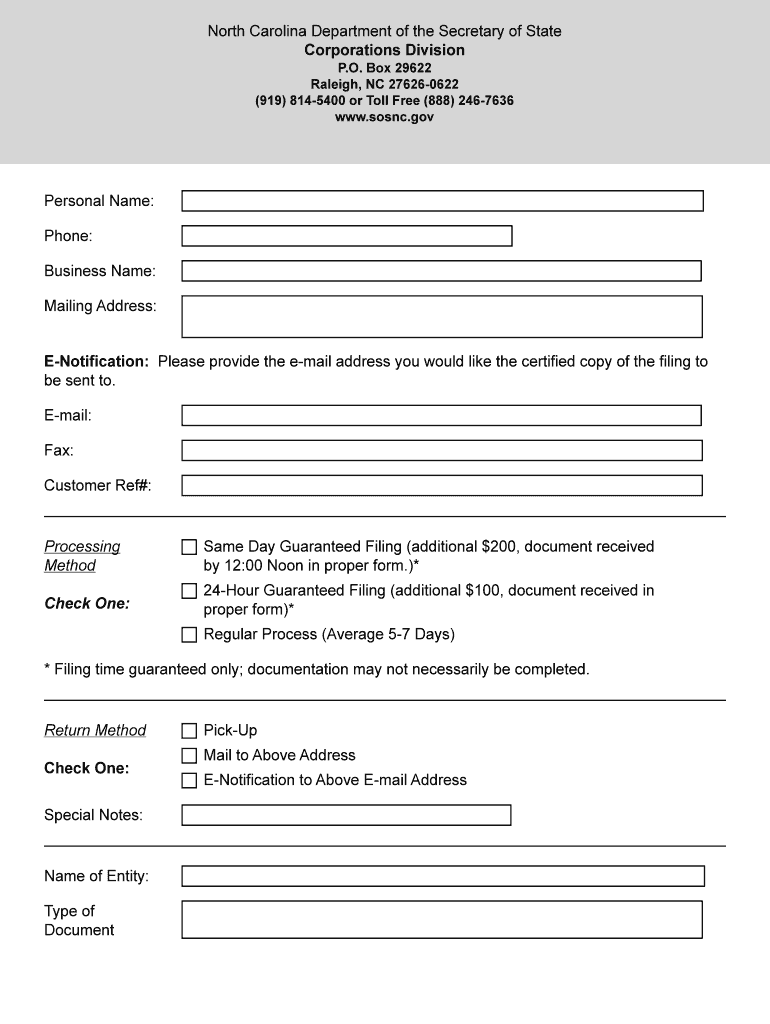

North Carolina Department of the Secretary of State Corporations Division P.O. Box 29622

Raleigh, NC 27626-0622

(919) 814-5400 or Toll Free (888) 246-7636 www.sosnc.gov

Personal Name: Phone:Business Name:

Mailing Address: E-Notification: Please provide the e-mail address you would like the certified copy of the filing to

be sent to. E-mail:Fax:Customer Ref#:

Processing Method Check One: Same Day Guaranteed Filing (additional $200, document received by 12:00 Noon in proper form.)* 24-Hour Guaranteed Filing (additional $100, document received in proper form)*

Regular Process (Average 5-7 Days)

* Filing time guaranteed only; documentation may not necessarily be completed.

Return Method Check One: Pick-Up

Mail to Above Address

E-Notification to Above E-mail Address

Special Notes:

Name of Entity:

Type of Document

CORPORATIONS DIVISION P. O. BOX 29622 RALEIGH, NC 27626-0622

Revised November, 2016 Form N-01

Instructions for

Completing Articles of Incorporation

Nonprofit Corporation (Form N -01)

Item 1 Enter the complete and accurate corporate name for the nonprofit corporation. The n ame may include a corporate ending.

Item 2 Charitable or religious corporation" means any corporation that is exempt u nder section 501(c)(3) of the Internal Revenue

Code of 1986 or any successor section, or that i t is organized exclusively for one or more of the purposes specified in

section 501(c)(3) of the Internal Revenue Code of 1986 or any successor section and that upon dissolution shall distribute

its assets to a charitable or religious corporation, the United States, a state or a n entity that is exempt under section

501(c)(3) of the Internal Revenue Code of 1986 or any successor section. Place a check mark in item 2 if the proposed

nonprofit corporation intends to seek exemption under Section 501(c)(3) of the I nternal Revenue Code.

Item 3 Enter the nam e of the initial registered agent. The registered agent must be either an individu al who resides in North

Carolina; a domestic business corporation, nonprofit corporation, or limite d liability company whose business office is

identical with the registered office; or a foreign corporation, nonprofit cor poration or limited liability company authorized to

transact business in North Carolina whose business office is identical with the registered office.

Item 4 Enter the complete street address of the registere d agent’s office located in North Carolina and the county in which it is

located. Enter the complete mailing address of the registered office only if m ail is not delivered to the street address stated

in Item 5 or if you prefer to receive mail at a P. O. Box or Drawer.

Item 5 Enter the name and business address of each incorporator.

Item 6 Indicate by checking either (a) or (b) if the nonprofit entity will or will not have m embers.

Item 7 Attach the provisions for the nonprofit regarding the distribution of assets upon dissolution. Form N -14 has sample

provisions for your use as a guide.

Item 8 Other provisions may address the purpose of the corporation, the limitation o f liability, etc. per statutes in Chapter 55 of the

North Carolina General Statutes.

Item 9 Enter the principal office telephone number and the complete street address of the p rincipal office and the county in which it

is located. If mail is not delivered to the street a ddress of the principal office or if you prefer to receive mail at a P.O. Box

or Drawer, enter the complete mailing address of the principal office.

Item 10 (Optional): This field is being provided in order to assist business entities in identifying its c ompany officials and

complying with Federal banking regulations.

Item 11 (Optional): The Department offers a free voluntary notification system for which you may choose to participate. If you

would like to receive this free service, please provide a busin ess e-mail address in the space provided. Your participation

will not result in your e -mail address being viewable on our website. Participation will help us to preven t identity theft in

the event an unauthorized person submits a fraudulent document for filing in the name of the business entity.

Item 1 2 The document will be effective on the date and at the time of filing, unless a delayed d ate or an effective time (on the day of

filing) is specified. If a delayed effective date is specified without a time, the document will be effective at 11:59:59 p.m.

on the day specified. If a delayed effective date is specified with a time, the document w ill be effective on the day and time

so specified. A delayed effective date may be specified up to and includi ng the 90th

day after the day of filing.

Date and Execution

Enter the date the document was executed.

In the blanks provided enter:

• The name of the entity executing the Articles of Incorporation; if an individual, leave blank.

• The signature of the incorporator or representative of the incorporating entity.

• The name of the incorporator or name and title of the above signed representative

CORPORATIONS DIVISION P. O. BOX 29622 RALEIGH, NC 27626-0622

Revised November, 2016 Form N-01

State of

North Carolina

Department of the Secretary of State

ARTICLES OF INCORPORATION

NONPROFIT CORPORATION

Pursuant to §55A -2-02 of the General Statutes of North Carolina, the undersigned corporation d oes hereby submit these Articles of

Incorporation for the purpose of forming a nonprofit corporation.

1. The name of the nonprofit corporation is: ____________________________________________________ .

2._____ (Check only if applicable.) The corporation is a charitable or religious corporati on as defined in NCGS

§55A-1-40(4).

3. The name of the initial registered agent is: __________________________________________________ .

4. The street address and county of the initial registered agent’s office of the corporation is:

Number and Street : _____________________________________________________________________

City: _______________ State: NC Zip Code: __________ County: __________________________

The mailing address if different from the street address of the initial registered agent’s office is:

Number and Street or PO Box: ____________________________________________________________

City: _______________ State: NC Zip Code: __________ County: __________________________

5. The name and address of each incorporator is as follows:

Name Address

__________________________________ ______________________________________________________________

__________________________________ ______________________________________________________________

__________________________________ __________________ ____________________________________________

6. (Check either “a” or “b” below.)

a.___The corporation will have members.

b.___The corporation will not have members.

7. Attached are provisions regarding the distribution of the corporation’s assets upon its dissolution.

8. Any other provisions which the corporation elects to include are attached.

CORPORATIONS DIVISION P. O. BOX 29622 RALEIGH, NC 27626-0622

Revised November, 2016 Form N-01

9. The street address and county of the principal office of the corporation is:

Principal Office Telephone Number: _______________________________________________________

Number and Street : _____________________________________________________________________

City: _______________ State: Zip Code: __________ County: __________________________

The mailing address if different from the street address of the principal office is:

Number and Street or PO Box: ____________________________________________________________

City: _______________ State: Zip Code: __________ County: __________________________

10. (Optional): Listing of Officers (See instructions for why this is important)

Name Address Title

11. (Optional): Please provide a business e -mail address: ____________________________________________.

The Secretary of State’s Office will e -mail the business automatically at the address provided at no charge

when a document is filed. The e-mail provided will not be viewable on the website. For more information

on why this service is being offered, ple ase see the instructions for this document.

12. These articles will be effective upon filing, unless a future time and/or date is specified: ______________

This is the_____day of_____________ ,20____.

___________________________________________

Incorporator Business Entity Name

___________________________________________

Signature of Incorporator

___________________________________________

Type or print Incorporator’s name and title, if any

NOTES:

1. Filing fee is $60. This document must be filed with the Secretary of State.

Department of the Secretary of State Corporations Division

501(c)(3) Attachment -- General Information

The attached provisions may be incorporated by reference into articles of incorpor ation of

a nonprofit corporation, by entering "See attached provisions" in Item #9 on the Sec retary

of State’s standard form for articles of incorporation for nonprofit corporations . This

should be done only

if the corporation is intended to be tax-exempt under Section

501(c)(3) of the Internal Revenue Code, and if its activities and the use of its proper ty are

intended to be restricted to one or more of the purposes listed in the "Purposes of

Corporation" provision. Do not

file this "General Information" sheet as a part of your

articles of incorporation.

Currently Section 501(c) of the Internal Revenue Code includes twenty-seven cat egories

of organizations which are exempt from federal taxation, and Subsection (c)(3) is onl y

one of those twenty-seven. The Department of the Secretary of State makes the att ached

provisions available as a courtesy to the public. This should not

be interpreted as advice

from the Department that the information in this form is appropriate for inclusion i n

documents designed for a specific corporate transaction, since the Department cannot be

aware of all the facts and circumstances relevant to a particular transa ction. Therefore,

your documents should be reviewed carefully by a competent attorney before you f ile

them.

The attached provisions may also be used as amendments to an existing nonprofit

corporation’s articles of incorporation, by entering "See attached provisions" in Item 2 of

the Secretary of State’s standard form for Articles of Amendment for nonprof it

corporations.

Important: A corporation seeking tax-exempt status may have to complete and submi t an

Application for Recognition of Exemption Under Section 501(c)(3) of the Internal

Revenue Code (Form 1023) in order to obtain that status. The procedures involved in

applying for tax-exempt status are described in IRS Publication 557, "Tax-E xempt Status

for Your Organization", available from the Internal Revenue Service. Merely including

the attached provisions as part of your articles of incorporation will not

necessarily

procure tax-exempt status for the corporation; often it is necessary to obtain a

"determination letter" from the IRS to achieve this goal.

May 1997

Purpose of Corporation

This corporation is organized for the following purpose(s) (check as applicable):

____religious,

____charitable,

____educational,

____testing for public safety,

____scientific,

____literary,

____fostering national or international amateur sports competition, and/or

____prevention of cruelty to children or animals,

including, for such purposes, the making of distributions to organizations that qualify a s

exempt organizations under Sections 501(c)(3) and 170(c)(2) of the Internal Revenue

Code of 1986 (herein the "Code") (or the corresponding provisions of any future United

States Internal Revenue Code).

Prohibited Activities

No part of the net earnings of the corporation shall inure to the benefit of or be

distributable to, its members, directors, officers, or other private persons ex cept that the

corporation shall be authorized and empowered to pay reasonable compensation for

services rendered and to make payments and distributions in furtherance of purposes set

forth in these articles of incorporation. No substantial part of the activities of the

corporation shall be the carrying on of propaganda or otherwise attempting to inf luence

legislation, and the corporation shall not participate in or intervene in (including the

publishing or distribution of statements) any political campaign on behalf of or in

opposition to any candidate for public office. Notwithstanding any other provisions of

these articles, the corporation shall not carry on any other activities not per mitted to be

carried on (a) by a corporation exempt from federal income tax under Section 501(c)( 3)

of the Code or (b) by a corporation, contributions to which are deductible under Section

170(c)(2) of the Code.

Distributions Upon Dissolution

Upon the dissolution of the corporation, the Board of Directors shall, after paying or

making provision for the payment of all of the liabilities of the corporation, dispose of all

of the assets of the corporation exclusively for the purposes of the corporation in suc h

manner, or to such organization or organizations organized and operated exclusively for

religious, charitable, educational, scientific or literary purposes as sha ll at the time

qualify as an exempt organization or organizations under Section 501(c)(3) of the Code

as the Board of Directors shall determine, or to federal, state, or local gover nments to be

used exclusively for public purposes. Any such assets not so disposed of shall be

disposed of by the Superior Court of the county in which the principal office of the

corporation is then located, exclusively for such purposes or to such organizations, such

as the court shall determine, which are organized and operated exclusively for such

purposes, or to such governments for such purposes.

Valuable tips on finalizing your ‘Incorporating Your Business In North Carolina Small ’ online

Are you fatigued by the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the mundane task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and authorize documents online. Take advantage of the extensive features included in this user-friendly and economical platform and transform your method of document management. Whether you need to endorse forms or gather digital signatures, airSlate SignNow simplifies everything, needing only a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Incorporating Your Business In North Carolina Small ’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for additional participants (if needed).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Store, print your copy, or convert it into a reusable template.

No need to worry if you need to work with your teammates on your Incorporating Your Business In North Carolina Small or send it for notarization—our platform provides everything you need to achieve those tasks. Sign up with airSlate SignNow today and enhance your document management to a higher standard!