FINANCE

NEW lYORK

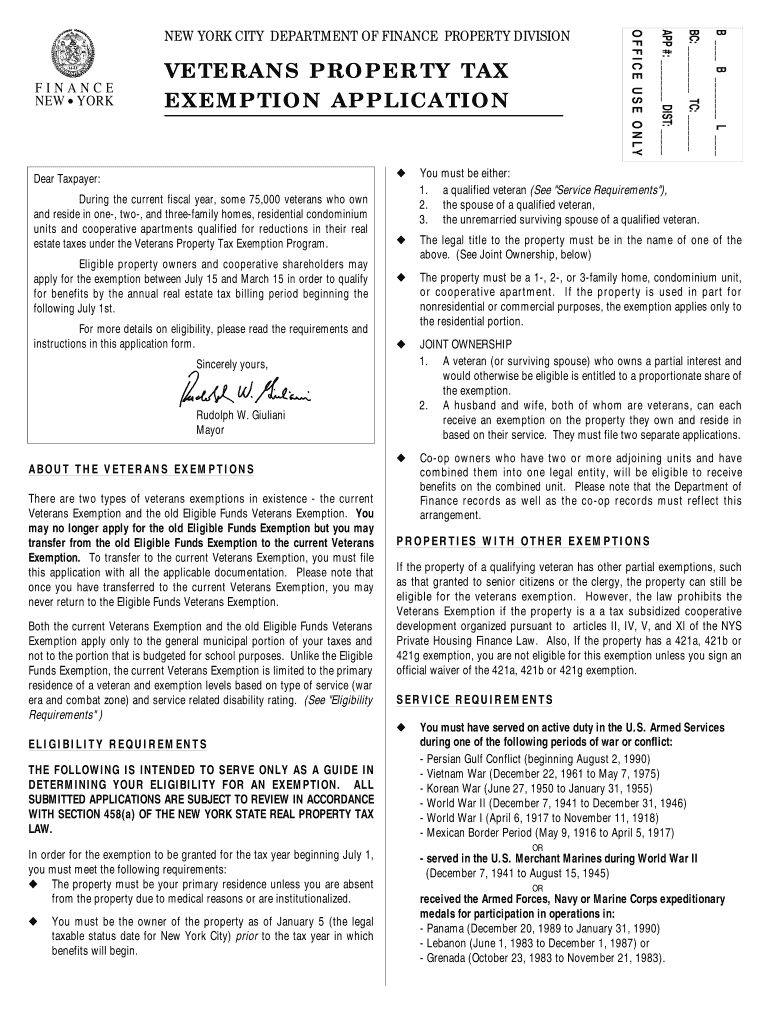

NEW YORK CITY DEPAR TMENT OF FINANCE PROPER TY DIVISION

VETERANS PROPER TY TAX

EXEMPTION APPLICATION

B ____ B ________ L ____

BC: _________ TC: _______

APP #: ________ DIST: _____

OFFICE USE ONLY

ABOUT THE VETERANS EXEMPTIONS

There are two types of veterans exemptions in existence - the current

Veterans Exemption and the old Eligible Funds Veterans Exemption. You

may no longer apply for the old Eligible Funds Exemption but you may

transfer from the old Eligible Funds Exemption to the current Veterans

Exemption. To transfer to the current Veterans Exemption, you must file

this application with all the applicable documentation. Please note that

once you have transferred to the current Veterans Exemption, you may

never return to the Eligible Funds Veterans Exemption.

Both the current Veterans Exemption and the old Eligible Funds Veterans

Exemption apply only to the general municipal portion of your taxes and

not to the portion that is budgeted for school purposes. Unlike the Eligible

Funds Exemption, the current Veterans Exemption is limited to the primary

residence of a veteran and exemption levels based on type of service (war

era and combat zone) and service related disability rating.

(See "Eligibility

Requirements" )

ELIGIBILITY REQUIREMENTS

THE FOLLOWING IS INTENDED TO SERVE ONLY AS A GUIDE IN

DETERMINING YOUR ELIGIBILITY FOR AN EXEMPTION. ALL

SUBMITTED APPLICATIONS ARE SUBJECT TO REVIEW IN ACCORDANCE

WITH SECTION 458(a) OF THE NEW YORK STATE REAL PROPERTY TAX

LAW.

In order for the exemption to be granted for the tax year beginning July 1,

you must meet the following requirements:

uThe property must be your primary residence unless you are absent

from the property due to medical reasons or are institutionalized.

uYou must be the owner of the property as of January 5 (the legal

taxable status date for New York City)

prior to the tax year in which

benefits will begin.uYou must be either:

1. a qualified veteran

(See "Service Requirements"),

2. the spouse of a qualified veteran,

3. the unremarried surviving spouse of a qualified veteran.

uThe legal title to the property must be in the name of one of the

above. (See Joint Ownership, below)

uThe property must be a 1-, 2-, or 3-family home, condominium unit,

or cooperative apartment. If the property is used in part for

nonresidential or commercial purposes, the exemption applies only to

the residential portion.

uJOINT OWNERSHIP

1. A veteran (or surviving spouse) who owns a partial interest and

would otherwise be eligible is entitled to a proportionate share of

the exemption.

2. A husband and wife, both of whom are veterans, can each

receive an exemption on the property they own and reside in

based on their service. They must file two separate applications.

uCo-op owners who have two or more adjoining units and have

combined them into one legal entity, will be eligible to receive

benefits on the combined unit. Please note that the Department of

Finance records as well as the co-op records must reflect this

arrangement.

PROPERTIES WITH OTHER EXEMPTIONS

If the property of a qualifying veteran has other partial exemptions, such

as that granted to senior citizens or the clergy, the property can still be

eligible for the veterans exemption. However, the law prohibits the

Veterans Exemption if the property is a a tax subsidized cooperative

development organized pursuant to articles II, IV, V, and XI of the NYS

Private Housing Finance Law. Also,

If the property has a 421a, 421b or

421g exemption, you are not eligible for this exemption unless you sign an

official waiver of the 421a, 421b or 421g exemption.

SERVICE REQUIREMENTS

uYou must have served on active duty in the U.S. Armed Services

during one of the following periods of war or conflict:

- Persian Gulf Conflict (beginning August 2, 1990)

- Vietnam War (December 22, 1961 to May 7, 1975)

- Korean War (June 27, 1950 to January 31, 1955)

- World War II (December 7, 1941 to December 31, 1946)

- World War I (April 6, 1917 to November 11, 1918)

- Mexican Border Period (May 9, 1916 to April 5, 1917)

OR - served in the U.S. Merchant Marines during World War II

(December 7, 1941 to August 15, 1945)

OR received the Armed Forces, Navy or Marine Corps expeditionary

medals for participation in operations in:

- Panama (December 20, 1989 to January 31, 1990)

- Lebanon (June 1, 1983 to December 1, 1987) or

- Grenada (October 23, 1983 to November 21, 1983).

Dear Taxpayer:

During the current fiscal year, some 75,000 veterans who own

and reside in one-, two-, and three-family homes, residential condominium

units and cooperative apartments qualified for reductions in their real

estate taxes under the Veterans Property Tax Exemption Program.

Eligible property owners and cooperative shareholders may

apply for the exemption between July 15 and March 15 in order to qualify

for benefits by the annual real estate tax billing period beginning the

following July 1st.

For more details on eligibility, please read the requirements and

instructions in this application form.

Sincerely yours,

Rudolph W. Giuliani

Mayor

SPECIFIC INSTRUCTIONS

Veterans Property Tax Exemption ApplicationPage 2

SECTION 1 - OWNERSHIP / PERSONAL INFORMATION

QUESTION 3

- A copy of the deed to the property or the appropriate

section of the proprietary lease is required for property owned by the

veteran and/or spouse.

QUESTION 4 - If you and your spouse are veterans, joint owners and

both reside at the same property, you must file two separate

applications. If you are a widow or widower of a veteran, you must

check the box labeled ÒUnremarried Spouse of a Deceased Veteran.Ó

SECTION 2 - SERVICE-RELATED INFORMATION

QUESTIONS 1, 2 and 3 - The burden of proof as to the dates of service,

combat zone action and disability rating is upon you. You must attach

documentation so that the assessor can determine if you are eligible for

this exemption.

Form DD-214, which the veteran should have received upon separation

from the service, contains most of the information the assessor needs to

determine eligibility. Other written documentation also may help to

prove eligibility, such as a copy of discharge orders, VA documentation

for disability rating, etc.

INFORMATION NEEDED TO PROVE ELIGIBILITY

uWHERE TO OBTAIN DOCUMENTATION OF MILITARY SERVICE

If you do not have the documentation needed to determine military

service for this exemption, the local office of the New York State Division

of Veterans Affairs can detail how you can obtain it. The DivisionÕs toll

free number is 1-888-VETS-NYS. In addition, you can write to the

Federal Records Center, 9700 Page Boulevard, St. Louis, MO 63132. If

you have discharge papers, you should photocopy the front and back

and send the copy to the Federal Records Center requesting that they

supply the necessary additional information to document your eligibility

for this exemption. If you need to verify your percentage of disability

compensation rating, you may call the US Department of Veterans

Affairs, NY Regional Office toll free at 1-800-827-1000.

CHECKLIST BEFORE SUBMITTING YOUR APPLICATION

A

VOID A DELAY IN THE PROCESSING OF YOUR APPLICATION . C HECK (3) TO

MAKE SURE THAT YOU DO THE FOLLOWING BEFORE SUBMITTING YOUR

APPLICATION TO THE

PROPERTY DIVISION :

qread the requirements to make sure you are eligible;

qfile this application between July 15 and March 15;

qcomplete all sections of the application;

qhave all property owners and spouses of owners applying for the

exemption sign the application on page 4;

qhave a non-relative witness the signatures;

qlist a work and home phone number where you can be reached or the

name and phone of a relative or friend;

qco-op apartment owners, have an officer of the co-op board complete

the certification, Section 4, on page 4.

A

TTACH THE FOLLOWING :

qcopy of most recent deed (recorded or unrecorded) or if a co-op

owner, you must submit a copy of the page(s) of your proprietary

lease, which shows the name(s) of the grantor and grantee and the

number of shares in your unit; or if the proprietary lease is unavailable,

then a copy of your stock certificate, both front and back sides,

showing names of all owners;

qcopy of DD-214, or separation papers; proof of honorable discharge;

qcopy of proof of service in a combat zone;

qletter within the last 12 months from the Veterans Administration

documenting your disability rating, if applicable; or if deceased, a letter

from the Veterans Administration detailing the disability rating prior to

death;

qcopy of death certificate;

qcopy of marriage certificate.

WHEN AND WHERE TO FILE

You must file this application with all required documents between July 15

and March 15. If approved, benefits will begin on the next July 1 following

application.

Mail or bring your application to the Assessment Office in the borough in

which the property is located. The addresses are listed below.

MANHATTAN

1 Centre Street Rm. 910 New York, NY 10007

(212) 669-4896

BRONX

1932 Arthur Avenue Rm. 701 Bronx, NY 10457

(718) 579-6879

BROOKLYN

210 Joralemon St. Rm. 200 Brooklyn, NY 11201

(718) 802-3560

QUEENS

144-06 94th Ave., 2nd Floor, Jamaica, NY 11435

(718) 298-7099

STATEN ISLAND

350 St. Marks Place, Staten Island, NY 10301

(718) 390-5295

NEED HELP?

IF YOU NEED HELP IN COMPLETING THIS FORM, VISIT

OR CALL ANY OF THE BOROUGH OFFICES LISTED ABOVE.

The Department of Finance is pleased to offer the following customer

service initiative to provide an applicant with proof of filing. Upon

receipt of an application, the department will time-stamp a copy of the

application. Please note that the department can only provide this

service when a copy

is provided by the applicant. Where an application

has been mailed, a self-addressed stamped envelope

must also be

provided in addition to the copy. All applicants are strongly encouraged

to retain for their personal records a copy of all applications and

documents.

SECTION 3 - OTHER INFORMATION

SECTION 2 - SERVICE-RELATED INFORMATION

SECTION 1 - OWNERSHIP / PERSONAL INFORMATION

Veterans Property Tax Exemption ApplicationPage 3

1.In which war or period of conflict did the veteran serve? (See "Service Requirements", page 1, for list) _______________________

___________________________________________________________________________________

2.Did the veteran serve in a combat zone or combat theatre? ............................................................. q YES q NO

If " YES ", where did the veteran serve and when was such service performed? ( You must attach documentation.) (See "Information

Needed to Prove Eligibility" and "Checklist")

________________________________________________________________________

3.Has the veteran received or did the veteran receive, prior to his/her death, a compensation rating from the United States Veterans

Administration as a result of a service-connected disability?

........................................................... q YES q NO

If " YES ", attach a letter of disability rating, dated within the last 12 months, from the US Department of Veterans Affairs, NY Regional

Office, documenting the veteran's disability rating. (You may obtain this letter by calling toll free 1-800-827-1000.)

1a.Is the owner(s) now receiving a Veterans Exemption anywhere in New York City or New York State? ............................. q YES q NO

b.If " YES ", complete the following: Street Address: ____________________________________________________________________

County: ____________________________ Block: ________________ Lot: ______________

2a.Is the owner(s) now receiving benefits based on service as a Veteran anywhere other than

in New York City or New York State? .............................................................................................................................

q YES q NO

b.If " YES ", specify address: ______________________________________________ City and State __________________________

1.Borough: __________________________ Block: ______________ Lot: ____________

Address of property: _______________________________________________________________ Zip Code: _________________

2. Is this property used exclusively for residential purposes? ...........................

q YES q NO

If " NO ", State the percentage of nonresidential space: ______________________________________

3. Type of residence

(check one) : q 1-, 2-, 3-family home q condominium unit q cooperative apartment - unit number: _________

4.Applicant is (check one) (attach proof of status) :

q VETERAN q SPOUSE OF VETERAN q UNREMARRIED SPOUSE OF DECEASED VETERAN q OTHER (specify) _________________

5.Name of applicant: __________________________________________________________________________________________

Work telephone number: ____________________________ Home telephone number: _____________________________

VeteranÕs Social Security Number

___ ___ ___ - ___ ___ - ___ ___ ___ ___ Branch of active service: _____________________

Date of beginning of service: ________________ Date of honorable discharge or release from service: ______________________

(You must attach documentation.) (See "Information Needed to Prove Eligibility" and "Checklist")

SpouseÕs Social Security Number ___ ___ ___ - ___ ___ - ___ ___ ___ ___

6.Is the address the legal and primary residence of the applicant(s)? .......................................... q YES q NO

7.Is any owner now in a nursing home or institution? .................................................................. q YES q NO

If " YES ", state owner's name: _________________________________________________ Date entered: ______________________

SECTION 4 - CERTIFICATION BY CO-OP BOARD OF MANAGERS

t OFFICE USE ONLY t

Veterans Property Tax Exemption ApplicationPage 4

GRANTED ____________ DENIED _____________

41121 ________________ % OWNERSHIP _______________ REASON __________________________

41131 ________________ % COMMERCIAL _____________ __________________________________

41141 ________________ % DISABILITY _______________ REVIEWED BY ______________________

CRTÕd BY __________________________

DATE _____________________________

DEED DATED__________________________19________, EXHIBITED _________________________________________________

SHOWS TITLE VESTED IN _________________________________________________________________________________________

RECORDED IN __________________ COUNTY ON__________________19_______, IN LIBER _______________ OF CONVEYANCES

AT PAGE _____________ SECTION _____________ VOLUME _____________ BLOCK _______________ LOT ___________

STREET ADDRESS _______________________________________________________________________________________________

DEED CHECKED BY ________________________________________

I (we) certify that all statements made on this application are true and correct to the best of my (our) knowledge and belief. I (we) understand that

any willful false statements made herein will subject me (us) to the penalties prescribed in the Penal Law.

_______________________________________ _______________________________________ __________________

_______________________________________ _______________________________________ __________________

_______________________________________ _______________________________________ __________________

Signatures of all applicants

s Non-relative witness s Date s

PRINTED ON

RECYCLED

PAPER ç ç Veterans Exemption Application 07/99

CERTIFICATION and SIGNATURE

FOR COOPERATIVE PROPERTIES ONLY

The following information must be completed by an officer of the cooperative corporation:

Applicant's unit number: ___________ Floor number of this unit: ___________

Number of shares in this unit owned by applicant: ____________ Date applicant purchased these shares: _______ / _______ / _______

Borough: ______________________ Block: ______________ Lot: ____________ of the building in which this unit is located.

Total number of shares for this development: _________________________

I certify that the above information is true and correct.

( )

____________________________________ ________________________________ ______________ ________________

Signature of Officer print name Title Telephone number