Fill and Sign the Multistate Fixed Rate Note Form 3200 Word Fannie Mae

Useful suggestions for finishing your ‘Multistate Fixed Rate Note Form 3200 Word Fannie Mae’ online

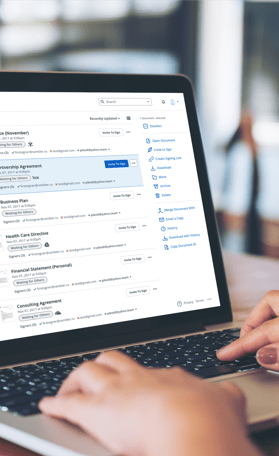

Are you fed up with the complications of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can conveniently finalize and sign documents online. Take advantage of the comprehensive features integrated into this user-friendly and budget-friendly platform and transform your method of document handling. Whether you need to approve documents or gather signatures, airSlate SignNow manages it all effortlessly, requiring only a few clicks.

Follow this detailed guide:

- Access your account or sign up for a no-cost trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Multistate Fixed Rate Note Form 3200 Word Fannie Mae’ in the editor.

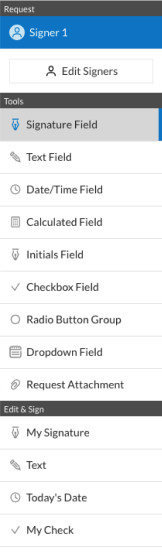

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for other individuals (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t stress if you need to collaborate with your colleagues on your Multistate Fixed Rate Note Form 3200 Word Fannie Mae or send it for notarization—our solution offers everything you need to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is a Fannie Mae promissory note?

A Fannie Mae promissory note is a legal document that outlines the terms of a loan secured by real estate. It serves as a promise to repay the borrowed amount, typically used in mortgage transactions. Understanding this document is crucial for both lenders and borrowers in the home financing process.

-

How can airSlate SignNow help with Fannie Mae promissory notes?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning Fannie Mae promissory notes. Our user-friendly interface simplifies the document management process, ensuring that all parties can easily access and sign the necessary paperwork. This streamlines the loan process and enhances overall efficiency.

-

What are the pricing options for using airSlate SignNow for Fannie Mae promissory notes?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling Fannie Mae promissory notes. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements. You can start with a free trial to explore our services before committing.

-

What features does airSlate SignNow offer for managing Fannie Mae promissory notes?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning for Fannie Mae promissory notes. Additionally, you can track document status in real-time and integrate with other tools to enhance your workflow. These features ensure a seamless experience for all users.

-

Are there any benefits to using airSlate SignNow for Fannie Mae promissory notes?

Using airSlate SignNow for Fannie Mae promissory notes offers numerous benefits, including increased efficiency and reduced turnaround times. Our solution minimizes paperwork and enhances collaboration among stakeholders. This ultimately leads to a smoother transaction process and improved customer satisfaction.

-

Can airSlate SignNow integrate with other software for Fannie Mae promissory notes?

Yes, airSlate SignNow can seamlessly integrate with various software applications to manage Fannie Mae promissory notes. This includes CRM systems, document management tools, and other business applications. These integrations help streamline your workflow and ensure that all your documents are easily accessible.

-

Is airSlate SignNow secure for handling Fannie Mae promissory notes?

Absolutely! airSlate SignNow prioritizes security when handling Fannie Mae promissory notes. Our platform employs advanced encryption and compliance with industry standards to protect your sensitive information. You can trust that your documents are safe and secure throughout the signing process.

The best way to complete and sign your multistate fixed rate note form 3200 word fannie mae

Get more for multistate fixed rate note form 3200 word fannie mae

Find out other multistate fixed rate note form 3200 word fannie mae

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles