Fill and Sign the Personal Loan Agreement Indusind Bank Form

Useful Advice on Preparing Your ‘Personal Loan Agreement Indusind Bank’ Online

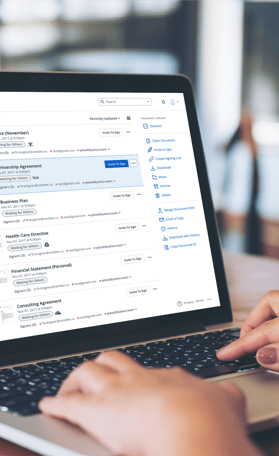

Are you fed up with the difficulties of managing documents? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning files. With airSlate SignNow, you can conveniently complete and sign documents online. Utilize the comprehensive tools included in this user-friendly and economical platform to transform your method of document handling. Whether you need to authorize forms or collect signatures, airSlate SignNow takes care of it all seamlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Personal Loan Agreement Indusind Bank’ within the editor.

- Click Me (Fill Out Now) to finish the form on your end.

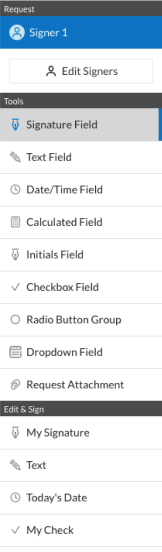

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite options to request eSignatures from additional parties.

- Download, print your version, or convert it into a reusable template.

No need to worry if you wish to work with your colleagues on your Personal Loan Agreement Indusind Bank or send it for notarization—our platform provides everything you need to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a PERSONAL LOAN AGREEMENT IndusInd Bank?

A PERSONAL LOAN AGREEMENT IndusInd Bank is a legally binding document that outlines the terms and conditions of a personal loan offered by IndusInd Bank. This agreement specifies the loan amount, interest rate, repayment schedule, and other essential details to ensure clarity between the lender and borrower.

-

How can I apply for a PERSONAL LOAN AGREEMENT IndusInd Bank online?

You can easily apply for a PERSONAL LOAN AGREEMENT IndusInd Bank through their official website or mobile app. Simply fill out the online application form, submit the required documents, and await approval. The process is designed to be quick and straightforward for your convenience.

-

What are the benefits of a PERSONAL LOAN AGREEMENT IndusInd Bank?

A PERSONAL LOAN AGREEMENT IndusInd Bank offers numerous benefits, including flexible repayment options, competitive interest rates, and quick disbursement. Additionally, it allows you to manage your finances better by consolidating debts or financing personal expenses without collateral.

-

Are there any fees associated with the PERSONAL LOAN AGREEMENT IndusInd Bank?

Yes, there may be processing fees associated with the PERSONAL LOAN AGREEMENT IndusInd Bank, typically a percentage of the loan amount. It's essential to review the terms outlined in the agreement to understand any applicable fees, as well as the overall cost of borrowing.

-

What documents are required for a PERSONAL LOAN AGREEMENT IndusInd Bank?

To process a PERSONAL LOAN AGREEMENT IndusInd Bank, you will typically need to submit identity proof, income proof, address proof, and other relevant financial documents. Ensure that you have all necessary paperwork ready to expedite the loan approval process.

-

How does airSlate SignNow facilitate signing a PERSONAL LOAN AGREEMENT IndusInd Bank?

airSlate SignNow simplifies the eSigning process for a PERSONAL LOAN AGREEMENT IndusInd Bank by allowing you to send and sign documents securely online. With its user-friendly interface, you can easily add signatures, initials, and even comments, making the entire process efficient and paperless.

-

Can I track the status of my PERSONAL LOAN AGREEMENT IndusInd Bank application?

Yes, you can track the status of your PERSONAL LOAN AGREEMENT IndusInd Bank application through the bank's online portal or mobile app. This feature allows you to stay updated on the progress and receive notifications about your loan application and approval.

Related searches to personal loan agreement indusind bank form

Find out other personal loan agreement indusind bank form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles