- 1 -

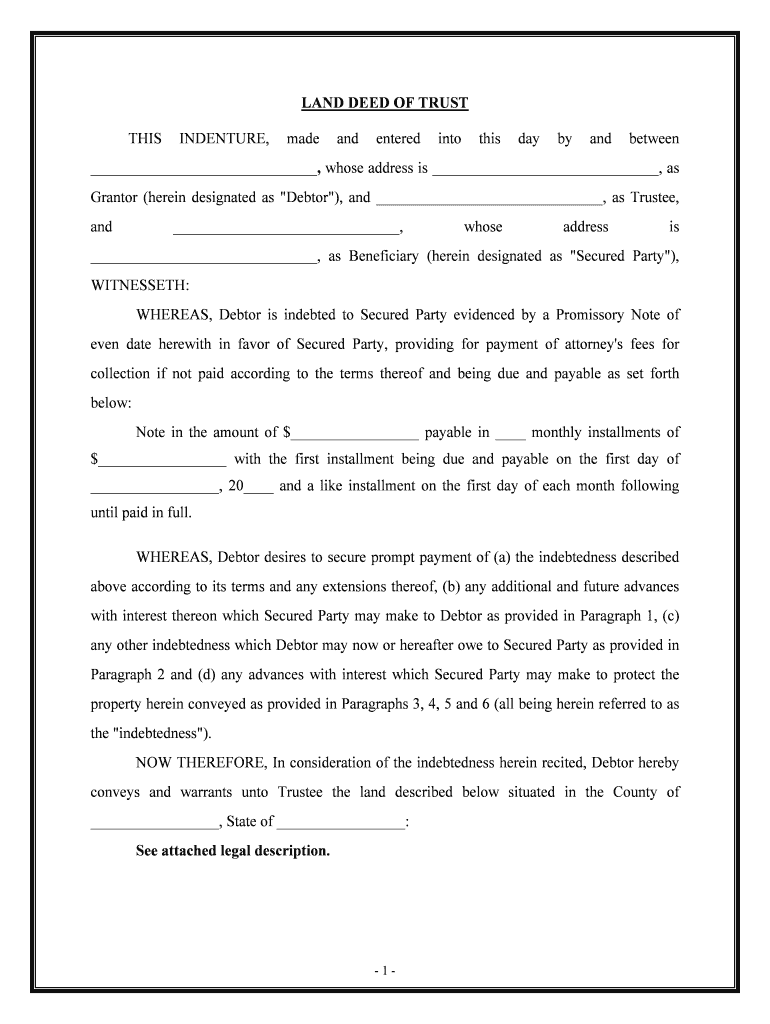

LAND DEED OF TRUST

THIS INDENTURE, made and entered into this day by and between ______________________________, whose address is ______________________________, as

Grantor (herein designated as "Debtor"), and ______________________________, as Trustee,

and ______________________________, whose address is

______________________________, as Beneficiary (herein designated as "Secured Party"),

WITNESSETH: WHEREAS, Debtor is indebted to Secured Party evidenced by a Promissory Note of

even date herewith in favor of Secured Party, providing for payment of attorney's fees for

collection if not paid according to the terms thereof and being due and payable as se t forth

below: Note in the amount of $_________________ payable in ____ monthly installments of

$_________________ with the first installment being due and payable on the first day of

_________________, 20____ and a like installment on the first day of each month following

until paid in full.

WHEREAS, Debtor desires to secure prompt payment of (a) the indebtedness described

above according to its terms and any extensions thereof, (b) any additional and future advanc es

with interest thereon which Secured Party may make to Debtor as provided in Paragraph 1, (c )

any other indebtedness which Debtor may now or hereafter owe to Secured Party as provided in

Paragraph 2 and (d) any advances with interest which Secured Party may make to protect the

property herein conveyed as provided in Paragraphs 3, 4, 5 and 6 (all being herein referred to as

the "indebtedness"). NOW THEREFORE, In consideration of the indebtedness herein recited, Debtor hereby

conveys and warrants unto Trustee the land described below situated in the County of

_________________, State of _________________: See attached legal description.

- 2 -

together with all improvements and appurtenances now or hereafter erected on, and all fixtures

of any and every description now or hereafter attached to, said land (all being herein re ferred to

as the "Property").

- 3 -

THIS CONVEYANCE, HOWEVER, IS IN TRUST (subject to the covenants, stipulations

and conditions below), to secure prompt payment of all existing and future indebtedness due by

Debtor to Secured Party under the provisions of this Deed of Trust. If Debtor shall pay said

indebtedness promptly when due and shall perform all covenants made by Debtor, then this

conveyance shall be void and of no effect. If Debtor shall be in default as provided in

Paragraph 9, then, in that event, the entire indebtedness, together with all interest accrued

thereon, shall, at the option of Secured Party, be and become at once due and payable wi thout

notice to Debtor, and Trustee shall, at the request of Secured Party, sell the Property conveyed,

or a sufficiency thereof, to satisfy the indebtedness at public outcry to the highest bi dder for cash

in accordance with the laws of the state in which the property is located. Should Secured Party be a corporation or an unincorporated association, then any officer

thereof may declare Debtor to be in default as provided in Paragraph 9 and request Trustee to sell

the Property. Secured Party shall have the same right to purchase the property at the fore closure

sale as would a purchaser who is not a Party to this Deed of Trust.

From the proceeds of the sale Trustee shall first pay all costs of the sale incl uding

reasonable compensation to the Trustee; then the indebtedness due Secured Party by Debtor,

including accrued interest and attorney's fees due for collection of the debt; and then, lastly, any

balance remaining to Debtor.

IT IS AGREED that this conveyance is made subject to the covenants, stipulat ions and

conditions set forth below which shall be binding upon all parties hereto.

1. This Deed of Trust shall also secure all future and additional advances which Secured

Party may make to Debtor from time to time upon the security herein conveyed. Such a dvances

shall be optional with Secured Party and shall be on such terms as to amount, maturity and rate

of interest as may be mutually agreeable to both Debtor and Secured Party. Any such advanc e

may be made to any one of the Debtors should there be more than one, and if so made, shall be

secured by this Deed of Trust to the same extent as if made to all Debtors. However, on all

transactions covered by Truth in Lending, when Debtor's notes, debts, obligations and liabiliti es

- 4 -

to Secured Party (in any form) arising out of existing, concurrent and future credit granted by

Secured Party are secured by this Deed of Trust, it will be so indicated on the document that

evidences the transaction. Therefore this Deed of Trust will in no way secure any form of

credit governed by the Truth in Lending Act unless the document which evidences the Credi t

Transaction indicates by proper disclosure that the Transaction is secured by this Deed of Trust.

2. This Deed of Trust shall also secure any and all other indebtedness of Debtor due to

Secured Party with interest thereon as specified, or of any one of the Debtors should there be

more than one, whether direct or contingent, primary or secondary, sole, joint or several, now

existing or hereafter arising at any time before cancellation of this Deed of Trust . Such

indebtedness may be evidenced by note, open account, overdraft, endorsement, guaranty or

otherwise. However, on all transactions covered by Truth in Lending, when Debtor's notes,

debts, obligations and liabilities to Secured Party (in any form) arising out of existing, c oncurrent

and future credit granted by Secured Party are secured by this Deed of Trust, it will be so

indicated on the document that evidences the transaction. Therefore this Deed of Trust will in

no way secure any form of credit governed by the Truth in Lending Act unless the document

which evidences the Credit Transaction indicates by proper disclosure that the Transa ction is

secured by this Deed of Trust.

3. Debtor shall keep all improvements on the land herein conveyed insured against fi re,

all hazards included within the term "extended coverage", flood in areas designated by the U. S.

Department of Housing and Urban Development as being subject to overflow and such other

hazards as Secured Party may reasonable require in such amounts as Debtor may determine but

for not less than the indebtedness secured by this Deed of Trust. All policies shall be wri tten by

reliable insurance companies acceptable to Secured Party, shall include standard loss payable

clauses in favor of Secured Party and shall be delivered to Secured Party, Debtor shall prom ptly

pay when due all premiums charged for such insurance, and shall furnish Secured Party the

premium receipts for inspection. Upon Debtor's failure to pay the premiums, Secured Party

- 5 -

shall have the right, but not the obligation, to pay such premiums. In the event of a loss covered

by the insurance in force, Debtor shall promptly notify Secured Party who may make proof of

loss if timely proof is not made by Debtor. All loss payments shall be made directly to Secured

Party as loss payee who may either apply the proceeds to the repair or restoration of the damaged

improvements or to the indebtedness of Debtor, or release such proceeds in whole or in part to

Debtor.

4. Debtor shall pay all taxes and assessments, general or special, levied against the

Property or upon the Interest of Trustee or Secured Party therein, during the term of this Deed of

Trust before such taxes or assessments become delinquent, and shall furnish Secured Party the

tax receipts for inspection. Should Debtor fail to pay all taxes and assessments when due,

Secured Party shall have the right, but not the obligation, to make these payments.

5. Debtor shall keep the Property in good repair and shall not permit or commit waste,

impairment or deterioration thereof. Debtor shall use the Property for lawful purposes only.

Secured Party may make or arrange to be made entries upon and inspections of the Property a fter

first giving Debtor notice prior to any inspection specifying a just cause related to Sec ured

Party's interest in the Property. Secured Party shall have the right, but not the obligation, t o cause

needed repairs to be made to the Property after first affording Debtor a reasonable opportunity to

make the repairs.

Should the purpose of the primary indebtedness for which this Deed of Trust is

given as security be for construction of improvements on the land herein conveyed, Secured

Party shall have the right to make or arrange to be made entries upon the Property and

inspections of the construction in progress. Should Secured Party determine that Debtor is

failing to perform such construction in a timely and satisfactory manner, Secured Party shal l

have the right, but not the obligation, to take charge of and proceed with the construct ion at the

- 6 -

expense of Debtor after first affording Debtor a reasonable opportunity to continue the

construction in a manner agreeable to Secured Party.

6. Any sums advanced by Secured Party for Insurance, taxes, repairs or construction as

provided in Paragraphs 3, 4 and 5 shall be secured by this Deed of Trust as advances made to

protect the Property and shall be payable by Debtor to Secured Party, with interest at the rate

specified in the note representing the primary indebtedness, within thirty days following writt en

demand for payment sent by Secured Party to Debtor by certified mail. Receipts for insura nce

premiums, taxes and repair or construction costs for which Secured Party has made payment

shall serve as conclusive evidence thereof.

7. As additional security Debtor hereby assigns to Secured Party all rents accruing on t he

Property. Debtor shall have the right to collect and retain the rents as long as Debtor is not in

default as provided in Paragraph 9. In the event of default, Secured Party in person, by an age nt

or by a judicially appointed receiver shall be entitled to enter upon, take possession of and

manage the Property and collect the rents. All rents so collected shall be appli ed first to the

costs of managing the Property and collecting the rents, including fees for a receiver a nd an

attorney, commissions to rental agents, repairs and other necessary related expenses and then to

payments on the indebtedness.

8. This Deed of Trust (indenture) may not be assumed by any buyer from Debtor. Any

attempted transfer of any interest in this property (including, but not limited to posse ssion) will

constitute a default and Secured Party may accelerate the entire balance of the indebtedness.

If Secured Party elects to exercise the option to accelerate, Secured Party shall send Debtor

notice of acceleration by certified mail. Such notice shall provide a period of t hirty days from

the date of mailing within which Debtor may pay the indebtedness in full. If Debtor fail s to pay

- 7 -

such indebtedness prior to the expiration of thirty days. Secured Party may, without further

notice to Debtor, invoke any remedies set forth in this Deed of Trust.

9. Debtor shall be in default under the provisions of the Deed of Trust if Debtor (a) shall

fail to comply with any of Debtor's covenants or obligations contained herein, (b) shall fail to

pay any of the indebtedness secured hereby, or any installment thereof or interest thereon, a s

such indebtedness, installment or interest shall be due by contractual agreement or by

acceleration, (c) shall become bankrupt or insolvent or be placed in receivership, (d) sha ll, if a

corporation, a partnership or an unincorporated association be dissolved voluntarily or

involuntarily, or (e) if Secured Party in good faith deems itself insecure and its prospect of

repayment seriously impaired.

10. Secured Party may at any time, without giving formal notice to the original or any

successor Trustee, or to Debtor, and without regard to the willingness or inability of any such

Trustee to execute this trust, appoint another person or succession of persons to act as Truste e,

and such appointee in the execution of this trust shall have all the powers vested in and

obligations imposed upon Trustee. Should Secured Party be a corporation or an unincorporated

association, then any officer thereof may make such appointment.

11. Each privilege, option or remedy provided in this Deed of Trust to Secured Party is

distinct from every other privilege, option or remedy contained herein or afforded by law or

equity, and may be exercised independently, concurrently, cumulatively or successively by

Secured Party or by any other owner or holder of the indebtedness. Forbearance by Secured

Party in exercising any privilege, option or remedy after the right to do so has accrued shall not

constitute a waiver of Secured Party's right to exercise such privilege, option or remedy in event

of any subsequent accrual.

- 8 -

12. The words "Debtor" or "Secured Party" shall each embrace one individual, two or

more individuals, a corporation, a partnership or an unincorporated association, depending on the

recital herein of the parties to this Deed of Trust. The covenants herein contained shall bind, and

the benefits herein provided shall inure to, the respective legal or personal representat ives,

successors or assigns of the parties hereto subject to the provisions of Paragraph 8. If there be

more than one Debtor, then Debtor's obligations shall be joint and several. Whenever in t his

Deed of Trust the context so requires, the singular shall include the plural and the plural the

singular. Notices required herein from Secured Party to Debtor shall be sent to the addre ss of

Debtor shown in the Deed of Trust.

13. If any provision of this deed of trust shall be declared invalid, the intent of the part ies is

that the remaining provisions shall remain in full force and effect and shall be enforced.

14. This deed of trust shall be governed by the laws of the State of _________________.

IN WITNESS WHEREOF, Debtor has executed this Deed of Trust on the ____ day of _________________, 20____.

Signed: ___________________________________ DEBTOR

Print Name: _______________________________

[Add acknowledgment for your state].