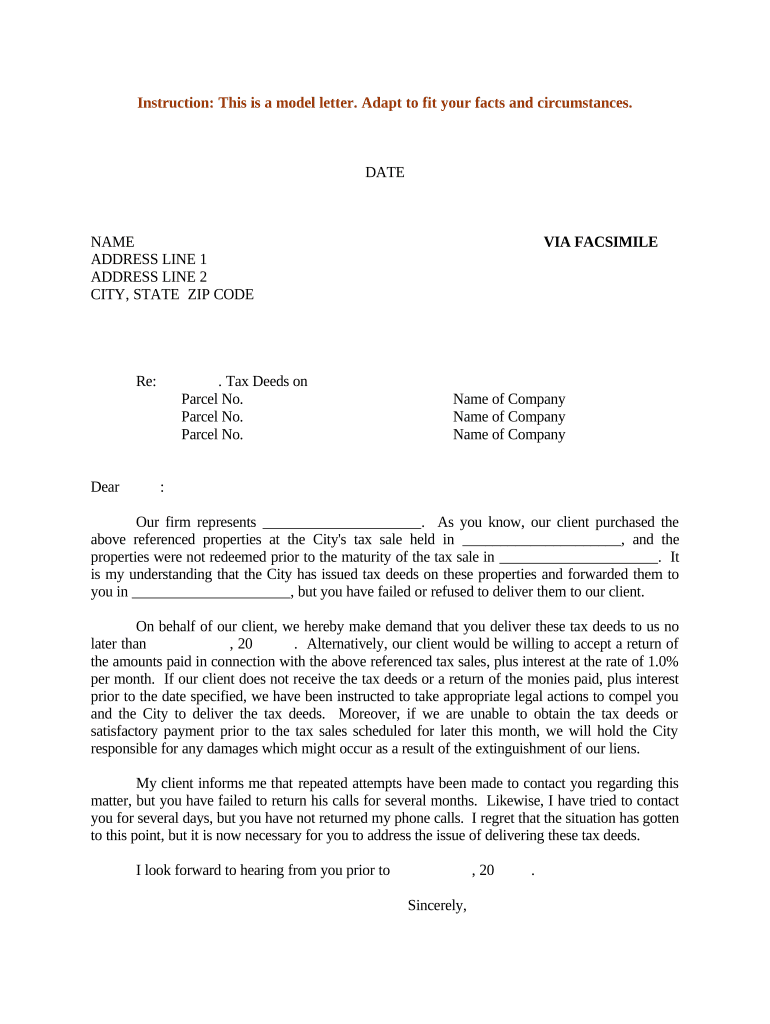

Fill and Sign the Sample Letter Tax Form

Practical advice on finishing your ‘Sample Letter Tax’ online

Are you weary of the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your approach to document handling. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all with ease, requiring just a few clicks.

Follow this comprehensive guide:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our template library.

- Open your ‘Sample Letter Tax’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or transform it into a multi-usable template.

No need to worry if you have to collaborate with your coworkers on your Sample Letter Tax or send it for notarization—our solution offers everything you need to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a Sample Letter Tax and how can it help my business?

A Sample Letter Tax is a template that businesses can use to draft communication regarding tax-related matters. Utilizing a Sample Letter Tax can streamline your correspondence, ensuring that all necessary information is included. This can save time and reduce errors when dealing with tax documents.

-

How does airSlate SignNow assist with creating a Sample Letter Tax?

airSlate SignNow provides easy-to-use tools that allow you to create and customize a Sample Letter Tax effortlessly. You can start from a template or build your own from scratch, ensuring that it fits your specific needs. With our platform, you can also eSign and send documents securely.

-

Is there a cost associated with using a Sample Letter Tax on airSlate SignNow?

Yes, while creating a Sample Letter Tax is free, using airSlate SignNow's advanced features may require a subscription. However, our pricing plans are cost-effective and designed to accommodate businesses of all sizes. You can choose a plan that best fits your budget and needs.

-

Can I integrate airSlate SignNow with other applications for managing my Sample Letter Tax?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and other document management systems. This allows you to easily manage and store your Sample Letter Tax alongside other important files.

-

What features does airSlate SignNow offer for managing Sample Letter Tax?

airSlate SignNow offers features like document templates, eSignature capabilities, and secure cloud storage to effectively manage your Sample Letter Tax. Additionally, you can track document status and set reminders for important deadlines, making tax management more efficient.

-

How secure is airSlate SignNow for sending my Sample Letter Tax?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that your Sample Letter Tax and other documents are protected. You can send and sign documents with peace of mind knowing that your information is secure.

-

Can I use airSlate SignNow to send a Sample Letter Tax for multiple recipients?

Yes, airSlate SignNow allows you to send a Sample Letter Tax to multiple recipients easily. You can set up a bulk send feature, ensuring that everyone receives the document simultaneously, which is ideal for business communications.

The best way to complete and sign your sample letter tax form

Find out other sample letter tax form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles