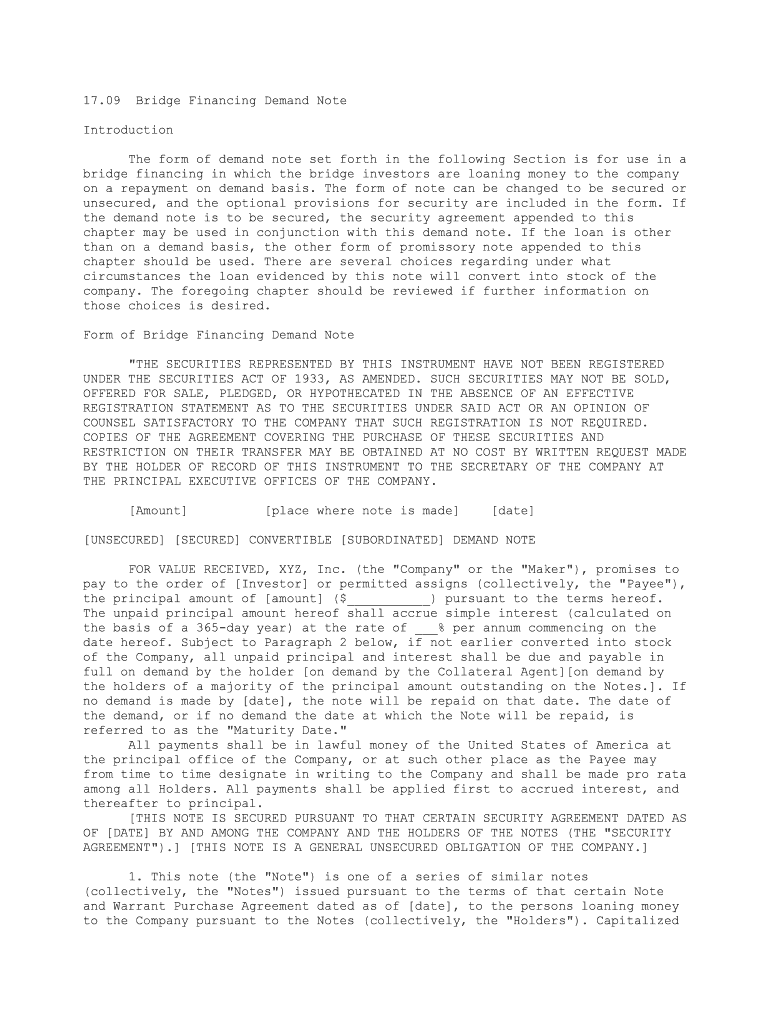

17.09 Bridge Financing Demand Note

IntroductionThe form of demand note set forth in the following Section is for use in a

bridge financing in which the bridge investors are loaning money to the company

on a repayment on demand basis. The form of note can be changed to be secured or

unsecured, and the optional provisions for security are included in the form. If

the demand note is to be secured, the security agreement appended to this

chapter may be used in conjunction with this demand note. If the loan is other

than on a demand basis, the other form of promissory note appended to this

chapter should be used. There are several choices regarding under what

circumstances the loan evidenced by this note will convert into stock of the

company. The foregoing chapter should be reviewed if further information on

those choices is desired.

Form of Bridge Financing Demand Note

"THE SECURITIES REPRESENTED BY THIS INSTRUMENT HAVE NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933, AS AMENDED. SUCH SECURITIES MAY NOT BE SOLD,

OFFERED FOR SALE, PLEDGED, OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE

REGISTRATION STATEMENT AS TO THE SECURITIES UNDER SAID ACT OR AN OPINION OF

COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

COPIES OF THE AGREEMENT COVERING THE PURCHASE OF THESE SECURITIES AND

RESTRICTION ON THEIR TRANSFER MAY BE OBTAINED AT NO COST BY WRITTEN REQUEST MADE

BY THE HOLDER OF RECORD OF THIS INSTRUMENT TO THE SECRETARY OF THE COMPANY AT

THE PRINCIPAL EXECUTIVE OFFICES OF THE COMPANY.

[Amount] [place where note is made] [date]

[UNSECURED] [SECURED] CONVERTIBLE [SUBORDINATED] DEMAND NOTE

FOR VALUE RECEIVED, XYZ, Inc. (the "Company" or the "Maker"), promises to

pay to the order of [Investor] or permitted assigns (collectively, the "Payee"),

the principal amount of [amount] ($___________) pursuant to the terms hereof.

The unpaid principal amount hereof shall accrue simple interest (calculated on

the basis of a 365-day year) at the rate of ___% per annum commencing on the

date hereof. Subject to Paragraph 2 below, if not earlier converted into stock

of the Company, all unpaid principal and interest shall be due and payable in

full on demand by the holder [on demand by the Collateral Agent][on demand by

the holders of a majority of the principal amount outstanding on the Notes.]. If

no demand is made by [date], the note will be repaid on that date. The date of

the demand, or if no demand the date at which the Note will be repaid, is

referred to as the "Maturity Date."

All payments shall be in lawful money of the United States of America at

the principal office of the Company, or at such other place as the Payee may

from time to time designate in writing to the Company and shall be made pro rata

among all Holders. All payments shall be applied first to accrued interest, and

thereafter to principal.

[THIS NOTE IS SECURED PURSUANT TO THAT CERTAIN SECURITY AGREEMENT DATED AS

OF [DATE] BY AND AMONG THE COMPANY AND THE HOLDERS OF THE NOTES (THE "SECURITY

AGREEMENT").] [THIS NOTE IS A GENERAL UNSECURED OBLIGATION OF THE COMPANY.]

1. This note (the "Note") is one of a series of similar notes

(collectively, the "Notes") issued pursuant to the terms of that certain Note

and Warrant Purchase Agreement dated as of [date], to the persons loaning money

to the Company pursuant to the Notes (collectively, the "Holders"). Capitalized

terms not defined herein shall have the meanings set forth in the Purchase

Agreement.2. In the event the Maker consummates an equity financing after the date

of this Note but on or prior to the Maturity Date resulting in gross aggregate

proceeds to the Company of at least [amount] (excluding the principal and

interest of any Notes that, by operation of this Note, are converted in such

transaction) (a "Next Equity Financing"), the principal amount of the Note [and

all accrued interest] on the Note will convert automatically into fully paid and

nonassessable shares of the Company's capital stock (the "New Stock") sold in

such financing, at the per share price in such Next Equity Financing

("Conversion Price"). The number of shares of New Stock to be issued upon such

automatic conversion shall be equal to the quotient obtained by dividing (x) the

unpaid principal amount of this Note [and all accrued interest on the Note] by

(y) the price per share of New Stock issued in the Next Equity Financing. Any

New Stock to be issued to the Holder shall have the same rights, preferences and

privileges as those applicable to shares issued in the Next Equity Financing.

The Holder hereof acknowledges that he or she will be required to execute and

deliver the documents required of the investors in the Next Equity Financing.

3. All covenants, agreements and undertakings in this Note by or on behalf

of any of the parties shall bind and inure to the benefit of the respective

successors and assigns of the parties whether so expressed or not.

4. The Maker may [not] prepay any part of this Note [without the prior

written consent of the Payee] [provided that prepayment of any Notes issued

pursuant to the Purchase Agreement shall be credited to the Notes issued to a

particular investor in the order of the issuance of such Notes starting with the

earliest Notes issued.] [except in the event (i) of an acquisition, merger or

similar transaction in which the shareholders of the Company immediately prior

to such transaction own less than 50% of the voting power of the Company's

shares after such transaction or (ii) a sale or transfer of all or substantially

all of the Company's assets. The events described in subsections 4(i) and 4(ii)

are defined as a "Liquidity Event". The Company's right to prepay this Note

shall be expressly conditioned on the Company providing Payee at least twenty

(20) days advance written notice of the Liquidity Event, but no more than thirty

(30) days advance written notice describing the terms of the Liquidity Event in

detail, including an analysis of the projected distribution to the Company's

shareholders.]

[Any failure to pay this Note [the Notes] upon demand or at the Maturity

Date, or any initiation either voluntarily or involuntarily of any bankruptcy or

insolvency proceeding shall be deemed an "Event of Default" under the Security

Agreement.]

5. The Maker waives presentment for payment, demand, protest and notice of

protest for nonpayment of this Note, and consents to any extension or

postponement of the time of payment or any other indulgence. [This Note may be

amended by agreement of the Payee and the Maker, or may be amended by agreement

of the Maker and a majority-in-interest of the Holders, [or by the Collateral

Agent acting on behalf of the holders of the Notes] provided all Notes are

treated equally by such amendment.] Any amendment or waiver of any term of this

Note shall be conducted pursuant to the terms of the Purchase Agreement.

6. In the event that Payee brings a legal action against the Maker, or the

Maker brings a legal action against Payee, to enforce or otherwise determine the

meaning or enforceability of this Note or any provision hereof, the party

prevailing in such action shall recover from the opposing party all reasonable

expenses, including attorneys' fees, directly attributable to such action.7. In no event shall any officer or director of the Company be liable for

any amounts due and payable pursuant to this Note.

8. This Note shall be governed in all respects by the internal laws of the

State of _______________. Any and all disputes arising out of or related to this

Note shall be adjudicated exclusively in the state and federal courts located in

[county] [state].

9. [This Note shall be senior in all respects (including right of payment)

to all other indebtedness of the Company, now existing or hereafter incurred.]

The indebtedness evidenced by this Note is hereby expressly subordinated, to the

extent and in the manner hereinafter set forth, in right of payment to the prior

payment in full of all the Company's Senior Indebtedness, as hereinafter

defined. "Senior Indebtedness" shall mean the principal of (and premium, if any)

and unpaid interest on, or other payment obligation with respect to all

indebtedness of the Company to commercial banks or equipment leasing companies

for money borrowed by the Company whether or not secured, and whether incurred

previously or incurred after the date the Notes are made. Any and all claims

arising under this Note are and shall be at all times subject and subordinate to

the Senior Indebtedness, and any interest thereon.] [If requested by the

Company, the holder hereof will execute and deliver any necessary documents to

assure any lender or prospective lender of Senior Indebtedness of the

subordination agreed to by the holder hereof.]

10. Payee has the option to convert the principal and any unpaid interest

on this Note into [class/series of Stock] at [$____] per share (as adjusted for

stock splits and the like) if (i) no Next Equity Financing occurs, or will

occur, by the Maturity Date, [(ii) immediately prior to a Liquidity Event, or

(iii) upon the closing of an IPO.]

11. The Company hereby agrees, subject only to any limitation imposed by

applicable law, to pay all expenses, including reasonable attorneys' fees and

legal expenses, incurred by the holder of this Note ("Costs") in endeavoring to

collect any amounts payable hereunder which are not paid when due, whether by

declaration or otherwise. The Company agrees that any delay on the part of the

holder in exercising any rights hereunder will not operate as a waiver of such

rights. The holder of this Note shall not by any act, delay, omission or

otherwise be deemed to have waived any of its rights or remedies, and no waiver

of any kind shall be valid unless in writing and signed by the party or parties

waiving such rights or remedies.

IN WITNESS WHEREOF, this Note has been executed and delivered on the date

specified by the Maker and the Payee.

XYZ, INC. ("MAKER")

By: ________________________________

Title: ________________________________

[INVESTOR]

________________________________

Name:

Valuable advice on finalizing your ‘Tennessee Statewide Multimodal Freight Plan Tngov’ online

Are you exhausted by the burden of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature service for individuals and small to medium-sized businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can easily fill out and sign paperwork online. Take advantage of the comprehensive tools embedded in this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to authorize forms or gather signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Tennessee Statewide Multimodal Freight Plan Tngov’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Tennessee Statewide Multimodal Freight Plan Tngov or send it for notarization—our solution has everything you require to accomplish such tasks. Sign up with airSlate SignNow today and take your document management to new levels!