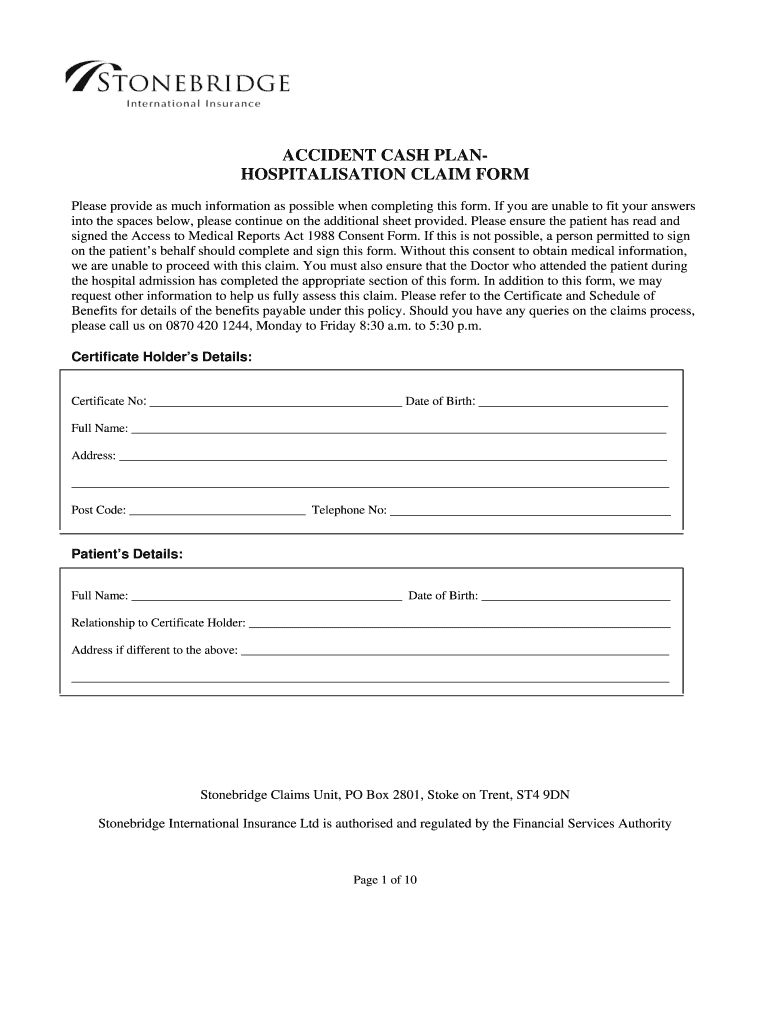

Fill and Sign the Stonebridge Claim Form PDF

Useful suggestions for preparing your ‘Stonebridge Claim Form Pdf’ online

Are you fed up with the complications of handling paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can easily finalize and sign documents online. Utilize the extensive features included in this straightforward and cost-effective platform to transform your method of document management. Whether you need to sign forms or collect eSignatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form collection.

- Open your ‘Stonebridge Claim Form Pdf’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable areas for others (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your version, or transform it into a multi-use template.

No need to worry if you have to collaborate with your coworkers on your Stonebridge Claim Form Pdf or send it for notarization—our solution provides everything necessary to achieve those objectives. Join airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

What is a Stonebridge Life Claim and how does it work?

A Stonebridge Life Claim refers to the process of submitting a claim for benefits through Stonebridge Life Insurance Company. This typically involves filling out a claim form, providing necessary documentation, and submitting it for review. Using airSlate SignNow, you can easily eSign and send your claim documents securely, ensuring a smooth claims process.

-

How can airSlate SignNow assist with my Stonebridge Life Claim process?

AirSlate SignNow streamlines the Stonebridge Life Claim process by allowing you to electronically sign and manage your documents with ease. Our platform ensures that all your claims-related paperwork is completed quickly and accurately. With features like templates and document tracking, you can stay organized and informed throughout your claim submission.

-

Are there any costs associated with using airSlate SignNow for Stonebridge Life Claims?

AirSlate SignNow offers a cost-effective solution for managing Stonebridge Life Claims. We provide various pricing plans to accommodate different needs, so you can choose one that fits your budget. The fees are transparent, with no hidden charges, making it easy to manage your claim submissions.

-

What features does airSlate SignNow offer for managing Stonebridge Life Claims?

AirSlate SignNow includes features such as eSigning, document templates, and real-time notifications to enhance your experience with Stonebridge Life Claims. Our platform allows you to customize documents, track their status, and collaborate with others involved in the claims process. These features make it easier to complete your claims promptly and efficiently.

-

Can I integrate airSlate SignNow with other applications for my Stonebridge Life Claims?

Yes, airSlate SignNow offers seamless integrations with various applications, which can enhance your Stonebridge Life Claim process. You can connect our platform with CRM systems, cloud storage solutions, and other business tools to streamline your workflow. This integration capability helps you manage your claims more effectively.

-

What are the benefits of using airSlate SignNow for my Stonebridge Life Claim?

Using airSlate SignNow for your Stonebridge Life Claim offers numerous benefits, including increased efficiency, improved document security, and easier collaboration. The platform allows for quick eSigning and document sharing, reducing the time it takes to submit claims. Additionally, you can access your documents from anywhere, making the claims process more convenient.

-

How secure is airSlate SignNow for handling Stonebridge Life Claims?

AirSlate SignNow takes security seriously, especially when dealing with sensitive information related to Stonebridge Life Claims. Our platform uses advanced encryption and security protocols to protect your documents and personal data. You can trust that your claims information is safe and confidential when using our services.

Find out other stonebridge claim form pdf

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles