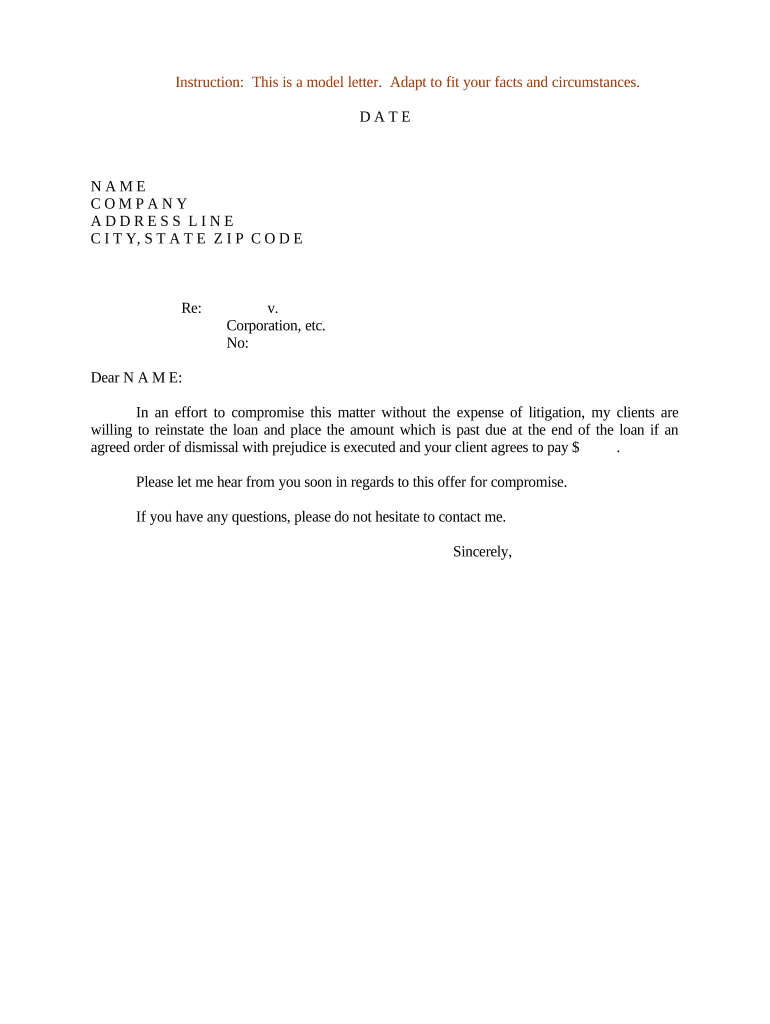

Fill and Sign the Reinstatement Request Letter Form

Beneficial hints on preparing your ‘Reinstatement Request Letter’ online

Are you fed up with the troubles of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Take advantage of the powerful tools integrated into this user-friendly and affordable platform and transform your method of document management. Whether you need to approve documents or gather eSignatures, airSlate SignNow manages everything effortlessly, requiring only a few clicks.

Adhere to this comprehensive guideline:

- Access your account or sign up for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Reinstatement Request Letter’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for other users (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with others on your Reinstatement Request Letter or send it for notarization—our solution provides you with everything required to accomplish such tasks. Register with airSlate SignNow today and enhance your document management experience!

FAQs

-

What is a reinstatement letter and when do I need one?

A reinstatement letter is a formal document used to request the reinstatement of a previously canceled contract or service. Businesses often need a reinstatement letter when they want to reactivate an account, service, or policy that was terminated. Using airSlate SignNow, you can create and send your reinstatement letter securely and efficiently.

-

How does airSlate SignNow help with creating a reinstatement letter?

airSlate SignNow provides customizable templates that make it easy to draft a reinstatement letter tailored to your specific needs. You can add your details, format the letter, and ensure it meets any necessary legal requirements. Plus, the eSignature feature allows you to get quick approvals on the reinstatement letter from relevant parties.

-

Is there a cost associated with using airSlate SignNow for a reinstatement letter?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the preparation and signing of documents, including reinstatement letters. You can choose a plan that fits your budget while enjoying the benefits of an efficient document management solution.

-

What features does airSlate SignNow offer for managing reinstatement letters?

With airSlate SignNow, you can take advantage of features like document templates, eSigning, and real-time tracking. These tools streamline the process of creating and sending a reinstatement letter, ensuring that you can manage your documents effectively. Additionally, electronic storage helps keep your reinstatement letters organized and easily accessible.

-

Are there any integrations available with airSlate SignNow for sending reinstatement letters?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, including CRMs and cloud storage services. This allows you to send your reinstatement letter directly from your existing platforms. By leveraging these integrations, you can enhance your workflow and improve efficiency in document management.

-

How secure is the process of sending a reinstatement letter using airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect your documents, including reinstatement letters, during transmission and storage. Compliance with industry standards ensures that your sensitive information remains safe. You can confidently send your reinstatement letter, knowing that it is secured.

-

Can I track the status of my reinstatement letter after sending it?

Absolutely! airSlate SignNow offers real-time tracking for sent documents, including your reinstatement letter. You can easily monitor who has opened the document, signed it, or if any action is pending. This feature helps you stay informed about the progress of your reinstatement request.

The best way to complete and sign your reinstatement request letter form

Find out other reinstatement request letter form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles