Fill and Sign the Returns Proforma Invoice Yoox

Practical advice on creating your ‘Returns Proforma Invoice Yoox’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can easily complete and sign paperwork online. Utilize the robust features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our form library.

- Open your ‘Returns Proforma Invoice Yoox’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite options to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Returns Proforma Invoice Yoox or send it for notarization—our solution offers everything you need to complete such tasks. Sign up with airSlate SignNow today and enhance your document management to a higher level!

FAQs

-

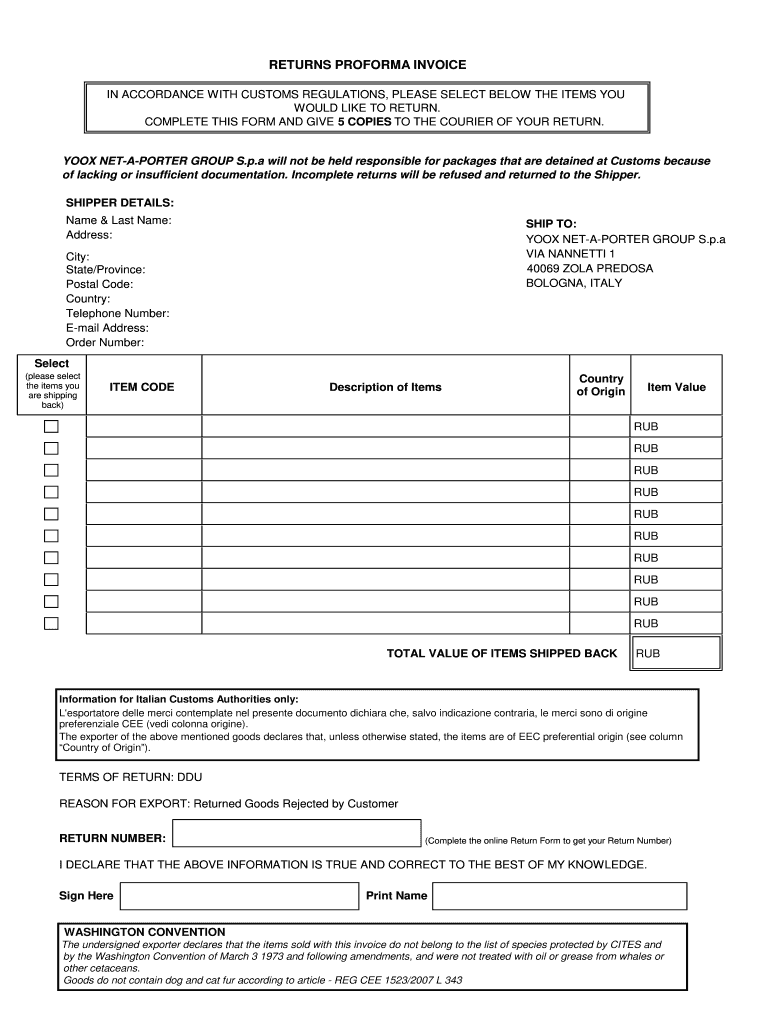

What is a Returns Proforma Invoice Yoox and why is it important?

A Returns Proforma Invoice Yoox is a document that outlines the details of a return transaction for products purchased from Yoox. It is essential for processing returns efficiently and ensuring that both the customer and the retailer have a clear understanding of the return process. Using a Returns Proforma Invoice Yoox helps streamline communication and reduces discrepancies during the return process.

-

How can airSlate SignNow help with Returns Proforma Invoice Yoox?

airSlate SignNow simplifies the process of creating and signing Returns Proforma Invoices Yoox by providing an intuitive platform for eSigning documents. With its user-friendly interface, businesses can quickly generate proforma invoices, ensuring that all necessary details are included for a smooth return transaction. This not only saves time but also enhances the overall customer experience.

-

Are there any fees associated with creating a Returns Proforma Invoice Yoox using airSlate SignNow?

airSlate SignNow offers competitive pricing with various plans that cater to different business needs. While there may be a subscription fee, creating a Returns Proforma Invoice Yoox and sending it for eSignature is typically included in the service, making it a cost-effective solution for handling returns. You can easily review the pricing plans on our website to find the best fit for your business.

-

What features does airSlate SignNow offer for managing Returns Proforma Invoice Yoox?

airSlate SignNow includes features that allow you to create, edit, and send Returns Proforma Invoices Yoox seamlessly. Key functionalities include customizable templates, automated workflows, and secure document storage. These features help ensure that your return documentation is always organized and easily accessible.

-

Can I integrate airSlate SignNow with other platforms for Returns Proforma Invoice Yoox?

Yes, airSlate SignNow offers integrations with various business applications, enabling you to streamline your workflow when processing Returns Proforma Invoices Yoox. Whether you use eCommerce platforms, CRM systems, or accounting software, our integration options ensure that your return processes remain efficient and connected.

-

How does using airSlate SignNow for Returns Proforma Invoice Yoox benefit my business?

Using airSlate SignNow for Returns Proforma Invoice Yoox enhances efficiency and reduces the time spent on paperwork. With electronic signatures and automated workflows, your team can handle returns quickly, improving customer satisfaction and retention. Additionally, the ability to track document status in real-time ensures that your return process is transparent and accountable.

-

Is airSlate SignNow secure for handling Returns Proforma Invoice Yoox?

Absolutely! airSlate SignNow prioritizes security, ensuring that all Returns Proforma Invoices Yoox are protected through encryption and secure storage options. Our platform complies with industry standards for data protection, giving you peace of mind when managing sensitive return transactions.

Find out other returns proforma invoice yoox

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles