mortgage

logistics

by chapelhouse

Mortgage: 1. a conveyance of an interest in

property as security for the repayment of money

borrowed. 2. the deed by which such a

transaction is effected. 3. the rights conferred

by it, or the state of the property conveyed.

Logistics: 1. the management of materials

flow through an organisation. 2. the detailed

planning and organisation of any complex

operation

“We

shape our buildings, and afterwards our buildings shape us.”

Winston Churchill

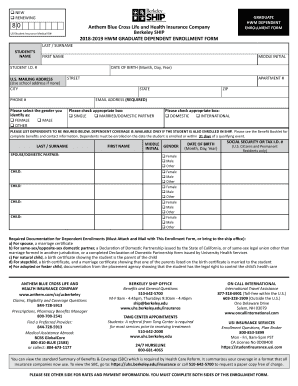

Development finance application

�Mortgage Notes

Please answer all the questions in full using BLOCK CAPITALS or ticking the appropriate box. All answers must be completed. If some questions are not relevant please

enter NOT APPLICABLE. Where this form is not completed by the applicant(s) personally, it is essential that the answers are confirmed as correct by the applicant(s) before

signing. Both first and Second applicants are required to fill in Sections 1

1—

— 8.

3 Personal Details -

Before completing please read the Data Protection Act at the back of this form

First Applicant If more than two applicants please complete a further form

Second Applicant

1. Title Mr/Ms/Other

2. Surname

3. Forenames

4. Maiden / Previous names

5. Professional Qualification

/

6. Date of Birth / Nationality

/

Nationality

/

/

Nationality

7. Relationship to Joint Applicant

Single

Married

Widow/ er

Single

Married

Widow/er

Separated

Divorced

Living together

Separated

Divorced

Living together

8. Marital Status

Male

9. Sex

10. How long resident in U.K. ?

Female

Yrs

Male

Female

Months

Yrs

Months

11. National Insurance Number

12. Do you have the right to work

and reside in the U.K. permanently?

Yes

No

Yes

No

If no to either, please provide details in section 17

14 Present Address

Postcode

15 How long at this address

16 Telephone Numbers

17 Residential Status

Years

Postcode

Months

Years

Home

Months

Home

Work

Mobile

Work

Owner

Living with Friends / Relatives

Private Tenant

Local Authority Tenant

If the above are not applicable please provide further details in Section 17

18 If less than 3 years give previous

address (es) to cover last 3 years

including residential status

Mobile

Owner

Living with Friends / Relatives

Private Tenant

Local Authority Tenant

If the above are not applicable please provide further details in Section 17

Postcode

continue in section 17 if necessary

19 How long at this address

Years

Postcode

Months

4 Employment Details

Years

Months

If self employed or if you own more than 20% shareholding in company go to section 5

1. Employers Name

2.

Employers Address

Postcode

Postcode

3. Where is your place of work ?

(nearest Town)

3. Are you

employed

self—employed

employed

self—employed

retired

not employed

retired

not employed

Temporary ?

Permanent ?

Temporary ?

Fixed term contract

Date your contract ends

Permanent ?

4. Is your employment

6. Telephone & Fax Number’s

7. Length of service

please give dates

Fixed term contract

Date your contract ends

Tel

/

Fax

years

months

From

/

Tel

to

years

months

Fax

From

to

/

/

�8. Position held / Job title

9. Nature of business

10. Percentage shareholding

if partnership interest

14. If either applicant has been with

their current employer for less

than 3 years, please give name

and address of previous employer

with dates in section 17

Postcode

Postcode

Head Office Use:

Annual Income Details

First Applicant

15. Basic Gross Salary p.a.

£

16. Guaranteed overtime, bonus /es

or additional payments p.a.

£

17. Mortgage / rent subsidy p.a.

£

18. Guaranteed pension income

£

excluding state pensions

19. Non Guaranteed overtime, bonuses or additional payments p.a.

£

20 Additional income I.e. rental,

investment etc please specify

£

Second Applicant

regular but not guaranteed

Total Gross Income p.a. £

21. Net Income from Employer p.m.

£

£

Total Net Income per month £

£

Please provide source and amount of any additional income in section 17

22 If either applicant has been with

their current employer for less

than 3 years, please give name

and address of previous employer

with dates in section 17

Postcode

Postcode

23 How many employers have you

worked for in the past 10 years

Head Office Use:

5 Self Employed Details

1.

Name of business

2.

Nature of business

3.

Your position in business

4.

Business address

Postcode

5. Telephone number / Fax

Tel

7. How long business established

Fax

years

Postcode

Tel

Fax

years

months

months

Perman ent ? Te mpo rary ?

8. How long has business been

owned by applicant?

If less than 3 years details of previous

business’s / employment required

Postcode

Postcode

%

9. Percentage holding or partnership

interest

%

10. Name and address of your

Accountant.

Please provide contact name

Postcode

Contact Name

11. Telephone number / Fax

12.

Certified / Chartered

if other please state qualifications

Tel

Postcode

Fax

Tel

Fax

�Yr Ending

Key Information

13. Business performance for the

last 3 trading years.

Yr Ending

Yr Ending

Yr Ending

Key Information

Turnover

Turnover

Net Profit before tax

Net Profit before tax

Drawings / Salary

Drawings / Salary

Dividends

Dividends

Yr Ending

Yr Ending

Net Assets (less Goodwill

Net Assets (less Goodwill ie.

Total Assets less Liabilities)

ie. Total Assets — Liabilities)

Head Office Use:

6 Assets and Liabilities

Assets

Plea se not e : Failure to declare any regular and unavoidable personal committed debt may result in your mortgage application being

declined

1. Savings and Investments

£

£

2. Other Assets e.g. Jewellery,

£

£

3. Main Residence

£

£

2. Other Properties

£

£

£

£

cars, antiques etc

Total Assets

Liabilities

1. Name and Address of current

residential mortgage lender /

landlord

Postcode

Telephone

Postcode

Telephone

2. Existing mortgage account

number

3. How long have you held this

account

Years

4. Amount of loan outstanding

£

5. Current mortgage / rent

payment

£

6. Is your property used as security

for any other loans including

business overdrafts? If yes please

£

Monthly

Payment

Current debts and

outgoings

No

Name of lender

£

7. Loans, HP and leases

£

£

£

8. Store and credit cards

£

£

£

9. Overdrafts

£

£

£

£

10. Other Mortgages

Months

£

Yes

provide details and purpose of loans

in Section 17.

Years

Months

£

£

Head Office Use:

Yes

Start Date

End Date

Account number

No

Credit limit or

original loan

amount

Balance

outstanding

1st or 2nd Applicant

�7. Bank Details

First Applicant

Second Applicant

1. Name and address of your Bank

2. Name of Account holder

3. Bank Account Number

4. Is Bank account a current account?

Yes

Specify

No

Yes

Specify

No

0.

5. Bank Sort Code

-

6. How long have you had this account?

-

-

Years

-

Years

Months

Months

8. Credit History

If your answer is yes to any of the questions below, please give full details in Section 12 or on a separate sheet

1. Have you ever been in arrears with

your mortgage payment, rental

payment or any other loan

If yes please state number of monthly

payments missed in the last 12

months

Yes

No

3. Have you ever been refused a

mortgage?

Yes

No

4. Have you ever had a judgement for

bad debt recorded against you? Or if

self-employed / Controlling Director,

against your company?

Yes

No

Yes

Yes

No

Yes

No

6. Have you ever been insolvent,

declared bankrupt, had a bankruptcy

petition presented against you or

made arrangement with creditors?

Yes

No

Yes

No

7. Have you ever been refused credit?

Yes

No

Yes

No

2.

Yes

No

If yes please state number of

monthly payments missed in the

last 12 months

If yes, when were these cleared

5. Have you any pending or imminent

court proceedings against you

Yes

No

9 Development Funding Requirements

1. What is the type of development?

2. What is the type of property on

completion of project?

Property

Refurbishment

Property

Conversion

New

Build

House / Barn

Please state

number

Apartments

Yes

No

4. Loan Details

Loan required

5. Are you contributing funds to the

project?

Yes

No

If Yes, please state amount

Yes

No

If Yes, to above please provide

details and value of security

£

Term

Commercial

Current site

value

£

Balance outstanding

£

Please state

number in block

If Yes, please state name of

Lender

3. Is the proposed site/building

mortgaged

6. Are you offering additional security

for this Funding?

Residential

Months

£

�10. Development Site Information

1. Address of Site

2. Build Cost inc of interest and fees

£

3. Gross Development Value

£

4. Name and Address of building

Contractor.

4. Will property be retained as

investment property?

Yes

No

0.

5. If property to be sold please provide

selling agent details

6. If property not being sold please

provide details of how loan will be

repaid?

11 Solicitor Details

Please Note : Some lenders will only use Solicitors with multiple practising partners

1. Solicitor Firm

Number of Partners

2. Name of Contact

3. Address

8. Contact Numbers

Postcode

DX Number

Telephone

Fax Number

�12 Additional Information

1.

Please use this page to write down

any relevant information as requested

in the previous sections supporting

this application. Also indicate to

which section each piece of information is relevant. Use an additional piece of paper

if necessary

�13 Uses of Data

A QUALITY SERVICE

We place paramount importance on customer service and aim to meet your expectations on

every occasion. To achieve this aim we need accurate personal information about you. Please

help us take prompt and efficient action by informing us of any changes to your personal

circumstances by writing to us.

We have a legal obligation under the Data Protection Act to ensure that all information held and

processed about you complies with the principles of the Act. The Act requires all personal

information to be treated in the strictest confidence and to be used only for purposes of which

you are aware.

CONFIDENTIALITY

We and the lender will treat all your personal information as private and confidential (even

when you are no longer a customer). Nothing about your accounts nor your name or address

will be disclosed to anyone other than in four exceptional circumstances permitted by law.

These cases are:

1. where we are legally compelled to do so;

2. where there is a duty to the public to disclose;

3. where disclosure is required to protect our interest (This will not be used as a reason for

disclosing information about you or your accounts, including your name and address to anyone

else for marketing purposes).

4. where disclosure is made at your request or with your consent. (this can be either as a result

of an application for a product or service or by signing an explicit declaration as part of the

application. Consent does not need to be in writing if the service is provided over the telephone)

From time to time we are employed as agents or sub-contractors to process your information on

the lenders behalf. The same duty of security and confidentiality will apply to us and all processing will only be carried out under the lenders instruction and will be supported by a written

contract between the lender and ourselves.

USING YOUR PERSONAL INFORMATION

Your details will be used in providing the service you applied for and for the ongoing administration of the service. If you are taking out insurance, your details will be passed to the insurer for

this purpose. If you make a claim, any information you provide to the insurers may be put onto

a register of claims through which insurers share such information to prevent fraudulent claims.

A list of the participants and address of the operator are available from the insurers.

KEEPING YOU INFORMED

If you borrow and do not repay in full and on time, the Lender may tell credit reference agencies and/or the Council of Mortgage Lenders’ Possessions Register who will record the outstanding debt. It is important that you give accurate information. We and the lender will check

your details with fraud prevention agencies and if you give false or inaccurate information and

where there is suspicion of fraud the lender will record this

We and the lender and other organisations may use and search these records to:

⇒

Help make decisions about credit and credit related services for you and members of

your household.

⇒

Help make decisions on motor, household, credit life and other insurance proposals

and insurance claims, for you and members of your household. Trace debtors, recover

debt, prevent fraud and to manage your accounts or insurance policies;

⇒

Check your identity to prevent money laundering, unless we are furnished with other

satisfactory proof of identity.

For these purposes we or they may make further searches. The Credit Reference Agencies and

Fraud Prevention Agencies will also use the records for statistical analysis about credit and

about insurance and fraud. If you have experienced problems obtaining credit we recommend

you request a copy of your credit file from the Credit Reference Agencies. They will charge for

this service. Their addresses are shown below.

INTRODUCERS

Where your business has been introduced to us from a third party, we will pass back information about you and your agreement that may be necessary for the purpose of administration,

payment or settlement. The person who introduces you to us may use this information for

marketing purposes but only with your consent.

SENSITIVE DATA

Certain information collected by us and the lender may be classified as sensitive and we and or

the lender can only use this information when we have explicit consent. This data relates to

racial or ethnic origin, political opinions or religious beliefs, trade union membership, physical

or mental health, sexual life, criminal proceedings and offences and will only be processed in

order to provide the service requested.

THE DETAILS HELD

These uses of your personal information are covered by our and the lenders notification under

the Data Protection Act. Under the terms of the Act, you have the right to obtain a copy of the

information held about you, upon payment of the appropriate fee.

We hope that you have found the information of interest. Please be assured that we and the

lender will actively review your personal information, please do not hesitate to contact us at

any time.

There may be times when we or the lender feel that a service or product offered by us or a

selected third party may benefit you. We or the lender may use information we obtain from your

account transactions in this decision making process. To make you aware of the service or

product we or a selected third party may contact you by mail, telephone, fax, e-mail or other

reasonable method to give you further details so that you can make an informed choice.

CREDIT REFERENCE AGENCIES’ ADDRESSES

You are of course, under no obligation to apply for any of the services or products offered. If you

prefer not to receive any of this information, please write to us, the lender or the selected third

party. We will only contact you by fax where you have given us your explicit consent.

EXPERIAN LIMITED

Consumer Help Service

PO Box 8000

Nottingham

NG80 7WF

Tel: 0870 241 6212

www.experian.co.uk

RESEARCH AND STATISTICAL ANALYSIS

We and the lender will use your details to assist us in understanding individual needs and

business trends in order to improve the products and services offered.

The lender will always try to protect you from entering into any agreement that may not be in

your best interest. When you apply for credit they may use a process known as Credit Scoring.

This will help them to assess your application to ensure that you are able to repay the borrowing comfortably and fulfil their duty to you as a responsible lender.

Declined applications based on this automated technique can be reviewed manually on request.

In considering your application we and the lender will search your record at Credit Reference

Agencies. They will add to your credit file details of the search and your application and this will

be seen by other organisations that make searches. We and the lender will also add to your

record with the Credit Reference Agencies details of your agreement, the payment you make

under it, any default or failure to keep to its terms and any change of address you fail to tell the

lender about where a payment is overdue. Where you borrow or may borrow from the Lender,

they may give details of your account and how you manage it (whether or not in default) to

credit reference agencies.

If you would like a copy of your credit file, please write to the following enclosing a cheque or

postal order for £2. You will need to tell them your full name and address(es) for the last six

years.

EQUIFAX

Credit File Advice Centre

PO Box 1140

Bradford

BD1 5US

Tel: 08705 143700

www.equifax.co.uk

FOR BUSINESS CUSTOMERS

The Data Protection Act does not apply to companies in themselves but it does extend to sole

traders and partnerships. When an application is received from a business, in addition to the

above information, information may be sought from Credit Reference Agencies on the company directors and/or partners as individuals.

MARKETING

From time to time the Lender may wish to contact you regarding other products and services

that may be of interest to you. By ticking this box I/we agree to receive details of products and

services offered by the Lender by mail, telephone, e-mail or fax. I/We understand that if I/we

do not wish to receive further information regarding such services and products

I/we may write to the Lender and its records will be amended accordingly.

Chapel House

Holmeswood Road

Rufford

Lancashire

L40 1TZ

Telephone 0844 815 5885

Fax

0844 815 5886

E-mail

info@chapelhouse.biz

�14 Declaration and Consent

Note: this declaration must be signed by the Applicant(s) personally

To Chapel House MSP, the lender, its successors and assignees, and those deriving title through

it I / We declare and agree that:

1.

The information set out on this form is, to the best of my / our knowledge and belief true

and complete and contains no material omission and forms part of the terms of my / our

mortgage. I / We understand that if any answer has been written by any other person, that

person shall for that purpose be regarded as acting for me / us and not for the lender.

2.

If any of the information in this form changes prior to the making of the advance I/We will

notify the Lender and Chapel House in writing and will not take up the advance unless

the Lender has previously consented in writing.

3.

I / We authorise the lender or its agents to instruct valuers to carry out a valuation of the

property and agree to pay the valuation charge. I / We understand that this amount will

not be returnable after the valuation has been carried out.

4.

I / We will not rely in any way on any valuation report prepared for the lender in deciding

whether to proceed with the purchase or re-mortgage of the property offered to the lender

as security and / or in the event of a purchase, in deciding how much to pay for such

property. Where a Home Buyers report is approved, I / We agree and accept the

conditions of engagement of the Surveyor when the report is issued, and that the Surveyor

is not an agent of the lender. I/We understand that the lenders willingness to make an

advance does not imply any representation about the value or condition of the property

5.

I / We understand the lender reserves the right to revalue the property at any time after

completion of the mortgage and, if necessary, to reschedule the loan accordingly.

6.

I / We acknowledge the lender is entitled to make such arrangements as it thinks fit with

third parties to protect itself against any failure my me / us to pay the mortgage loan, and

that any such arrangement will be for the lenders benefit and not mine / ours. I / We

further acknowledge that the lender may pass to such third parties any information

contained in this application and this application itself together with any relevant

supporting documentation.

7.

Any monthly payments which are made by one or two or more joint borrowers may be

treated as made for and on behalf of other joint borrowers.

8.

Chapel House/the lender has the right of access to your personal records held by credit

and fraud agencies. Chapel House/the lender will supply their names and addresses upon

request. .Chapel House MSP and the lender may request such information by way of

references as they may consider appropriate. This includes making enquiries of my/our

previous and present employers, Lenders, Landlords, Accountants, Bankers, Tax office and

Insurance company and I/We give my / our consent that such information may be

disclosed to Chapel House MSP and the lender. In addition Chapel House MSP and the

lender may make such enquiries as they consider appropriate about me / us and I / We

will be responsible for all fees incurred. I / We understand that telephone calls may be

monitored or recorded as part of your efforts to improve service to customers.

9.

I/We agree that Chapel House MSP/the lender may search the files of credit reference

agencies and the Council of Mortgage Lenders Possessions Register which will keep a

record of the search. Details of how l/we conduct the account (including any repossession

of the property and any arrears) may be disclosed to these agencies. This information may

be used by other lenders in assessing applications from me/us and members of my/our

household and for occasional debt tracing and fraud prevention.

10. The information on this form (together with additional information supplied to or obtained

by Chapel House MSP, or the lender separately) may be held on computer. It may be

retained after my / our account is closed. This information about me / us may be used, in

particular (and without prejudice to any other fair and lawful purpose) for the following

purposes:

[a] Credit assessment including credit scoring;

[b] Obtaining references from my / our employer, accountant, bank or other similar

sources.

[c] Credit reference purposes I/We authorise the lender /Chapel House to make

searches about me/us at credit reference agencies who will supply the lender/Chapel

House with credit information, as well as information from the Electoral Register. The

agencies will record details of the search whether or not this application proceeds.

The lender/ Chapel House may use credit-scoring methods to assess this application

and to verify my/our identity. Credit searches and other information which is provided to the lender/Chapel House and/or the credit reference agencies, about me/us

and those with whom I/we are linked financially may be used by the Lender / Chapel

House and other companies if credit decisions are made about me/us. This

information may also be used for debt tracing and the prevention of money

laundering as well as the management of my/our account. applications from me/us

and

members of my/our household and for occasional debt tracing and fraud

prevention;likewise information may be disclosed to and held on the Possessions

Register maintained by the Council of Mortgage Lenders

[d]

Marketing purposes, for example keeping me / us informed of other products and

services (if I / We do not wish to receive such information I / We will notify Chapel

House MSP by writing to Marketing Department The Tower, Rivington House, Chorley

New Road, Horwich, BL6 5UE) and disclosure to market research organisations for

the purpose of confidential market research conducted on behalf of Chapel House

MSP or the lender. Marketing may be carried by post, telephone, e-mail or fax.

[e] Fraud prevention. In addition the lender and the MCL, central mortgage checking

system may make information available to other mortgage lenders in the interest of

fraud prevention.

[f] Collection agents, to assist in the collection of any arrears and/or administrators to

assist in the administration of the mortgage

11. I/We authorise Chapel House MSP/the lender to disclose information relating to this

application and any agreement entered into as a result of this application to all persons in

the limited circumstances where such disclosure is necessary, including

[a] Subsidiaries / subcontractors and / or agents of Chapel House MSP or the lender in

connection with the purpose listed in paragraph 10 above (for any other fair and

lawful purpose);

[b] Other mortgage lenders and / or any party acting on behalf of mortgage lenders for

the purpose of fraud prevention including National Hunter

[c] The Financial Services Authority in monitoring our compliance.

[d] The mortgage broker, valuer or solicitor or other agent who introduced me/us

[e] Insurers and lenders insurers (if any)

[f] Any lender for whom Chapel House MSP/the lender may be acting as agent and any

other person having a legal right to the information

I/We understand that Chapel House MSP/ the lender will keep this information confidential and it will only be shown to other parties in limited circumstances, namely; if it has to

do so by law; it is in the public interest or Chapel House/the lenders interest to do so; the

recipient is another member of Chapel House MSP/ the lenders group; or if I/We have

given my/our permission

12. I / We hereby instruct my Solicitor / Licensed Conveyancer acting on my / our behalf to

disclose all information relevant to the lenders decision to lend, to the lender / Chapel

House MSP and I / We waive the right to claim Solicitor / Client confidentiality or legal

privilege in respect of such information and generally in respect of the transaction of which

the mortgage forms, or is to form a part. I/we consent to the Lender providing their

acting Solicitors with the mortgage application form or copy thereof

13.

I/We confirm that the declaration contained in this application form shall continue in full

force and effect notwithstanding the completion of any mortgage.

14. I / We acknowledge that Chapel House MSP may be entitled to receive, upon completion, a

standard fee for administration services in connection with this application for mortgage

finance and that details of this fee will be made available via a Key Facts Illustration (KFI).

15. I / We consent to the information on this form and any claim I / We make being supplied

to IDS so that it can be made available to other insurers. I / We also agree that, in response

to any searches you may make in connection with this application or any claim, IDS may

supply information it has received from other insurers about other claims I / We have

made. In addition I/we accept that the Underwriting insurer may monitor any calls made to

them. I/We understand that Chapel House MSP/the lender may record and monitor phone

calls for training and security purposes and Chapel House MSP/the lender may retain notes

of any conversation relating to my/our mortgage account.

16. I / We authorise the lender to share information about the property, or its value within

subsidiaries or anyone else for the purpose of providing information to help in valuing

properties.

17. I / we acknowledge that the lender , its successors in title and assigns (whether legal or

equitable) may in due course wish to dispose of or raise finance on any mortgage that may

be made to me / us by way of securitisation or otherwise and may;

[a]

[b]

[c]

Transfer, assign (whether legal or equitable or whether by absolute assignment or by

way of novation or by way of security only) or otherwise dispose of any benefits, rights

and obligations (to the extent possible in law) of such mortgage together with any

collateral security provided with it and I/we hereby consent to each such transaction.

Enter into any contractual arrangement relating to the funding of such mortgage with

any person; and

Pass any information contained in the application and any supporting documentation

which is now enclosed or may be provided in the future under any other information

relating to the property, the mortgage, the security for the mortgage and the history

and conduct of my / our account to any interested or potentially interested person

who may rely on the truth and accuracy of the information contained in the application.

18. I / We authorise the lender to add to the advance requested all fees and costs associated

with processing the application including (but not limited to) acceptance fee, telegraphic

transfer fee , additional security or higher advance fee, general and life assurance premiums,

and Accident Sickness and Unemployment premiums.

19. All property insurance claims over a certain sum (currently £5,000) will be paid through the

lender on satisfactory evidence of restitution of the property.

20. If not a Buy to Let application I/we declare that the property will be used as my / our sole

main residence and no part will be used for business purposes. I/we further undertake not

to enter into any letting arrangements without the prior consent of the lender

21. I / We understand that if I / we are found to have made any false statements or not fully

disclosed information required by this form then this can result in my / our application

being declined, any offer issued being cancelled by the lender (even if contracts have been

exchanged) and loss of any fees I / we have paid to date. I / We also understand that the

lender may, at any time and without stating a reason, withdraw, cancel or revise any

mortgage offer it may make

22. I / We have not arranged any other loan, second mortgage or improvement grant in

connection with the property unless I/we tell you otherwise

23. I / We agree that, if a Guarantor is being used in support of this application, Chapel House

MSP, the lender or its agents may disclose to them, details of my / our confidential information

24. If you are joining in this mortgage as a Guarantor you may become liable, instead of, or as

well as, the borrower(s)

25. I/we will make all payments by direct debit. I understand that the amount that I pay each

month may change or the date that I make the monthly payment may change and that in

either case the Lender will give me notice in writing before this happens.

26. If I / We choose to allow the Lender to arrange my buildings insurance I hereby authorise

the deduction of monthly insurance premiums to be included in the monthly direct debit

payable to the Lender

27. I/We confirm that any Additional Security Fee arrangements are for the Lenders benefit

only and that I have no right or claim in relation to them.

28. I / We acknowledge the way an interest only mortgage works and that the balance of my/

our mortgage will not reduce over the term of the mortgage and it will be my/our responsibility to repay the loan from other sources at maturity of the loan (this applies only to

applicants who are taking out an interest only mortgage

29. I/We understand that Chapel House MSP is not an Agent of the Lender and does not have

any authority to commit the Lender to any binding agreement

Data Protection Act 1998 Declaration

By signing this document:

1.

I confirm that I have read the information sheet “Uses of Data” and agree that the information I have provided in this application, and any other information relating to my account

(s), may be processed and disclosed in the ways described.

2.

I agree that my personal data may be shared with any company from time to time together with the Lender and Broker and any associated Companies (if applicable) and

Insurers (if applicable) who may also use it in the ways described in the information sheet,

Uses of Data. In addition may be disclosed to Collection agents, to assist in the collection

of any arrears and/or administration of the Mortgage.

3.

I agree that information on the performance of my account(s) may be shared with Credit

Reference Agencies and may be used by other Lenders for credit assessment.

4.

I agree that any sensitive information obtained will only be processed in order to provide

the service

I am entitled to disclose information about any co-applicant or guarantor and/or anyone

else referred to by me, and to authorise Chapel House MSP and the Lender to search and/

or record information at Credit Reference Agencies about each of us. I understand that an

“association” will be created at the Credit Reference Agencies, which will link our financial

records. This linking will continue until one of you successfully files a ‘disassociation’ at

the Credit Reference Agencies

5.

�15 Declaration and Consent

6.

continued

I/We understand that you will record details of this application at credit reference agencies,

whether or not this application proceeds. An ‘Association’ will therefore be created at credit

reference agencies which will link our financial records. I/We understand that our associates

information will be taken into account unless I/we instruct otherwise. If either of us applies for

access to information held at credit reference agencies, the applicant will receive only information relating to him / herself and the names of any associate(s). By signing this declaration I am

consenting to this

7.

Chapel House MSP and any Lender(s) may use the Data to send information to you about

Chapel House MSP products or services and/or products or services of other companies. By

ticking this box I agree to receive such information.

8.

Chapel House MSP and any Lender(s) may pass the Data to third parties who wish to send

information to me about their products or services. By ticking this box I agree to receive such

information.

9.

I have the right of access under the Data Protection Act 1998 to my personal records held at

Chapel House MSP or any Lenders files. The Company has notified me that it processes

`sensitive data' regarding criminal convictions about applicants and for insurance purposes. I/We

am/are informed that this information is only used for assessing risk, my/our eligibility for a

mortgage and for any contract of insurance. I consent to the Company holding securely any

medical health data about me.

10.

If any of the information in this form changes prior to the making of the advance I/We will notify

the Lender and Chapel House in writing and will not take up the advance unless the Lender has

previously consented in writing

11.

I / We enclose a cheque

to cover the submission fee and any other amounts

required to be paid with this application. I /We understand that part of the submission fee

contributes towards the cost of the initial assessment of the loan application and, in the event

that the loan application is declined or does not proceed before the valuer has been instructed,

the submission fee will be refunded less a sum of £249 towards these costs. Once a valuer has

been instructed, no refund of the submission fee will be made.

I/We declare that I/We have personally completed this application form, or if completed by

another have read the full application form and checked every answer given, and understand

and agree the above declaration and consent and Data Protection Act 1998 notice

I/We have received and read the Key Facts Illustration (KFI) and Initial Disclosure Document

(IDD) provided by my/our mortgage intermediary named in Section 1 of this application

12.

13.

WARNING:

Make sure you can afford your mortgage if your income falls

DECLARATION OF CONSENT

If a Payment Protection Plan has not been arranged with your Mortgage Broker, consideration

should be given to how your mortgage payments will be made if you become ill or unemployed. Please check through this application form to ensure that it is fully completed. Any

sections that are not completed may result in unnecessary delays.

It is important that all the applicants have read and understood the declarations before

signing this document. By signing you agree that Chapel House MSP, the Lender and Agents

can use the information in this way.

Signature of Applicant 1

Print Name

Date

/

/

/

/

Signature of Applicant 2

Print Name

Date

Mortgages are subject to status and valuation. Written quotations are available

upon request. Borrowers must be 18 or over or as otherwise specified. The caveat

regarding “security” does not apply to Buy to Let Mortgages unless you occupy the

Buy to Let property as your home any time after completion.

�