Fill and Sign the Indiana Amended Individual Income Tax Return Form it 40x State Form 44405 R13 9 14 If You Are Not Filing for the Calendar Year

Practical advice on setting up your ‘Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year’ online

Are you fed up with the complications of handling paperwork? Your solution is airSlate SignNow, the leading e-signature service for individuals and organizations. Bid farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can conveniently complete and sign documents online. Take advantage of the comprehensive features available in this user-friendly and affordable platform to transform your paperwork management approach. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Adhere to this comprehensive tutorial:

- Log into your account or sign up for a complimentary trial with our platform.

- Select +Create to upload a file from your device, cloud storage, or our template collection.

- Access your ‘Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year’ in the editor.

- Select Me (Fill Out Now) to prepare the document on your end.

- Add and allocate fillable fields for others (if needed).

- Proceed with the Send Invite settings to seek eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year or send it for notarization—our service offers everything required to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

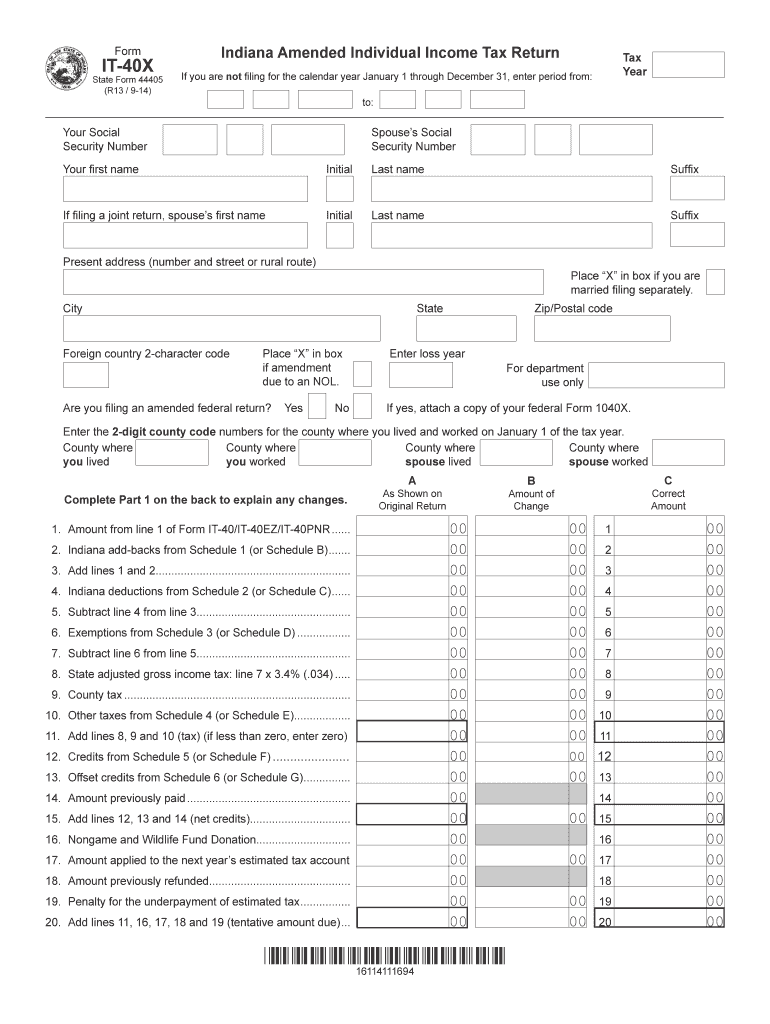

What is the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year?

The Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year is used by Indiana residents to amend their previously filed income tax returns. This form allows taxpayers to correct errors or make changes to their income, deductions, or credits for the state tax year.

-

How can airSlate SignNow help me with the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year?

airSlate SignNow simplifies the process of completing and eSigning the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year. Our platform enables users to fill out the form electronically, ensuring accuracy and efficiency while also allowing for secure eSignature collection.

-

Is there a cost associated with using airSlate SignNow for the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. While there is a cost associated with using our service, the investment can lead to signNow time savings and improved workflow when handling documents like the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year.

-

What features does airSlate SignNow offer for managing tax forms like the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year?

airSlate SignNow provides several features that enhance document management, such as customizable templates, automated workflows, and secure cloud storage. These features ensure that you can effectively manage the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year efficiently and with a high level of security.

-

Can I integrate airSlate SignNow with other software for filing the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software to streamline your filing process. This capability is especially beneficial for managing forms like the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year, allowing for a more cohesive workflow.

-

What are the benefits of using airSlate SignNow for tax amendments like the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year?

Using airSlate SignNow for tax amendments offers numerous benefits, including time efficiency, reduced errors, and increased security. By utilizing our platform for the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year, you can expedite the process and ensure that your amendments are filed correctly.

-

How do I get started with airSlate SignNow for the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year?

Getting started with airSlate SignNow is easy. Simply sign up for an account, choose a plan that suits your needs, and begin creating or uploading your Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year. Our intuitive interface guides you through the entire process.

Find out other indiana amended individual income tax return form it 40x state form 44405 r13 9 14 if you are not filing for the calendar year

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles