Fill and Sign the Irs Tax Form 6559a

Useful advice on getting your ‘Irs Tax Form 6559a’ online

Are you overwhelmed by the burden of managing paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and organizations. Bid farewell to the laborious task of printing and scanning documents. With airSlate SignNow, you can conveniently finalize and sign documents online. Utilize the extensive features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or collect signatures, airSlate SignNow simplifies the entire process, needing just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Open your ‘Irs Tax Form 6559a’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to fret if you want to collaborate with others on your Irs Tax Form 6559a or send it for notarization—our solution has everything required to accomplish such tasks. Enroll with airSlate SignNow today and enhance your document management experience!

FAQs

-

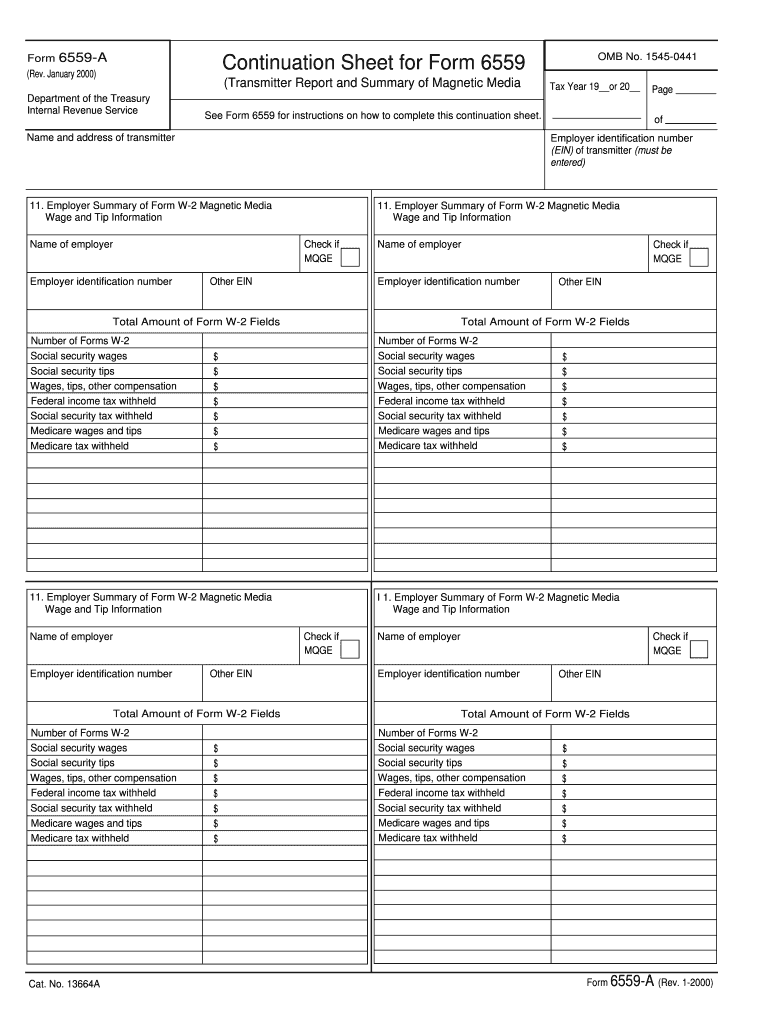

What is the Irs Tax Form 6559a and why do I need it?

The Irs Tax Form 6559a is used for reporting specific tax information required by the IRS. Businesses and individuals need this form to ensure compliance with federal tax regulations. Properly filling out and submitting the Irs Tax Form 6559a can help you avoid potential penalties.

-

How can airSlate SignNow help me manage my Irs Tax Form 6559a?

airSlate SignNow provides a seamless platform for eSigning and managing your Irs Tax Form 6559a. With our easy-to-use interface, you can quickly prepare, send, and sign this important document, ensuring that your tax filings are handled efficiently. Our solution streamlines the process, making tax compliance easier.

-

Is there a cost to use airSlate SignNow for my Irs Tax Form 6559a?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features for managing the Irs Tax Form 6559a. Our plans are designed to be cost-effective, making it affordable for individuals and businesses to ensure compliance with IRS requirements. You can choose a plan that best fits your document signing needs.

-

Can I integrate airSlate SignNow with other software for handling the Irs Tax Form 6559a?

Absolutely! airSlate SignNow offers integrations with various platforms that enable you to manage your Irs Tax Form 6559a alongside your other business applications. This connectivity allows for a smoother workflow and helps you keep all your important documents organized in one place.

-

What are the benefits of using airSlate SignNow for eSigning the Irs Tax Form 6559a?

Using airSlate SignNow for eSigning the Irs Tax Form 6559a offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. Our platform ensures that your documents are secure and compliant with legal standards, giving you peace of mind while handling your tax forms.

-

How long does it take to complete the Irs Tax Form 6559a using airSlate SignNow?

Completing the Irs Tax Form 6559a using airSlate SignNow can be done in just a few minutes. Our user-friendly interface allows you to fill out and eSign the form quickly, signNowly reducing the time spent on paperwork. This efficiency can help you meet deadlines more effectively.

-

Is airSlate SignNow compliant with IRS regulations for the Irs Tax Form 6559a?

Yes, airSlate SignNow is fully compliant with IRS regulations when handling the Irs Tax Form 6559a. Our platform ensures that all eSigned documents meet the necessary legal requirements, providing you with confidence in the compliance of your tax submissions.

Find out other irs tax form 6559a

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles