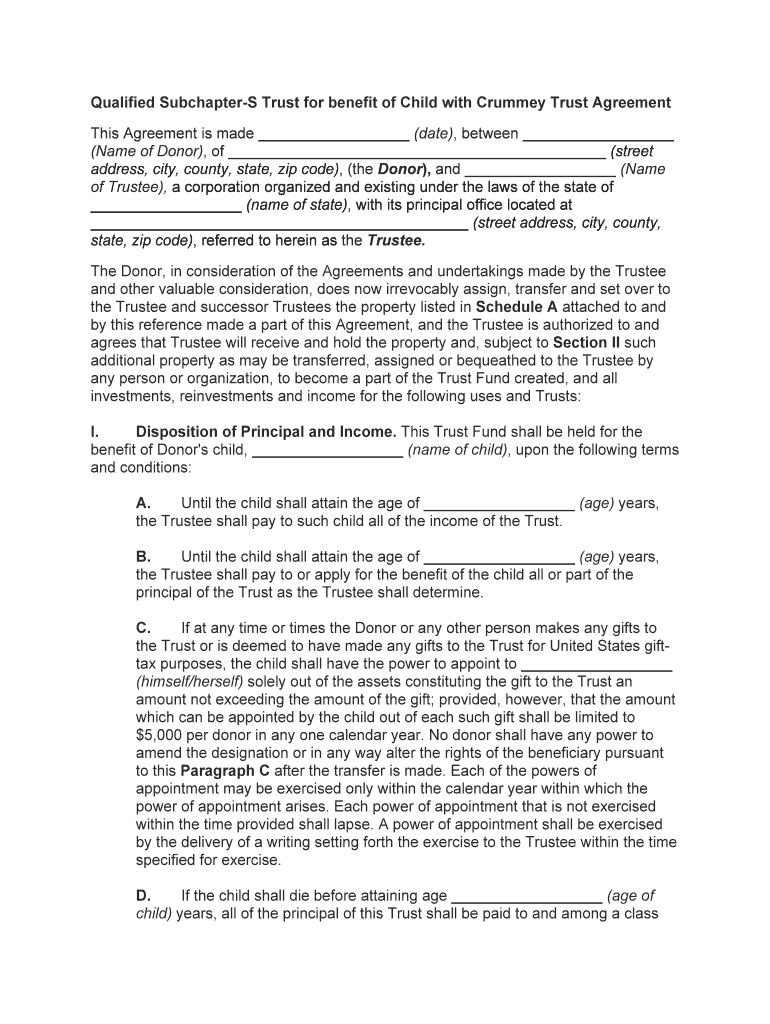

Qualified Subchapter-S Trust for benefit of Child with Crummey Trust AgreementThis Agreement is made __________________ (date) , between __________________

(Name of Donor), of _____________________________________________ (street

address, city, county, state, zip code) , (the Donor), and __________________ (Name

of Trustee), a corporation organized and existing under the laws of the state of

__________________ (name of state), with its principal office located at

_____________________________________________ (street address, city, county,

state, zip code), referred to herein as the Trustee.

The Donor, in consideration of the Agreements and undertakings made by the Trustee

and other valuable consideration, does now irrevocably assign, transfer and set over to

the Trustee and successor Trustees the property listed in Schedule A attached to and

by this reference made a part of this Agreement, and the Trustee is authorized to and

agrees that Trustee will receive and hold the property and, subject to Section II such

additional property as may be transferred, assigned or bequeathed to the Trustee by

any person or organization, to become a part of the Trust Fund created, and all

investments, reinvestments and income for the following uses and Trusts:I.Disposition of Principal and Income. This Trust Fund shall be held for the

benefit of Donor's child, __________________ (name of child), upon the following terms

and conditions:

A. Until the child shall attain the age of __________________ (age) years,

the Trustee shall pay to such child all of the income of the Trust.

B. Until the child shall attain the age of __________________ (age) years,

the Trustee shall pay to or apply for the benefit of the child all or part of the

principal of the Trust as the Trustee shall determine.

C. If at any time or times the Donor or any other person makes any gifts to

the Trust or is deemed to have made any gifts to the Trust for United States gift-

tax purposes, the child shall have the power to appoint to __________________

(himself/herself) solely out of the assets constituting the gift to the Trust an

amount not exceeding the amount of the gift; provided, however, that the amount

which can be appointed by the child out of each such gift shall be limited to

$5,000 per donor in any one calendar year. No donor shall have any power to

amend the designation or in any way alter the rights of the beneficiary pursuant

to this Paragraph C after the transfer is made. Each of the powers of

appointment may be exercised only within the calendar year within which the

power of appointment arises. Each power of appointment that is not exercised

within the time provided shall lapse. A power of appointment shall be exercised

by the delivery of a writing setting forth the exercise to the Trustee within the time

specified for exercise.

D. If the child shall die before attaining age __________________ (age of

child) years, all of the principal of this Trust shall be paid to and among a class

limited to the child's issue in amounts and proportions as may be appointed by

the child's last will and testament specifically referring to this special power of

appointment.E. To the extent that the child fails to exercise the special power of appointment effectively, the principal and income remaining shall be set aside in

separate and distinct trusts for the child's then living issue, per stirpes, or, if there

be none, for the child's brothers and sisters then living and the then-living issue

of the child's brothers and sisters then deceased, per stirpes, or, if there be none,

for the persons then living, excluding the Donor and any other Donor, who would

have inherited the estate of the child if the child had then died intestate under the

laws of __________________ (name of state) existing on the date of the

execution of this instrument in the proportions prescribed by such laws. Each

Trust will be designated with the name of the person for whom it is set aside.

Each Trust created under the terms of this paragraph will be held, administered,

divided and distributed in the same manner as the Trust for the initial beneficiary,

and in applying the terms of this instrument the person with whose name such

subsequent Trust is designated shall be considered the child.

F. When the child of the Donor shall attain the age of __________________

(age of child at distribution 1) years, the Trustee shall pay over to the

child __________________ (fraction of principal distributed at distribution 1) of

the principal of the Trust. When the child shall attain the age of

__________________ (age of child at distribution 2) years, the Trustee shall pay

over to the child __________________ (fraction of principal distributed at

distribution 2) of the then-remaining balance of the principal of the Trust, and

when the child shall attain the age of __________________ (age) years, the

Trustee shall pay over to the child the entire remaining principal of the Trust,

together with all of the accrued, accumulated and undistributed income, and the

Trust shall terminate with respect to the child.

G. This Trust may be terminated, in whole or in part, at any time if such

action is deemed advisable and for the best interests of such Trust, or the

beneficiary, in the sole discretion of the Trustee whose judgment shall be

conclusive and free from question by anyone or in any court. In the event of

termination, the principal of the Trust terminated, together with all of the accrued,

accumulated and undistributed income, shall be paid over and distributed to the

Donor's child.II. Additions to Trust. The Donor or any other person or organization may, at any

time, give, transfer or bequeath to the Trust created by this instrument, either by inter

vivos transfer or testamentary disposition, additional money or property of any kind

acceptable to the Trustee, and in that event the additional property shall become a part

of the Trust created by this instrument and shall be divided, allocated, administered and

distributed as if it originally had been a part of the Trust. The Trustee may assume any

obligation associated with any such property.

III.Irrevocability. It is the intention of the Donor that this instrument shall constitute

an irrevocable gift in Trust of all property at any time held under the Trust, and any right,

title or reversionary interest in it, of any kind or description, which the Donor now has or

may subsequently acquire, either by operation of law or otherwise, is renounced and

relinquished forever. Any future gift of property to this Trust, whether by the Donor or

any other person, shall likewise be irrevocable, and any right, title or reversionary

interest in it, of any kind and description, which the Donor may have or subsequently

acquire, by operation of law or otherwise, shall, by the making of such gift to this Trust,

be renounced and relinquished forever.IV.Discretion of Trustee. In allotting or making any division of or payment or

distribution from the Trust Fund or any portion of it for any purpose, the Trustee shall

not be required to convert any property, real or personal, tangible or intangible, into

money or to divide or apportion each or any item of property, but may, in the sole

discretion of the Trustee, allot all or any part (including an undivided interest) of any

item of property, real or personal, tangible or intangible, to any fund or to any

beneficiary provided for by this instrument; or the Trustee may convert any property into

any other form, it being the Donor's intent and purpose to leave all such divisions and

apportionments entirely to the discretion of the Trustee with the direction merely that

each fund, share, portion or part at any time created or provided for shall be constituted

so that the same shall have the value, relative or absolute, designated by this

instrument.V. Powers of Trustee. Subject only to the provisions and limitations set forth in this

Section V and elsewhere in this instrument, the Trustee, in extension and not in

limitation of the powers given Trustee by law or other provisions of this instrument, shall

have the following powers with respect to the Trust created here and its property, in

each case to be exercised from time to time in the Trustee's discretion and without order

or license of any court:A. To change the situs of the Trust and of any property which is part of the

Trust to any place in the United States of America or any other country.B. Not to file an inventory of the property which is part of the Trust nor annual

accounts of administration with and not to have any of the property examined by

any court where filing or examination is not required by applicable law.C. To retain for any period of time any property which may be received or

acquired, even though its retention by reason of its character or otherwise would

not be appropriate apart from this provision.D. To collect, receive and receipt for rents, profits or other income from any

property which may be held.

E. To expend money or other property in order to collect, sell, manage,

conserve or administer any property which may be held, or in order to improve,

repair, equip, develop, furnish, maintain, alter, extend or add to any property.F. To sell at public or private sale (including, specifically, the power to initiate

or participate in any public offering or underwriting), partition, exchange for like or

unlike property, lease for any period of time even though it may be longer than

the duration of the Trust, modify, renew or extend any lease, grant options on,

release, demolish, abandon, dedicate and otherwise dispose of any property

which may be held, upon terms and conditions, including credit, and for

consideration, even though it may be less than the value at which the property

was received or acquired, or for such other benefit, even though it may be

intangible, as may be deemed appropriate.G. To transfer title to, grant rights in and convey in fee simple or otherwise

any property which may be held, free of all Trusts.H. To invest and reinvest in any and all kinds of securities, domestic or

foreign, including common and preferred stocks, bonds, debentures, notes,

commodity contracts, mortgages and options on property; in investment trusts

and in common trust funds; in any real property; in any personal or mixed

property; in any business, mining or farming operation or other venture; or in any

other interest or investment medium, even though the investment would not be of

a character authorized by applicable law but for this provision.I. Not to diversify the property which may be held, whether the property was

originally received or subsequently acquired by exchange, investment or

otherwise.J. To retain cash for reasonable periods of time in amounts sufficient to meet

anticipated needs, including payments of expenses and to beneficiaries.K. With respect to property subject to depreciation or depletion, to withhold

an amount from Trust income in the discretion of the Trustee to provide for a

reasonable allowance for depreciation or depletion on such property under

generally accepted accounting principles.L. To do all things necessary, customary or desirable to conduct the affairs of

an unincorporated business, mining or farming operation, real-estate operation or

other venture.M. To do all things necessary, customary or desirable to conduct the affairs of

any corporation; to act as officer, director, attorney or employee of any

corporation; and to place stock in the name of the Trustee or any beneficiary of

the Trust in order to qualify him or her as a director of the corporation.

N. Alone or with others to organize, reorganize, merge, consolidate,

recapitalize, dissolve, liquidate or otherwise create or change the form of any

corporation, partnership, joint venture or other entity.O. To exercise all voting, sale, purchase, exchange or other rights or options

with respect to any security or other property which may be held.P. To refuse, reject or not to exercise any offer to purchase, option to purchase, voting or other right or option with respect to any security or other

property which may be held.Q. To participate in any plan or proceeding for protecting or enforcing any

right, obligation or interest arising from any property which may be held; to serve

as a member of a security-holder protective committee; and to deposit securities

in accordance with any plan agreed upon.R. To expend money or other property, whether by bidding in at foreclosure,

by making a contribution to capital, by paying an assessment or otherwise, in

order to protect any property which may be held.S. To pay, contest, compromise, abandon, release, adjust, submit to

arbitration, sue on, defend and otherwise deal with and settle any claim in favor

of or against the Trust or the Trustee.T. To receive, acquire and retain policies of fire, motor vehicle, business-

interruption, title, liability, fidelity, indemnity, or other casualty insurance, either in

stock or in mutual companies, in any amount, against any risk in which the Trust

has an insurable interest.U. To borrow money or other property for such periods of time, upon such

terms and conditions, and for such purposes as may be deemed appropriate; to

mortgage, pledge or otherwise encumber any property which may be held as

security for any such loan; and to renew, extend or refund any existing loan

either as maker or endorser.V. With respect to any obligation held, whether secured or unsecured, to

reduce the interest rate on it, to continue it on and after maturity with or without

renewal or extension and without regard to the then-value of any security, to

foreclose on the security or to acquire the security without foreclosure.W. To keep books of account and to make reports upon a reasonable basis

and with detail as may be deemed appropriate.X. To execute any instrument under seal or otherwise.

Y. To bind absolutely, by any action taken or not taken, all beneficiaries, born

or unborn, ascertained or unascertained, of the Trust as against any other party;

and no party dealing with the Trustee shall have any duty to follow any property

transferred by him to the Trustee.Z. To sell any property to, to exchange any property with, to purchase any

property from or otherwise to deal with any beneficiary of the Trust or with any

Trust or estate of which either the Donor, the Donor's spouse or any issue of the

Donor is or was a Donor or beneficiary, whether created by this instrument or

not, even though the Trustee is also a fiduciary of such other trust or estate; and

when dealing with any fiduciaries, the Trustee shall have no duty to follow any

property transferred by such Trustee.AA. To act notwithstanding the self-interest of the Trustee, including the

powers to lease, mortgage or sell any property to or lease or purchase any

property from the Trustee, to determine the amount of and to receive

compensation for services as Trustee or in any other capacity; in the case of a

corporate Trustee, to borrow from, deposit money or otherwise deal with its own

banking department, to invest in its own stock or stock of any of its affiliates, or to

invest in its own common trust fund, and to be interested in any investment,

corporation, unincorporated business, farming or mining operation, real-estate

operation or other venture in which the Trust is interested.BB. To obtain the advice of accountants, attorneys at law, brokers, investment

counsel, realtors, appraisers and other experts, and to compensate such experts

by salary, commission, fee or otherwise, and to act pursuant to the advice of

such experts without independent investigation.CC. To delegate to agents: (i) the authority to execute contracts, checks, documents of title and

other instruments, to keep books of account, to prepare reports and tax

returns, to hold possession and record ownership of securities, bank

accounts and other property or to perform any other ministerial function; (ii) the authority to perform the following discretionary functions: (a) the management of any investment, unincorporated

business, farming or mining operation, real-estate operation or

other venture (whether by employing agents, giving proxies,

entering into voting trusts or otherwise); and (b) the selection of the time to acquire or to dispose of any

property which may be held;

(iii) any power, including this power, possessed by the Trustee which is

necessary, customary or desirable so that the agent may perform any

function delegated pursuant to this paragraph; and (iv) to compensate such agents by salary, commission, fee or

otherwise.DD. To enter into binding agreements not to exercise any power which the

Trustee possesses upon such terms and conditions and for such reasons as may

be deemed appropriate.EE. To enter into any pooling or unitization agreement.FF. To advance money on behalf of the Trust for which advances, with any

interest, the Trustee shall have a lien on the assets of the Trust as against any

beneficiary.GG. To permit any beneficiary to have the use, possession and enjoyment of

any property then distributable pending actual distribution.HH. To loan money or other property, with or without formal evidence of

indebtedness, with or without collateral security, for periods of time and on terms

and conditions as may be deemed appropriate to the beneficiary of the Trust

created by this instrument, out of the Trust created by this instrument from which

the beneficiary is eligible to receive income; to make any such loan a lien upon

any property payable or distributable to the beneficiary; and to guarantee any

loans of the beneficiary.II. To retain for any period of time cash or other unproductive property.JJ. To receive, acquire and retain policies and proceeds of policies of life

insurance and of immediate and deferred annuities, either in stock or in mutual

companies, in any amount, on the life of the beneficiary of the Trust created by

this instrument, or on the life of any person in whom the beneficiary or the Trust

has an insurable interest; to pay the premiums out of either the income or

principal or both of such Trust which is the beneficiary of such policy or out of

which the beneficiary of such policy is eligible to receive income; and to exercise

all rights, privileges and options available under such policy.XI. Limitations on Trustee’s Powers. Notwithstanding any powers conferred upon

the Trustee elsewhere in this Agreement, no Trustee or successor Trustee or any other

person shall have at any time, or in any manner or capacity, either directly or indirectly,

the power to do any of the following in respect of the Trust and Trust Fund created:A. To revest title to any part of the principal of the Trust Fund in the Donor

(including without further mention in this article any other Donor of property) or

the Donor's spouse; to hold or accumulate any part of the income of the Trust or

Trust Fund for future distribution to the Donor or the Donor's spouse; to distribute

any part of the income of the Trust to the Donor or the Donor's spouse; or to

apply any part of the income or principal to the payment of premiums upon

policies of insurance on the life of the Donor or the Donor's spouse.B. To enable any person to purchase, exchange or otherwise deal with or

dispose of any part or all of the principal or income of the Trust for less than

adequate and full consideration in money or money's worth.C. To enable the Donor or the Donor's spouse directly or indirectly to borrow

any part or all of the principal or income of the Trust.D. To exercise any power of administration over the Trust other than in a

fiduciary capacity for the benefit of the beneficiaries.VII. Governing Law; Counterparts.A. This Agreement and Trust are specifically created as a

__________________ (name of state) agreement and trust and the construction,

validity and effect of this Agreement and the rights and duties of the beneficiaries

and Trustee shall at all times be governed exclusively by the laws of

__________________ (name of state).

B. This Agreement may be executed in any number of counterparts, any one

of which shall constitute the Agreement between the parties.VIII.Construction.A. Unless the context requires otherwise, all words used in this instrument in

the singular number shall extend to and include the plural, and all words used in

the plural number shall extend to and include the singular.B. As used in this instrument, the terms brother and sister shall include

persons who have acquired the designated relationship by the half as well as the

whole blood, but shall be limited to persons related to the Donor by blood or

adoption.C. As used in this instrument, the term Trustee shall include all those holding

that office under this instrument from time to time without regard to whether they

were initially appointed, successor or additional Trustees.IX.Trustees.A. __________________ (Name of Trustee) is appointed initial Trustee. If it

shall resign or cease to act as Trustee, then it may appoint a successor, and if

it fails to appoint a successor then the successor shall be __________________

(name of successor Trustee).

B. Any Trustee may resign as Trustee of the Trust by delivering a written

instrument to that effect signed by or on behalf of Trustee to the individual or

corporation who is to serve as successor Trustee. Any resignation shall be

effective as of the date of completion of delivery of the instrument or as of such

later date as shall be specified in the instrument. In no event, however, shall the

Donor, the Donor's spouse, or any child of the Donor serve as a Trustee under

this instrument.C. No bond or other security shall ever be required to be given or be filed by any Trustee for the faithful execution of Trustee's duty under this instrument. If,

notwithstanding the preceding provision, a bond shall nevertheless be required,

no sureties shall be required.D. No Trustee shall be liable for any cause or in any event except for willful

malfeasance or bad faith.X. Subchapter-S Trust. It is the Donor's intention that this Trust shall be a Qualified

Subchapter-S Trust, as defined in Section 1361(d)(3) of the Internal Revenue Code

of 1986, as amended. Accordingly, no Trustee shall have any power the possession of

which would cause this Trust not to be a Qualified Subchapter-S Trust; no power shall

be exercisable in a manner that any Trust will not be a Qualified Subchapter-S Trust;

and any ambiguity in this Trust Agreement shall be resolved in a manner that this Trust

shall be a Qualified Subchapter-S Trust. Specifically, but not by way of limiting the

general application of the foregoing, during all periods in which this Trust owns stock in

any small business corporation, within the meaning of Section 1361(b) of the Internal

Revenue Service, that has an election under Section 1362(a) in effect, notwithstanding

any other provision in this Trust Agreement:A. Until the death of the beneficiary of the Trust, the Trustee shall pay and

distribute to the beneficiary and to no other person all of the net income of the

Trust annually or at more frequent intervals. Any and all income accrued but not

paid to the beneficiary prior to the death of the beneficiary shall be paid to the

estate of the beneficiary.B. Any distributions of principal from the Trust may be made only to the

beneficiary then entitled to receive income from the Trust.C. Any power provided in Section V of this Trust Agreement may be

exercised with respect to the Trust if and only if, or to the extent that, the exercise

of any such power shall not violate the provisions of this article and shall not

impair or disqualify the Qualified Subchapter-S Trust status of the Trust.

The Donor and the Trustee have executed this Agreement at

_____________________________________________ (place of execution) the day

and year first above-written.

_________________________(Signature of Donor)________________________(Printed Name of Donor)________________________(Name of Trustee)_________________________(Signature of Officer of Trust)________________________(Printed Name of Officer)(Acknowledgments)(Attachment of schedule)