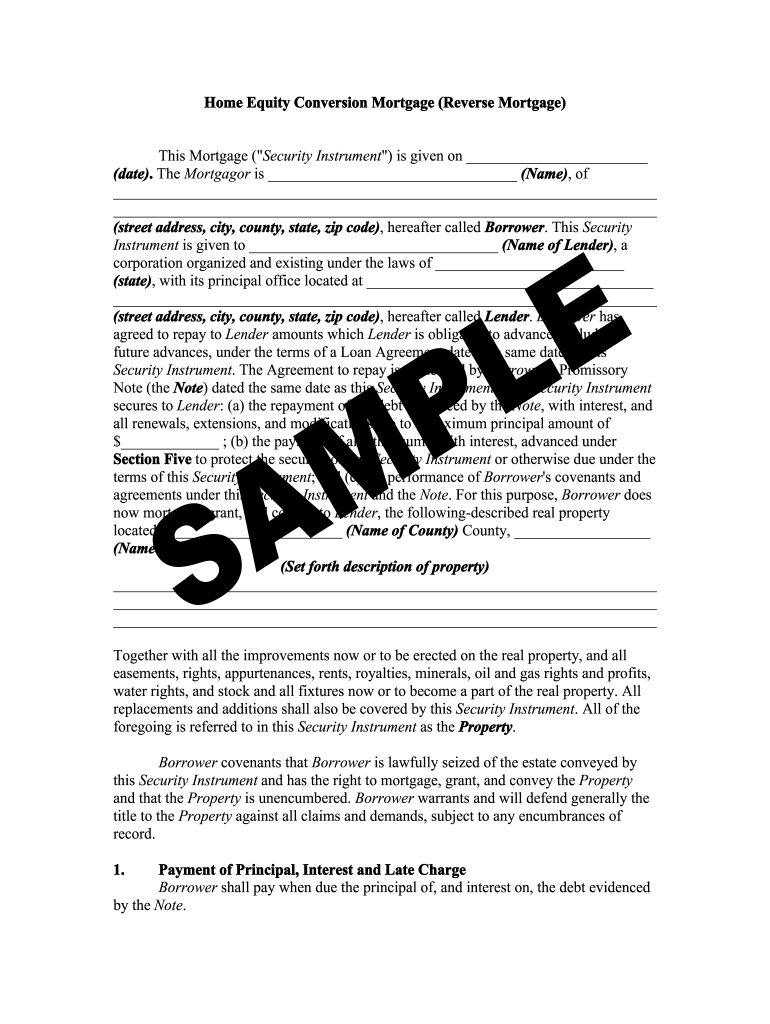

Fill and Sign the Reverse Mortgage Business Asset Purchase Agreement Fdic Form

Practical advice on setting up your ‘Reverse Mortgage Business Asset Purchase Agreement Fdic’ digitally

Are you fed up with the inconvenience of dealing with documentation? Search no further than airSlate SignNow, the leading eSignature solution for individuals and small to medium businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the comprehensive features integrated into this accessible and cost-effective platform and transform your method of document management. Whether you need to validate forms or collect eSignatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow this comprehensive tutorial:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Open your ‘Reverse Mortgage Business Asset Purchase Agreement Fdic’ in the editor.

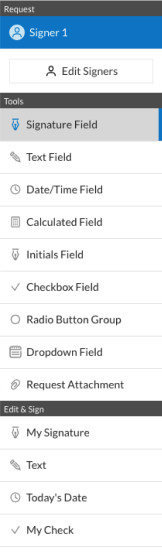

- Click Me (Fill Out Now) to complete the document on your behalf.

- Add and designate fillable fields for additional parties (if required).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a multi-use template.

Do not be concerned if you need to work with your colleagues on your Reverse Mortgage Business Asset Purchase Agreement Fdic or send it for notarization—our platform offers everything necessary to achieve those tasks. Register with airSlate SignNow today and enhance your document management experience!

FAQs

-

What is a reverse mortgage example?

A reverse mortgage example illustrates how homeowners can convert part of their home equity into cash without having to sell their home. This financial product allows seniors to receive funds while still living in their property, making it a popular choice for those looking to supplement their retirement income.

-

How does a reverse mortgage example work?

In a reverse mortgage example, a homeowner borrows against the equity in their home, receiving payments from the lender. The loan is repaid when the homeowner sells the home, moves out, or passes away, allowing them to access funds without monthly payments during their lifetime.

-

What are the benefits of a reverse mortgage example?

The benefits of a reverse mortgage example include increased cash flow for retirees, the ability to stay in their home, and no monthly mortgage payments. This financial tool can help seniors cover living expenses, healthcare costs, or even travel, enhancing their quality of life.

-

Are there any costs associated with a reverse mortgage example?

Yes, a reverse mortgage example typically involves costs such as origination fees, closing costs, and mortgage insurance premiums. It's essential for potential borrowers to understand these costs upfront to make informed decisions about their financial future.

-

Can I use a reverse mortgage example to pay off existing debts?

Absolutely! A reverse mortgage example can be used to pay off existing debts, such as credit cards or other loans. This can help improve cash flow and reduce financial stress for retirees, allowing them to manage their finances more effectively.

-

What features should I look for in a reverse mortgage example?

When considering a reverse mortgage example, look for features such as flexible payment options, competitive interest rates, and clear terms. Additionally, ensure that the lender provides excellent customer support and transparent information about the loan process.

-

How does a reverse mortgage example affect my heirs?

A reverse mortgage example can impact heirs since the loan must be repaid when the homeowner passes away or moves out. However, heirs can inherit the home by paying off the reverse mortgage balance, allowing them to keep the property if they choose.

The best way to complete and sign your reverse mortgage business asset purchase agreement fdic form

Find out other reverse mortgage business asset purchase agreement fdic form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles