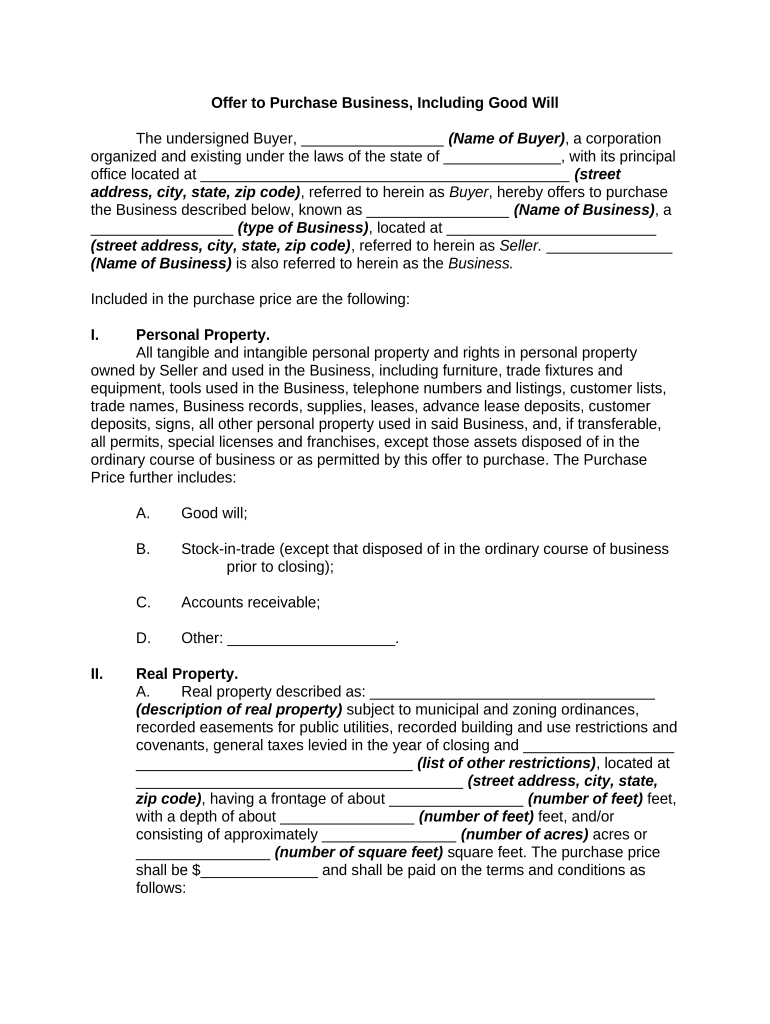

Offer to Purchase Business, Including Good Will

The undersigned Buyer, _________________ (Name of Buyer) , a corporation

organized and existing under the laws of the state of ______________, with its principal

office located at ____________________________________________ (street

address, city, state, zip code) , referred to herein as Buyer , hereby offers to purchase

the Business described below, known as _________________ (Name of Business) , a

_________________ (type of Business) , located at _________________________

(street address, city, state, zip code) , referred to herein as Seller. _______________

(Name of Business) is also referred to herein as the Business.

Included in the purchase price are the following:

I. Personal Property.

All tangible and intangible personal property and rights in personal property

owned by Seller and used in the Business, including furniture, trade fixtures and

equipment, tools used in the Business, telephone numbers and listings, customer lists,

trade names, Business records, supplies, leases, advance lease deposits, customer

deposits, signs, all other personal property used in said Business, and, if transferable,

all permits, special licenses and franchises, except those assets disposed of in the

ordinary course of business or as permitted by this offer to purchase. The Purchase

Price further includes:

A. Good will;

B. Stock-in-trade (except that disposed of in the ordinary course of business

prior to closing);

C. Accounts receivable;

D. Other: ____________________.

II. Real Property.

A. Real property described as: __________________________________

(description of real property) subject to municipal and zoning ordinances,

recorded easements for public utilities, recorded building and use restrictions and

covenants, general taxes levied in the year of closing and __________________

_________________________________ (list of other restrictions) , located at

_______________________________________ (street address, city, state,

zip code) , having a frontage of about ________________ (number of feet) feet,

with a depth of about ________________ (number of feet) feet, and/or

consisting of approximately ________________ (number of acres) acres or

________________ (number of square feet) square feet. The purchase price

shall be $______________ and shall be paid on the terms and conditions as

follows:

1. Earnest money of $_________________ tendered herewith;

2. Cash in the amount of $____________ at closing.

B. The allocation of the purchase price between personal property,

real property, good will, and value of the lease or other valuation shall be

as follows:

a. Good Will $____________

b. Stock-in-trade $____________

c. Accounts receivable $____________

d. Other personal property $____________

e. Real property $____________

f. Other: ____________ $____________

g. Other: ____________ $____________

Total Purchase Price: $____________

C. In addition, the sum of $__________ shall be withheld from the purchase

price to be escrowed with ____________ (name of escrow) to guarantee

delivery of occupancy of Business and/or real property to Buyer and For No

Other Purpose, which sum upon Seller's failure to deliver occupancy shall be

paid to Buyer as liquidated damages or returned to Seller if occupancy is

delivered to Buyer on the agreed date. This is not an exclusive remedy. All

earnest money paid shall be applied toward payment of the purchase price if this

offer is accepted on or before ____________ (date of acceptance) , otherwise,

to be returned to the undersigned Buyer no later than ____________ (date of

return) and this offer shall become null and void.

III. Legal possession of Business and/or real property shall be delivered to Buyer on

date of closing. Occupancy shall be given to Buyer on ____________ (date) . If Seller is

permitted to occupy Business and/or real property after closing, Seller shall prepay

occupancy charge of $___________ payable as follows: ________________________

(specify of manner of payment) .

IV. If this offer is accepted, it shall not become binding upon Buyer until copy of

accepted offer is deposited, postage prepaid, in the United States mail, addressed

Buyer at ________________ (address of buyer) , ______________ (name of city) ,

______________ (name of county) County, ______________ (name of state) , or by

personal delivery thereof.

V. This transaction is to be closed at the office of Buyer's mortgagee or at the office

of _________________ (name of seller) on or before ______________ (date of

closing) , or at such other time and place as may be agreed in writing by Buyer and

Seller.

VI. AS TO THE BUSINESS OR ANY PERSONAL PROPERTY AFFECTED BY THIS

AGREEMENT, THE FOLLOWING TERMS SHALL APPLY UNLESS SPECIFICALLY

PROVIDED TO THE CONTRARY HEREIN:

A. Personal property tax, prepaid insurance (if assumed) and rents shall be

prorated at the time of closing. Proration of personal property taxes shall be

based on the personal property taxes for the current year, if known, otherwise on

the personal property taxes for the preceding year.

B. Sales tax, if any, shall be paid by Seller. Seller agrees to surrender

Seller's sales tax permit timely.

C. Seller shall deliver possession of the personal property on date of closing

and shall convey the property by bill of sale or free and clear of all liens and

encumbrances, except ___________________________________________

_____________________________________________ (list of exceptions) .

D. Seller shall comply with the applicable Bulk Transfers Law. The execution

and/or delivery of a fully executed copy of this contract to Seller shall constitute a

written demand for a list of creditors and for the preparation of a schedule of the

property transferred, as required by the Bulk Transfers Law.

VII. Seller shall continue to conduct the Business in a regular and normal manner

and shall use Seller's best efforts to keep available the services of Seller's present

employees and to preserve the good will of Seller's suppliers, customers and others

having Business relations with Seller.

VIII. If stock-in-trade is purchased, its cost will not be in excess of $_________ and

the purchase will be based on the following cost: __________________________

_____________________________________ (explain formula or percentage) .

IX. This offer is contingent upon the following:

A. Buyer's ability to secure a license or permit of any kind, if the Business

being sold requires such license or permit.

B. Buyer being able to obtain a transfer of an existing franchise or the

issuance of a new franchise, if the Business being sold is a franchise

Business.

C. Seller furnishing Buyer within ____________ (number of days) days of

the date of acceptance of this offer, and Buyers being satisfied with same, the

following information and schedules designated with an “X”:

_____ 1 An inventory of all furniture, fixtures and equipment included

in this transaction.

_____ 2 Copies of all leases affecting equipment, real estate or signs;

and all copies of other leases pertaining to the Business.

_____ 3 Estimated principal balance of accounts receivable.

_____ 4 Estimated principal balance of accounts payable.

_____ 5 Copy of profit and loss statements, balance sheets,

Business books and records, and income tax returns for the

following years: ___________ (identification of years) ,

which Buyer may have examined by Buyer's agents or

attorneys.

_____ 6 Copies of latest real estate and personal property tax bills.

_____ 7 Copies of franchise agreements, if any.

_____ 8 Copy of corporate minutes approving or authorizing the sale,

if Seller is a corporation.

_____ 9 Copies of all licenses used in operating the Business.

_____ 10 An agreement regarding a restriction on Seller competing

with Buyer after the closing of this transaction

_____ 11 Others ______________________________________ (list

of other information)

D. If Buyer Fails to Register Disapproval of Any of These Items in

Writing Within ____________ (number of days) Days of Receiving Them,

Disapproval Shall be Waived.

X. AS TO ANY REAL PROPERTY AFFECTED BY THIS OFFER TO PURCHASE, THE

FOLLOWING TERMS SHALL APPLY UNLESS SPECIFICALLY PROVIDED TO THE

CONTRARY HEREIN:

A. Real property transferred includes all fixtures on the property on the

date of this offer, which will be delivered free and clear of

encumbrances, except that the following items will not be

Included in Sale:

______________________________________

(List of items not included in sale)

B. Interest, rents, water and sewer use charges, other assessments,

and unused fuels shall be prorated as of the date of closing.

Accrued income and expenses, including taxes for the day of

closing, shall accrue to the Seller.

C. General real property taxes shall be prorated at the time of closing

based on the net general taxes for the current year, if known,

otherwise on the net general taxes for the preceding year.

D. If property has not been fully assessed for tax purposes, or reassessment

is completed or pending, tax proration shall be on the basis of

$_____________ estimated annual tax.

E. Seller shall furnish and deliver to Buyer for examination at least 15 days

prior to the date set for closing. Seller's choice of either:

1. A complete abstract of title made by an abstract company,

extended to within 30 days of the closing, said abstract to show

Seller's title to be marketable and in the condition called for by this

agreement, except for mortgages, judgments or other liens which will be

satisfied out of the proceeds of the sale. Buyer shall notify Seller in

writing of any valid objection to the title within 10 days after receipt of

said abstract and Seller shall then have a reasonable time, but not

exceeding 60 days, within which to rectify the title (or furnish a title policy

as hereinafter provided) and in such cases the time of closing shall be

accordingly extended; or

2. An owner's policy of title insurance in the amount stated in the

transfer tax return, naming Buyer as the insured, as Buyer's interest may

appear, written by a responsible title insurance company licensed by the

State of ____________ (Name of State) , which policy shall guarantee

Seller's title to be in condition called for by this agreement, except for

standard policy exceptions and mortgages, judgments, or other liens

which will be satisfied out of the proceeds of the sale. A commitment by

such a title company, agreeing to issue such a title policy upon the

recording of the proper documents as agreed herein, shall be deemed

sufficient performance.

4. Seller shall, upon payment of the purchase price, convey the real

property by warranty deed, free and clear of all liens and

encumbrances, except those stated above, provided none of the

foregoing prohibit present use.

XI. Seller's Warranties and Representations

Seller warrants and represents to Buyer that Seller has no notice or knowledge

of:

A. As to the Business and personal property,

1. Any material defects in any of the equipment, appliances, fixtures,

tools, or furniture included in this transaction, and further warrants

that all will be in good working order on the day of closing.

2. Any encumbrances on the Business or personal property being

sold, all integral parts thereof, or the personal property being

conveyed in conjunction with the Business, except as stated in this

contract and in any schedule attached to it.

3. Any litigation, government proceeding or investigation being in

progress or being threatened or in prospect against or relating to

this Business.

4. Any road change or road work which would materially affect the

present use of the property.

5. Any right granted to underlying lienholders to accelerate their

obligation by reason of the transfer of ownership, or any permission

to transfer being required and not obtained.

6. Any unpaid income taxes, sales taxes, payroll taxes, social security

taxes, unemployment taxes, or any other employer/employee taxes due

and payable or accrued.

7. Any failure of the financial statements and schedules to present the

true and correct condition of the Business as of the date on the statements

and schedules and that since the date of the last financial statements and

schedules provided by Seller there has been no change in the

financial condition or operations of the Business except changes in

the ordinary course of business, which changes have not in the

aggregate been materially adverse.

B. As to the real property,

1. Any planned or commenced public improvements which may result

in special assessments or otherwise materially affect the property.

2. Any government agency or court order requiring repair, alteration,

or correction of any existing condition.

3. Any structural or mechanical defect of material significance in

property, including inadequacy for normal use of mechanical

systems, sanitary disposal systems and well, and unsafe well water

according to state standards.

Seller further warrants and represents to Buyer that:

1. The property is zoned for present use, or ____________

(specification of usage of property) .

2. The property is not located in a flood plain, as per ____________

(specification of document) .

C. All representations and warranties of Seller set forth in this Agreement and

in any written statements delivered to Buyer by Seller under this agreement will

also be true and correct as of the closing date as if made on that date. The

representations, warranties and all provisions of this contract shall survive the

closing of this transaction.

D. Should Buyer fail to carry out this agreement, all money paid hereunder,

including any additional earnest money, shall, at the option of Seller, be paid to

or retained by Seller as liquidated damages.

E. Should Seller be unable to carry out this Agreement by reason of a valid

legal defect in title which Buyer is unwilling to waive, all money paid hereunder

shall be returned to Buyer forthwith, and this contract shall be void.

G. In the event the real property shall be damaged by fire or elements prior to

time of closing in an amount of not more than 5% of the selling price, Seller shall

be obligated to repair the property and restore it to the same condition that it was

on the date of this offer. In the event that such damage shall exceed such sum,

this Agreement may be cancelled at option of Buyer. Should Buyer elect to carry

out this Agreement despite such damage, Buyer shall be entitled to the insurance

proceeds relating to damage to property.

XII. Special Provisions: _____________________________________________

(list of special provisions) .

Buyer has read, fully understands and acknowledges receipt of a copy of this

offer to purchase.

_______________________ Date: ______________

(Printed Name of Buyer)

_______________________

(Signature of Buyer)

THIS OFFER IS HEREBY ACCEPTED. THE UNDERSIGNED HEREBY AGREES TO

SELL AND CONVEY THE ABOVE-MENTIONED PROPERTY ON THE TERMS AND

CONDITIONS AS SET FORTH AND ACKNOWLEDGES RECEIPT OF A COPY OF THIS

AGREEMENT.

________________________ Date: ______________

(Printed Name of Seller)

_______________________

(Signature of Seller)

Earnest Money Receipt

Earnest money in the amount of $___________ has been received by the undersigned,

who hereby agrees to hold same in an authorized real estate trust account in

_______________________ (Name of State) , or transmit the same in accordance with

the terms of the above offer.

_____________________ Date: __________

(Name of Escrow Agent)

_______________________

(Signature of Escrow Agent)