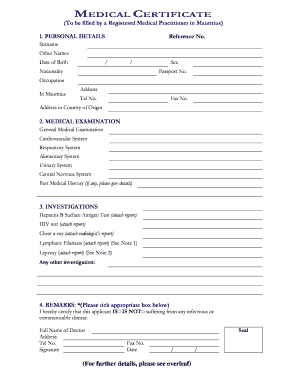

Fill and Sign the Medical Certificate Mauritius Form

Valuable suggestions for preparing your ‘Medical Certificate Mauritius’ online

Are you fed up with the complexities of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Leverage the powerful functionalities integrated into this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to validate forms or gather eSignatures, airSlate SignNow manages everything efficiently, needing only a few clicks.

Follow these comprehensive steps:

- Sign in to your account or sign up for a free trial with our platform.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Open your ‘Medical Certificate Mauritius’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Insert and assign fillable fields for others (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Medical Certificate Mauritius or send it for notarization—our platform has everything you need to accomplish such tasks. Sign up with airSlate SignNow today and enhance your document management to unprecedented levels!

FAQs

-

What is a Medical Certificate Mauritius and when do I need one?

A Medical Certificate Mauritius is an official document issued by a licensed healthcare professional confirming an individual's medical condition. You may need one for various reasons, including employment requirements, travel, or school admission. Having a Medical Certificate Mauritius ensures that you meet health and safety regulations.

-

How can I obtain a Medical Certificate Mauritius using airSlate SignNow?

To obtain a Medical Certificate Mauritius via airSlate SignNow, simply upload your documents and request an eSignature from your healthcare provider. The platform allows for easy document management and secure signing, streamlining the process. Once signed, you can download your Medical Certificate Mauritius instantly.

-

What features does airSlate SignNow offer for managing Medical Certificates in Mauritius?

airSlate SignNow offers a suite of features for managing Medical Certificates Mauritius, including eSignature capabilities, document templates, and secure cloud storage. You can track the status of your documents in real-time, ensuring that you never miss an important signature. The platform is user-friendly, making it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for obtaining Medical Certificates Mauritius?

Yes, airSlate SignNow is a cost-effective solution for obtaining Medical Certificates Mauritius. With flexible pricing plans, businesses and individuals can choose the option that best fits their needs without breaking the bank. The platform offers excellent value with its comprehensive features.

-

Does airSlate SignNow integrate with other tools for managing Medical Certificates Mauritius?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to manage your Medical Certificates Mauritius alongside other business applications. This integration capability enhances workflow efficiency and ensures that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for Medical Certificates in Mauritius?

Using airSlate SignNow for Medical Certificates Mauritius provides numerous benefits, including expedited document processing, enhanced security features, and ease of use. The platform eliminates the hassle of paper-based signatures, allowing you to manage all your medical documentation digitally. This ensures that you can focus on your health and work without unnecessary delays.

-

Can I track the status of my Medical Certificate Mauritius sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Medical Certificate Mauritius in real-time. You can see when the document is viewed, signed, and completed, giving you peace of mind. This tracking feature helps you stay informed throughout the process.

Find out other medical certificate mauritius form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles