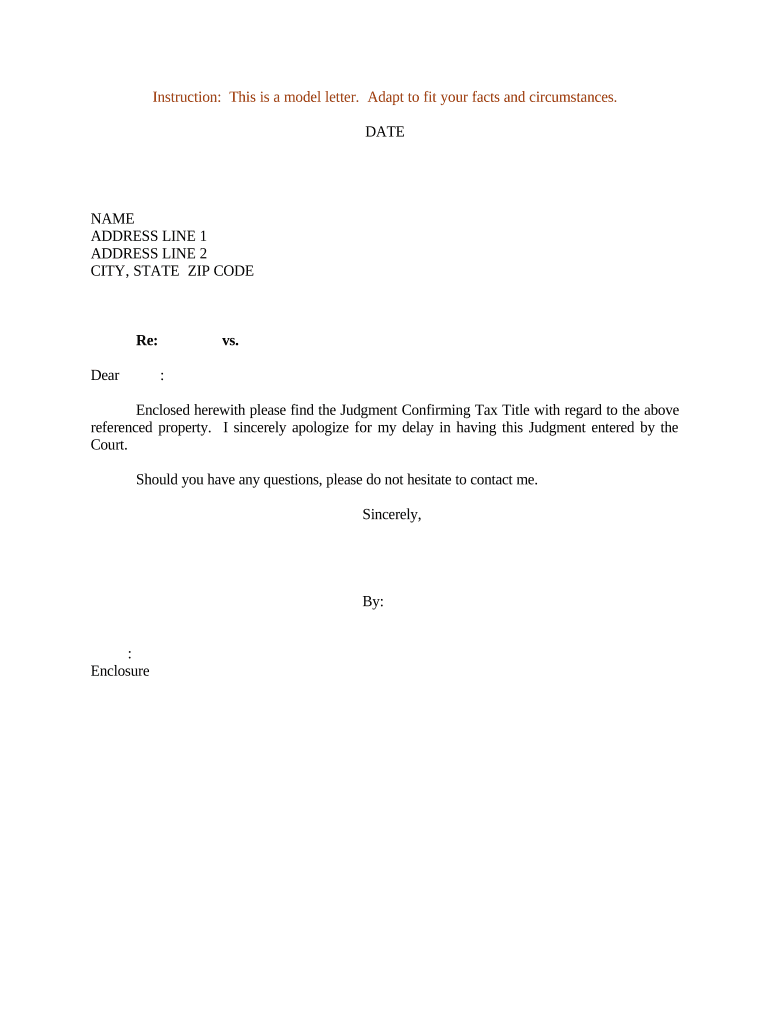

Fill and Sign the Sample Tax Letter Form

Practical advice on preparing your ‘Sample Tax Letter’ online

Are you fed up with the complications of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the laborious process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and endorse paperwork online. Utilize the robust features embedded in this straightforward and affordable platform to transform your method of paperwork management. Whether you need to authorize forms or collect eSignatures, airSlate SignNow takes care of it all with ease, requiring just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Sample Tax Letter’ in the editor.

- Click Me (Fill Out Now) to finish the document on your part.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to work with others on your Sample Tax Letter or send it for notarization—our platform provides you with everything required to complete such tasks. Sign up with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is a Sample Tax Letter and how can it be used?

A Sample Tax Letter is a template designed to help individuals and businesses communicate tax-related information effectively. It can be customized to suit various tax needs, such as requesting documents or providing necessary information to tax authorities. Using a Sample Tax Letter streamlines the process and ensures that all pertinent details are included.

-

How does airSlate SignNow simplify the process of creating a Sample Tax Letter?

airSlate SignNow makes it easy to create a Sample Tax Letter by providing customizable templates and a user-friendly interface. You can quickly edit the template to fit your specific requirements, ensuring that you include all necessary information for your tax correspondence. This efficiency saves you time and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for a Sample Tax Letter?

Using airSlate SignNow for a Sample Tax Letter offers numerous benefits, including enhanced security, easy eSigning, and seamless document sharing. The platform ensures that your sensitive tax documents are protected while allowing for quick signing and sending. This streamlined process helps you meet deadlines and stay organized during tax season.

-

Is there a cost associated with using airSlate SignNow for a Sample Tax Letter?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. The pricing varies depending on the plan you choose, but it generally offers great value considering the features available. You can create and manage multiple Sample Tax Letters without breaking the bank.

-

Can I integrate airSlate SignNow with other software for my Sample Tax Letter needs?

Absolutely! airSlate SignNow supports integration with various applications, including CRM systems, cloud storage, and accounting software. This allows you to streamline your workflow and manage your Sample Tax Letter alongside other business processes, enhancing efficiency and productivity.

-

What features does airSlate SignNow offer for managing Sample Tax Letters?

airSlate SignNow offers a range of features for managing Sample Tax Letters, including customizable templates, automated workflows, and secure eSignature capabilities. You can track document status in real-time and receive notifications when a letter has been signed, ensuring you stay updated throughout the process.

-

How secure is the information shared in a Sample Tax Letter using airSlate SignNow?

Security is a top priority for airSlate SignNow. When you create and send a Sample Tax Letter through the platform, your information is protected with encryption and secure access controls. This ensures that sensitive tax information remains confidential and is only accessible by authorized individuals.

The best way to complete and sign your sample tax letter form

Find out other sample tax letter form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles