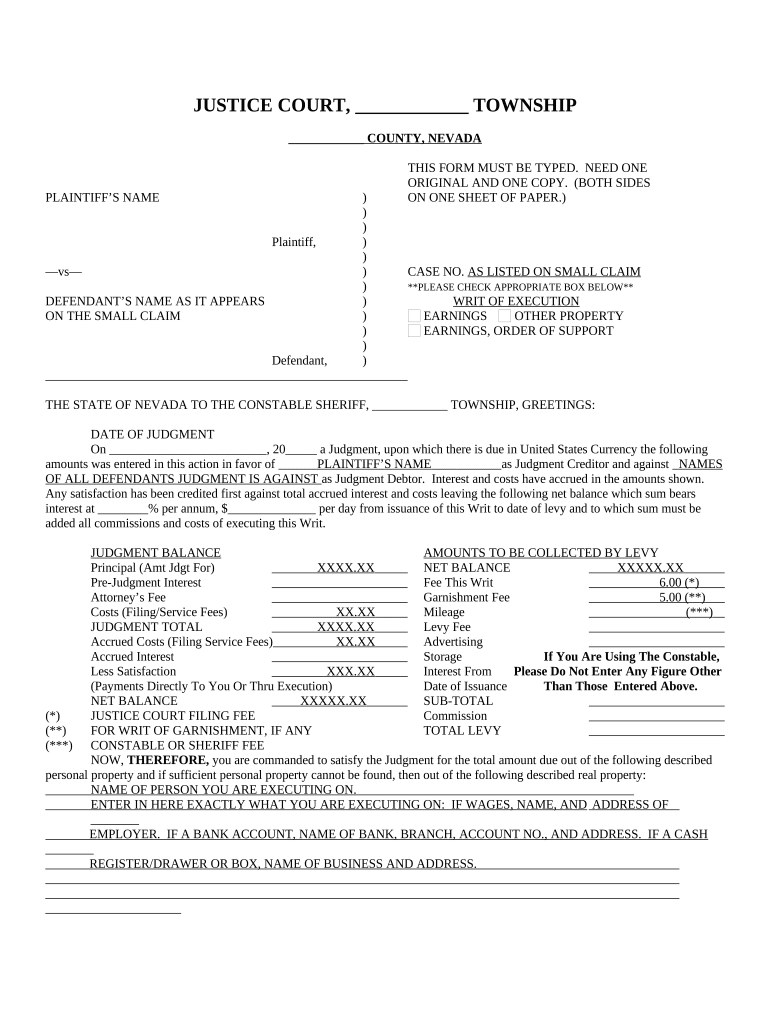

JUSTICE COURT, ____________ TOWNSHIP

____________ COUNTY, NEVADA

THIS FORM MUST BE TYPED. NEED ONE

ORIGINAL AND ONE COPY. (BOTH SIDES

PLAINTIFF’S NAME ) ON ONE SHEET OF PAPER.)

)

)

Plaintiff, )

)

—vs— ) CASE NO. AS LISTED ON SMALL CLAIM

) **PLEASE CHECK APPROPRIATE BOX BELOW**

DEFENDANT’S NAME AS IT APPEARS ) WRIT OF EXECUTION

ON THE SMALL CLAIM ) EARNINGS OTHER PROPERTY

) EARNINGS, ORDER OF SUPPORT

)

Defendant, )

THE STATE OF NEVADA TO THE CONSTABLE SHERIFF, ____________ TOWNSHIP, GREETINGS:

DATE OF JUDGMENT

On _________________________, 20_____ a Judgment, upon which there is due in United States Currency the following

amounts was entered in this action in favor of PLAINTIFF’S NAME as Judgment Creditor and against NAMES

OF ALL DEFENDANTS JUDGMENT IS AGAINST as Judgment Debtor. Interest and costs have accrued in the amounts shown.

Any satisfaction has been credited first against total accrued interest and costs leaving the following net balance which sum bears

interest at ________% per annum, $______________ per day from issuance of this Writ to date of levy and to which sum must be

added all commissions and costs of executing this Writ.

JUDGMENT BALANCE AMOUNTS TO BE COLLECTED BY LE VY

Principal (Amt Jdgt For) XXXX.XX NET BALANCE XXXXX.XX

Pre-Judgment Interest Fee This Writ 6.00 (*)

Attorney’s Fee Garnishment Fee 5.00 (**)

Costs (Filing/Service Fees) XX.XX Mileage (***)

JUDGMENT TOTAL XXXX.XX Levy Fee

Accrued Costs (Filing Service Fees) XX.XX Advertising

Accrued Interest Storage If You Are Using The Constable,

Less Satisfaction XXX.XX Interest From Please Do Not Enter Any Figure Other

(Payments Directly To You Or Thru Execution) Date of Issuance Than Those Entered Above.

NET BALANCE XXXXX.XX SUB-TOTAL

(*) JUSTICE COURT FILING FEE Commission

(**) FOR WRIT OF GARNISHMENT, IF ANY TOTAL LEVY

(***) CONSTABLE OR SHERIFF FEE

NOW, THEREFORE, you are commanded to satisfy the Judgment for the total amount due out of the following described

personal property and if sufficient personal property cannot be found, then out of the following described real property:

NAME OF PERSON YOU ARE EXECUTING ON.

ENTER IN HERE EXACTLY WHAT YOU ARE EXECUTING ON: IF WAGES, NAME, AND ADDRESS OF

EMPLOYER. IF A BANK ACCOUNT, NAME OF BANK, BRANCH, ACCOUNT NO., AND ADDRESS. IF A CASH

REGISTER/DRAWER OR BOX, NAME OF BUSINESS AND ADDRESS.

(SEE REVERSE SIDE FOR EXEMPTIONS WHICH MAY APPLY)

EXEMPTIONS WHICH APPLY TO THIS LEVY

(Check Appropriate Paragraph & Complete As Necessary)

Property Other Than Wages. The exemption set forth in NRS 21.090 or in other applicable Federal Statutes may apply.

Consult an attorney.

Earnings. The amount subject to garnishment and this Writ shall not exceed for any one pay period the lessor of:

a. 2.5% of the disposable earnings due the Judgment Debtor for the pay period, or

b. the difference between the disposable earnings for the period and $100.50 per week for each week of the pay period.

Earnings (Judgment or Order for Support)

A Judgment was entered for amounts due under a Decree or Order entered on _________________________, 20_____, by

the ______________________________________ for the support of _________________________________________, for

the period from _______________________, 20_____, through ____________________________, 20_____, in __________

installments of $_________________________.

The amount of disposable earnings subject to garnishment and this Writ shall not exceed for any one day period:

(Check Appropriate Box)

a maximum of 50 percent of the disposable earnings of such Judgment Debtor who is supporting a spouse or dependant child

other than the dependent named above;

a maximum of 60 percent of the disposable earnings of such Judgment Debtor who is not supporting a spouse or dependant

child other than the dependent named above;

plus an additional 5 percent of the disposable earnings of such Judgment Debtor if and to extent that the Judgment is for

support due for a period of time more than 12 weeks prior to the beginning of the work period of the Judgment Debtor during

which the levy is made upon the disposable earnings.

NOTE: Disposable earnings are defined as gross earnings less deductions for Federal Income Tax Withholding, Federal

Social Security Tax and Withholding for any State, County, or City Taxes.

You are required to return this Writ from date of issuance not less than 10 days or more than 120 days with the results of your

levy endorsed thereon. If wages are involved causing the Writs of Garnishment and Execution to extend past the 120 days, the

result of the continuing levy thereafter must be reported to the Constable or Sheriff’s Civil Bureau.

Issued at direction of:

By:

Deputy Clerk Date

Attorney for

RETURN

I hereby certify that I have this date returned the Not Satisfied $

Foregoing Writ of Execution with the results of Satisfied In Sum of $

the levy endorsed thereon. Costs Retained $

Commission Retained $

Costs Incurred $

Commission Incurred $

Costs Received $

By: REMITTED TO

Title Date JUDGMENT CREDITOR $

JUSTICE COURT, _________ TOWNSHIP

_________ COUNTY, NEVADA

CASE NO.

NOTICE OF EXECUTION AFTER JUDGMENT

I. YOUR PROPERTY IS BEING ATTACHED OR YOUR WAGES ARE BEING GARNISHED

The Court has determined that you owe money to TYPE PLAINTIFF’S NAME HERE the judgment creditor. He

has begun the procedure to collect that money by garnishing your wages, attachment of your bank account or other personal

property held by third persons or by taking money or other property in your possession.

Certain benefits and property owned by you, may be exempt from execution and may not be taken from you. The following

is a partial list of exemptions:

1. Payments received under the Social Security Act.

2. Payments for benefits or the return of contributions under the Public Employees Retirements System.

3. Payments for public assistance granted through the Welfare Division of the Department of Human Resources.

4. Proceeds from a policy of life insurance.

5. Payments of benefits under a program of industrial insurance.

6. Payments received as unemployment compensation.

7. Veteran’s benefits.

8. A homestead in a dwelling or a mobile home, not to exceed $125,000.00, unless:

a. The judgment is for a medical bill, in which case all the primary dwelling, including a mobile or manufactured

home, may be exempt.

b. Allodial title has been established and not relinquished for the dwelling or mobile home, in which case all of the

dwelling or mobile home and its appurtenances are exempt, including the land on which they are located, unless a

valid waiver executed pursuant to NRS 115.010 is applicable to the judgment.

9. A vehicle, if your equity in the vehicle is less than $4,500.00

10. Seventy-five percent of the take home pay from any period, unless the weekly take home pay is less than 30 times the

federal minimum wage, in which case the entire amount may be exempt.

11. Money, not to exceed $500,00.00 in present value, held for retirement pursuant to certain arrangements or plans meeting

the requirements for qualified arrangements or plans of Section 401 et. seq. of the Internal Revenue Code (26 U.S.C. 401

et. seq.).

12. All money and other benefits paid pursuant to the order of a court of competent jurisdiction for the support, education

and maintenance of a child, whether collected by the judgment debtor or the state.

13. All money and other benefits paid pursuant to the order of a court of competent jurisdiction for the support and

maintenance of a former spouse, including the amount of any arrearages in the payment of such support and maintenance

to which the former spouse may be entitled.

14. A vehicle for use by you or your dependant which is specially equipped or modified to provide mobility for a person

with a permanent disability.

15. A prosthesis or any equipment prescribed by a physician or dentist for you or your defendant.

These exemptions may not apply in certain cases, such as a proceeding to enforce a judgment for support of a person or a

judgment of foreclosure on a mechanic’s lien. You should consult an attorney immediately to assist you in determining

whether your property or money is exempt from execution. If you cannot afford any attorney, you may be eligible for

assistance through Nevada Legal Services.

II. PROCEDURE FOR CLAIMING EXEMPT PROPERTY

If you believe that the money or property taken from you is exempt, you must complete and file with the Clerk of the Court a

notarized affidavit claiming the exemption. A copy of the affidavit must be served upon the sheriff or constable and the

judgment creditor within 8 days after the notice of execution is mailed. The property must be returned to you within 5 days

after you file the affidavit unless you or the judgment creditor files a motion for a hearing to determine the issue of

exemption. If this happens, a hearing will be held to determine whether the property or money is exempt. The motion for the

hearing to determine the issue of exemption must be filed within 10 days after the affidavit claiming exemption is filed. The

hearing to determine whether the property or money is exempt must be held within 10 days after the motion for hearing is

filed.

NOTE: IF YOU DO NOT FILE THE AFFIDAVIT WITHIN THE TIME SPECIFIED YOUR PROPERTY MAY BE SOLD AND

THE MONEY GIVEN TO THE JUDGMENT CREDITOR, EVEN IF THE PROPERTY OR MONEY IS EXEMPT.

Helpful suggestions for preparing your ‘Nevada Writ’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for both individuals and organizations. Bid farewell to the labor-intensive process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the extensive features offered by this user-friendly and affordable platform and transform your document management techniques. Whether you need to sign forms or collect signatures, airSlate SignNow manages everything efficiently, with just a few clicks.

Follow these comprehensive steps:

- Sign into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Nevada Writ’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your behalf.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to request eSignatures from additional signers.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you wish to collaborate with others on your Nevada Writ or send it for notarization—our solution offers everything required to complete such tasks. Sign up with airSlate SignNow today and enhance your document management to new levels!