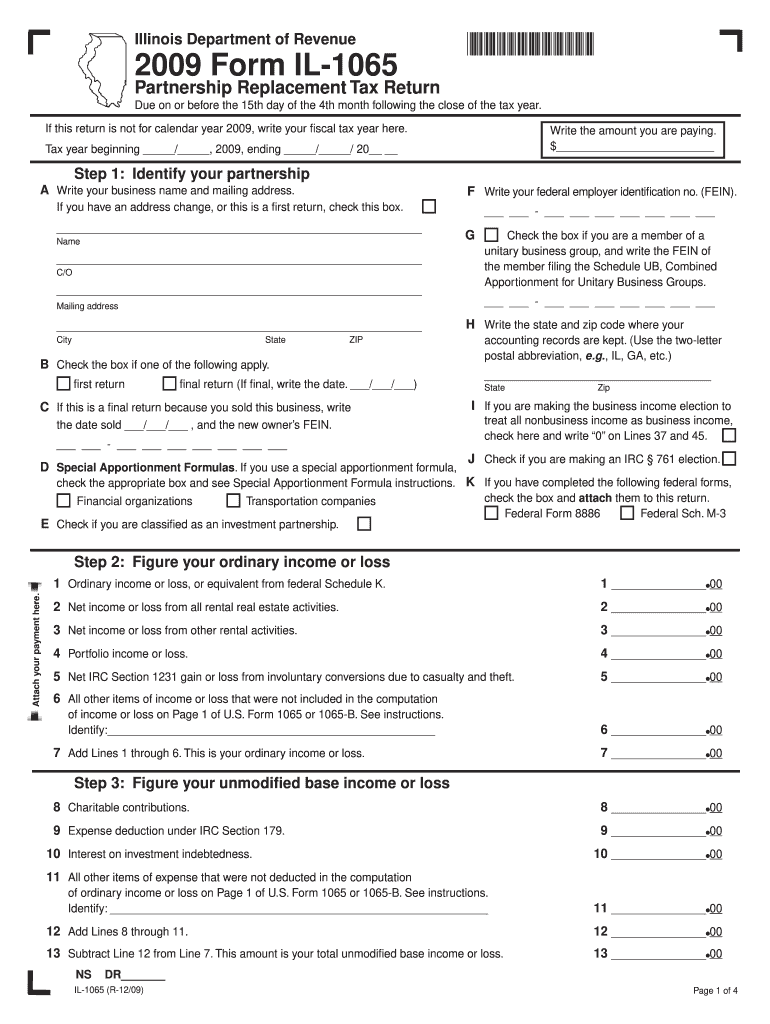

Fill and Sign the Illinois Department of Revenue Partnership Replacement Tax Return Due on or Before the 15th Day of the 4th Month Following the Form

Practical advice on setting up your ‘Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can smoothly finalize and sign paperwork online. Take advantage of the extensive features embedded within this intuitive and budget-friendly platform and transform your method of document management. Whether you need to sign forms or gather signatures, airSlate SignNow makes it all simple, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if required).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or transform it into a reusable template.

Don’t be concerned if you need to work together with others on your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The or send it for notarization—our solution has you covered with everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and take your document management to the next level!

FAQs

-

What is the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C.?

The Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C. refers to the deadline for partnerships in Illinois to file their tax returns. This due date is crucial for compliance and avoiding penalties. Ensure your documents are prepared and submitted on time to meet this deadline.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Partnership Replacement Tax Return?

AirSlate SignNow streamlines the process of preparing and signing documents necessary for the Illinois Department Of Revenue Partnership Replacement Tax Return. With features like customizable templates and secure e-signatures, you can efficiently manage your tax documents. This helps ensure that you meet the due date without hassle.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers robust features for tax document management, including e-signature capabilities, document templates, and real-time collaboration. These tools are designed to simplify the process of preparing your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C. and other important documents.

-

Is there a pricing plan for using airSlate SignNow for tax returns?

Yes, airSlate SignNow offers flexible pricing plans to cater to different needs, including those for businesses managing tax returns. These plans are cost-effective and designed to ensure you can efficiently meet the requirements, such as the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! AirSlate SignNow integrates with various accounting software, making it easy to manage your documents related to the Illinois Department Of Revenue Partnership Replacement Tax Return. This integration allows for seamless data flow and ensures your tax filings are accurate and timely.

-

What are the benefits of using airSlate SignNow for my partnership tax documents?

Using airSlate SignNow for your partnership tax documents offers several benefits, including improved efficiency, reduced errors, and enhanced security. By streamlining the process of preparing your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C., you can focus more on your business and less on paperwork.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow employs industry-leading security measures to protect your sensitive tax documents. With features like encryption and secure cloud storage, you can confidently manage your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C. without compromising your data security.

Find out other illinois department of revenue partnership replacement tax return due on or before the 15th day of the 4th month following the form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles