Fill and Sign the Publication 1281 Internal Revenue Service Form

Practical advice on finalizing your ‘Publication 1281 Internal Revenue Service’ digitally

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the laborious task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the extensive features available in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or collect eSignatures, airSlate SignNow makes it all simple, with just a few clicks.

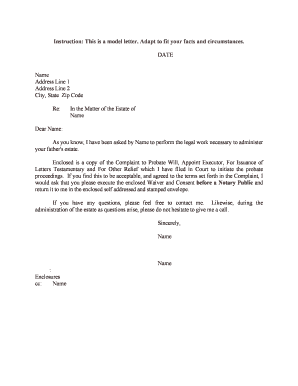

Follow this detailed guideline:

- Sign in to your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Publication 1281 Internal Revenue Service’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for other participants (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your version, or transform it into a reusable template.

Don’t worry if you need to work with your team on your Publication 1281 Internal Revenue Service or send it for notarization—our platform provides everything essential to accomplish these tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is Publication 1281 from the Internal Revenue Service?

Publication 1281 from the Internal Revenue Service provides guidelines on backup withholding for certain payments. It outlines the requirements for businesses to withhold taxes on payments made to individuals and entities that do not provide a correct taxpayer identification number. Understanding this publication is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with compliance related to Publication 1281?

airSlate SignNow offers features that streamline the process of collecting taxpayer identification information, ensuring compliance with Publication 1281 from the Internal Revenue Service. By using our eSignature solution, businesses can securely gather necessary documentation and maintain accurate records, reducing the risk of errors and penalties.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of various businesses. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements while ensuring compliance with regulations like Publication 1281 from the Internal Revenue Service.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features for efficient document management, such as customizable templates, automated workflows, and secure eSigning. These features not only enhance productivity but also help businesses adhere to guidelines set forth in Publication 1281 from the Internal Revenue Service.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRM systems and cloud storage services. This integration capability allows businesses to streamline their processes and ensure compliance with Publication 1281 from the Internal Revenue Service without disrupting their existing workflows.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. By utilizing our platform, businesses can ensure they meet the requirements of Publication 1281 from the Internal Revenue Service while providing a user-friendly experience for their clients.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Our cost-effective solutions and user-friendly interface make it easy for small businesses to manage their documents and comply with regulations like Publication 1281 from the Internal Revenue Service.

The best way to complete and sign your publication 1281 internal revenue service form

Find out other publication 1281 internal revenue service form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles