Fill and Sign the Hyundai Odometer Statement Form

Helpful suggestions for finishing your ‘Hyundai Odometer Statement Form’ online

Are you exhausted by the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the powerful features embedded within this user-friendly and cost-effective platform and transform your document handling approach. Whether you need to approve documents or collect signatures, airSlate SignNow can manage it all with just a few simple clicks.

Adhere to this detailed guideline:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Hyundai Odometer Statement Form’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Include and assign fillable fields for other individuals (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Hyundai Odometer Statement Form or send it for notarization—our solution provides you with everything necessary to complete these tasks. Sign up with airSlate SignNow today and enhance your document management like never before!

FAQs

-

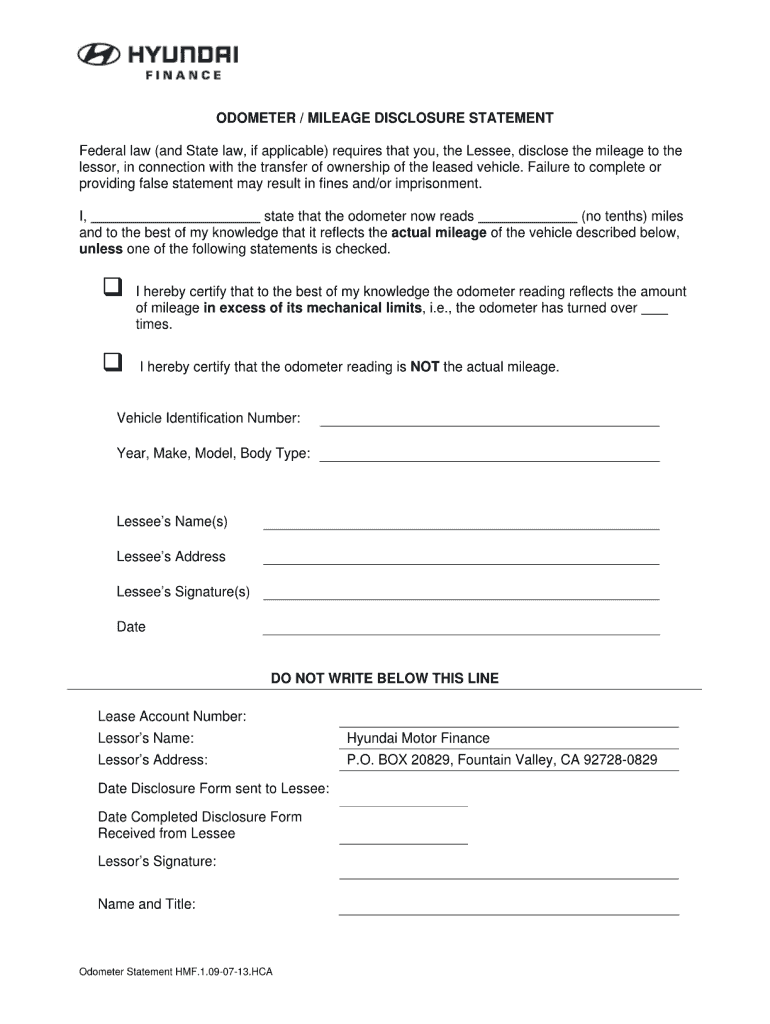

What is a Hyundai Odometer Disclosure Statement?

A Hyundai Odometer Disclosure Statement is a legal document that certifies the mileage on a Hyundai vehicle at the time of sale. This statement is essential for potential buyers to ensure they are aware of the vehicle's history and can help prevent fraud related to odometer tampering.

-

Why do I need a Hyundai Odometer Disclosure Statement when selling my car?

When selling your Hyundai, providing a Hyundai Odometer Disclosure Statement is crucial as it protects both you and the buyer. This document ensures transparency regarding the vehicle's mileage, which is vital for maintaining trust and avoiding legal issues down the line.

-

How can airSlate SignNow help me create a Hyundai Odometer Disclosure Statement?

airSlate SignNow offers an easy-to-use platform that allows you to create a Hyundai Odometer Disclosure Statement quickly. With our customizable templates, you can input the necessary information, eSign the document, and send it securely to the buyer, streamlining the selling process.

-

Is there a cost associated with using airSlate SignNow for the Hyundai Odometer Disclosure Statement?

airSlate SignNow provides various pricing plans tailored to meet your needs, including a free trial option. You can create and send a Hyundai Odometer Disclosure Statement at an affordable rate, making it a cost-effective solution for document signing.

-

What features does airSlate SignNow offer for my Hyundai Odometer Disclosure Statement?

With airSlate SignNow, you can easily create, edit, and eSign your Hyundai Odometer Disclosure Statement. Features include customizable templates, secure cloud storage, and automated workflows, ensuring that your document is professional and legally binding.

-

Can I integrate airSlate SignNow with other applications for my Hyundai Odometer Disclosure Statement?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This allows you to manage your Hyundai Odometer Disclosure Statement alongside your other documents and streamline your workflow.

-

How secure is my Hyundai Odometer Disclosure Statement with airSlate SignNow?

Security is a priority at airSlate SignNow. Your Hyundai Odometer Disclosure Statement is protected with industry-standard encryption and complies with legal regulations, ensuring that your sensitive information remains safe and confidential.

Find out other hyundai odometer statement form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles