LIMITED LIABILITY COMPANY DISSOLUTION PACKET:STATE OF TEXAS Electronic Version

STATUTORY REFERENCE

Texas Statutes: Business Organization Code; Title 1, Chapter 11 & Title 3, Chapter 101, Subchapter L

http://www.statutes.legis.state.tx.us/Index.aspx

INTRODUCTORY NOTES

A Texas limited liability company (LLC) is dissolved and it must wind up its business affairs

upon the happening of the first to occur of the following: 1. the period fixed for the duration of the LLC expires;

2. the occurrence of events specified in the articles of organization or in the regula tions to

cause dissolution;

3. the action of the members to dissolve the LLC;

4. if no capital has been paid into the LLC, the act of a majority of the m anagers or

members named in the articles of organization to dissolve the limited liability company;

5. except as otherwise provided upon the death, expulsion, withdrawal pursuant to or as

provided in the articles of organization or regulations, bankruptcy, or dissolution of a

member or the occurrence of any other event which terminates the continued membershi p

of a member in the LLC; or

6. entry of a decree of judicial dissolution under Section 6.02 of this Act.

NOTE: this form packet addresses only voluntary dissolution.

A LLC is not upon the happening of an event of dissolution if there is at least one remaining

member, and the business of the LLC is continued by the vote of that/those members as stated in

the articles of organization or regulations of the LLC, or if not so stated, by all re maining

members.

Unless otherwise provided in the articles of organization or in the regulations, an elect ion to

continue the business of the LLC must be made within 90 days after the date of the oc currence of

the event of dissolution. If an election to continue the business of the LLC is so made , the

election is not effective unless an appropriate amendment extending the period fixed for the

duration of the LLC or deleting the event specified in the articles of organiza tion that caused the

dissolution is made by the LLC to its articles of organization during the three-year period

following the date of the event of dissolution.

When the LLC is dissolved, the affairs of the business must be wound up as soon as reasonably

practicable. The winding up is accomplished by the managers or members or by any other pe rson

or persons designated by the articles of organization, by the regulations, or by resolution of the

managers or members. (A court of competent jurisdiction, on cause shown, may wind up the

LLC's affairs on application of any member or the member's legal representative or assignee and

may appoint a person to carry out the liquidation and may make all other orders, directions, and

inquiries that the circumstances require.)

When the LLC is dissolved, and BEFORE it files Articles of Dissolution, the LLC 1. must cease to carry on its business except as may be necessary for the winding up process.

2. must send a written notice by registered or certified mail of the intent of the LLC to

dissolve to each known creditor of and claimant against the LLC.

3. must collect its assets, convey and dispose of such of its properties as are not to be distributed in kind to its members, pay, satisfy or discharge its liabilities and

obligations,(or make adequate provisions for payment and discharge of those liabilities

and obligations), and

4. must do all other acts required to liquidate its business and affairs.

In the event that the assets of the LLC are not sufficient to satisfy or discharge all the LLC's

liabilities and obligations, the LLC must apply those assets so far as they will go to the just and

equitable payment of the liabilities and obligations.

After paying or discharging all of its obligations, or making adequate provisions for payment and

discharge of those obligations, the LLC must then distribute the remainder of its asset s, either in

cash or in kind, among its members according to their respective rights and interest.

On the winding up of a LLC, the assets must be paid or transferred as follows: 1. otherwise provided by the articles of organization or regulations, to members its members according to the extent otherwise permitted by law, to creditors, including members who

are creditors in satisfaction of liabilities (other than for distributions) of the LLC , whether

by payment or by establishment of reserves;

2. unless otherwise provided by the articles of organization or regulations, to members and former members in satisfaction of the company's liability for distributions; and

3. Unless to their respective rights and interest.

When all liabilities and obligations of the LLC have been paid or discharged (or ade quate

provision has been made for those liabilities and obligations) and all of the remaining property

and assets of the LLC have been distributed to its members according to their re spective rights

and interest, articles of dissolution are filed by a manager or authorized member, or i n the case of

a dissolution by action of the organizer of the LLC, by the organizer. In the event the L LC

property and assets are not sufficient to satisfy and discharge all the LLC's liabil ities and

obligations and all the property and assets have been applied so far as they will go t o the just and

equitable payment of the LLC's liabilities and obligations, articles of dissoluti on are filed at that

time.

If the LLC has elected to dissolve by action of its members, a copy of the resoluti on to dissolve,

together with a statement that the resolution was adopted in accordance with Sec tion D, Article

2.23, of this the Limited Liability Company Act.

When the articles of dissolution filed, there must be filed with them a certificate (#05-305 or

#05-329) from the Comptroller of Public Accounts that all franchise taxes have been paid and

that the company is in good standing for the purpose of dissolution.

Requests for certificates or questions on tax status should be directed to: Tax Assistance Section

Comptroller of Public Accounts

Austin, Texas 78774-0100 (512) 463-4600 (800) 252-138

(TDD) (800) 248-4099.

Remember that a tax year ends on December 31st. The company must be in good standing

through the date of receipt of the articles of dissolution by the secretary of state. A post mark

date will not be considered as the date of receipt. The Secretary of State suggest s that companies

attempting to dissolve prior to the end of the franchise tax year, make their submissions we ll in

advance of the tax deadline.

Limited liability companies not dissolved on or before December 31st will be subject to the new

franchise tax year's requirements as of January 1st.

STEPS AND GUIDELINES TO DISSOLVE A TEXAS LIMITED LIABILITY COMPANY

Step 1: SEE FORM 1 - RESOLUTION OF MEMBERS CONSENTING TO

DISSOLUTION

Or, if no capital has been paid into the LLC

SEE FORM 2 - RESOLUTION OF INITIAL MANAGERS OR MEMBERS

Step 2: Complete the winding up process as set out above in the Introductory Notes. SEE FORM 3 - NOTICE TO CREDITORS

Step 3: SEE FORM 4 - ARTICLES OF DISSOLUTION

Download the form in the format of your choice from the download links below.

Follow the instructions on the form.

A cover letter to send with the Certificate of Cancellation is included.

SEE FORM A - TRANSMITTAL LETTER

* * *

Disclaimer: If you are not an attorney, you are advised to seek the advice of an

attorney for all serious legal matters. The information and forms contained

herein are not legal advice and are not to be construed as such. Although the

information contained herein is believed to be correct, no warranty of fitness

or any other warranty shall apply. All use is subject to the U.S. Legal Forms,

Inc. Disclaimer and License located at

http://www.uslegalforms.com/disclaimer.htm

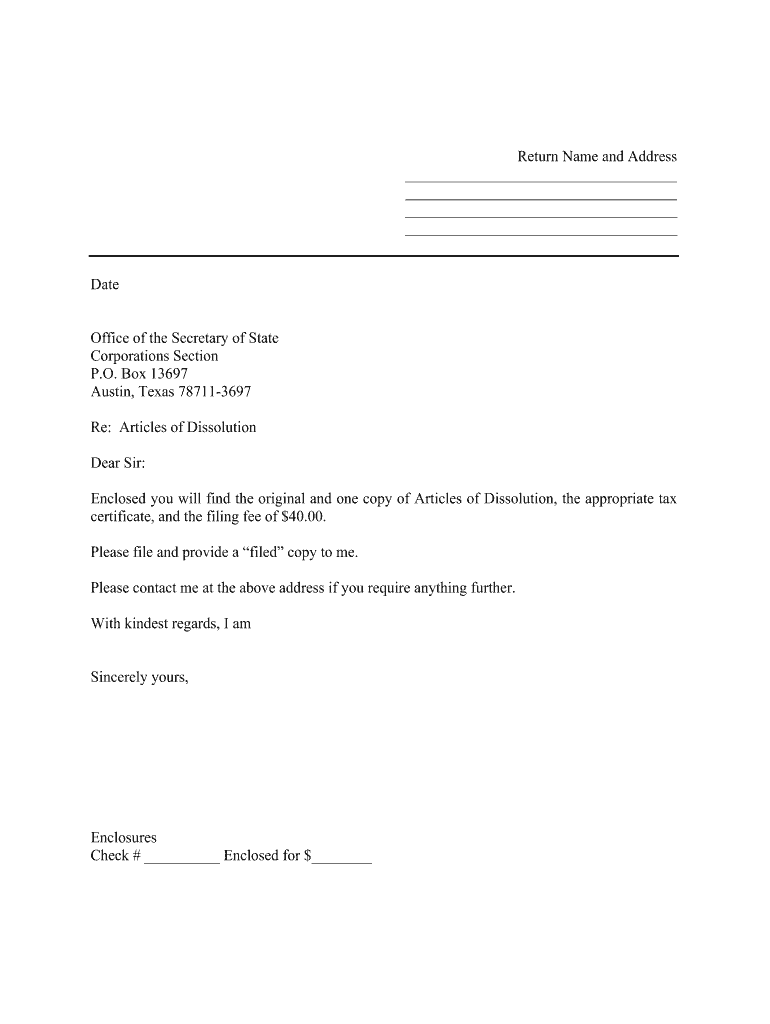

FORM A

TRANSMITTAL LETTER

Return Name and Address

____________________________________ ____________________________________ ____________________________________ ____________________________________

Date

Office of the Secretary of State

Corporations Section

P.O. Box 13697

Austin, Texas 78711-3697

Re: Articles of Dissolution

Dear Sir:

Enclosed you will find the original and one copy of Articles of Dissolution, the appropriate t ax

certificate, and the filing fee of $40.00.

Please file and provide a “filed” copy to me.

Please contact me at the above address if you require anything further.

With kindest regards, I am

Sincerely yours,

Enclosures

Check # __________ Enclosed for $________

FORM 1

RESOLUTION OF MEMBERS

CONSENTING TO DISSOLUTION

RESOLUTION OF MEMBERS OF

________________________________________

A TEXAS LIMITED LIABILITY COMPANY

The undersigned, being all the members of _______________________________________, a

Texas limited liability company, hereby resolve to dissolve and consent to the di ssolution of the

limited liability company.

Dated this the ______ day of ______________________________, 20___. ____________________________________

Member ____________________________________

Member ____________________________________

Member

FORM 2

RESOLUTION OF INITIAL

MANAGERS/MEMBERS CONSENTING

TO DISSOLUTION

RESOLUTION OF INITIAL MANAGERS/MEMBERS OF

________________________________________

A TEXAS LIMITED LIABILITY COMPANY

The undersigned, being all the initial managers/members of

_______________________________________, a Texas limited liability company, hereby

resolve to dissolve and consent to the dissolution of the limited liability company.

Dated this the ______ day of ______________________________, 20___. ____________________________________

Manager/Member ____________________________________

Manager/Member ____________________________________

Manager/Member

FORM 3

NOTICE TO CREDITORS

NOTICE OF INTENT TO VOLUNTARILY DISSOLVE A LIMITED LIABILITY COMPANY AND A REQUEST FOR CLAIMS

Notice is given that a resolution to dissolve __________________________________________

________________________________________________________________ (name of LLC),

a Texas limited liability company with its office at ___________________________________________________________________________________________________________________

(address of office), has been filed approved by the members/managers in accordance with the

laws of the State of Texas.

The LLC requests that all Claimants against the company provide written proof of t heir claims to

the corporation at the following address:______________________________________________________________________________ ____________________________________________________________________________________________________________________________________________________________

All claims must be in writing and must contain sufficient information reasonably to inform the

corporation of the identity of the claimant and the substance of the claim.

DATE OF NOTICE: ______________________________

FORM 4

ARTICLES OF DISSOLUTION

Download the form by clicking the link below, or copying the link into the address window of your web browser. Pdf version:

http://www.uslegalforms.com/dissolution/TX/TX-DissLLC.pdf

Microsoft Word Version: http://www.uslegalforms.com/dissolution/TX/TX-DissLLC.doc

The form is in .pdf format and you will need the free Adobe Acrobat Reader to view the form. In the unlikely

circumstance that the Adobe Acrobat Reader is not installed on your computer, you can download it free from

http://www.adobe.com/products/acrobat/readstep2.html . The download is quick and easy.

Fill out this form, and mail it in as directed.

FOLLOW THE INSTRUCTIONS ON THE FORM.

Convenient advice on finalizing your ‘Texas Texas Dissolution Package To Dissolve Limited Liability Company Llc’ online

Are you fed up with the inconvenience of dealing with paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the powerful features included in this intuitive and affordable platform and transform your method of document management. Whether you need to authorize forms or collect signatures, airSlate SignNow takes care of everything efficiently, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or initiate a free trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Texas Texas Dissolution Package To Dissolve Limited Liability Company Llc’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Texas Texas Dissolution Package To Dissolve Limited Liability Company Llc or send it for notarization—our platform offers everything you need to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to new heights!