Fill and Sign the Undersigned of Street Form

Valuable advice on preparing your ‘The Undersigned Of Street’ online

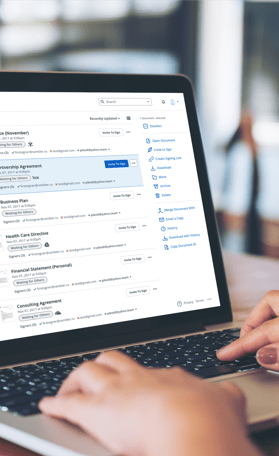

Are you fed up with the burden of dealing with paperwork? Look no farther than airSlate SignNow, the top eSignature solution for individuals and organizations. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and sign paperwork online. Utilize the powerful features integrated into this user-friendly and cost-effective platform and transform your method of paperwork management. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all effortlessly, requiring just a few clicks.

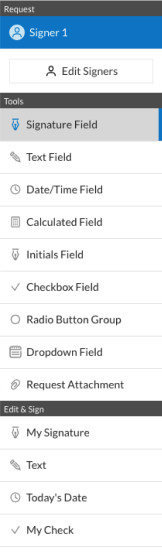

Follow this step-by-step instruction:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our form library.

- Open your ‘The Undersigned Of Street’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite configurations to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your The Undersigned Of Street or send it for notarization—our solution provides everything necessary to achieve such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the undersigned meaning in the context of eSigning?

The undersigned meaning refers to the individual or entity that has signed a document, indicating their agreement or acknowledgment. In eSigning, this term is crucial as it establishes the identity of the signatory, ensuring that the document is legally binding and recognized.

-

How does airSlate SignNow define the undersigned meaning?

At airSlate SignNow, the undersigned meaning is defined as the party who has electronically signed a document. This definition is essential for maintaining the integrity of the signing process and ensuring that all parties understand their commitments.

-

What features does airSlate SignNow offer related to the undersigned meaning?

airSlate SignNow offers features that clarify the undersigned meaning, such as signature verification and audit trails. These features help users confirm the identity of the signers and track the signing process, enhancing security and trust in the documents.

-

Is there a cost associated with understanding the undersigned meaning?

Understanding the undersigned meaning itself is free; however, using airSlate SignNow's services to manage eSignatures comes with a pricing structure. Our plans are designed to be cost-effective, providing businesses with the tools they need to streamline their document signing processes.

-

How can airSlate SignNow benefit my business regarding the undersigned meaning?

By using airSlate SignNow, businesses can ensure that the undersigned meaning is clear and legally recognized in all their documents. This clarity helps prevent disputes and enhances the overall efficiency of document management, allowing for faster transactions and improved customer satisfaction.

-

What integrations does airSlate SignNow offer that relate to the undersigned meaning?

airSlate SignNow integrates with various platforms to enhance the understanding of the undersigned meaning. These integrations allow users to seamlessly incorporate eSigning into their existing workflows, ensuring that all signed documents are easily accessible and properly managed.

-

Can I customize the undersigned meaning in my documents?

Yes, airSlate SignNow allows users to customize documents to reflect the undersigned meaning accurately. You can add specific clauses or definitions that clarify the roles and responsibilities of the signers, ensuring that all parties are on the same page.

The best way to complete and sign your the undersigned of street form

Get more for the undersigned of street form

Find out other the undersigned of street form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles