Power of Attorney forms

Browse over 85,000 state-specific fillable forms for all your business and personal needs. Customize legal forms using advanced airSlate SignNow tools.

Showing results for:

Get legally-binding signatures now!

What exactly is a Power of Attorney?

What are the five types of Power of Attorney?

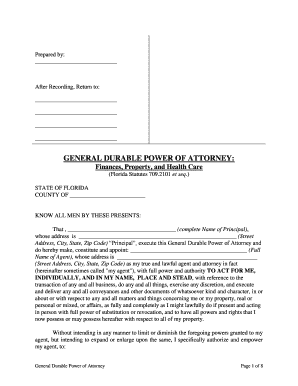

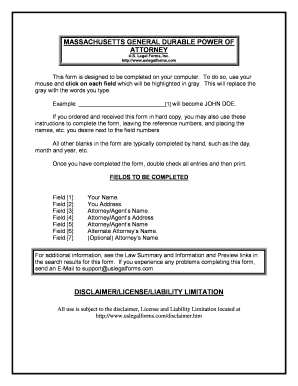

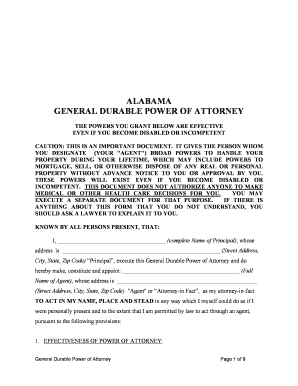

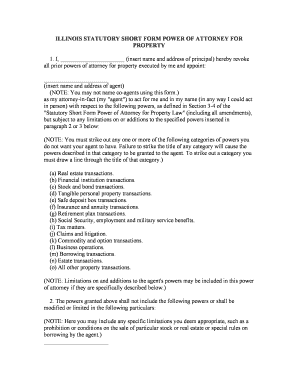

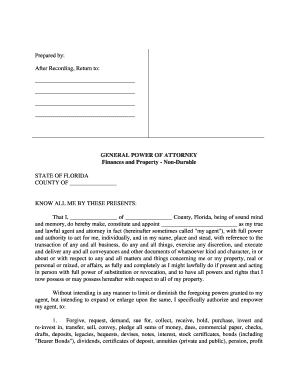

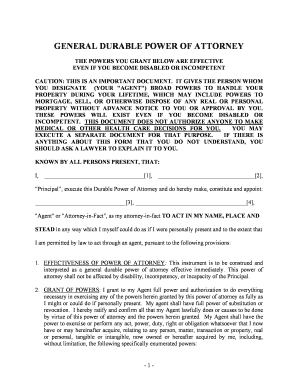

General POA is used for settled time frames. Creating this form enables your attorney-in-fact to perform any action, including finance and property deals, but the document is terminated if you revoke the POA or become incapacitated.

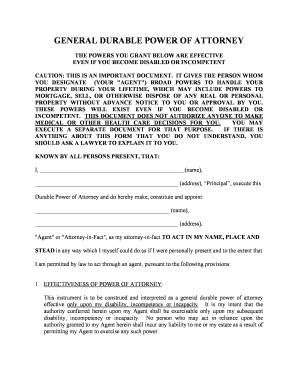

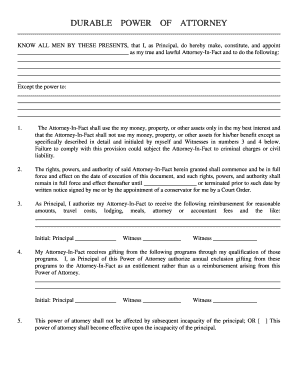

Durable POA is used for the same purposes as the General POA. But this arrangement doesn't have a fixed time period. These powers will exist if you become disabled or incompetent. If/when that happens your attorney-in-fact gets the ability to make decisions regarding your property and assets. Like the previous type, in the case of the principal's death, the arrangement expires.

Special or Limited POA is used for one-off cases. For example, if you can't go to the bank on your own, your agent has the right to go for you. Also, you can use a Special Power of Attorney for closing a real estate deal. This is one of the safest methods since the agent's authority is limited to a specific area. On the other hand, you need to think in advance about what rights your agent should have. Otherwise, you’ll have to create another Special or Limited Power of Attorney for each new action.

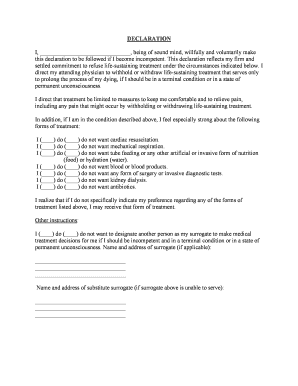

Medical POA is a kind of Limited Power of Attorney that’s only used for health matters. If you are unable to make a medical decision, your attorney-in-fact will take care of it. This arrangement usually takes effect with the consent of the presiding physician.

Springing Durable POA is only used for specific events. The principal can make this arrangement permanent or for a particular period. For example, an agent gets the right to cooperate with banks on your behalf only when you are abroad.

What can't an attorney-in-fact do?

While you, as a principal, empower your agent to perform on your behalf, there are a number of things that they can't do:

- Modify or revoke your Living Will.

- Continue to be an agent after your death.

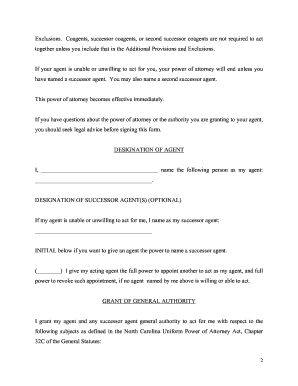

- Appoint another attorney-in-fact.

Notwithstanding these restrictions, an agent can say no to their duties at any time. To avoid a baffling situation where the principal is left without an attorney-in-fact, you should specify an alternative trusted representative in the arrangement.

Why do I need a General or Durable Power of Attorney?

Many people see no reason to issue a Power of Attorney, but the truth is, no one knows what awaits you. Therefore, you need to have a fallback in case of an emergency. Look at the situations when a POA comes in hand:

Business or personal travel. If you don't want any problems with the bank to ruin an important deal or a long-awaited vacation, find an agent who can back you up while you're out of town.

Dangerous work. If you work in the military or so on, then a POA is a way to make sure that someone will keep your affairs in order if something happens.

Medical decisions. Suppose you suffered from an unfortunate accident or became incapacitated. In that case, the Durable Power Of Attorney For Health Care is one of the most accessible options to handle health matters via your trusted representative.

Who can act as an agent?

In short, anybody who's over 18 can become your agent. However, this question is much deeper than a description of legal requirements. You need to trust your agent, knowing that any decision your agent makes would be your decision. Many choose a family member for this reason, so consider your relatives first. Your spouse can take part. Just make a note that some state laws automatically terminate the arrangement if you divorce. So you should ask a lawyer to explain it to you first.

An attorney-in-fact needs to follow your wishes and stick to your attitude to life. Different religious and political beliefs can be a stumbling block in the future. Clarify things at the start and make sure your agent can go against their own opinions for you.

Take into account the health condition and capabilities of your potential representative. They will need to visit banks or hospitals, so they should constantly be in the country to fulfill duties. Remember, you can't make anyone your agent against their will. Therefore, before you start preparing documents, talk to your potential agent and tell them what you expect from them.

Is a Power of Attorney in one state recognized by another state?

Well, it depends. You create a Power of Attorney following your state's laws. Therefore, another state may not consider your General or Durable Power of Attorney as a valid one. However, more than half of the states have already enacted the Uniform Power of Attorney Act, meaning that if you signed your arrangement in Idaho, it would be enforceable in other states that have adopted the UPOAA.

This is not a breezy topic to discuss, but it is prudent for you and your loved ones to have a plan for the future.