Fill and Sign the Property Tax Deferral Application Oregongov Form

Valuable tips on organizing your ‘Property Tax Deferral Application Oregongov’ digitally

Are you fatigued from the complexities of managing paper documents? Look no further than airSlate SignNow, the premier eSignature service for individuals and small to medium businesses. Bid farewell to the tedious routine of printing and scanning papers. With airSlate SignNow, you can effortlessly complete and endorse documents online. Utilize the comprehensive features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow manages it all seamlessly, requiring just a few clicks.

Adhere to this comprehensive guide:

- Access your account or initiate a free trial with our service.

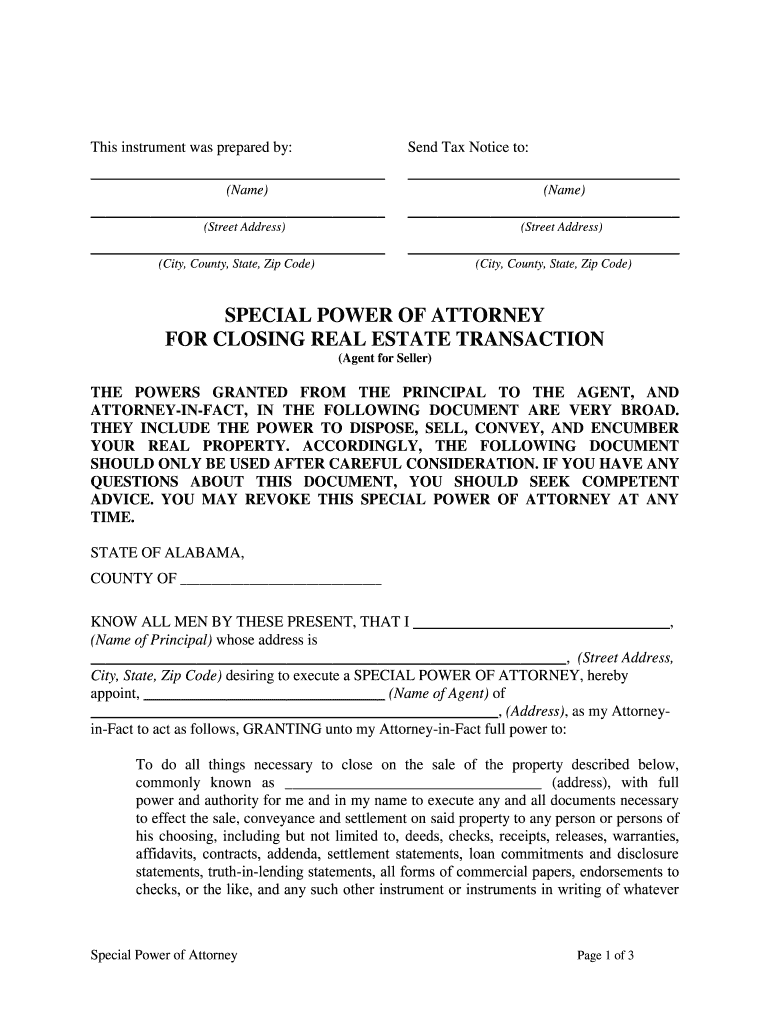

- Click +Create to import a file from your device, cloud storage, or our template collection.

- Open your ‘Property Tax Deferral Application Oregongov’ in the editing tool.

- Click Me (Fill Out Now) to finalize the document on your end.

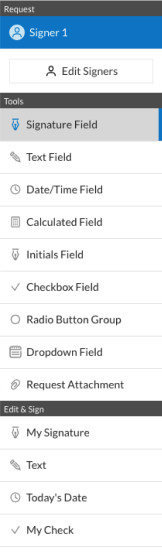

- Insert and allocate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from additional parties.

- Store, print a copy, or convert it into a reusable template.

Don't fret if you need to work with your teammates on your Property Tax Deferral Application Oregongov or send it for notarization—our solution offers everything necessary to achieve such objectives. Create an account with airSlate SignNow today and elevate your document management to unprecedented levels!

FAQs

-

What is the Property Tax Deferral Application Oregon gov?

The Property Tax Deferral Application Oregon gov is a program that allows eligible homeowners to defer their property taxes until a later date. This application helps individuals manage their financial obligations more effectively, especially during challenging times. By utilizing this program, homeowners can ensure they remain in their homes without the immediate burden of property tax payments.

-

How can I apply for the Property Tax Deferral Application Oregon gov?

To apply for the Property Tax Deferral Application Oregon gov, you can visit the official Oregon government website where the application is hosted. The process typically involves filling out an online form and providing necessary documentation to verify your eligibility. Make sure to follow the guidelines provided to ensure a smooth application process.

-

What are the eligibility requirements for the Property Tax Deferral Application Oregon gov?

Eligibility for the Property Tax Deferral Application Oregon gov generally includes being a homeowner who meets specific income and age criteria. Typically, applicants must be at least 62 years old or disabled and have a household income below a certain threshold. It's important to review the detailed eligibility requirements on the Oregon government website before applying.

-

What are the benefits of using the Property Tax Deferral Application Oregon gov?

The Property Tax Deferral Application Oregon gov offers signNow benefits, including the ability to postpone property tax payments, which can alleviate financial stress. This program helps homeowners maintain their property without the immediate pressure of tax payments, allowing them to allocate funds to other essential needs. Additionally, it can provide peace of mind during economic hardships.

-

Is there a fee associated with the Property Tax Deferral Application Oregon gov?

There is typically no fee to apply for the Property Tax Deferral Application Oregon gov. However, homeowners should be aware that deferred taxes will accumulate interest until they are paid. It's advisable to check the official Oregon government website for any updates regarding fees or changes to the application process.

-

How does the Property Tax Deferral Application Oregon gov impact my credit score?

Applying for the Property Tax Deferral Application Oregon gov does not directly impact your credit score. However, it is essential to understand that while your property taxes are deferred, they will still accrue interest and must be paid eventually. Managing your finances responsibly during this period is crucial to maintaining a good credit standing.

-

Can I use airSlate SignNow to submit my Property Tax Deferral Application Oregon gov?

Yes, you can use airSlate SignNow to streamline the submission of your Property Tax Deferral Application Oregon gov. Our platform allows you to eSign and send documents securely and efficiently, ensuring that your application is submitted promptly. This can save you time and reduce the hassle of traditional paper submissions.

The best way to complete and sign your property tax deferral application oregongov form

Get more for property tax deferral application oregongov form

Find out other property tax deferral application oregongov form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles