Fill and Sign the Letter Creditors Sample Form

Useful suggestions for preparing your ‘Letter Creditors Sample’ online

Are you fed up with the trouble of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Utilize the powerful features integrated into this user-friendly and affordable platform and transform your method of document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow this detailed guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Letter Creditors Sample’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Insert and assign fillable fields for additional parties (if needed).

- Proceed with the Send Invite settings to request electronic signatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your Letter Creditors Sample or send it for notarization—our solution provides everything you require to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to a higher level!

FAQs

-

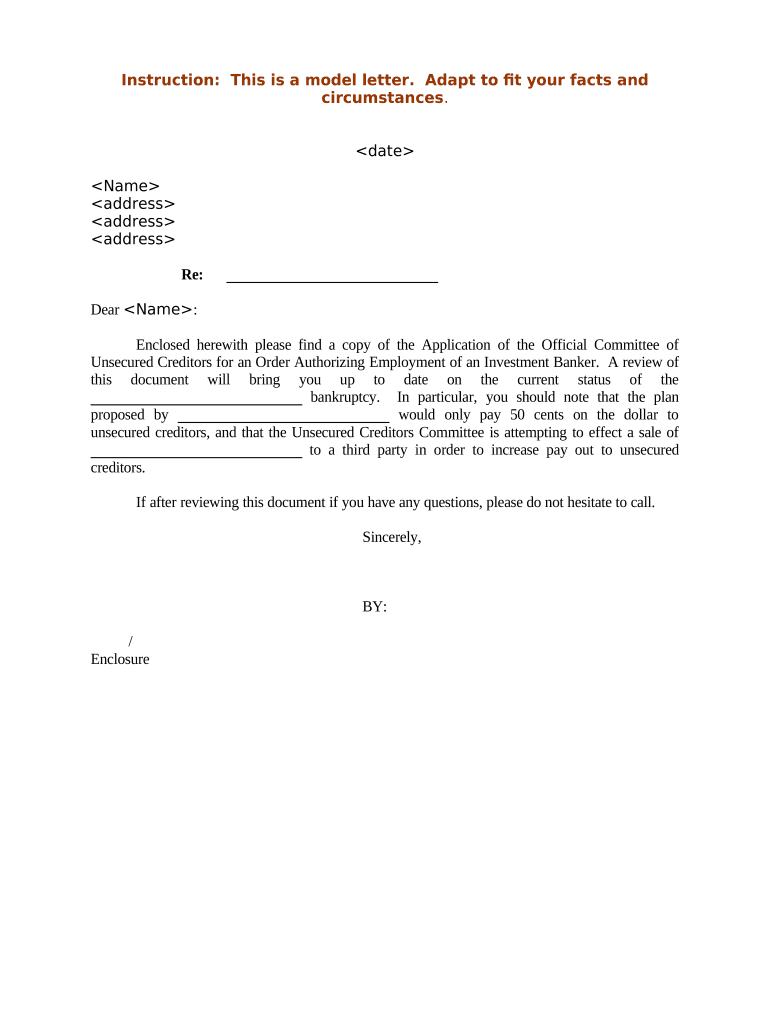

What is a Letter Creditors Sample and how can it be used?

A Letter Creditors Sample is a template designed to communicate effectively with creditors regarding outstanding debts or payment arrangements. By using airSlate SignNow, you can easily customize and send these samples for electronic signatures, ensuring a professional approach to debt management.

-

How does airSlate SignNow simplify the process of sending a Letter Creditors Sample?

airSlate SignNow streamlines the process by allowing you to create, edit, and send a Letter Creditors Sample within minutes. Our user-friendly interface makes it easy to personalize your letter and collect eSignatures, saving you time and effort.

-

Are there any costs associated with using the Letter Creditors Sample feature in airSlate SignNow?

Using the Letter Creditors Sample feature in airSlate SignNow is part of our cost-effective pricing plans. We offer various subscription options to fit your needs, allowing you to send unlimited documents for eSignature without breaking the bank.

-

Can I customize the Letter Creditors Sample template in airSlate SignNow?

Absolutely! airSlate SignNow provides full customization options for the Letter Creditors Sample template. You can easily modify the content, add your branding, and adjust any details to make it specific to your situation.

-

What are the benefits of using airSlate SignNow for a Letter Creditors Sample?

Using airSlate SignNow for a Letter Creditors Sample offers numerous benefits, including improved efficiency, enhanced security, and faster turnaround times for eSignatures. This ensures that your communication with creditors is both timely and professional.

-

Does airSlate SignNow integrate with other software to manage my Letter Creditors Sample?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRM and accounting tools. This allows you to manage your Letter Creditors Sample alongside other business processes, enhancing overall workflow efficiency.

-

Is it secure to send a Letter Creditors Sample through airSlate SignNow?

Definitely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Letter Creditors Sample and sensitive information. You can confidently send and receive documents knowing that your data is secure.

The best way to complete and sign your letter creditors sample form

Find out other letter creditors sample form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles