�Nature of Action

1

2

3. This action has been requested by the Chief Counsel of the Internal Revenue Service,

3

a delegate of the Secretary of the Treasury, and commenced at the direction of a delegate of the

4

Attorney General, pursuant to I.R.C. § 7402.

5

4. The United States is bringing this complaint to permanently enjoin the Molens from

6

failing to (a) withhold federal taxes from employee wages, (b) file timely federal employment

7

and unemployment tax returns, (c) file timely wage and tax statements (IRS Forms W-2) with

8

the Social Security Administration (SSA) and issue them to their employees, and (d) make

9

timely federal employment and unemployment tax deposits and payments to the IRS.

10

5. An injunction is warranted based on the Molens’ continuing violation of the internal

11

revenue laws, including I.R.C. §§ 3102, 3111, 3301, 3402, 6011, and 6041. Since January 2000,

12

the Molens have failed to withhold federal taxes from their employees’ wages, to file federal

13

employment and unemployment tax returns, to file and issue accurate Forms W-2, and to pay the

14

federal employment and unemployment taxes that are lawfully owing.

15

16

Defendants

6. James O. Molen resides at 189 Connors Avenue, Chico, California. He does business

17

as Touch of Class Florist, located at 1915 The Esplanade, Chico, California, a sole

18

proprietorship. He is Sandra L. Molen’s husband.

19

7. Sandra L. Molen also resides at 189 Connors Avenue, Chico, California. She also

20

does business as Touch of Class Florist, located at 1915 The Esplanade, Chico, California, a sole

21

proprietorship. She is James O. Molen’s wife.

22

23

24

25

26

Defendant’s Activities

8. The Molens have approximately four employees, to whom they pay wages and other

compensation.

9. I.R.C. §§ 3102, 3111, 3301, and 3402 require employers to withhold federal income

and Federal Insurance Contributions Act (FICA) taxes from their employees’ wages, and to pay

27

28

-2-

�1

over those withholdings, along with the employer’s own FICA and Federal Unemployment Tax

2

Act (FUTA) taxes, to the IRS.

3

10. I.R.C. § 6011 and Treasury Regulation (26 C.F.R.) § 31.6071(a)-1 require employers

4

to file Employer’s Quarterly Federal Tax Returns (IRS Forms 941) and Employer’s Annual

5

Federal Unemployment (FUTA) Tax Returns (IRS Forms 940) with the IRS.

6

11. I.R.C. §§ 6011 and 6041 and Treasury Regulation § 1.6041-2 require employers to

7

file annually with the SSA a Form W-2 for each employee, and to give each employee a copy of

8

his or her Form W-2.

9

12. On August 3, 2000, and again on November 30, 2000, the Molens wrote the IRS

10

requesting a refund of withheld federal income and FICA taxes from the first quarter of 1997

11

through the second quarter of 2000, and FUTA taxes from 1997 through 2000.

12

13. The Molens claimed in their August 3, 2000, letter to the IRS that they did not pay

13

any gross income or taxable income to their employees, and stated that they based this claim on

14

their interpretation of I.R.C. § 861, known as the “§ 861 argument.”

15

14. The patently frivolous § 861 argument posits that I.R.C. § 861 and Treasury

16

Regulation § 1.861-8(f) provide the exclusive list of income sources subject to federal income

17

tax. Because that narrow list focuses on foreign income, § 861 proponents argue that U.S.-

18

source income is not subject to federal income taxation.

19

15. Every court that has considered the § 861 argument has rejected it as frivolous.

20

Courts have sanctioned people for asserting the § 861 argument and enjoined people from

21

promoting it and preparing tax returns asserting it.

22

23

24

16. The Molens provided their employees with W-2 Forms falsely stating that they had

paid the employees $0 in 2000, 2001, and 2002.

17. In 2000, the Molens filed with the IRS multiple Supporting Statements to Correct

25

Information (IRS Forms 941C), requesting that their previously filed Forms 941 for the first

26

quarter of 1997 through the last quarter of 1999 be adjusted to report that they paid their

27

employees $0 in those quarters.

28

-3-

�1

18. In 2000, the Molens also submitted multiple Claims for Refund and Requests for

2

Abatement (IRS Forms 843), requesting a refund of the federal income, FICA, and FUTA taxes

3

they had paid for 1997 through 1999.

4

5

6

19. The IRS erroneously issued the Molens a refund of $30,698.03 for federal

employment and unemployment taxes paid from 1997 through 1999.

20. The Molens have not made any federal employment tax deposits, either of

7

withholdings from their employees’ paychecks or of their own FICA taxes, since the fourth

8

quarter of 1999.

9

21. The Molens last filed a Form 941 for the first quarter of 2000. In that Form 941,

10

they claimed that they owed $0 in tax and requested a refund of $38,876.28. They have not filed

11

a Form 941 since then.

12

13

14

15

22. The Molens last filed a Form 940 and paid FUTA taxes for the year 1999. They

have not filed a Form 940 or paid FUTA taxes for any year after 1999.

23. The Molens last filed accurate Forms W-2 and issued them to their employees for the

year 1999.

16

24. The Molens continue to employ approximately 4 people and to pay those people

17

wages and other compensation without withholding and paying the federal employment and

18

unemployment taxes.

19

25. The Molens’ actions cause hardship for their employees, who must determine and

20

pay their federal income tax liabilities without the benefit of Forms W-2 and tax withholding.

21

26. The IRS has advised the Molens that the § 861 argument is incorrect, but the Molens

22

persist in violating the law by failing to withhold and pay federal taxes and by failing to file

23

federal income and unemployment tax returns and W-2 forms.

24

27. I.R.C. § 7402(a) authorizes a court to issue orders of injunction as may be necessary

25

or appropriate for the enforcement of the internal revenue laws. The injunction remedy is in

26

addition to and not exclusive of other remedies available to the United States.

27

28

-4-

�28. The Molens, through the actions described above, have engaged and continue to

1

2

engage in conduct that substantially interferes with the enforcement of the internal revenue laws.

3

29. If the Molens are not enjoined, they are likely to continue to interfere with the

4

enforcement of the internal revenue laws.

5

30. Including the $30,698.03 erroneous refund that they received, the actual and

6

potential loss to the United States caused by the Molens’ violation of the internal revenue laws

7

as of June 30, 2003 is estimated to be $110,927.63 in federal employment and unemployment

8

taxes. This amount does not include interest or penalties.

9

31. If the Molens are not enjoined, their continuing violation of the internal revenue laws

10

will result additional losses to the United States estimated at more than $5,700 in federal income

11

and FICA taxes per quarter, plus more than $3,700 in estimated FUTA taxes per year.

12

32. If the Molens are not enjoined, the United States will suffer irreparable harm because

13

their mounting employment tax liabilities will be unrecoverable if they surpass their ability to

14

pay.

15

33. If the Molens are not enjoined, the United States will suffer irreparable harm because

16

the IRS’s administrative enforcement procedures are inadequate to stop the Molens’ continuing

17

violation of the internal revenue laws. The IRS can only prepare returns, assess taxes, and then

18

attempt to collect the taxes through levies and seizures; the IRS has no administrative procedure

19

to stop the Molens from accumulating more liabilities.

20

21

22

34. While the United States will suffer irreparable injury if the Molens are not enjoined,

the Molens will not be harmed by being compelled to obey the law.

35. The public interest would be advanced by enjoining the Molens because an

23

injunction will stop their illegal conduct and the harm that conduct is causing to the United

24

States Treasury and the Molens’ employees.

25

26

WHEREFORE, plaintiff, the United States of America, respectfully prays for the

following:

27

28

-5-

�1

A. That the Court find that the Molens have engaged and are engaging in conduct

2

interfering with the enforcement of the internal revenue laws, and that injunctive relief under

3

I.R.C. § 7402(a) and the Court’s inherent equity powers is appropriate to stop that conduct;

4

B. That this Court, pursuant to I.R.C. § 7402, enter a permanent injunction prohibiting

5

the Molens (individually and doing business as Touch of Class Florist or under any other name

6

or using any other entity), and their representatives, agents, servants, employees, attorneys, and

7

anyone in active concert or participation with him, from failing to withhold and pay over to the

8

IRS all employment taxes, including federal income, FICA, and FUTA taxes, required by law;

9

C. That this Court, pursuant to I.R.C. § 7402, enter a permanent injunction requiring the

10

Molens to file accurate and timely federal employment and unemployment tax returns (including

11

Forms 940 and 941), and Forms W-2, and, for the first two years after entry of the injunction, to

12

send copies of such returns and Forms W-2 to counsel for the United States at the same time that

13

he files the originals;

14

D. That this Court, pursuant to I.R.C. § 7402, enter a permanent injunction requiring the

15

Molens within three days of making each Touch of Class Florist payroll to make employment tax

16

deposits with their bank and on the same day the deposit is made to send by fax to the IRS

17

Revenue Officer assigned to this case a receipt for each employment tax deposit and a completed

18

worksheet showing the calculation for each deposit;

19

E. That this Court, pursuant to I.R.C. § 7402, enter a permanent injunction requiring the

20

Molens to file complete and accurate Forms 941 for all quarters beginning with the first quarter

21

of 2000, and file complete and accurate Forms 940 for all years after 1999, and pay the taxes

22

lawfully owing, plus interest thereon, within 30 days of the entry of the injunction;

23

F. That this Court, pursuant to I.R.C. § 7402, enter a permanent injunction requiring the

24

Molens to file with the SSA and issue to their employees complete and accurate Forms W-2 for

25

the years 2000 through 2002 within 30 days of the entry of the injunction;

26

27

28

-6-

��

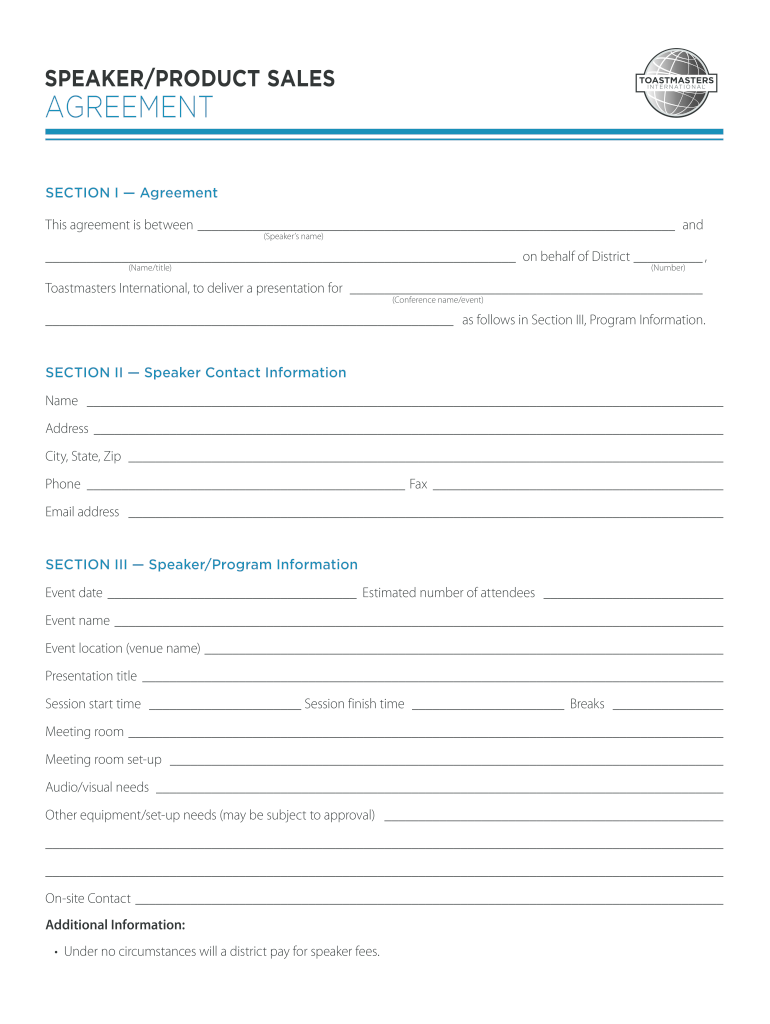

Useful tips for finishing your ‘Speakerproduct Sales Agreement Toastmasters International Toastmasters’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature service for individuals and businesses. Wave goodbye to the tedious task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the powerful features integrated into this user-friendly and economical platform and transform your document management strategy. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow manages it all efficiently, with just a few clicks.

Follow this step-by-step guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Open your ‘Speakerproduct Sales Agreement Toastmasters International Toastmasters’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Insert and assign fillable fields for others (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a multi-use template.

Don’t fret if you need to work with your colleagues on your Speakerproduct Sales Agreement Toastmasters International Toastmasters or send it for notarization—our platform provides everything necessary to achieve these tasks. Sign up with airSlate SignNow today and take your document management to a new level!