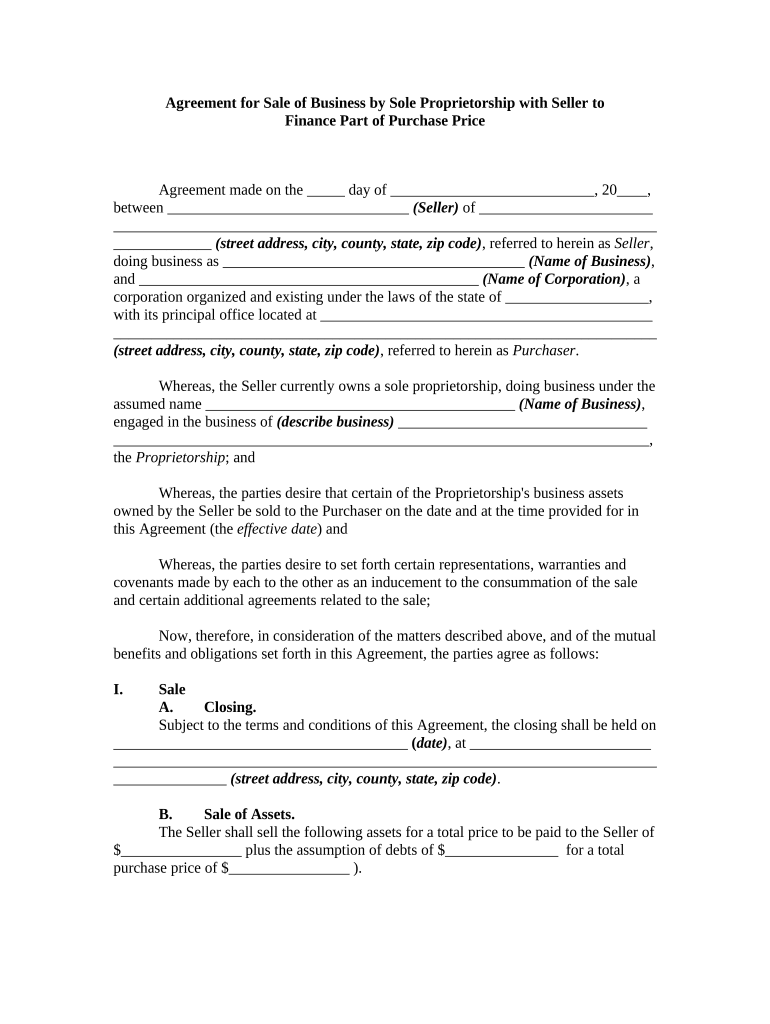

Agreement for Sale of Business by Sole Proprietorship with Seller to

Finance Part of Purchase Price

Agreement made on the _____ day of ___________________________, 20____,

between ________________________________ (Seller) of _______________________

________________________________________________________________________

_____________ (street address, city, county, state, zip code) , referred to herein as Seller ,

doing business as ________________________________________ (Name of Business) ,

and _____________________________________________ (Name of Corporation) , a

corporation organized and existing under the laws of the state of ___________________,

with its principal office located at ____________________________________________

________________________________________________________________________

(street address, city, county, state, zip code) , referred to herein as Purchaser .

Whereas, the Seller currently owns a sole proprietorship, doing business under the

assumed name _________________________________________ (Name of Business) ,

engaged in the business of ( describe business) _________________________________

_______________________________________________________________________,

the Proprietorship ; and

Whereas, the parties desire that certain of the Proprietorship's business assets

owned by the Seller be sold to the Purchaser on the date and at the time provided for in

this Agreement (the effective date ) and

Whereas, the parties desire to set forth certain representations, warranties and

covenants made by each to the other as an inducement to the consummation of the sale

and certain additional agreements related to the sale;

Now, therefore, in consideration of the matters described above, and of the mutual

benefits and obligations set forth in this Agreement, the parties agree as follows:

I. Sale

A. Closing.

Subject to the terms and conditions of this Agreement, the closing shall be held on

_______________________________________ ( date) , at ________________________

________________________________________________________________________

_______________ (street address, city, county, state, zip code) .

B. Sale of Assets.

The Seller shall sell the following assets for a total price to be paid to the Seller of

$________________ plus the assumption of debts of $_______________ for a total

purchase price of $________________ ) .

1. The purchase price represents interest in the following assets of the

Proprietorship, and the price shall be divided among the assets as

follows:

Fixtures and equipment (as set forth in Exhibit A ): $________________

Real estate (as set forth in Exhibit B ): $______________________

Inventory: $_________________________

Accounts receivable: $ _______________________

Cash type assets: $ ____________________________

Good will: $ _______________________________

2. However, the total purchase price and the price allocated to each of the

above described assets (except good will) and the principal payment of the

note described in Section I, Paragraph D shall be re-determined and

adjusted (up or down) by an appraisal of the assets to be conducted on

________________________________ (date) by ___________________

____________________________________________________________

_________________________________ ( name or names of appraisers) ,

which appraisal price shall be binding upon the parties to this Agreement.

The cost of such appraisal shall be split by both parties.

C. Closing Documents.

At the closing the Seller shall tender to the Purchaser the following fully executed

documents:

1. A bill of sale for all fixtures and equipment inventory and accounts

receivable in the form attached as Exhibit C.

2. A deed for the real estate in the form attached as Exhibit D.

D. Purchase Price and Terms.

At the closing the Purchaser shall deliver to the Seller a UCC-1 financing

statement securing the purchase price with all fixtures, inventory and accounts receivable

(and their proceeds) transferred under this Agreement; a mortgage (or deed of trust) of

the real estate transferred under this Agreement, securing the promissory note described

as follows; a certified or cashier's check of $_________________; and a fully executed

promissory note (in the form attached as Exhibit E ) for the balance of the purchase price.

The promissory note shall be for a term of _____ (number) years, shall bear interest at

the rate of ____% per annum, and shall be payable in equal (e.g., monthly) ___________

payments of $________________ for principal and interest, payable on the _____day of

each (e.g., month) ________________ beginning _______________________________

( date) .

E. Escrow and Bulk Sales Act.

The purchaser's consideration shall be held by ____________________________

( name of escrow agent) (the escrow agent ) until all of the following requirements are

fulfilled:

1. Notice to the escrow agent by the Purchaser that there are no federal or

state tax liens on the premises or its equipment or fixtures or any of

the other property conveyed by this Agreement as of a date on or after

closing.

2. Notice to the escrow agent by the Purchaser that there are no financing

statements or other liens or other claims recorded or noticed

pertaining to the property conveyed by this Agreement as of a date on or

after closing.

3. Notice to the escrow agent by the Purchaser of compliance with the

Bulk Sales Act of _____________________________ (state) said Notice

being more specifically described in Exhibit F.

II. Seller’s Representations

The Seller represents and warrants to the Purchaser as of the date of this

Agreement and on the effective date as follows:

A. Title.

To the knowledge and belief of the Seller, the Seller has good and marketable title

to all properties, assets and leasehold estates, real and personal, to be transferred pursuant

to this Agreement, subject to no mortgage, pledge, lien, conditional sales agreement,

encumbrance or charge, except for:

1. Liens reflected on the attached Schedule I as securing specified

liabilities (with respect to which no default exists);

2. Liens for current taxes and assessments not in default; and

3. Liens arising by operation of law of which, except to the extent

disclosed on Schedule II , the Seller has no knowledge of the

existence of any such liens.

B. Insurance.

The Seller has delivered to the purchaser a list (Schedule III) , complete in

all material respects, as of _________________________________ ( date) , of all

insurance policies carried by the Seller. The Seller carries insurance, which it believes to

be adequate in character and amount, with reputable insurers in respect of its properties,

assets, and business and such insurance policies are still in full force and effect.

C. Violations, Suits, Etc.

In all respects material to the business, financial condition and properties of the

Seller on a consolidated basis, the Seller is not in default under any law or regulation, or

under any order of any court or federal, state, municipal or other governmental

department, commission, board, bureau, agency or instrumentality wherever located, and,

except to the extent set forth on the Schedule IV , (1) there are no claims, actions, or suits

or proceedings instituted or filed, and (2) to the knowledge of the Seller, there are no

claims, actions, suits or proceedings threatened presently or which in the future may be

threatened against or affect the Seller at law or in equity, or before or by any federal,

state, municipal or other governmental department, commission, board, bureau, agency or

instrumentality, wherever located.

D. Tax Returns.

The Seller has filed all requisite federal, state, and other tax returns due for all

fiscal periods ended on or before ___________________________________ (date) .

III. Seller's Covenants Prior to Closing

Between the date of this Agreement and the closing date:

A. The Seller shall:

1. Carry on his business in substantially the same manner as he has prior

to this Agreement and not introduce any material new method of

management, operation or accounting;

2. Maintain his properties and facilities in as good working order and

condition as at present, ordinary wear and tear excepted;

3. Perform all material obligations under agreements relating to or

affecting his assets, properties and rights;

4. Keep in full force and effect present insurance policies or other

comparable insurance coverage; and

5. Use his best efforts to maintain and preserve his business organization

intact, retain his present employees and maintain his relationships

with suppliers, customers and others having business relations with the

Seller.

B. The Seller shall not, without the prior written consent of the Purchaser:

1. Enter into any contract or commitment or incur or agree to incur any

liability or make any capital expenditures except in the normal

course of business;

2. Increase the compensation payable or to become payable to any

employee or agent, or make any bonus payment to any such

person;

3. Create, assume or permit to exist any mortgage, pledge or other lien or

encumbrance upon any assets or properties whether now owned or

later acquired; or

4. Sell, assign, lease or otherwise transfer or dispose of any property or

equipment except in the normal course of business.

IV. Representations of Purchaser

The Purchaser represents and warrants to the Seller as of the date of this

Agreement and on the effective date, that the execution, delivery, and performance of this

Agreement by the Purchaser has been duly authorized by the board of directors of the

Purchaser and the Agreement constitutes the valid and binding obligation of the

Purchaser and that a properly certified board of directors' resolution to this effect will be

presented to the Seller before the effective date.

V. General Provisions

A. Additional Instruments

The parties shall deliver or cause to be delivered to each other on the effective

date, and at such other times and places as shall be reasonably agreed on, such additional

instruments as any party may reasonably request for the purpose of carrying out this

agreement. The Seller shall cooperate, and shall use his best efforts to have the Seller's

present employees cooperate, on and after the effective date in furnishing information,

evidence, testimony and other assistance in connection with any actions, proceedings,

arrangements or disputes of any nature with respect to matters pertaining to all periods

prior to the effective date.

B. Entire Agreement

This Agreement (including the attached exhibits and schedules) and the

documents delivered pursuant to this Agreement constitute the entire Agreement and

understanding between the parties to this Agreement and supersede any prior agreement

and understanding relating to the subject matter of this Agreement. This Agreement may

be modified or amended only by a duly authorized written instrument executed by both

parties.

C. Counterparts

This Agreement may be executed simultaneously in two or more counterparts,

each of which shall be deemed an original and all of which together shall constitute but

one and the same instrument. It shall not be necessary that any single counterpart be

executed by both parties so long as at least one counterpart is executed by each party.

D. Notices

Any notice or communication required or permitted under this Agreement shall be

sufficiently given if sent by first class mail, postage prepaid:

1. To the Purchaser: at ________________________________________

___________________________________________________________

(street address, city, county, state, zip code) ;

2. To the Seller: at ____________________________________________

____________________________________________________________

(street address, city, county, state, zip code) .

E. Survivorship

All warranties, covenants, representations and guarantees shall survive the closing

and execution of the documents contemplated by this Agreement. The parties, in

executing and in carrying out the provisions of this Agreement, are relying solely on the

representations, warranties and agreements contained in this Agreement or in any writing

delivered pursuant to provisions of this Agreement or at the closing of the transactions

provided for in this Agreement and not upon any representation, warranty, agreement,

promise or information, written or oral, made by any person other than as specifically set

forth in this Agreement or any such delivered writing.

F. Law

This agreement shall be construed in accordance with the laws of the state of

_____________________.

G. Arbitration

Any dispute under this Agreement shall be required to be resolved by binding

arbitration of the parties hereto. If the parties cannot agree on an arbitrator, each party

shall select one arbitrator and both arbitrators shall then select a third. The third

arbitrator so selected shall arbitrate said dispute. The arbitration shall be governed by the

rules of the American Arbitration Association then in force and effect.

WITNESS our signatures as of the day and date first above stated.

______________________________

(CORPORATION)

______________________________________ By: __________________________

(SELLER) ______________________________

D/B/A ________________________________________ (Name and Office in Corporation)

(Name of Business)

(Attach schedules and exhibits)

Exhibit F

Notice to the escrow agent by the Purchaser of compliance with the Bulk Sales

Act shall contain the following:

A. That the Seller has furnished to the Purchaser a list of existing creditors prepared

as follows:

1. The list must contain the names and business addresses of all creditors of

the transferor.

2. The list must state the amount of the indebtedness owing to each creditor

if such fact is known to the transferor.

3. The list must include the names of all persons who assert claims against

the transferor even though such claims are disputed.

4. The list must be signed and sworn to or affirmed by the transferor.

B. That the Seller has prepared a sworn schedule of the property to be transferred

which is sufficient to identify it.

C. That the Purchaser has received certified return receipts from all of the above-

described creditors and, in addition, from the treasurers of the county, school district and

township, city and community college where the premises are located, showing that

notice was received by the above-described parties at least ______ (number) days prior

to the date that distribution of the funds is to take place and an affidavit that the Seller has

complied with the notice requirements of the Bulk Sales Act inasmuch as the notice given

to the persons stated:

1. That a bulk transfer is about to be made.

2. The name and business address of the transferor.

3. The addresses used by the transferor within the last _____ ( number) years.

4. The name and business address of the transferee.

5. That the debts of the transferor are to be paid in full as they fall due.

6. The estimated total of the transferor's debts.

7. The location and general description of the property to be transferred.

D. That, as to any contested claims, a sum equal to the creditors' maximum claim has

been escrowed.