Fill and Sign the New Irs Form 8971 Rules to Report Beneficiary Cost Basis

Valuable tips for completing your ‘New Irs Form 8971 Rules To Report Beneficiary Cost Basis’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the lengthy task of printing and scanning documents. With airSlate SignNow, you can conveniently finalize and sign documents online. Utilize the powerful features packed into this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or collect digital signatures, airSlate SignNow tackles it all effortlessly, requiring only a few clicks.

Follow this comprehensive guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘New Irs Form 8971 Rules To Report Beneficiary Cost Basis’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and assign fillable fields for additional participants (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your New Irs Form 8971 Rules To Report Beneficiary Cost Basis or send it for notarization—our platform provides you with all the necessary tools to complete such tasks. Sign up with airSlate SignNow today and take your document management to the next level!

FAQs

-

What are the New IRS Form 8971 Rules To Report Beneficiary Cost Basis?

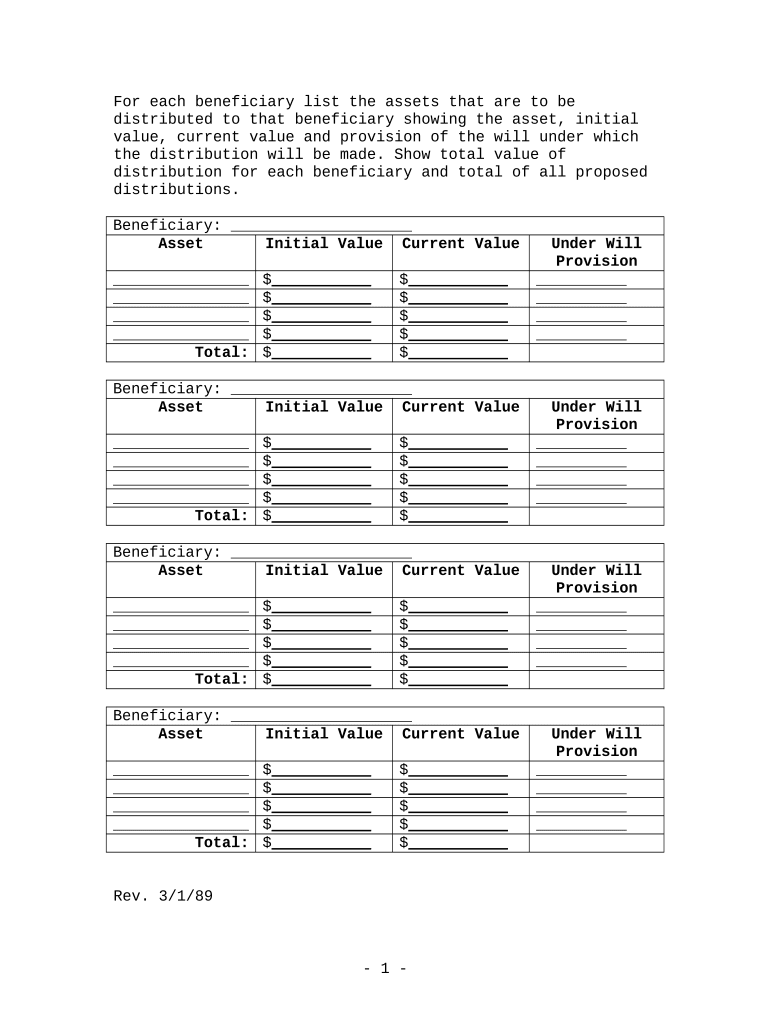

The New IRS Form 8971 Rules To Report Beneficiary Cost Basis require executors to report the fair market value of inherited assets as of the date of the decedent's death. This form is essential for beneficiaries to accurately determine their tax obligations when selling inherited property. Compliance with these rules ensures that beneficiaries have the correct cost basis for capital gains tax calculations.

-

How can airSlate SignNow help with compliance to the New IRS Form 8971 Rules To Report Beneficiary Cost Basis?

airSlate SignNow provides a streamlined solution for managing and electronically signing documents related to the New IRS Form 8971 Rules To Report Beneficiary Cost Basis. By using our platform, businesses can easily create, send, and store necessary documentation, ensuring all compliance requirements are met efficiently and securely.

-

What features does airSlate SignNow offer for handling IRS forms?

With airSlate SignNow, users can access features like customizable templates, secure eSignature capabilities, and automated workflows specifically designed to manage IRS forms, including those related to the New IRS Form 8971 Rules To Report Beneficiary Cost Basis. These tools enhance productivity and reduce the risk of errors in important financial documents.

-

Is airSlate SignNow affordable for small businesses needing to comply with the New IRS Form 8971 Rules To Report Beneficiary Cost Basis?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible and cater to small businesses, ensuring that compliance with the New IRS Form 8971 Rules To Report Beneficiary Cost Basis is accessible without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software to manage IRS forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of accounting software, allowing you to manage and eSign documents related to the New IRS Form 8971 Rules To Report Beneficiary Cost Basis alongside your financial records. This integration simplifies your workflow and enhances overall efficiency.

-

How does airSlate SignNow ensure the security of sensitive documents related to IRS forms?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect all documents, including those related to the New IRS Form 8971 Rules To Report Beneficiary Cost Basis. This means you can confidently manage sensitive information without fear of data bsignNowes.

-

What benefits does airSlate SignNow provide for estate planning professionals dealing with IRS forms?

For estate planning professionals, airSlate SignNow offers signNow benefits such as streamlined document management, enhanced collaboration with clients, and quick turnaround times for eSignatures. By leveraging our platform, you can efficiently handle the New IRS Form 8971 Rules To Report Beneficiary Cost Basis and provide exceptional service to your clients.

The best way to complete and sign your new irs form 8971 rules to report beneficiary cost basis

Find out other new irs form 8971 rules to report beneficiary cost basis

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles