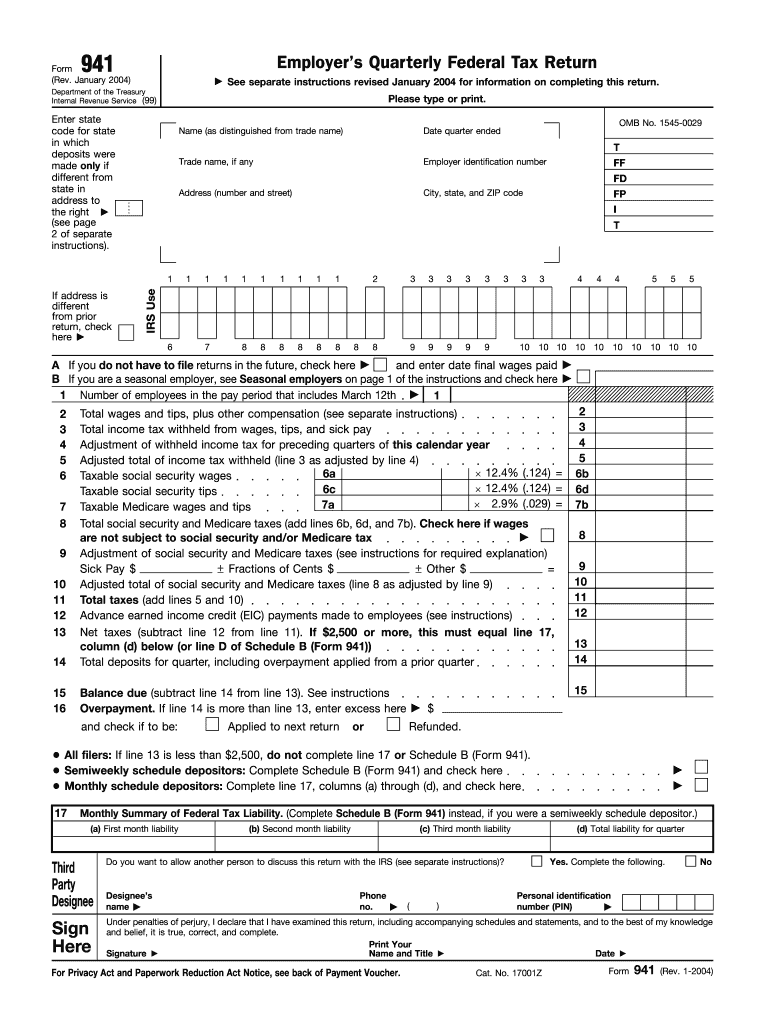

Fill and Sign the January 2004 Department of the Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate Form

Useful suggestions for finishing your ‘January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate’ online

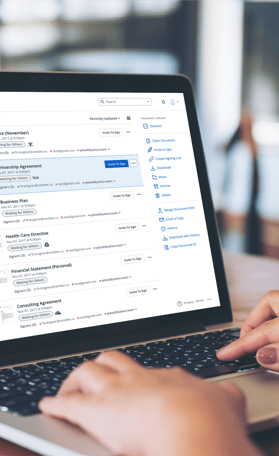

Are you fed up with the trouble of handling paperwork? Look no further than airSlate SignNow, the top eSignature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can smoothly finalize and sign documents online. Take advantage of the powerful tools integrated into this user-friendly and affordable platform and transform your method of document management. Whether you need to approve forms or gather electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Edit your ‘January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate’ in the editor.

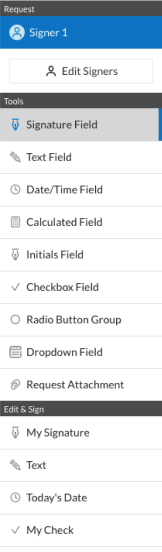

- Select Me (Fill Out Now) to complete the form on your behalf.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you have to collaborate with your teammates on your January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate or send it for notarization—our solution provides everything you require to complete such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate?

The January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate is a tax form used by employers to report payroll taxes. This form is crucial for businesses to ensure compliance with federal tax obligations and to accurately report income, Social Security, and Medicare taxes withheld from employee wages.

-

How can airSlate SignNow help with the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate?

airSlate SignNow streamlines the process of filling out and submitting the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate. Our platform allows you to easily eSign and send documents securely, ensuring that your tax returns are completed efficiently and accurately.

-

What are the pricing plans for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for managing the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate. Each plan includes features like unlimited eSigning, customizable templates, and integration capabilities, allowing you to choose the one that best suits your business requirements.

-

Can I integrate airSlate SignNow with my accounting software for tax filings?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate. This integration helps streamline your financial processes, ensuring that all your tax documents are accessible and organized in one place.

-

What features does airSlate SignNow provide for managing tax documents like the 941 form?

airSlate SignNow provides a range of features for managing tax documents, including customizable templates, real-time tracking, and secure cloud storage. These features are essential for efficiently handling the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate while ensuring compliance and reducing the risk of errors.

-

Is airSlate SignNow secure for submitting sensitive tax information?

Absolutely! airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and security measures to protect sensitive tax information, including the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate. You can confidently submit your tax documents, knowing that your data is secure.

-

How does eSigning work for the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate?

eSigning with airSlate SignNow is simple and efficient. Once you upload the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate, you can easily add electronic signatures and send the document for approval, ensuring a quick turnaround for your tax filings.

Related searches to january 2004 department of the treasury internal revenue service 99 941 employers quarterly federal tax return see separate form

Find out other january 2004 department of the treasury internal revenue service 99 941 employers quarterly federal tax return see separate form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles