Proposal No. 2-APPROVAL OF AMENDMENT TO THE CORPORATION'SRESTATED ARTICLES OF INCORPORATION

Description of Amendment and Distribution

At the Annual Meeting, the shareholders of the Corporation will be asked to consider and act

upon a proposal (the "Proposal") to amend (the “Amendment”) Article IV of the Corporation's

Restated Articles of Incorporation to (a) authorize a new class of Common Stock to be

designated as *Class A Common Stock" (the “Class A Common Stock") consisting of

50,000,000 shares having a par value of $1 per share and having no voting rights except on

certain limited matters required by law, some of which shares the Corporation's Board of

Directors currently intends to distribute to shareholders as a 100% share dividend on the

Corporation's Common Stock and Class B Common Stock (the a Distribution"); and (b) fix and

establish the relative rights, powers and limitations of the Corporation's Common Stock, Class A

Common Stock and Class B Common Stock. The currently outstanding shares of common stock

would continue to be designated as "Common Stock" and "Class 8 Common Stock”. The full text

of Article IV, as proposed to be amended, is set forth as Exhibit A to this Proxy Statement and

has been marked to show all proposed changes to Article IV. As more fully described below, the

purpose of the Proposal is to (1) provide the Corporation with the flexibility to issue shares for

financing, acquisition and compensation purposes without diluting the voting interests of any

shareholders, including the Carver Family (as defined below); and (2) enable shareholders of the

Corporation, including the Carver Family, to sell portions of their equity interest in the

Corporation without reducing their voting interests in the Corporation, and thereby facilitate

continued control by the Carver Family.

The "Carver Family" is defined in Article IV, Paragraph 4(f)(iv) of the Corporation's Restated

Articles of Incorporation, which Article IV is set forth as Exhibit A to this Proxy Statement, as

follows:

For purposes of this Paragraph (f), "Carver Family” shall mean (i) Lucille A.

Carver, widow of Roy J. Carver, (ii) the Estate of Roy J. Carver, (iii) the lineal

descendants of Roy J. Carver and their spouses, (iv) executors and administrators

of the estate of Lucille A. Carver and the estates of lineal descendants of Roy J.

Carver and their spouses, (v) trusts in which Lucille A. Carver, the lineal

descendants of Roy J. Carver and their spouses are entitled, in the aggregate, to at

least a majority of the beneficial interest therein, NO any beneficiary of any such

trust to whom shares subject to such trust are subsequently distributed and lineal

descendants of any such beneficiary, (vii) any corporation in which a majority of

the outstanding voting shares are beneficially owned by Lucille A. Carver, the

lineal descendants of Roy J. Carver and their spouses, and (viii) any partnership in

which a majority of the partnership interests are beneficially owned by Lucille A.

Carver, the lineal descendants of Roy J. Carver and their spouses. For purposes of

the foregoing definitions in this subparagraph (iv), the terms "lineal descendant"

and "lineal descendants" includes an adopted child and adopted children,

respectively.

The Board of Directors strongly believes the Amendment and the Distribution are in the best

interests of the Corporation and its shareholders and has directed that the Amendment be

submitted to a vote of the shareholders. See 'Recommendation of the Board of Directors". Under

Iowa law and the Corporation's Restated Articles of Incorporation, in order to approve the

Amendment, the number of votes cast by the holders of the Common Stock favoring the

Amendment must exceed the votes cast by holders of Common Stock opposing the Amendment,

and the votes cast by the holders of the Class B Common Stock favoring the Amendment must

exceed the votes cast by the holders of Class B Common Stock opposing the Amendment. The

members of the Carver Family have indicated that they are in favor of the Amendment and that

they will vote their shares of Common Stock and Class B Common Stock in favor of the

Amendment. As of March 20, 1992, members of the Carver Family controlled the voting or

dispositive power over 2,318,070 shares of the Class B Common Stock, representing

approximately 96% of the outstanding shares of Class B Common Stock, and 2,328,584 shares

of Common Stock, representing approximately 20% of the outstanding shares of Common Stock.

If the Amendment is adopted by the shareholders pursuant to the foregoing requirements, the

Board of Directors intends to file Articles of Amendment to the Restated Articles of

Incorporation of the Corporation with the Secretary of State of the State of Iowa amending the

Restated Articles of Incorporation in accordance with the Amendment. The Amendment will be

effective immediately upon acceptance of filing by the Secretary of State of the State of Iowa.

The Board of Directors would then be free to cause the issuance of the Class A Common Stock

without any further action on the part of the shareholders. Although the Board of Directors

presently intends to file the Articles of Amendment if the Amendment is approved by the

shareholders, the Board of Directors reserves the right to abandon the Proposal and not file such

Articles of Amendment even if the Amendment is approved by the shareholders.

If the shareholders approve the Amendment, it is the present intention of the Board of Directors

to declare a dividend on the Common Stock and the Class B Common Stock of the Corporation

payable in Class A Common Stock on the basis of one share of Class A Common Stock for each

share of Common Stock and Class B Common Stock outstanding. The Distribution will be

essentially a two-for-one stock split. The record date for the Distribution (the "Distribution

Record Date") is expected to be established promptly after the Amendment is approved and

adopted by the shareholders and the Distribution would be made as soon thereafter as is

practicable. Shareholder approval of the Distribution is not required by Iowa law and is not being

solicited by this Proxy Statement. Although the Board of Directors presently intends to make the

Distribution, the Board of Directors reserves the right not to make the Distribution even if the

Amendment is approved by the shareholders and Articles of Amendment are filed with the

Secretary of State of the State of Iowa.

The Board of Directors strongly believes the Amendment is in the best interests of the

Corporation and its shareholders and recommends that the shareholders vote FOR the

Amendment.

Description of the Class A Common Stock

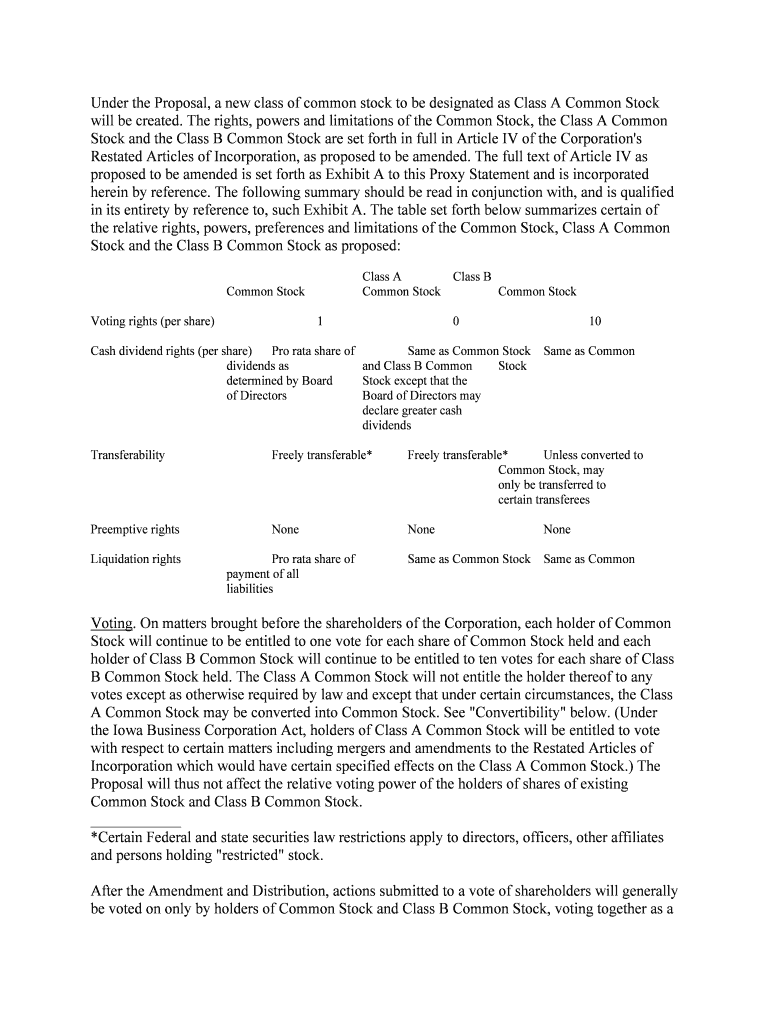

Under the Proposal, a new class of common stock to be designated as Class A Common Stock

will be created. The rights, powers and limitations of the Common Stock, the Class A Common

Stock and the Class B Common Stock are set forth in full in Article IV of the Corporation's

Restated Articles of Incorporation, as proposed to be amended. The full text of Article IV as

proposed to be amended is set forth as Exhibit A to this Proxy Statement and is incorporated

herein by reference. The following summary should be read in conjunction with, and is qualified

in its entirety by reference to, such Exhibit A. The table set forth below summarizes certain of

the relative rights, powers, preferences and limitations of the Common Stock, Class A Common

Stock and the Class B Common Stock as proposed:

Class A Class B

Common Stock Common Stock Common Stock

Voting rights (per share) 1 0 10

Cash dividend rights (per share) Pro rata share of Same as Common Stock Same as Common dividends as and Class B Common Stock

determined by Board Stock except that the

of Directors Board of Directors maydeclare greater cash

dividends

Transferability Freely transferable* Freely transferable* Unless converted to Common Stock, may

only be transferred to

certain transferees

Preemptive rights None None None

Liquidation rights Pro rata share of Same as Common Stock Same as Common payment of all

liabilities

Voting. On matters brought before the shareholders of the Corporation, each holder of Common

Stock will continue to be entitled to one vote for each share of Common Stock held and each

holder of Class B Common Stock will continue to be entitled to ten votes for each share of Class

B Common Stock held. The Class A Common Stock will not entitle the holder thereof to any

votes except as otherwise required by law and except that under certain circumstances, the Class

A Common Stock may be converted into Common Stock. See "Convertibility" below. (Under

the Iowa Business Corporation Act, holders of Class A Common Stock will be entitled to vote

with respect to certain matters including mergers and amendments to the Restated Articles of

Incorporation which would have certain specified effects on the Class A Common Stock.) The

Proposal will thus not affect the relative voting power of the holders of shares of existing

Common Stock and Class B Common Stock.____________

*Certain Federal and state securities law restrictions apply to directors, officers, other affiliat es

and persons holding "restricted" stock.

After the Amendment and Distribution, actions submitted to a vote of shareholders will generally

be voted on only by holders of Common Stock and Class B Common Stock, voting together as a

single class, except that the holders of Common Stock and Class B Common Stock will vote

separately as classes with respect to such matters as may require class votes under the Iowa

Business Corporation Act.Dividends; Liquidation Rights. Holders of Common Stock, Class A Common Stock and Class B

Common Stock will be entitled to receive ratably all such dividends, payable in cash or

otherwise, as may be declared by the Board of Directors out of assets or funds legally available

therefor except that the Board of Directors will have discretionary authority to declare greater

cash dividends on the shares of Class A Common Stock, and except that in the event of a stock

dividend or stock split (which occurs after the Distribution), only shares of Class A Common

Stock may be distributed with respect to the Class A Common Stock, only shares of Common

Stock or Class A Common Stock may be distributed with respect to the Common Stock, and

only shares of Class B Common Stock or Class A Common Stock may be distributed with

respect to the Class B Common Stock.The declaration and payment of cash dividends is solely within the discretion of the Board of

Directors, and there can be no assurance that such dividends will be declared and paid with any

regularity. The Corporation paid quarterly dividends of $.275 per share in the 1991 calendar

year. In the current calendar year, it has paid dividends of $.30 per share in the first quarter. The

Board presently intends to continue to declare cash dividends in the future consistent with its

historical dividend policy.

Holders of Common Stock, Class A Common Stock and Class B Common Stock will be equal

and have the same rights with respect to distributions in connection with a partial or complete

liquidation of the Corporation.

Transferability. Like the existing Common Stock, the Class A Common Stock will be freely

transferable, and except for federal and state securities law restrictions on directors, officers and

other affiliates of the Corporation and on persons holding "restricted" stock, Corporation

shareholders will not be restricted in their ability to sell or transfer shares of Class A Common

Stock. The Corporation is filing an application with the New York Stock Exchange to list the

Class A Common Stock for trading on such exchange. See "Certain Effects of the Proposal-

NYSE Criteria.' Holders of Class B Common Stock are currently, and will continue to be,

substantially restricted in their ability to transfer Class B Common Stock.Mergers and Consolidations. Each holder of Common Stock, Class A Common Stock and Class

B Common Stock will be entitled to receive the same per share consideration in a merger or

consolidation of the Corporation (whether or not the Corporation is the surviving corporation).Convertibility. If at any time the aggregate number of outstanding shares of Common Stock and

Class B Common Stock as reflected on the stock transfer books of the Corporation falls below 10

% of the aggregate number of outstanding shares of Common Stock, Class A Common Stock and

Class B Common Stock, then, immediately upon the occurrence of such event, all the

outstanding hares of Class A Common Stock shall be automatically converted into shares of

Common Stock, on a share-for-share basis. For purposes of the immediately preceding sentence,

any shares of stock repurchased by the Corporation shall no longer be deemed "outstanding"

from and after the date of repurchase.In the event of any such conversion of the Class A Common Stock, certificates which formerly

represented outstanding shares of Class A Common Stock will thereafter be deemed to represent

a like number of shares of Common Stock. Except as described above, the Class A Common

Stock will not be convertible into another class of stock or any other security of the Corporation.

Preemptive Rights. Neither the Common Stock, the Class A Common Stock nor the Class B

Common Stock will carry any preemptive rights enabling a holder to subscribe for or receive

shares of any class of stock of the Corporation or any other securities convertible into shares of

any class of stock of the Corporation.

Recommendation of the Board of Directors

The Proposal was initially considered and discussed at a meeting of the Board of Directors held

on November 19, 1991. At that time, the directors requested additional materials to review as

well as a more detailed study of the creation of a class of non-voting common stock for the

Corporation. Subsequently, William Blair & Company, the Corporation's financial advisor with

respect to the Proposal, prepared a detailed report, which was delivered to each director. After

reviewing such report and receiving further information from legal counsel for the Corporation,

the Board further reviewed and discussed the Proposal at a telephonic Board meeting held on

February 17, 1992. At subsequent meetings held on March 6 and 7, 1992, the Board met with

members of the Corporation's management, its financial advisors and its outside legal advisors to

discuss the Proposal in detail and to evaluate it as a means of enhancing the flexibility of the

Corporation and its shareholders. The Proposal's terms, likely benefits and possible

disadvantages were discussed. During the March 7, 1992 meeting, the Board unanimously

approved the Proposal and its submission to the shareholders of the Corporation for their

approval and accordingly each of the directors who is neither a member of the Carver Family nor

an officer or employee of the Corporation voted to approve the Amendment.

For the reasons described below under “Reasons for the Proposal", the Board of Directors

believes that the Proposal offers a number of potential benefits and that adoption of the Proposal

is in the best interests of the Corporation and all of its shareholders. Primarily, the Board believes

the Amendment should enable the Corporation to increase its financial flexibility and provide for

its long-term growth by providing the Corporation the ability to issue shares of Class A Common

Stock or other debt or equity securities convertible into Class A Common Stock for financing,

acquisition and compensation purposes without significantly diluting the voting power of

existing shareholders, including the Carver Family. The Proposal also provides shareholders with

the flexibility to sell a portion of their equity interest without diluting their voting power. Any

such voting dilution of the Carter Family interest could, in the opinion of the Board, adversely

affect the continuity of the Corporation's management and operating policies.

The Board of Directors strongly believes that the Amendment and the Distribution are in the best

interests of the Corporation and its shareholders and recommends that you vote "FOR" the

adoption of the Amendment. The Board of Directors suggests that each shareholder carefully

read and review the description of the Amendment and the Distribution and certain effects

thereof which are set forth herein.The Board of Directors analyzed information provided to it about the Proposal from

management, from William Blair & Company, its financial advisor, and from legal counsel. Mr.

Edgar D. Jannotta, a director of the Corporation, is the Managing Partner of William Blair &

Company. See "Financial Advisor to the Corporation." Mr. Robert K. Drummond, a director of

the Corporation, is a partner of Foley & Lardner, which provided legal services to the

Corporation in connection with the Proposal. Another partner of Foley & Lardner serves as

counsel to the Estate of Roy J. Carver. Mr. Drummond's father-in-law, Merle A. Young, is the

brother of Lucille A. Carver.

Reasons for the Proposal

The Board believes that a capital structure including the Class A Common Stock will offer a

number of potential benefits to the Corporation and its shareholders. These benefits are described

below.

Financing Flexibility. Implementation of the Proposal would provide the Corporation with

increased flexibility in the future to issue equity securities in connection with acquisitions and

existing and future employee benefit and incentive plans, and to raise equity capital or to issue

convertible debt as a means to finance future growth, without diluting the voting power of the

Corporation's existing shareholders, including the Carver Family. The listing of the Class A

Common Stock by the New York Stock Exchange will create a trading market, the existence of

which could be an important factor in assessing the value of such stock in connection with any

such acquisition, financing or benefit or incentive plan. See "Certain Effects of the Proposal -

NYSE Criteria". The Corporation has not heretofore generally issued Common Stock to finance

its operations or acquisitions and, except for the Corporation's Restricted Stock Grant Plan and

its Non-Qualified Stock Option Plan, has not generally used stock options or stock grants in

recent years as a means of retaining or compensating employees. Furthermore, members of the

Carver Family have indicated to the Corporation's management that they would react negatively

as shareholders of the Corporation toward the issuance of Common Stock under circumstances

which would materially dilute their voting control.

The Corporation has no present plans to issue additional equity securities or convertible

securities in any acquisition or financing transaction after the implementation of the Proposal. If

the Corporation issues any shares for such purposes, however, it is more likely that the shares

issued would be Class A Common Stock. Although the Common Stock may trade at a premium

with respect to the Class A Common Stock, as discussed below, the Amendment expressly

permits the Board to issue and sell shares of Class A Common Stock even if the consideration

which could be obtained by issuing or selling Common Stock would be greater. See "Certain

Effects of the Proposal - Effect on Market Price."

Shareholder Flexibility. Under the Proposal, shareholders desiring to maintain their voting

positions will be able to do so even if they decide to sell or otherwise dispose of up to 50% of

their equity interest in the Corporation. The Proposal thus gives all shareholders, including

members of the Carver Family, increased flexibility to dispose of a portion of their equity

interest in the Corporation without necessarily affecting their relative voting power. To the extent

that the members of the Carver Family desire to sell shares in the Corporation, the members of

the Carver Family have advised the Corporation that they presently intend to sell Class A

Common Stock and retain their voting interests in the Corporation. See "Continuity" below.Shareholders who are interested in maintaining their voting power in the Corporation might be

less reluctant to sell part of their holdings if the sales of shares would not result in a decrease in

their relative voting power. Sales by these shareholders could result in an increase in trading of

shares of the Corporation, thereby increasing liquidity. Implementation of the Proposal would

double the number of outstanding shares of the Corporation's common stock, including those in

the hands of holders other than the Carver Family, and therefore, would likely further improve

the liquidity of an investment in the Corporation. Furthermore, the issuance of the Class A

Common Stock would allow any shareholder to increase voting power without increasing the

shareholder's equity investment by selling Class A Common Stock and buying Common Stock

with the proceeds.

In addition to the flexibility the Amendment provides holders of Common Stock and Class B

Common Stock, the Amendment includes provisions intended to cause the holders of the

Common Stock to be treated equally with the holders of the Class B Common Stock with respect

to mergers and consolidations. Such protective provisions, which do not exist under the

Corporation's present Restated Articles of Incorporation, are intended to protect the holders of

the Common Stock and the holders of the Class A Common Stock against the possibility that

under certain circumstances the holders of the Class B Common Stock could realize greater

consideration for their shares on a per share basis than the holders of the Common Stock and

Class P Common Stock. See "Description of Class A Common Stock - Mergers and

Consolidations." In addition to the foregoing, the issuance of the Class A Common Stock

pursuant to the Distribution would create a more attractive per share price for investors in a

manner similar to any other stock dividend or stock split. See "Certain Effects of the Proposal -

Effect on Market Price.”

Continuity. The Proposal would facilitate the Carver Family's continued ownership of a

substantial portion of the Corporation's voting securities even if the members of the Carver

Family should find it necessary to sell a significant block of stock for diversification, for estate

tax obligations or for other reasons, and thereby enable the Corporation to continue to be

managed based on long-term objectives, which the Corporation's Board of Directors considers to

be a significant benefit to the Corporation and its shareholders. For example, upon the death of

any member of the Carver Family, it is possible that securities of the Corporation held by the

estate would have to be sold in the open market, to the Corporation or otherwise, in order to pay

federal and state estate and inheritance taxes. If the Proposal is adopted, it will be easier for the

estate of a deceased member of the Carver Family to sell Corporation securities without risk of

the Carver Family losing voting control over the Corporation. Absent the Proposal, it is possible

that the estate would be required to convert prior to sale Class B Common Stock to Common

Stock to achieve liquidity and thereby reduce the voting control of the remaining members of the

Carver Family.

The Corporation has operated under the stewardship of the Carver Family for over 34 years. The

existing two-class structure (Common Stock and Class B Common Stock) was proposed by the

Board and approved by the shareholders in 1986. At that time the Board believed that the two

class structure, which afforded the Carver Family the opportunity to obtain majority voting

control of the Corporation, was an effective means of assuring the continued loyalty of the

Corporation's dealer network and the continued independence and integrity of the Corporation's

operations and thereby enabling the Corporation to achieve its goals of long-range profitability

and growth. The Board of Directors continues to believe the leadership of the Carver Family has

been and continues to be an important factor in the Corporation's growth and success. The Board

also believes that because most of its franchised dealers operate family businesses themselves,

this family relationship and continuity in leadership is believed to be very important to the

Corporation's dealer network. See "Business Relationships.* By providing a means by which

shareholders, including the Carver Family, may sell or otherwise dispose of a portion of their

equity interest without reducing their voting control, the Proposal also reduces the risk that the

Corporation could at some future date be compelled to consider a potential acquisition of the

Corporation in an environment that could be dictated to the Corporation and the Board by the

financial circumstances of the members of the Carver Family or by third parties who may be

anticipating or speculating about such circumstances. The Board of Directors believes this

independence is necessary to continue a long-term earnings growth posture.

Business Relationships. To the extent that long-time customers, suppliers, joint venture partners

and franchised dealers may have concerns about potential changes in control of the Corporation

in the event that the holdings of the Carver Family are ever diluted, the implementation of the

Proposal may provide them with reassurance and encourage their willingness to make long-term

plans with and commitments to the Corporation. The Board of Directors believes that the

Corporation's greatest asset is the loyalty of its worldwide network of approximately 1,200

franchised dealers. In order to enhance the existing strong ties between the Corporation and its

dealers, the Corporation has, over the last several years, been dramatically increasing its

discretionary expenditures in areas related to new technologies, advertising, marketing and

promotional programs. It is believed that in order to stay competitive, particularly in the highly

competitive replacement market, and in order to continue to earn the loyalty, commitment and

capital of its dealers, the Corporation will have to continue concentrating on these programs. The

Board of Directors believes that without the continuity of leadership and independence necessary

to continue such a long-term earnings growth posture, the loyalty of its dealer network, which is

crucial to the growth and financial success of the Corporation, will suffer.

Certain Effects of the Proposal

Effect on Relative Ownership Interest and Voting Power. Because the Distribution is to be made

to all shareholders (Common Stock and Class B Common Stock) in proportion to the number of

shares of Common Stock and Class B Common Stock owned on the Distribution Record Date by

each shareholder, the relative ownership interest and voting power of each holder of a share of

Common Stock or Class B Common Stock will be the same immediately after the Distribution as

it was immediately prior thereto. Consequently, assuming that the members of the Carver Family

retain the shares of Common Stock and Class B Common Stock owned by them, the Amendment

will not alter the Carver Family's present control of the Corporation. Under the Proposal,

shareholders who sell shares of Common Stock after the Distribution will lose a greater amount

of voting control in proportion to equity than they would have prior to the Distribution.

Conversely, shareholders who sell shares of Class A Common Stock after the Distribution will

retain a greater amount of voting control in proportion to equity. Shareholders desiring to

maintain a long-term investment in the Corporation will be free to continue to hold the Common

Stock and Class B Common Stock and retain the benefits of the voting power attached to such

classes of common stock.As of March 20, 1992, members of the Carver Family had sole or shared voting or dispositive

power over an aggregate of 2,318,070 shares of Class B Common Stock and 2,328,584 shares of

Common Stock, representing 72% of the voting power of the Corporation. Accordingly, the

Carver Family will receive an aggregate of approximately 4,646,654 shares of Class A Common

Stock in connection with the Amendment and the Distribution. If the Carver Family, following

the Distribution, were to sell all of the shares of Class A Common Stock received by the Carver

Family in the Distribution, the Carver Family would still have at least 72% of the voting power

of the Corporation, assuming no other change. The foregoing is for illustrative purposes only and

is in no way intended to suggest that the Carver Family has any intention of selling any or all of

its shares of Class A Common Stock following the Distribution. It is the present intention of

members of the Carver Family to hold the shares of Common Stock and Class B Common Stock

and to sell shares of Class A Common Stock if they sell any shares.

Effect on Market Price. The market price of Common Stock and Class A Common Stock after

the Distribution will depend, as before the implementation of the Proposal, on many factors

including, among others, the future performance of the Corporation, general market conditions

and conditions relating to corporations in industries similar to that of the Corporation.

Accordingly, the Corporation cannot predict the prices at which the Common Stock and the

Class A Common Stock will trade following the adoption of the Amendment and the

Distribution, just as the Corporation could not predict the price at which the Common Stock

would trade absent the Amendment and the Distribution. It is expected, however, that the market

price of the Common Stock will reflect the effect of a two-for-one stock split. Absent other

factors, the Common Stock and Class A Common Stock are therefore expected to trade at

approximately one-half the price of the Common Stock prior to implementation of the Proposal.

On March 20, 1992, the closing price of the Common Stock on the NYSE was $126 per share.No assurance can be given that the Common Stock and Class A Common Stock will trade at the

same price or within a narrow range of prices and it is possible that the Common Stock could

trade at a premium compared to the Class A Common Stock. Should a premium on the Common

Stock develop, subsequent issuances of the Class A Common Stock could have a dilutive effect

on all shareholders. See "Dilutive Effect; Effect on Book Value and Earnings Per Share."

The Amendment expressly permits the Board to declare dividends on the Class A Common

Stock in an amount greater than on the other classes of equity of the Corporation. The

Amendment also permits the Board to authorize the purchase of shares of any one class or any

combination of classes without regard to the differences among them in price and other terms

under which such shares may be purchased. In addition, the Amendment permits the Board to

issue and sell shares of Class A Common Stock even if the consideration which could be

obtained by issuing or selling the Common Stock would be greater. On October 11, 1990, the

Board of Directors authorized the repurchase of up to 1,000,000 shares of Common Stock,

pursuant to which authorization the Corporation has repurchased 18,800 shares of Common

Stock since the repurchase was authorized. Continued repurchases of Common Stock by the

Corporation could result in the Common Stock trading at a premium to the Class A Common

Stock or could increase any then existing premium.Dilutive Effect; Effect on Book Value and Earnings Per Share. As noted above, the primary

purpose of creating the Class A Common Stock is to provide the Corporation with an alternative

equity financing vehicle which does not dilute the voting rights of the existing shareholders. The

Distribution, which would be made ratably to each holder of Common Stock and Class B

Common Stock, will not dilute the voting or other economic interests of the holders of the

Common Stock and the Class B Common Stock. However, if the Common Stock were to trade at

a premium to the Class A Common Stock, subsequent issuances of Class A Common Stock

instead of Common Stock in connection with an acquisition or other transaction could have a

greater dilutive effect on shareholders because such a transaction would require more shares to

deliver the same aggregate value.

As with any issuance of equity securities, a subsequent issuance of Class A Common Stock may

cause dilution of the economic interests that each outstanding share represents. Because the Class

A Common Stock is entitled to share equally with the Common Stock and Class B Common

Stock with respect to all economic benefits (subject to the authority of the Board to declare a

dividend on the Class A Common Stock in an amount greater than any dividend on the Common

Stock and Class B Common Stock), issuances of the Class A Common Stock will have a dilutive

effect on the economic interest of each outstanding share of Common Stock, Class A Common

Stock and Class B Common Stock just as subsequent issuances of the existing Common Stock

and Class B Common Stock would have on currently outstanding Common Stock and Class B

Common Stock.Although the interests of each shareholder in the total equity of the Corporation will remain

unchanged as a result of the Distribution, the issuance of the Class A Common Stock pursuant to

the Distribution will cause the book value and earnings per share of the Corporation to be

adjusted to reflect the increased number of shares outstanding. Although implemented in the

form of a dividend, for accounting purposes the Distribution will have the same effect as a two-

for-one stock split.

Since the market price of the Common Stock immediately subsequent to the Distribution is

expected to be approximately half of the price of the Common Stock immediately prior to the

Distribution, it will be possible to acquire more Common Stock for a given amount of

consideration after the Distribution. Therefore, the Proposal would permit shareholders,

including members of the Carver Family, to increase their relative voting control at a lower cost.

The Carver Family has advised management that it has no present plans to acquire any additional

shares of Common Stock after the Distribution.

Trading Market. Subsequent to the Distribution, there will be issued and outstanding

approximately 11,456,094, 2,412,577 and 13,868,671 shares of Common Stock, Class B

Common Stock and Class A Common Stock, respectively. In order to minimize dilution of the

voting power of the existing shareholders, the Corporation is more likely to issue additional

Class A Common Stock than Common Stock in the future to raise equity, finance acquisitions or

fund employee benefit plans. Furthermore, members of the Carver Family are more likely to sell

Class A Common Stock over time than Common Stock. Any such issuance of additional Class A

Common Stock by the Corporation or sales of Class A Common Stock by members of the Carver

Family or other major shareholders may serve to further increase market activity in the Class A

Common Stock relative to the Common Stock.Federal Income Tax Consequences. Foley & Lardner, counsel to the Corporation, has advised the

Corporation that, in general, for federal income tax purposes, (i) the proposed distribution of the

Class A Common Stock will not be taxable to a shareholder; (ii) the cost or other basis of the

shares of Common Stock or Class B Common Stock held by a shareholder on the Distribution

Record Date will be apportioned between the shares of Common Stock or Class B Common

Stock and the shares of Class A Common Stock received in the Distribution in proportion to the

fair market value of the shares of each class of stock on the date that the Distribution is

distributed; and GO a shareholder's holding period for the shares of Class A Common Stock

received with respect to the dividend will be the same as such shareholder's holding period for

the shares of Common Stock or Class B Common Stock with respect to which the shares of

Class A Common Stock were received. The preceding sentence constitutes the opinion of Foley

& Lardner, counsel to the Corporation, regarding the material federal income tax consequences

of the Proposal. Shareholders are urged to consult their tax advisors with specific reference to

their own tax situation.Securities Act of 1933. The issuance of the Class A Common Stock as a stock dividend will not

involve a "sale" of a security under the Securities Act of 1933 (the "Securities Act").

Consequently, the Corporation is not required to register and will not register under the

Securities Act of 1933 the issuance of Class A Common Stock. Since there will be no sale of the

Class A Common Stock, shareholders will not be deemed to have purchased such shares

separately from the Common Stock under the Securities Act and Rule 144 thereunder. Shares of

Class A Common Stock received in the Distribution, other than any such shares received by

affiliates of the Corporation within the meaning of the Securities Act, may be offered for sale

and sold in the same manner as the Common Stock without registration under the Securities Act.

Affiliates of the Corporation, including members of the Carver Family, will continue to be

subject to the restrictions specified in Rule 144 under the Securities Act, with each class of

common stock considered separately.NYSE Criteria. The Common Stock currently is traded on the New York Stock Exchange (the

"NYSE"), and application is being made to trade the Class A Common Stock on the NYSE as

well. The Proposal is intended to comply with the requirements of NYSE Rule 313.00(A) and

(B), which prohibits the listing on the NYSE of equity securities of an issuer if that issuer issues

stock or takes other corporate actions that have a “disenfranchising” effect on existing

shareholders. The Corporation has discussed the Proposal with the NYSE and has been advised

by the NYSE that the issuance of the Class A Common Stock pursuant to the terms of the

Proposal would not violate NYSE Rule 313.00(A) and (B). The Corporation presently

anticipates, therefore, that both the Class A Common Stock and the Common Stock will be

traded on the NYSE. Future issuances of Common Stock may be subject to NYSE Rule 313.00

and NYSE approval may be required in connection with any such future issuances.Increase in Authorized Stock. The Amendment would not increase the number of shares of

Common Stock which could be issued. Of the 21,500,000 shares of Common Stock authorized,

there are issued and outstanding 11,456,094 shares of Common Stock. The Amendment would,

however, authorize 50,000,000 shares of Class A Common Stock of which approximately

13,868,671 shares of Class A Common Stock would be issued in connection with the

Distribution. The remaining 36,131,329 shares of Class A Common Stock could be issued by the

Corporation from time to time without further shareholder approval. The Board of Directors

believes it is desirable to have the additional shares of Class A Common Stock available for

possible future financing and acquisition transactions, and other general corporate purposes. The

Board of Directors also believes that having such additional authorized shares available for

issuance in the future will give the Corporation greater flexibility and may allow such shares to

be issued without the expense and delay of a special shareholder's meeting. The Corporation

does not presently have any agreement, understanding, arrangement or plans that would result in

the issuance of any of the additional shares of Class A Common Stock to be authorized, except

pursuant to the Distribution. Unissued shares of Class A Common Stock could be issued in

circumstances that would serve to preserve control of the Corporation's then existing

management.

Certain Potential Disadvantages of the Proposal

While the Board of Directors has determined that implementation of the Proposal is in the best

interests of the Corporation and its shareholders, the Board recognizes that implementation of the

Proposal may result in certain disadvantages, including the following.

Anti-Takeover Effect. Under the present circumstances the Carver Family has the ability to

approve or disapprove any acquisition of the Corporation in a transaction involving a merger,

consolidation or sale of assets because of the voting power of the shares held by them. Virtually

all corporate acquisitions take one of these three forms except acquisitions in the form of a tender

offer to buy shares from the shareholders directly, a transaction that would not be likely in the

case of the Corporation because, unless the members of the Carver Family tender their shares,

the acquiror could not obtain voting control through a tender offer. The Amendment and the

Distribution will not change the fact that the Carver Family has sufficient voting power to

disapprove a merger, consolidation or sale of assets of the Corporation, nor will the Proposal

immediately give the Carver Family any greater voting control. However, by allowing the

Corporation to issue a substantial number of shares of Class A Common Stock without causing a

loss of the special voting rights of the holders of the Class B Common Stock and by enabling the

holders of the Class B Common Stock to dispose of up to one-half of their investment in the

Corporation without affecting their voting power, the Amendment and the Distribution may

continue to make the Corporation a less attractive target for a takeover bid than it otherwise may

have been, or continue to render more difficult or discourage a merger proposal, an unfriendly

tender offer, a proxy contest or the removal of incumbent directors or management, even if such

actions were favored by the shareholders of the Corporation other than the Carver Family.

Although the Board of Directors considers it to be in the best interests of all of the shareholders

to put the Corporation in a position where it can issue equity securities without making itself

more vulnerable to hostile takeovers, the impeding of hostile takeovers could mean that

shareholders will lose a chance to sell their shares at a premium over prevailing market prices

since hostile takeovers frequently involve the purchase of stock directly from shareholders at a

premium price. While the Board believes that this may be true, it also believes that the

advantages of the Amendment and the Distribution significantly outweigh this disadvantage. See

"Recommendation of the Board of Directors;" “Reasons for the Proposal." Making the

Corporation less vulnerable to a hostile takeover also means that any proposed acquisition of the

Corporation would have to be negotiated with its management, and this process could result in

receipt of an even greater premium. The Corporation is not aware of any existing or planned

effort on the part of any party to attempt an acquisition of the Corporation. The Corporation has

no present intention of seeking any such transaction.

Delay of Automatic Conversion Provisions. Under the terms of the current Restated Articles of

Incorporation, the Class B Common Stock will automatically convert to Common Stock and

thereby lose its special voting rights upon the occurrence of certain events. The Restated Articles

of Incorporation provide that the outstanding shares of Class B Common Stock shall

immediately and automatically convert into shares of Common Stock in the event (i) the number

of issued and outstanding shares of Class B Common Stock is less than 2% of the aggregate

number of shares of Common Stock and Class B Common Stock then outstanding; 00 the

number of shares of Common Stock and Class B Common Stock owned by the Carver Family

falls below 20% of the aggregate number of shares of Common Stock and Class B Common

Stock then issued and outstanding; or (iii) on January 15, 2002 (provided, however, the Board of

Directors may extend the existence of the Class B Common Stock for an additional period of 5

years thereafter). Significant issuances of Common Stock for acquisitions or other purposes, or

the voluntary conversion of a significant amount of Class B Common Stock by members of the

Carver Family, could result in the triggering of these automatic conversion provisions and

thereby would result in the loss of the special voting rights provided to holders of Class B

Common Stock. In such event holders of the Common Stock would have a much greater voice in

the election of directors and on other matters subject to a vote of shareholders. The Amendment

and Distribution will make it less likely that the Class B Common Stock held by members of the

Carver Family will be converted voluntarily and will delay the triggering of the foregoing

automatic conversion provisions. As a result, it will be more likely that the members of the

Carver Family will, through their ownership of Class B Common Stock, retain their special

voting rights. The Board believes that the retention of the special voting rights by members of

the Carver Family is in the best interests of the Corporation and its shareholders because the

special voting rights facilitate the maintenance of the Corporation's independence. The Board

believes this independence is necessary to permit the Corporation to be managed based on long-

term objectives which will assist in the retention of the loyalty of its dealer network which the

Board of Directors believes is crucial to the growth and financial success of the Corporation. See

"Reasons for the Proposal - Continuity;” "Reasons for the Proposal - Business Relationships."State Statutes. Some state securities statutes contain provisions which, following the issuance of

shares of Class A Common Stock, may restrict offerings of equity securities by the Corporation

or the secondary trading of its equity securities in such states. - Because of the availability of

applicable exemptions from such restrictions and because such restrictive provisions would only

apply to offers or sales made in a limited number of states, the Corporation does not believe that

such provisions will materially adversely affect the aggregate amount of equity securities which

the Corporation will be able to offer, the price obtainable for its equity securities in such

offerings or the secondary trading market for its equity securities.Acquisition Accounting. The Class A Common Stock may not be used to effect a business

combination to be accounted for using the "pooling of interests" method. In order for such

method to be used, the Corporation would be required to issue shares of the Class B Common

Stock as the consideration for the combination. However, the Restated Articles of Incorporation

provide that no additional shares of Class B Common Stock may be issued except in connection

with stock dividends on or stock splits of the Class B Common Stock. Thus, under present

accounting rules, the Corporation would not be entitled to use the "pooling of interests' method

while any shares of Class B Common Stock were outstanding.Brokerage Costs. Security for Credit. As is typical in connection with any stock split, brokerage

charges and stock transfer taxes, if any, may be somewhat higher with respect to purchases and

sales of Common Stock after the Distribution, assuming transactions of the same dollar amount,

because of the increased number of shares involved. The Corporation does not expect that the

adoption of the Amendment and the Distribution will affect the ability of holders to use the Class

A Common Stock or Common Stock as security for the extension of credit by financial

institutions or securities brokers or dealers.Investment by Institutions. The holding of non-voting equity securities such as the Class A

Common Stock may not be permitted by the investment policies of certain institutional investors

and therefore the Distribution may cause such shareholders to sell their Class A Common Stock,

as well as cause potential shareholders not to purchase Class A Common Stock after the

Distribution.

Interests of Certain Persons

The Carver Family has an interest in the implementation of the Proposal because, as noted

above, the Proposal may enhance the ability of members of the Carver Family to retain voting

control of the Corporation even if they dispose of a substantial portion of their shares of Class A

Common Stock. See "Reasons for the Proposal;” “Certain Potential Disadvantages of the

Proposal.”

Financial Advisor to the Corporation

The Corporation has retained William Blair & Company ("William Blair") as its financial

advisor in connection with the Proposal. The Corporation has paid William Blair a fee of

$125,000 and will pay an additional $50,000 if the Proposal is approved by the shareholders,

plus reimbursement of out-of-pocket expenses. William Blair, a nationally recognized

investment banking firm, is the Corporation's principal financial advisor and has rendered

investment banking and other services to the Corporation on several occasions.

William Blair has rendered an opinion to the Board of Directors in connection with the

Amendment and the Distribution providing, generally, that the adoption of the Amendment and

the implementation of the Distribution will not have a material adverse effect upon (i) the market

liquidity for the Common Stock or Class A Common Stock, 00 the ability of investors to buy and

sell Common Stock and Class A Common Stock, or (iii) the ability of the Corporation to raise

capital through an offering or offerings of Class A Common Stock. It is also William Blair's

opinion that immediately after the announcement and implementation of the Distribution, the

total market value of the Common Stock, Class A Common Stock and Class B Common Stock

will not be materially different, than the total market value of the Common Stock and Class B

Common Stock immediately prior to the announcement and implementation of the Distribution.

The opinion of William Blair is set out in full in Exhibit B to this Proxy Statement. The

Corporation has agreed to indemnify William Blair against certain liabilities arising out of its

services in connection with the Proposal, except from claims based on its negligence, bad faith or

willful misconduct.

Expenses

The costs of proceeding with the Proposal (such as transfer agent's fees, printing, engraving and

mailing costs, legal fees, investment banking fees, solicitation fees and NYSE fees) will be

charged against the Corporation's pre-tax earnings. The approximate cost of proceeding with the

Proposal is estimated to be $300,000, inclusive of fees of financial and legal advisors.

THE BOARD OF DIRECTORS STRONGLY BELIEVES THAT THE AMENDMENT IS IN

THE BEST INTERESTS OF THE CORPORATION AND ITS SHAREHOLDERS AND

THEREFORE UNANIMOUSLY RECOMMENDS THAT THE CORPORATION'S

SHAREHOLDERS VOTE FOR THE ADOPTION OF THE AMENDMENT.

EXHIBIT A

PROPOSED ARTICLE IV OF THE

RESTATED ARTICLES OF INCORPORATION OF

BANDAG, INCORPORATED

Proposed additions to the Corporation's current Article IV have been underlined and proposed

deletions have been indicated by overstriking.

IV. The total number of shares of all classes of stock which the Corporation shall

have

authority to issue is 30,000,000 80,000.000 shares of common stock having a par value of one

dollar ($1.00) per share consisting of 21,500,000 shares of a class designated "Common Stock"

and , 8,500,000 shares of a class designated "Class B Common Stock", all shares of the

Corporation issued and outstanding immediately prior to the adoption of these Restate Articles of

Incorporation and all shares of the Corporation constituting treasury shares immediately prior to

the adoption of these Restated Articles of Incorporation shall be designated as Common Stock

and 50,000,000 shares of a class designated “Class A Common Stock".

Any and all such shares of Common Stock and Class A Common Stock constituting authorized

but unissued shares may be issued for such consideration, not less than the par value thereof, as

shall be fixed from time to time by the Board of Directors. The powers, preferences, limitations

and relative rights of the Common Stock and, the Class B Common Stock and the Class A

Common Stock shall be as follows:

1. Voting. Except as may otherwise be required by law or except as may be expressly

provided for herein, with respect to all matters upon which shareholders are entitled to vote or to

which shareholders are entitled to give consent, the holders of the outstanding shares of Class A

Common Stock shall have no voting rights and shall not vote, the holders of the outstanding

shares of Common Stock and the holders of the outstanding shares of Class B Common Stock

shall vote together as a single class, and every holder of an outstanding share of Common Stock

shall be entitled to cast thereon one (1) vote in person or by proxy for each share of Common

Stock standing in his name on the stock transfer records of the Corporation, and every holder of

an outstanding share of Class B Common Stock shall be entitled to cast thereon ten (10) votes in

person or by proxy for each share of Class B Common Stock standing in his name on the stock

transfer records of the Corporation.

2. Dividends and Distributions .

(a) Dividends . Holders of Common Stock and, Class B Common Stock and Class A Common

Stock shall be entitled to share ratably in all such dividends, payable in cash or otherwise, as may

be declared thereon by the Board of Directors from time to time out of assets or funds of the

Corporation legally available therefore except that the Board of Directors shall have

discretionary authority to declare greater cash dividends on the shares of Class A Common

Stock, and except that in the case of dividends or other distributions payable in stock of the

Corporation, including distributions pursuant to stock split-ups or divisions, which occur after

the initial distribution of the Class B Common Stock to holders of Common Stock and the initial

distribution of the Class A Common Stock to holders of Common Stock and Class B Common

Stock, only shares of Class A Common Stock shall be distributed with respect to the Class A

Common Stock, only shares of Common Stock or CIM A Common Stock shall be distributed

with respect to the Common Stock, and only shares of Class B Common Stock or Class A

Common Stock shall be distributed with respect to the Class B Common Stock.(b) Distributions . In the event the Corporation shall be liquidated (either partial or complete),

dissolved or wound up, whether voluntarily or involuntarily, the holders of the Common Stock

and, the Class B Common Stock and the Class A Common Stock shall be entitled to share

ratably, as a single class, in the remaining net assets of the Corporation; that is, an equal amount

of net assets for each share of Common Stock and, Class B Common Stock and Class A

Common Stock.

3. Restrictions on Transfer of the Class B Common Stock.

(a) No beneficial owner (as hereinafter defined) of shares of Class 13 Common Stock

(hereinafter referred to as a 'Class B Shareholder') may transfer, and the Corporation shall not

register the transfer of, shares of Class B Common Stock of such Class B Shareholder, whether

by sale, assignment, gift, bequest, appointment or otherwise, except to a Permitted Transferee of

such Class B Shareholder. A "Permitted Transferee" shall be defined as (i) the Class B

Shareholder; 60 the spouse of the Class B Shareholder; (iii) any parent and any lineal descendant

(including any adopted child) of any parent of the Class B Shareholder or of the Class B

Shareholder's spouse; (iv) any trustee, guardian or custodian for, or any executor, administrator

or other legal representative of the estate of, any of the foregoing Permitted Transferees; (v) the

trustee of a trust (including a voting trust) principally for the benefit of such Class B Shareholder

and/or any of his or her Permitted Transferees; and (vi) any corporation, partnership or other

entity if a majority of the beneficial ownership thereof is held by the Class B Shareholder and/or

any of his or her Permitted Transferees. If a Class B Shareholder and all of his or her Permitted

Transferees cease, for whatever reason, to hold a majority of the beneficial ownership of any

corporation, partnership or other entity specified in clause NO above, then any and all shares of

Class B Common Stock held by such corporation, partnership or other entity shall automatically,

without further deed or action by or on behalf of any party, be deemed to have been transferred

to other than a Permitted Transferee with the result that such shares shall be deemed to have been

converted into a like number of shares of Common Stock.

(b) Notwithstanding anything to the contrary set forth herein, any Class B Shareholder may

pledge his shares of Class B Common Stock to a pledgee pursuant to a bona fide pledge of such

shares as collateral security for indebtedness due to the pledgee, provided that such shares shall

not be transferred to or registered in the name of the pledgee and shall remain subject to the

provisions of this Paragraph 3. In the event of foreclosure, realization or other similar action by

the pledgee, such pledged shares of Class B Common Stock may only be transferred to a

Permitted Transferee of the pledgor or converted into shares of Common Stock, as the pledgee

may elect. (c) Any purported transfer of shares of Class B Common Stock not permitted hereunder shall

be void and of no effect. Any purported transferee of shares of Class B Common Stock purported

to be transferred in violation of this Paragraph 3 shall have no rights as a shareholder of the

Corporation and no other rights against, or with respect to, the Corporation, except the right to

receive shares of Common Stock upon the conversion of his or her shares of Class B Common

Stock into shares of Common Stock. The Corporation and its transfer agent may, as a condition

to the transfer or the registration of a transfer of shares of Class B Common Stock to a purported

Permitted Transferee, require the furnishing of such affidavits or other proof as they deem

necessary to establish that such transferee is a Permitted Transferee.

(d) The Corporation shall note on the certificates for shares of Class B Common Stock the

restrictions on transfer and registration of transfer imposed by this Paragraph 3.

(e) Shares of Class B Common Stock shall be registered in the name(s) of the beneficial owner(s)

thereof (as herein defined) and not in “street" or “nominee" names; provided, however,

certificates representing shares of Class B Common Stock issued in the initial distribution

thereof to holders of the issued and outstanding Common Stock may be registered in the same

name and manner as the certificates representing the shares of Common Stock with respect to

which the shares of Class B Common Stock are issued. Any shares of Class B Common Stock

registered in "street" or 'nominee" name may be transferred to the beneficial owner of such

shares on the record date for such initial distribution, upon proof satisfactory to the Corporation

and the Transfer Agent that such person was in fact the beneficial owner of such shares on such

record date.

(f) For the purpose of this Paragraph 3 the term 'beneficial owner(s)" of any shares of Class

B Common Stock shall mean a person or persons who, or entity or entities which, have or share

the power, either singly or jointly, to direct the voting or disposition of such shares.

4. Conversion of the Class B Common Stock.

(a) Each share of Class B Common Stock may at any time or from time to time, at the option of

the record holder thereof, be converted into one (1) fully paid and nonassessable share of

Common Stock. Such conversion right shall be exercised by the surrender of the certificate

representing such share of Class B Common Stock to be converted to the Corporation at any time

during normal business hours at the principal executive offices of the Corporation (to the

attention of the Secretary of the Corporation), or if an agent for the registration or transfer of

shares of Class B Common Stock is then duly appointed and acting (said agent being referred to

in this Article IV as the "Transfer Agent"), then at the office of the Transfer Agent, accompanied

by a written notice of the election by the holder thereof to convert and (if so required by the

Corporation or the Transfer Agent) by instruments of transfer, in form satisfactory to the

Corporation and to the Transfer Agent, duly executed by such holder or his duly authorized

attorney, and transfer tax stamps or funds therefor, if required pursuant to Paragraph 4(e) below.

(b) As promptly as practicable after the surrender for conversion of a certificate representing

shares of Class B Common Stock in the manner provided in Paragraph 4(a) above, and the

payment in cash of any amount required by the provisions of Paragraph 4(e), the Corporation

will deliver or cause to be delivered at the office of the Transfer Agent to, or upon the written

order of, the holder of such certificate, a certificate or certificates representing the number of full

shares of Common Stock issuable upon such conversion, issued in such name or names as such

holder may direct. Such conversion shall be deemed to have been made immediately prior to the

close of business on the date of the surrender of the certificate representing shares of Class B

Common Stock, and all rights of the holder of such shares as such holder shall cease at such time

and the person or persons in whose name or names the certificate or certificates representing the

shares of Common Stock are to be issued shall be treated for all purposes as having become the

record holder or holders of such shares of Common Stock at such time; provided, however, that

in the event any such surrender and payment are made on any date when the stock transfer

records of the Corporation shall be closed, the person or persons in whose name or names the

certificate or certificates representing shares of Common Stock are to be issued will become the

record holder or holders thereof for all purposes immediately prior to the close of business on the

next succeeding day on which such stock transfer records are open.

(c) No adjustments in respect of dividends or other distributions shall be made upon the

conversion of any share of Class B Common Stock; provided, however, that if a share shall be

converted subsequent to the record date for the payment of a dividend or other distribution on

shares of Class B Common Stock but prior to such payment, the registered holder of such share

at the close of business on such record date shall be entitled to receive the dividend or other

distribution payable on such share on the date set for payment of such dividend or other

distribution notwithstanding the conversion thereof or the Corporation's default in payment of

the dividend or distribution due on such date.

(d) The Corporation covenants that it will at all times reserve and keep available, solely for the

purpose of issuance upon conversion of the outstanding shares of Class B Common Stock, such

number of shares of Common Stock as shall be issuable upon the conversion of all such

outstanding shares; provided, that nothing contained herein shall be construed to preclude the

Corporation from satisfying its obligations in respect of the conversion of the outstanding shares

of Class B Common Stock by delivery of purchased shares of Common Stock which are held in

the treasury of the Corporation. The Corporation covenants that if any shares of Common Stock

required to be reserved for purposes of conversion hereunder require registration with or

approval of any governmental authority under any federal or state law before such shares of

Common Stock may be issued upon conversion, the Corporation will cause such shares to be

duly registered or approved, as the case may be. The Corporation will endeavor to list the shares

of Common Stock required to be delivered upon conversion prior to such delivery upon each

national securities exchange, if any, upon which the outstanding Common Stock is listed at the

time of such delivery. The Corporation covenants that all shares of Common Stock which shall

be issued upon conversion of the shares of Class B Common Stock will, upon issue, be fully paid

and nonassessable and not subject to any preemptive rights.

(e) The issuance of certificates for shares of Common Stock upon conversion of shares of Class

B Common Stock shall be made without charge for any stamp or other similar tax in respect of

such issuance. However, if any such certificate is to be issued in a name other than that of the

record holder of the share or