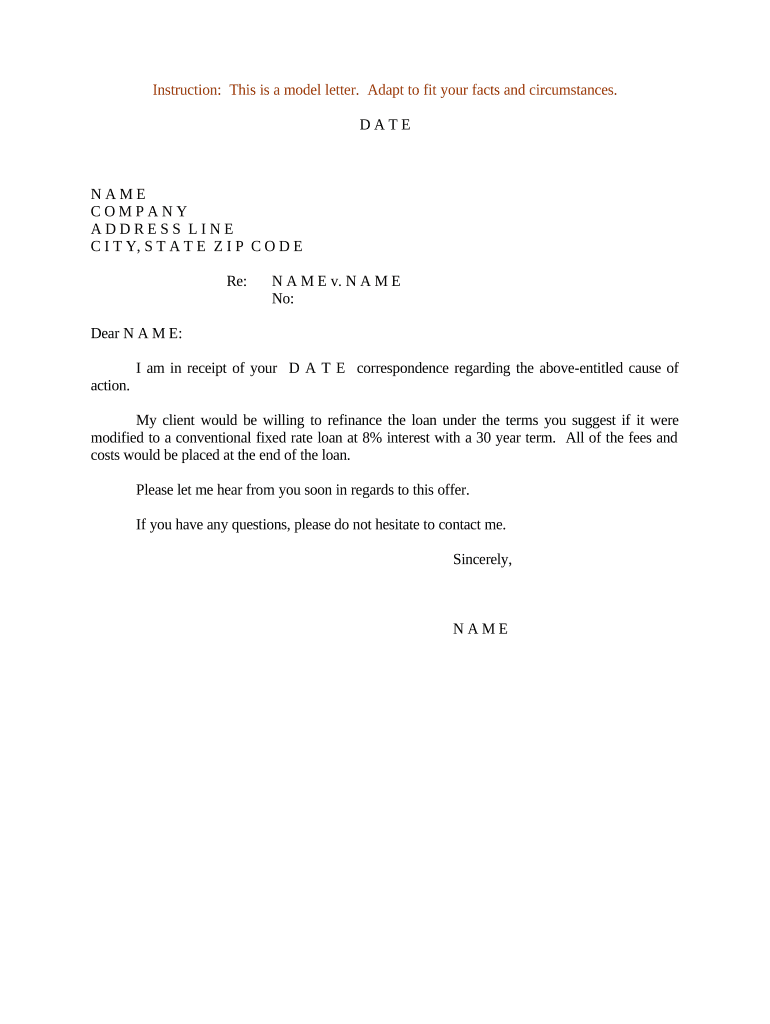

Fill and Sign the Sample Loan Form

Valuable advice on finishing your ‘Sample Loan’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature platform for individuals and organizations. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and endorse paperwork online. Take advantage of the extensive features embedded in this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this step-by-step guide:

- Log into your account or initiate a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our forms library.

- Open your ‘Sample Loan’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and assign fillable fields for other individuals (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a multi-use template.

Don’t fret if you need to collaborate with others on your Sample Loan or send it for notarization—our solution provides everything you require to achieve such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a Sample Loan and how does it work?

A Sample Loan is a predefined template used for creating loan agreements quickly and efficiently. With airSlate SignNow, you can easily customize this Sample Loan to fit your needs, allowing for seamless document creation and eSigning. This saves time and ensures that all necessary information is included, streamlining the loan process.

-

How can I create a Sample Loan document using airSlate SignNow?

Creating a Sample Loan document with airSlate SignNow is straightforward. Simply select the Sample Loan template from our library, fill in the required details, and customize it to match your specific requirements. Once completed, you can send it out for eSignature in just a few clicks.

-

What are the pricing options for using airSlate SignNow for Sample Loans?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for handling Sample Loans. Our plans are designed to be cost-effective, ensuring you get the best value for your investment in document management and eSigning solutions.

-

What features does airSlate SignNow offer for managing Sample Loans?

airSlate SignNow provides a range of features for managing Sample Loans, including customizable templates, secure eSigning, and document tracking. These tools help you streamline the loan process and ensure that all parties can easily access and sign documents electronically.

-

Can I integrate airSlate SignNow with other software for managing Sample Loans?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your Sample Loan management. Whether you use CRM, accounting tools, or cloud storage services, our integrations allow for a more efficient workflow and better document handling.

-

What benefits does airSlate SignNow offer for businesses dealing with Sample Loans?

Using airSlate SignNow for Sample Loans provides numerous benefits, including reduced paperwork, faster turnaround times, and improved accuracy in loan documentation. By digitizing your loan processes, you can enhance customer satisfaction and increase operational efficiency.

-

Is airSlate SignNow secure for handling Sample Loans?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all Sample Loans are protected with advanced encryption and authentication measures. You can trust that your sensitive documents are safe and secure throughout the signing process.

The best way to complete and sign your sample loan form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles