Fill and Sign the How to Fill Up Sbi Home Loan Application Form 2009

Practical advice on preparing your ‘How To Fill Up Sbi Home Loan Application Form 2009’ online

Are you weary of the inconvenience of managing documents? Look no further than airSlate SignNow, the premier electronic signature service for individuals and businesses. Bid farewell to the tedious practice of printing and scanning files. With airSlate SignNow, you can easily finalize and sign documents online. Utilize the robust tools integrated into this user-friendly and budget-friendly platform and transform your method of document administration. Whether you need to approve forms or collect digital signatures, airSlate SignNow manages it all effortlessly, needing only a few clicks.

Follow this step-by-step tutorial:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

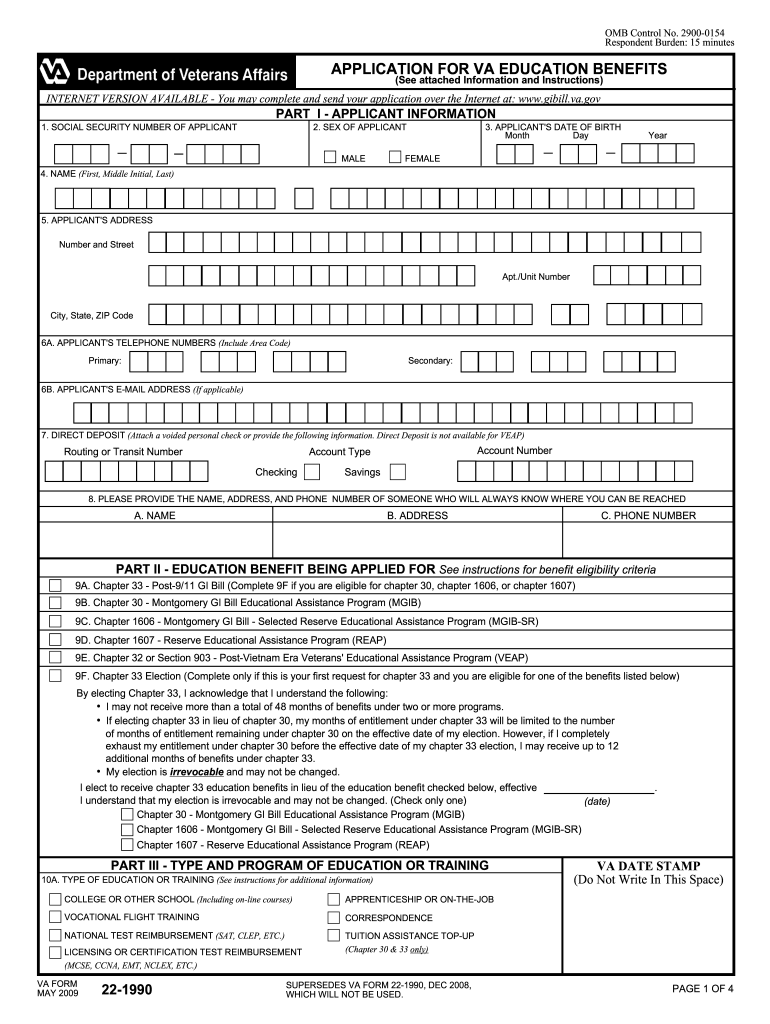

- Open your ‘How To Fill Up Sbi Home Loan Application Form 2009’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and assign fillable fields for others (if required).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your How To Fill Up Sbi Home Loan Application Form 2009 or send it for notarization—our platform provides everything necessary to achieve such objectives. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the first step in learning how to fill up SBI home loan application form?

To begin understanding how to fill up SBI home loan application form, gather all necessary documents such as identity proof, income proof, and property details. These documents will be essential in ensuring that you complete the application accurately and efficiently.

-

Are there any fees associated with the SBI home loan application process?

Yes, there may be fees involved when applying for a home loan through SBI, including processing fees and documentation charges. It is important to check with SBI for the latest fee structure while you learn how to fill up SBI home loan application form.

-

Can I apply for an SBI home loan online?

Absolutely! SBI allows applicants to complete their home loan application online, making it easier to learn how to fill up SBI home loan application form from the comfort of your home. You can visit the SBI website to access the online form and submit your application.

-

What features does airSlate SignNow offer for signing SBI home loan documents?

airSlate SignNow provides a user-friendly platform that allows you to eSign your SBI home loan documents seamlessly. This feature simplifies the process and ensures that you can quickly complete your paperwork while learning how to fill up SBI home loan application form.

-

Is there a mobile app for managing SBI home loan applications?

Yes, SBI offers a mobile banking app that allows you to manage your home loan application and access necessary forms. This can be particularly helpful as you navigate how to fill up SBI home loan application form on-the-go.

-

What are the benefits of using airSlate SignNow for SBI home loan applications?

Using airSlate SignNow for your SBI home loan applications offers efficiency and security. It streamlines the signature process, allowing you to focus on how to fill up SBI home loan application form without worrying about the logistics of document signing.

-

How can I track the status of my SBI home loan application?

You can track the status of your SBI home loan application through the SBI website or mobile app. This feature is beneficial while you learn how to fill up SBI home loan application form, as it keeps you updated on your application progress.

Find out other how to fill up sbi home loan application form 2009

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles