or to permit any person to reacquire the Trust principal by

substituting other property of an equivalent value.

8.

Annual Account and Compensation of Trustee

The Trustee shall render an account of its receipts and disbursements at least annually

to the Grantor if living, otherwise to each adult income beneficiary. The Trustee shall be

reimbursed for all reasonable expenses incurred in the management and protection of the Trust

and shall receive fair compensation for its services. The Trustee's regular compensation shall

be charged against income during the Grantor's lifetime and subsequently half against income

and half against principal, except that the Trustee shall have full discretion at any time or times

to charge a larger portion or all against income without being limited to circumstances specified

by state law.

9.

Successor Trustees

Trustee, or any successor, may resign at any time on giving written notice (number)

days before the resignation shall take effect, to Trustor, or after Trustor's death, to all adult

beneficiaries and to the guardians or other fiduciaries of the Estate of any minor or incompetent

beneficiaries who may then be receiving, or are entitled to receive, income under this

Agreement. On the resignation of any Trustee, those to whom notice of resignation is to be

given shall designate a successor Trustee by written notice to the resigning Trustee within

__________ (number) days after receipt of notice of resignation. In the event a successor

Trustee shall not be so designated, the resigning Trustee shall have the right to appoint a

successor Trustee. The resigning Trustee shall transfer and deliver to the successor Trustee the

then entire Trust Estate and shall then be discharged as Trustee of these Trusts and shall have

no further powers, discretions, rights, obligations, or duties with reference to the Trust Estate. All

such powers, discretions, rights, obligations, and duties of the resigning Trustee shall inure to,

and be binding on, the successor Trustee. Any Trustee, or successor Trustee, named or

appointed under this Agreement must be neither Trustor nor a related or subordinate party as

that term is defined for federal tax purposes.

10.

Spendthrift Provision

No title or interest in the money or other property constituting the principal of the Trust

�Estate, or in any income accruing from or on the principal, shall vest in any beneficiary during

the continuance of the Trust created by this Agreement. No beneficiary shall have the power or

authority to anticipate in any way any of the rents, issues, profits, income, monies, or payments

provided or authorized to be paid by this Agreement to the beneficiary, or any part of the same,

nor to alienate, convey, transfer or dispose of the same or any interest in or any part of the

same in advance of payment. None of the same shall be involuntarily alienated by any

beneficiary or be subject to attachment, execution, or be levied on or taken on any process for

any debts that any beneficiary of the Trust shall have contracted or shall contract, or in

satisfaction of any demands or obligations that any beneficiary shall incur. All payments

authorized and provided to be made by Trustee shall be made and shall be valid and effectual

only when paid to the beneficiary to whom the payments shall belong, or otherwise, as provided

in this Agreement.

11.

Perpetuities Savings Clause

Each Trust created by this Agreement, unless sooner terminated as otherwise provided

in this Agreement, shall fully cease and terminate 21 years after the death of the last survivor of

Trustor and all issue of Trustor living on the date of this Agreement. On such termination, the

entire principal of the Trust Estate of each Trust, together with any undistributed income from

the Trust, shall vest in and be distributed to the persons entitled to take under the provisions of

each such Trust.

12.

Governing Law

This Agreement and Trust are specifically created as a ___________________ (name

of state) Agreement and Trust and the construction, validity, and effect of this Agreement and

the rights and duties of the beneficiaries and the Trustee shall at all times be governed

exclusively by the laws of ___________________ (name of state).

13.

Counterparts

This Agreement may be executed in any number of counterparts, any one of which shall

constitute the Agreement between the parties.

14.

Construction

Unless the context requires otherwise, all words used in this instrument in the singular

number shall extend to and include the plural. All words used in the plural number shall extend

to and include the singular; and all words used in any gender shall extend to and include all

genders.

15.

No Bond or Surety

No Trustee under this Agreement shall be required to give or file any bond or other

security or surety of any kind, nor shall any Trustee be personally liable except for willful

malfeasance or bad faith.

The parties have executed this Agreement on the day and year first above written.

____________________________________

Name & Signature of Trustor

(Acknowledgments before Notary Public)

(Attach Exhibit)

___________________________________

Name & Signature of Trustee

�