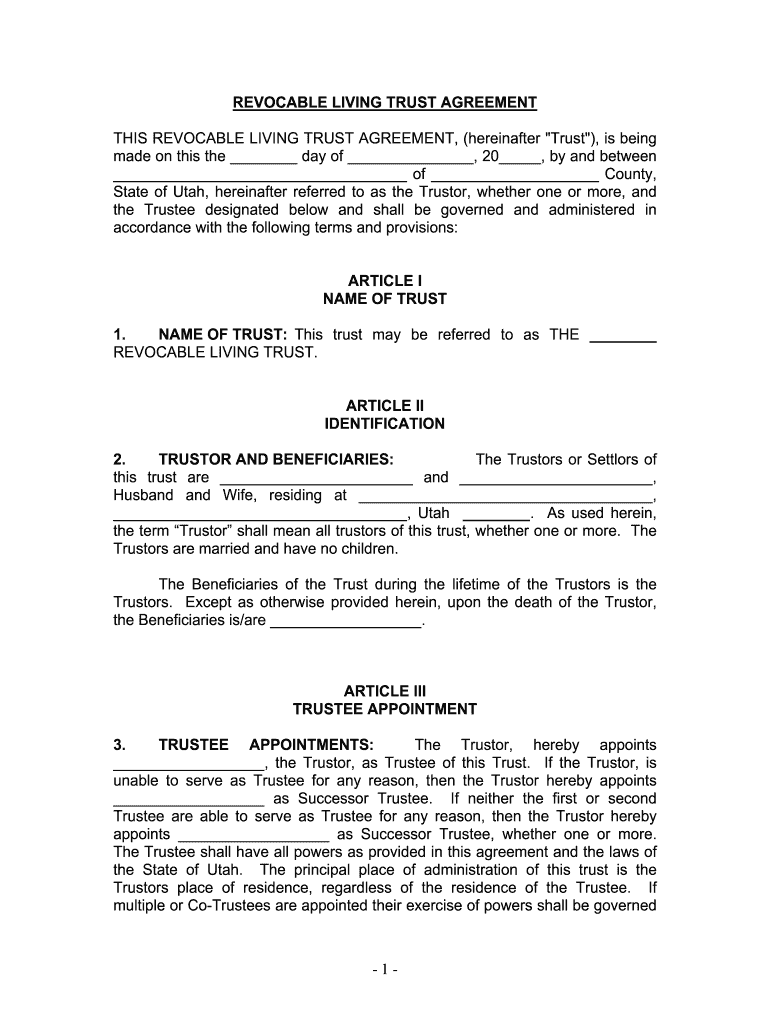

Fill and Sign the Trustor and Beneficiaries Form

Valuable tips for getting your ‘Trustor And Beneficiaries’ ready online

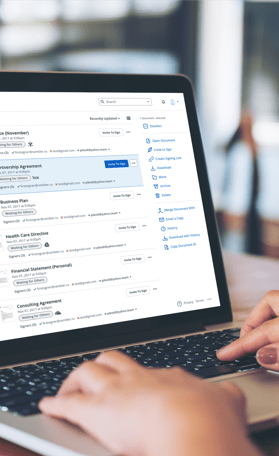

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading e-signature solution for individuals and small to medium-sized businesses. Bid farewell to the laborious routine of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Take advantage of the comprehensive tools included in this intuitive and affordable platform to transform your document management approach. Whether you need to sign forms or collect eSignatures, airSlate SignNow makes it all seamless, all within just a few clicks.

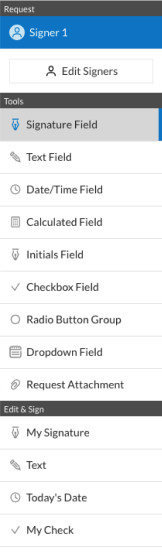

Follow this detailed guide:

- Log into your account or register for a complimentary trial with our service.

- Hit +Create to upload a file from your device, cloud storage, or our template collection.

- Access your ‘Trustor And Beneficiaries’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for additional individuals (if needed).

- Complete the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No concerns if you need to collaborate with your colleagues on your Trustor And Beneficiaries or send it for notarization—our platform offers everything you require to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to a whole new level!

FAQs

-

What is the difference between a trustor and a trustee?

The trustor is the individual who creates the trust and transfers assets into it, while the trustee is the person or entity responsible for managing those assets according to the trust's terms. Understanding the roles of trustor vs trustee is crucial for effective estate planning.

-

How does airSlate SignNow facilitate the trustor vs trustee relationship?

airSlate SignNow provides a seamless platform for trustors and trustees to sign and manage documents electronically. This ensures that all parties can easily access and execute necessary agreements, enhancing communication and efficiency in the trust management process.

-

What features does airSlate SignNow offer for trust documentation?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for trust documentation. These features help clarify the roles of trustor vs trustee and ensure that all legal requirements are met.

-

Is airSlate SignNow cost-effective for managing trusts?

Yes, airSlate SignNow is a cost-effective solution for managing trusts, allowing trustors and trustees to save on traditional paper-based processes. With competitive pricing plans, users can efficiently handle their trust documentation without breaking the bank.

-

Can airSlate SignNow integrate with other tools for trust management?

Absolutely! airSlate SignNow integrates with various tools and platforms, enhancing the trustor vs trustee workflow. This integration capability allows users to streamline their processes and maintain organized records across different applications.

-

What are the benefits of using airSlate SignNow for trust agreements?

Using airSlate SignNow for trust agreements offers numerous benefits, including increased security, faster turnaround times, and improved accessibility. By understanding the trustor vs trustee dynamics, users can leverage these advantages to ensure smooth trust operations.

-

How secure is airSlate SignNow for handling trust documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect trust documents. This is particularly important when dealing with sensitive information related to the trustor vs trustee relationship.

The best way to complete and sign your trustor and beneficiaries form

Get more for trustor and beneficiaries form

Find out other trustor and beneficiaries form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles