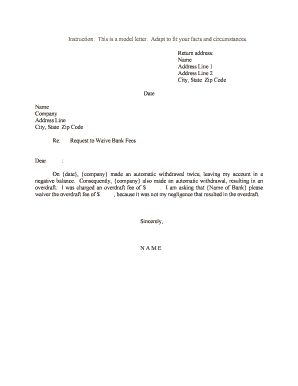

Fill and Sign the Request to Waive Bank Fees Form

Valuable tips for finalizing your ‘Request To Waive Bank Fees’ online

Are you weary of the trouble that comes with handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the robust features included in this intuitive and budget-friendly platform and transform your method of managing paperwork. Whether you need to sign forms or collect electronic signatures, airSlate SignNow manages everything seamlessly, requiring only a few simple clicks.

Adhere to this comprehensive guide:

- Log into your account or sign up for a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud, or utilize our template library.

- Access your ‘Request To Waive Bank Fees’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to ask for eSignatures from others.

- Save, print your version, or transform it into a multi-use template.

Don’t fret if you need to work with others on your Request To Waive Bank Fees or send it for notarization—our platform provides you with everything necessary to accomplish such tasks. Enroll with airSlate SignNow today and enhance your document management to unprecedented levels!

FAQs

-

What is a sample letter to IRS to waive penalty?

A sample letter to IRS to waive penalty is a template that individuals can use to request the IRS to forgive penalties for late payments or filings. This letter typically includes personal information, the reason for the request, and any supporting documentation. Using a well-structured sample letter can increase the chances of a favorable response from the IRS.

-

How can airSlate SignNow help me create a sample letter to IRS to waive penalty?

airSlate SignNow provides an easy-to-use platform that allows you to create, edit, and eSign documents, including a sample letter to IRS to waive penalty. With customizable templates and a user-friendly interface, you can quickly draft your letter and ensure it meets IRS requirements. This streamlines the process and saves you time.

-

Is there a cost associated with using airSlate SignNow for creating a sample letter to IRS to waive penalty?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The cost is competitive and provides access to features that simplify document management, including creating a sample letter to IRS to waive penalty. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features including eSigning, document templates, and secure cloud storage. These features make it easy to create and send a sample letter to IRS to waive penalty, ensuring that your documents are signed quickly and securely. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with various applications such as Google Drive, Salesforce, and more. This allows you to seamlessly incorporate your sample letter to IRS to waive penalty into your existing workflows. Integrations enhance productivity and ensure that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly enhance your business's efficiency by simplifying document management and eSigning processes. It allows you to create a sample letter to IRS to waive penalty quickly, reducing turnaround time. Additionally, the platform is cost-effective, making it a smart choice for businesses of all sizes.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security and compliance, employing advanced encryption and security protocols to protect your documents. When creating a sample letter to IRS to waive penalty, you can trust that your information is safe. The platform is designed to meet industry standards for data protection.

The best way to complete and sign your request to waive bank fees form

Find out other request to waive bank fees form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles