Young Researchers Enlargement Conferences

DISTRIBUTION OF ECONOMIC ACTIVITY

IN THE BALTIC STATES:

CONCENTRATION AND SPECIALIZATION PATTERNS

JŪLIJA BAŠAROVA

NELLIJA TITOVA

University of Southern Denmark

June 2004

1

�YouREC Working Paper

June 2004

Distribution of Economic Activity in the Baltic States: Concentration and

Specialization Patterns

Abstract

The Baltic States – Lithuania, Latvia and Estonia – are often perceived as one homogeneous

entity. All three states are small open economies, highly dependent on oil products and natural gas,

with a similar geographical position and natural resources. But although having so much in common,

they have achieved different results during the transition and may have different growth prospects in

the long run. The reasons for this lie much deeper than is usually supposed. Looking closer, the three

Baltic States differ in religion and culture, history and political preferences, structure of industry and

trade, and many other aspects that influence the behaviour and development of independent units.

The paper seeks to establish more formally whether there are indeed significant differences between

the three Baltic States with respect to the spatial dispersion of economic activity in the three Baltic

States.

Keyword : Baltic States, Transition and Enlargement Processes

Authors:

Jūlija Bašarova, ajiluj@one.lv

Nellija Titova, nellija@eurofaculty.lv

University of Southern Denmark

Campusvej 55

DK-5230 Odense M

Denmark

2

�INTRODUCTION

The Baltic States – Lithuania, Latvia and Estonia – are often perceived as one homogeneous

entity. All three states are small open economies, highly dependent on oil products and natural

gas, with a similar geographical position and natural resources. But although having so much in

common, they have achieved different results during the transition and may have different growth

prospects in the long run. The reasons for this lie much deeper than is usually supposed. Looking

closer, the three Baltic States differ in religion and culture, history and political preferences,

structure of industry and trade, and many other aspects that influence the behaviour and

development of independent units.

The experience of transition together with prospective accession to the European Union offer a

natural experiment in how such factors have influenced international location decisions and the

Baltics represent a neat laboratory to test the ideas of the theory on spatial distribution of

economic activity and the clustering theory.

The paper seeks to establish more formally whether there are indeed significant differences

between the three Baltic States with respect to the spatial dispersion of economic activity in the

three Baltic States.

In Part 1 we have compiled a variety of descriptive statistics some of which we have displayed on

maps of the three Baltic countries (analysed in Part 1 below) and others are reported as summary

statistics (Part 3). The territorial units of analysis employed in the research are counties in

Lithuania and Estonia (10 and 15 respectively) and districts (26 of them) in Latvia.

Using the data of Central Statistical Offices of the three countries, we have faced a number of

problems in the process of data synchronisation and analysis, i.e. different methodology and

definitions, different time periods for certain statistics, unavailability of all the necessary data at

certain aggregation level for all the three countries etc.

In Part 2 of the thesis we give a brief presentation of different theories related to the distribution

of economic activity and the determinants of economic location, as well as a short overview of

empirical studies on the issue.

3

�Summary statistics on the location of economic activity are calculated and analysed in Part 3.

Unfortunately, for the moment the summary statistics are most detailed and comprehensive for

Latvia so there remains some work to be done on the other two countries. The disaggregated data

set is available only for Latvia and, therefore, makes the analysis of Latvian data more

comprehensive. For the investigation of the regions or districts of the Baltic countries and their

industries, the Location Quotient method was applied to measure the concentration and

importance of an economic activity in regions relative to other selected territories.

Part 4 presents the econometric results on the application of Midelfart-Knarvik et al. (2000)

model on determinants of distribution of economic activity and Davis and Weinstein (1998)

model on determinants of manufacturing production structure.

The final part of the thesis, Part 5 contains further research proposal, to use in the future when

appropriate data will be collected and synchronised. In particular, the analysis of the thesis could

be extended to include Stern, Porter and Furman (2000) model on the determinants of national

innovative capacity that has to be modified to be applied to the case of the Baltic States.

We would like to stress here that the given paper is just one of the first attempts to elaborate on

this theme in Latvia, Lithuania and Estonia. Therefore the rich empirical testing is required to

follow up with the theoretical framework.

4

�PART I. GEOGRAPHICAL STRUCTURE OF INDUSTRIAL ACTIVITY AND

HUMAN RESOURCES IN THE BALTIC STATES

1.1.

Introduction

In this section we provide a visual description of the geographical structure of industrial activity

and human resources in the three Baltic States with an aim to find empirically concentration

tendencies in the Baltic States using available statistics. For the comprehensive investigation of

the distribution of economic activity and human resources in the Baltic States, we take a snapshot

of statistics available for the year 1999 (the latest year obtainable for the three countries at the

time of the research). The processing of numerous available statistics resulted in creation of an

extensive database covering different socio-economic aspects. For easier perception of data, the

various statistical indicators were reflected in maps (23 altogether).

Two notes are important at this point:

1)

The choice of variables under analysis is based on the relevance (direct or indirect) of

a particular variable to the issues spatial distribution of economic activity and human

resources.

2)

The reason for choosing statistics for 1999 was the availability of extensive data for

this year at the time of the research. Not all the statistics for later years were fully

available for public due to delayed calculations and publishing. Due to differences in

methodology of data collection and limited and complicated access to data the

descriptive part is limited to 23 basic variables to compare.

In order to summarize the statistical information related to the concentration of economic activity

and human resources issues, we sorted the data in ascending order for each of the variable of

analysis and gave scores to each of the region according to its performance: the minimum score

was given to the “best” value of the respective indicator. The scores for a particular variable

ranged form 1 (most concentrated region) to 51 (most underdeveloped / problematic region).

Then the regions were grouped according to the sums of the scores. (see Annex 1.)

5

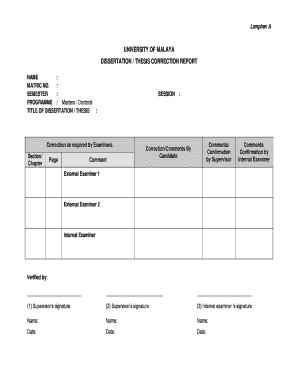

�Map 1

Regional scoring model

6

�As a result we have 6 groups of regions depicted on Map 1, i.e.:

1. The representatives of the first and second groups of regions show the highest rates of

concentration. Not surprisingly we have the groups consisting of the regions where the

capitals of the Baltic countries are situated. The dispersion of scores is interested here.

The only representative of the first group is undoubtedly Riga region in Latvia with only

34 points. Riga holds first place over all the regions in five positions, namely Density of

population, universities, vocational and secondary education establishments, employment

rate and contribution of region to state industrial production. Riga is in the second

position looking at number of economic entities’, third speaking about industrial

production per employee, fourth for investment per capita, sixths for contribution of

region to GDP share. The only weak point of Riga is gross wages situation, where

statistics shows Riga being on 14th position but that could be explained by low quality of

statistics on real incomes of population.

The next region with twice as higher scores is Harju region (Tallinn included) in Estonia

(68 points). Harju region in turn keeps leading positions in number of economic entities,

investment per capita, gross wages and contribution of region to GDP terms. Employment

rate position is only 14th comparing the regions of the Baltic States and the lowest score is

for industrial production per employee showing the effectiveness of production.

The last in the group is Vilnius region with maximum possible point number in the

group, namely 100.

3

The third group presents the information on the “second best” in the countries among the

regions. Tartu (Estonia), Kaunas and Klaipeda (Lithuania), the second biggest cities and,

as a consequence, regions where the cities are situated, are among the regions listed in the

third group ranging from 100 to 150 points. What is interesting about the group members

– the majority of the regions have quite low employment rates in spite of having

significant amount of economic entities and universities in the region, and quite low

investments per capita rates compared with the average in the country (except for Tartu).

This fact could be partly explained by the high density of population as it usually lowers

the per capita ratios. Latvian regions are not present in this group. That reflects the real

life situation when we see a big gap between the development of Riga region and other

regions of the country.

7

�4

The range of the fourth group including four Estonian, three Lithuanian and three Latvian

regions is 151 to 200 points. The regions representing this group not necessarily have

universities on the regions’ territory. Ogres region in Latvia is compensating lack of

education in the region by high investment per capita and, therefore, still is in the fourth

group.

5.

The fifth and six groups scoring 200-300 points represent the middle level regions in the

Baltic States. These are the two biggest groups in our distribution and we have to make a

deeper analysis to formulate some conclusions on region similarities and specific features.

6.

The seventh groups in our table are the poorest and less concentrated region. What is

shocking here is the fact that Ventspils and Daugavpils regions in Latvia and especially

Vilnius region in Lithuania showing impressive results as cities are the poorest as regions.

Another sad fact is the composition of the group, i.e. mainly Latvian regions down the

table.

The general conclusion:

Looking at the distribution of the regions we can see that countries have different patterns of

allocation and concentration of economic activities. Latvia shows the most extreme case being at

the same time the first and the last in the range. Dissimilarities of Riga region and border

regions could be seen at the first glance from general statistics for the regions. Lithuania, by

contrast, is presenting the example of equally spread activities showing the average level results

for the majority of the regions. Estonia shows the middle line tendency having undoubtedly top

region Harju (Tallinn) being the centre and the number of well developed regions as well as

loosing positions in the peripheral regions.

8

�PART 2. SPATIAL DISTRIBUTIONS OF ECONOMIC ACTIVITY:

THEORETICAL BACKGROUND AND EMPIRICAL EVIDENCE

There is a growing literature documenting spatial distributions of industries at country and

regional levels, which focuses predominantly on the United States and the European Union. In

this section we present some of the findings and results of these studies, as well as we try to apply

these theories to the Baltic case.

2.1.

Location Theory

The impact of economic integration on regional specialisation and location of industrial activity

has been analysed using three theoretical approaches1. While offering different explanations of

patterns of specialisation, all three theoretical models predict increasing specialisation as a result

of trade liberalization and economic integration. It is impossible to give a full presentation of a

vast body of theoretical thinking in a summary of a couple of pages, thus we present here a

simple categorisation of intellectual contributions, which can give structure to the following

analysis of dispersion of economic activity in the Baltic countries. (see Table 2.1.)

The neo-classical theory predicts that trade liberalization (economic integration) will result in

production re-location and increasing specialization according to comparative advantages. The

consequent changes in demands for factors of productions will tend to equalize factor prices

across countries and regions. The neo-classical trade models can explain a substantial proportion

of inter-industry specialization. While relevant, comparative advantage is however not sufficient

as the only explanation of specialisation. In reality, different production structures are found in

similar regions and the bulk of trade takes place among countries with similar factor endowments

and production technologies. Most of trade between industrialised countries takes the form of

intra- industry trade that is an exchange of differentiated goods that fall into the same product

category.

1

Recent surveys of theoretical literature include: Amiti (1998), Venables (1998), Brülhart (1998), Aiginger et al.

(1999), Hallet (2000).

9

�Table 2.1.

Three Strands of Location Theory

Neo-Classical Theory (NCT)

New Trade Theory (NTT)

Seminal papers

Ricardo (1817)a, Heckscher

(1919), Ohlin (1933), Weber

(1909), Vanek (1986)

Krugman (1979, 1980, 1981),

Dixit and Norman (1980),

Helpman and Krugman (1985),

Weder (1995)

Market structure

Determinants of

location

Perfect competition

• Technological differences

• Natural resource

endowments

• Factor endowments and

factor intensities

Monopolistic competition

• Degree of plant-level

increasing returns

• Substitutability of

differentiated goods

• Size of home market c

Location of industry

• Overall distribution of

economic activity (labour)

determined by given

endowments

• Inter-industry specialisation

• Unique equilibria

• Overall distribution of

economic activity (labour)

exogenously given

• Intra- and inter-industry

specialisation

• Unique equilibria

Trade structure

Welfare effects of

nondiscriminatory

trade liberalisation

Inter-industry trade e

• Net welfare gains

• All countries gain

• Owners of scarce factors lose

Intra- and inter-industry trade

• Net welfare gains

• Large countries benefit more

than small ones

• Possibility that owners of all

factors gain

a

New Economic Geography

(NEG)

Marshall (1920)b, Krugman

(1991a, b), Krugman and

Venables (1995a, b), Venables

(1996), Markusen and Venables

(1996), Puga and Venables

(1997), Fujita, Krugman and

Venables (1998)

Monopolistic competition

• Pecuniary externalities

(labour-market pooling,

input-output linkages,

migration-induced demand

linkages)

• Technological externalities d

• Trade costs

• Overall distribution of

economic activity (labour)

endogenous

• Centripetal agglomeration

forces

• Intra- and inter-industry

specialisation

• Multiple equilibria

• “u curve”

Intra- and inter-industry trade

• Net welfare gains

• “u curve”: periphery/ core

can lose at intermediate/

advanced stages of

integration

Strictly speaking, Ricardo’s work is part of pre-Marshallian “classical” economic theory.

Recent work on NEG theory mainly amounts to a formalisation of Marshall’s ideas.

c

Some authors consider models with non-zero trade costs (a la Krugman, 1980) as part of NEG.

d

This is not formally an element of NEG models, but implicitly cannot be disassociated from other concentration forces.

e

Davis (1995) has shown that IIT can be compatible with a Ricardian trade model.

b

Source: Brülhart 1998

The prediction of new trade theory regarding the distribution of economic activity between the

core and periphery is relevant in the case of the accession of Central and East European countries

to the European Union. The current economic integration situation could be seen as one with

“intermediate trade costs”. A further integration could result in re-location of manufacturing

towards these countries due to factor cost considerations.

New economic geography models: If trade costs are sufficiently low, demand linkages outweigh

the trade costs of servicing a non- local market. In this case, regions with an initial scale

advantage in a particular sector would see their advantage reinforced in those sectors. Supply10

�side linkages: manufacturing firms benefit from locating in a region where they have access to

suppliers providing a range of specialised. In this case, one would expect European integration to

simply bring about massive concentration and specialisation in sectors where supply-side and

demand-side linkages are important. However, the simple agglomeration result seems unrealistic

in a European context where inter-EU country mobility is extremely low and even intra-EU

country mobility is less than perfect. Agglomeration effects emerging around border regions

could be observed: by locating closer to border regions, firms might be able to exploit supplyside linkages with firms in other EU countries whilst still attracting their own national work force

without increasing labour demand and setting off a large increase in labour costs.

Previously mentioned models of comparative advantages and/or increasing returns make a

number of predictions about the characteristics of the industries we should expect to become

geographically concentrated, and the characteristics of the countries where these locate. The main

deficiency of many (if not of all) theories is restrictive and unrealistic assumptions. Therefore,

one should look at the question: which theory is best at approximating real-world events at a

particular time, in a particular sector and/or at a particular location?

2.2.

Empirical Evidence

The spatial distribution of economic activity in itself is one of the most important research topics

in economics. Hence, much of the relevant empirical literature is not designed as an explicit test

of competing theories, but mainly as a descriptive account of locational structures and trends.

Compared to the theoretical literature, empirical analysis of the impact of economic integration

on regional specialisation and geographic concentration of industries is still at an early stage of

analysis. There is no consensus on conceptual issues and evidence appears partly contradictory.

In this Section, we provide some characteristics and results of recent work in this field.

The most interesting studies have focused on the US and the European Union (EU) and have

established the following stylised facts (Traistaru et. al (2002:6)):

a) Regional specialization and industrial concentration are higher in the US than in EU

(Krugman, 1991b; Midelfart-Knarvik et al., 2000; Aiginger et al., 1999)

b) Production specialisation has increased in EU Member States while trade specialisation

has decreased (Sapir, 1996; Amiti, 1997; Haaland et al., 1999; Midelfart-Knarvik et al.,

2000; Brulhart, 1996, 2001)

11

�c) Slow growing and unskilled labour intensive industries have become more concentrated

in the EU (Midelfart-Knarvik et al., 2000)

d) Medium and high technology industries have become more dispersed in the EU (Brulhart,

1996, 2001)

e) Industries with large economies of scale have been concentrated close to the European

core during the early stages of European Integration but have become more dispersed in

the 1980s (Brulhart, 1998; Brulhart and Torstensson, 1996)

The main features of studies on the EU can be briefly summarised as follows:

•

Most studies use national data, i.e. data at Member States level;

•

Time periods taken into account are 10 to 25 years due to the limited availability of

comparable earlier data (in comparison to the USA);

•

Variables analysed are mostly on production, employment or trade in the manufacturing

sector;

•

Indicators used vary considerably, although all of them take either a sectoral perspective

(“concentration”) or a geographic perspective (“specialisation”);

•

Most authors add a statistical analysis to explain the results by specific industry

characteristics (factor, scale and R&D intensities etc.) or country characteristics

(centrality, income etc.).

•

Most studies find a (weak) tendency towards less specialisation and concentration in

manufacturing in the 1970s and a slight reversal of this tendency since the 1980s.

However, we still do not avail of a consistent and comprehensive description of

specialisation trends in the EU. There is an evident contradiction between the

specialization results based on trade data, which show rising intra-industry trade, and

those based on production data, which suggest increasing concentration.

With respect to the EU accession countries, existing evidence based on trade statistics suggests

that these countries tend to specialise in labour and resource-intensive sectors following an interindustry trade pattern (Landesmann, 1995). Despite the dominance of the inter-industry

(Heckscher-Ohlin) type of trade, intra-industry trade has also increased, more evident for the

Czech Republic and Hungary (Landesmann, 1995, Dobrinsky, 1995). This increase however,

12

�may be associated with the intensification of outward processing traffic. Most of the research on

regional issues in transition economies has focused on patterns of disparities with the aim to

identify policy needs at the regional level (for instance Spiridonova 1995, 1999 - for Bulgaria,

Nemes-Nagy, 1994, 1998 - for Hungary, Constantin, 1997 - for Romania). It has been claimed

that the processes of internationalisation and structural change in transition economies tend to

favour metropolitan and western regions, as well as regions with a strong industrial base

(Petrakos, 1996). In addition, at a macro-geographical level the process of transition will increase

disparities at the European level, by favouring countries near the East- West frontier (Petrakos,

1999). Increasing core-periphery differences in Estonia are documented in Raagmaa (1996).

Regional determinants of new private firms in Romania have been investigated in Traistaru

(1999). Using the approach of the “new economic geography”, Altomonte and Resmini (1999)

investigated the role of foreign direct investment in shaping regional specialisation in accession

countries. [Traistaru et al. (2002)]

Yet to date, there is no comprehensive study on the impact of the economic integration with the

European Union on regional specialisation and location of industrial activity in accession

countries.

13

�PART 3. SUMMARY STATISTICS OF LOCATION OF

ECONOMIC ACTIVITY IN THE BALTIC STATES

The question we discuss in this Section is: “How can we describe the geographical structure of

production across the regions of the three Baltic States”. This problem could be viewed from the

two different, but correlated / interconnected, angles:

From economic activity (industry) side: how localised / concentrated is a particular

economic activity;

From location (region) side: how specialised is a particular geographical unit.

We try to address these questions here by using the following data:

•

Gross value added regional data by kind of activity, Latvia and Estonia, current prices,

1996-1998;

•

Employment regional data by kind of activity, Latvia and Lithuania, 1996-2001.

The gross value added statistics is preferable calculating the indexes. Due to the lack of poor

diversity of data on gross value added describing geographical structure of production across the

region we have used also the employment data. The employment data also reflect the cluster

structure and due to a richer range of data available the employment-based calculations are

analyzed and presented in the paper together to the value added method. Therefore, we can

compare the geographical structure of the Baltic States using value added and employment

proxies for production that appear to provide quite different results in many aspects.

We calculated location and specialisation coefficients and other indicators for 5 big Latvian

regions for 15 NACE industries with value added data for 1996-1998 and with employment data

for 1996-2001. Estonian regional value added data allowed us to calculate the mentioned

statistics for 6 sectors of economy, while Lithuanian data limited the analysis to 10 regions and

only 4 economic sectors. The given short version of paper presents only some fragments of

analysis – results of economic base analysis for the regions and industries of the three Baltic

countries.

14

�Box 3.1. Summary Statistics of Location Definitions

9 Production specialisation is the (distribution of the) shares of an industry in total

manufacturing in a specific country i.

If we denote yik as production of industry k in location i then

The specialisation of a location can be studied by looking at yik relative to the total

production of that location, sik = yik / ∑k yik. This measures the share of industry k in

region i’s total production of all industries.

9 Geographic concentration (alternatively – localization) is the (distribution of the) shares

of countries or regions in an individual industry k.

The concentration (or localisation) of industry k can be addressed by looking at yik

relative to total production of that industry: lik = yik / ∑i yik. This measures the share of

location i in the total production of industry k.

9 Location Quotient: Since regions and industries differ in size, it is necessary to

normalise these two measures. If we normalise the first by the share of the location in

overall activity and the second by the share of the industry in overall activity we end up

with a measure which is called the location quotient,

k

ri =

y ik / ∑ i y ik

∑k yik / ∑i ∑k yik

=

y ik / ∑ k y ik

∑i yik] / ∑k ∑i yik

These are two equivalent expressions or interpretations of the location quotient. The first

is as a measure of the localisation of industry k in i, relative to the localisation of activity

as a whole in i. The second is as a measure of location i’s specialisation in industry k

relative to the share of the industry in total world output. It is important to be clear that

economic geography models make statements about both localisation and specialisation.

We shall refer to statements about the distribution of rik across locations i for given

industry k as statements about the localisation of industry k, noting that k could be an

aggregate of many or all sectors. And we shall refer to statements about the distribution of

rik across industries for a given location as describing the specialisation of location i.

9 Herfindahl (H): This measure is popular in industrial economics and in competition

policy. It sums up the squared share of each sector or industry in total manufacturing. For

example, the Herfindahl index of absolute specialisation, takes the form hi = ∑k (sik)2.

Though the measure formally makes use of all information, its value is heavily

influenced by the largest (market, export, country) shares.

15

�3.1.

Economic Base Analysis for LATVIAN Regions and Sectors

3.1.1. Value added data

A commonly used methodology for location analysis is economic base analysis. The central idea

of this method is that if the region that is being studied has a higher concentration of en economic

activity than the benchmark, this indicates an activity that exports it ‘surplus’, that is, produces

goods and services in a volume that is higher then required to meet the consumption needs of the

local population. Accordingly it is termed a basic activity. If the concentration is less than the

benchmark, the activity is non-basic and the region can be considered an importer of that product

or service, that is, the region produces less than it is required to meet the consumption need of the

local population. If the concentration is similar to the benchmark, the activity is non-basic and the

region is neither an exporter nor importer, but is more or less “self-sufficient” in the provision of

that product or service. However, this interpretation assumes that demand is uniform throughout

the benchmark area, which may not always be justified.

Basic activities are characterized by a location quotient (LQ) in excess of 1, where the location

quotient shows the localisation of industry k in i, relative to the localisation of activity as a whole

in i. Alternatively, it measures location i's specialisation in industry k relative to its share of the

total benchmark area activity.

Based on Latvian 1998 gross value added data, we calculate the LQ for Latvian regions and 2digit industries. Each region’s coefficients are ranked in descending order of LQ in Table 3.1.

For Riga region, the highest coefficient is for real estate activities (1.414), closely followed by

hotels and restaurants (1.379). These do not have a straightforward economic base interpretation.

Real estate is almost certainly high because of, on the one hand, a higher demand in Riga than

anywhere else and secondly because higher property prices make for higher value added in Riga

as compared with other regions. Trade (1.164) and financial intermediation (1.152) are also basic

activities in Riga. The concentration of real estate and financial intermediation in the region

around capital is not surprising, since Riga is the financial centre of the country. Additionally, the

development of these sectors is related to the rapid development of Riga in the last years.

16

�Table 3.1.

K

H

G

J

O

D

F

L

N

I

E

M

C

A

B

Location Quotients and Basic Activities of the Regions

R

1.414

1.379

1.164

1.152

1.061

1.052

1.023

0.941

0.924

0.877

0.832

0.729

0.501

0.289

0.205

A

M

C

E

N

D

O

L

J

G

F

I

B

K

H

V

2.377

1.854

1.623

1.489

1.355

1.196

1.054

1.052

0.830

0.823

0.655

0.606

0.524

0.384

0.269

K

5.535

1.895

1.679

1.049

0.866

0.861

0.844

0.813

0.793

0.774

0.762

0.762

0.601

0.428

0.311

B

I

F

A

L

M

E

D

O

J

N

C

G

H

K

A

C

M

E

N

L

D

O

G

B

I

F

J

K

H

Z

4.172

4.143

1.624

1.454

1.200

1.039

0.952

0.922

0.854

0.684

0.632

0.586

0.514

0.366

0.269

M

E

A

N

L

I

C

J

O

G

D

H

F

K

B

L

1.687

1.517

1.422

1.381

1.378

1.223

1.155

0.950

0.929

0.807

0.791

0.693

0.523

0.419

0.211

A – Agriculture, hunting and forestry; B – Fishing; C – Mining and quarrying; D – Manufacturing; E – Electricity,

gas and water supply; F – Construction; G – Wholesale and retail trade; etc.; H – Hotels and restaurants; I –

Transport, storage and communication; J – Financial intermediation; K – Real estate, renting and other business

activities; L – Public administration and defence; M – Education; N – Health and social work ; O – Other activities

Source: authors’ calculations

Manufacturing (1.052) and construction (1.023) are marginally basic. However, despite the

severe industrial contraction of the last decade, Riga has managed to maintain its position as the

major industrial centre in the region, although Vidzeme has a higher LQ for manufacturing.

One would expect public administration to be highly concentrated in Riga region, since national

government and ministries are located in the capital, but this activity here falls into the non-basic

category (0.941). One should not forget, that we use here gross value added data, not

employment, and public administration is not the activity that creates large value added. Another

reason to expect LQ for public administration sector to be high in Riga region is the need for

large local public administration in a region with more than 40 per cent of Latvia’s population.

(and more than 40 percent of those employed in public administration work in Riga). In Vidzeme,

Zemgale and Latgale public administration has an LQ in excess of 1. This probably reflects the

fact that these are much poorer regions of Latvia with low private sector value added than Riga

region.

17

�Health and social work (0.924) is also not that different from national shares. Therefore Riga

region does not have a comparative advantage in this sector. That is not bad – it suggests that

health and social work as an economic activity is not necessarily concentrated in Riga region.

Surprisingly, transport and communication (0.877), electricity, water and gas supply (0.832) and

education (0.729) appeared to be underrepresented in Riga region compared with Latvia. We

were expecting a high LQ for transport and communication for the capital city and its

surroundings – there is a big port and developed railway lines. This result does not go in line with

high employment in this sector in Riga region – around 17% as compared to approximately 810% in the whole Latvia.

Value added in the primary sectors (0.289 for agriculture and 0.205 for fishing) is substantially

underrepresented in Riga region compared to whole Latvia, these activities are non-urban in

nature. Similarly for mining and quarrying (0.501).

According to Table 3.10., the basic sectors of Vidzeme in 1998 were Agriculture, hunting and

forestry (2.377), Education (1.854) [probably due to Vidzeme High school located Valmiera],

Mining and quarrying (1.623), Electricity, gas and water supply (1.489), Health and social work

(1.355), Manufacturing (1.196) (that has the highest LQ among all Latvian regions), Other

activities (1.054), and Public administration and defence (1.052). Other sectors are not that

different from national shares or show no particular concentration in this region.

Kurzeme has only 4 sectors with the LQs above one - Fishing (5.535) – being the region with the

longest coastal line, Transport, storage and communication (1.895) – Liepaja and Ventspils ports

are the centres of transit (especially, oil), Construction (1.679) (seems due to big amounts of

construction works in Ventspils port area), Agriculture, hunting and forestry (1.049).

Manufacturing (0.813) appeared to be non-basic sector, though there are number of factories in

this region.

Zemgale turned to be the agricultural region (with the highest LQ for agriculture among Latvian

regions - 4.172). Mining and quarrying (4.143), Education (1.624) [Latvian Agricultural

university is located in the city of Jelgava], Electricity, gas and water supply (1.454), Health and

social work (1.200), and Public administration and defence (1.039) are basic activities in

Zemgale region.

18

�Education with LQ of 1.687 is the basic activity of Latgale region (Pedagogical university of

Daugavpils) is followed by Electricity, gas and water supply (1.517). Agriculture (1.422), Health

and social work (1.381), Public administration and defence (1.378), Transport, storage and

communication (1.223), and Mining and quarrying (1.155) are also basic activities for Latgale

region.

Interestingly enough, there are four sectors that are non-basic in all four non-Riga regions Financial intermediation (LQs: 0.514-0.95), Wholesale and retail trade; etc. (LQs: 0.601-0.854),

Hotels and restaurants (LQs: 0.269-0.693) and Real estate, renting and business activities (LQs:

0.311-0.419). These sectors show the highest concentration in Riga region.

3.1.2.

Employment data

Table 3.2. provides the calculation results by ranking the coefficients in a descending order – we

get the information on basic activities in five big Latvian regions in the year 1998 using

employment as a proxy.

Table 3.2.

K

H

J

G

F

I

O

D

N

L

E

C

B

M

A

Location Quotients and Basic Activities of the Regions

R

1.490

1.346

1.268

1.137

1.123

1.102

1.068

0.982

0.941

0.857

0.831

0.788

0.782

0.765

0.276

A

C

M

E

L

N

D

O

G

J

F

I

H

B

K

V

2.130

1.439

1.304

1.296

1.193

1.074

1.047

0.972

0.864

0.757

0.701

0.658

0.482

0.471

0.445

K

3.852

1.257

1.224

1.136

1.128

1.095

1.074

1.031

0.935

0.903

0.881

0.863

0.838

0.674

0.510

B

A

F

I

E

L

M

D

O

N

H

G

C

J

K

A

C

M

E

N

L

O

D

G

F

I

H

J

B

K

Z

2.704

1.982

1.308

1.145

1.076

1.042

0.981

0.958

0.819

0.814

0.752

0.643

0.626

0.485

0.479

M

L

N

E

D

A

I

G

O

J

F

C

H

K

B

L

1.280

1.242

1.175

1.129

1.033

1.025

1.016

0.886

0.843

0.821

0.768

0.713

0.580

0.540

0.203

A – Agriculture, hunting and forestry; B – Fishing; C – Mining and quarrying; D – Manufacturing; E – Electricity,

gas and water supply; F – Construction; G – Wholesale and retail trade; etc.; H – Hotels and restaurants; I –

Transport, storage and communication; J – Financial intermediation; K – Real estate, renting and other business

activities; L – Public administration and defence; M – Education; N – Health and social work ; O – Other activities

Source: authors’ calculations

19

�Riga region shows the highest coefficient in Real Estate Business followed by Hotel and

restaurant business, thus matching the gross value added results. Trade and Financial

interpretation changing the rank still appear as one of Riga region basic activities.

As for differences, Manufacturing drops from the list of basic activity in employment case. In

contrast to value added interpretation it could be seen that Riga region could not be considered

industrial region in 1998. The second difference appearing in table 3.2. is Transport and Storage

coefficient among the basic activities of Riga region. That could be logical as Transport and

storage activity is one of the sound business areas, Riga being the crossroad of the West-East,

North-South corridors.

Vidzeme in employment terms shows one additional activity, but unfortunately we cannot

interpret the activity as it is Other activities which is quite broad category.

Comparison of Kurzeme value added bases and employment based calculations shows drastic

decrease in the number of basic activities from employment point of view. The number of basic

activities reduces from 8 in value added case to 4 in employment one excluding 4th, 5th, 6th and

7th activity from the list, namely Electricity, gas and water supply, Public Administration,

Manufacturing and Education.

Zemgale column shows perfectly identical results to the value added ones.

In Latgale column the number of basic activities remains the same Construction being subtracted

by mining and quarrying activity. Therefore we can logically conclude that value added statistics

extracts manufacturing as basic activity mining and quarrying as low value added activity while

in labour terms mining and quarrying employs more people than manufacturing.

3.1.3.

Economic Base Analysis for LATVIAN Manufacturing

In order to get a more detailed and comprehensive picture of the distribution of economic activit

in Latvia, we calculated LQs for manufacturing sub-sectors for the 5 Latvian regions for 1998.

In value added terms, Riga region has a big number of basic activities in manufacturing – 16 out

of 23 sub-sectors have LQ > 1, while in employment terms – only 10. Basic sectors in Riga

region only in value added are: manufacturing of tobacco products, office machinery and

computers, chemicals and chemical products, pulp, paper and paper products, motor vehicles,

20

�trailers and semi-trailers, food products and beverages, wearing apparel, dressing and dyeing of

fur. Medical, precision and optical instruments, watches and clocks, electrical machinery and

apparatus n.e.c., leather articles, coke, refined petroleum products, furniture, radio, television and

communication equipment and apparatus, publishing, printing and reproduction of recorded

media, other transport equipment, and rubber and plastic products show highest concentration in

Riga region both in value added and employment terms.

Manufacture of textiles, wood and of products of wood and cork as well as manufacture of

fabricated metal products, except machinery and equipment are concentrated in Vidzeme (value

added data). Employment data suggest that only food products and beverages is basic activity in

the region.

Manufacture of basic metals shows a particularly high concentration in Kurzeme, followed by

manufacture of other non-metallic mineral products, manufacture of textiles, manufacture of

wood and of products of wood and cork, except furniture, manufacture of fabricated metal

products, except machinery and equipment. (value added data)

In Zemgale, first place is taken by recycling, then manufacture of wearing apparel; dressing and

dyeing of fur, manufacture of motor vehicles, trailers and semi-trailers, manufacture of food

products and beverages, manufacture of fabricated metal products, except machinery and

equipment, manufacture of wood and of products of wood and cork, except furniture. (value

added data)

The fifth region Latgale seems to be concentrated in the manufacture of machinery and

equipment n.e.c., and recycling, manufacture of other transport equipment, manufacture of coke,

refined petroleum products and nuclear fuel, manufacture of wearing apparel; dressing and

dyeing of fur, manufacture of other non-metallic mineral products, manufacture of rubber and

plastic products. (value added data)

According to our calculations and empirical evidence from the maps, we see that there is a

tendency for location clustering in Latvia; at the same time specialization of regions is

rather week. All the regions have the standard set of “survival industries” where people are

mostly employed. Riga region and Zemgale region show a bigger number of basic activities

compared to other big regions thus becoming perspective regions in terms of employment

level in the state.

21

�3.2.

Economic Base Analysis for ESTONIAN Regions and Sectors

(value added, no employment data)

Turning to the Location Quotient, Table 3.3. shows the calculations based on Estonian value

added data for 1998.

Table 3.3.

Location Quotient

LOCATION QUOTIENT

A+B

C+D

E

F

G*

L*

N

0.265

0.789

0.727

1.019

1.241

0.918

C

2.906

1.530

0.526

1.124

0.629

0.800

NE

0.671

1.641

4.349

0.731

0.555

1.057

W

2.485

1.178

0.713

1.289

0.694

1.019

S

2.057

1.105

0.777

0.847

0.696

1.340

A – Agriculture, hunting and forestry; B – Fishing; C – Mining and quarrying; D – Manufacturing; E – Electricity,

gas and water supply; F – Construction; G – Wholesale and retail trade; etc.; H – Hotels and restaurants; I –

Transport, storage and communication; J – Financial intermediation; K – Real estate, renting and other business

activities; L – Public administration and defence; M – Education; N – Health and social work; O – Other activities

G*=G+H+I+J+K

* Wholesale and retail trade; hotels and restaurants; transport, communication; financial

intermediation; real estate, renting and business activities

* Public administration and compulsory social security, education; health and social work;

L*=L+M+N+O

other community, social and personal service activities

Source: Estonian Statistical Bureau, authors’ calculations

Thus private services, with an LQ of 1.241, is Northern Estonia’s basic sector, while

Construction almost does not differ from the national share (1.019). Other sectors are

underrepresented in this region.

In Central Estonia the basic sectors are Agriculture and Fishing (2.906), Mining and quarrying

and Manufacturing (1.530) and Construction (1.124). The highest LQ for Northeastern Estonia

produces Electricity, gas and water supply sector (4.349); Mining and quarrying and

Manufacturing (1.641) and public services (1.057) are basic for this region. These sectors are

basic for Western Estonia: Agriculture and Fishing (2.485), Mining and quarrying and

Manufacturing (1.178) and Construction (1.289); public services (1.019) does not differ much

from national shares. Similarly, Agriculture and Fishing (2.057), public services (1.340) and

Mining and quarrying and Manufacturing (1.105) are basic sectors of Southern Estonia.

22

�3.3.

Economic Base Analysis for LITHUANIAN Regions and Sectors

(only employment, no value added)

Location quotient analysis crystallizes out the basic activities of the regions.

Table 3.4.

Location Quotient

Alytus

Agr, Hunt,

Forestry

Industry

Construction

Services

1)

2)

3)

4)

1.160

1.385

0.941

0.791

LOCATION QUOTIENT

Marijam PaneveKaunas Klaipeda -pole

Siauliai Taurage Telsiai

zys

0.921

1.162

1.090

0.957

0.808

0.977

1.033

1.084

1.898

0.807

0.674

0.745

1.420

1.001

0.780

0.855

1.806

0.867

0.800

1.202

0.787

0.180

0.227

0.295

0.610

0.649

0.583

0.453

Utena

0.954

0.575

0.889

0.436

Vilnius

1.029

3.102

3.525

3.870

A – Agriculture, hunting and forestry; B – Fishing;

C – Mining and quarrying; D – Manufacturing; E – Electricity, gas and water supply;

F – Construction;

G – Wholesale and retail trade; etc.; H – Hotels and restaurants; I – Transport, storage and communication;

J – Financial intermediation; K – Real estate, renting and other business activities; L – Public administration

and defence; M – Education; N – Health and social work ; O – Other activities

Source: Lithuanian Central Statistical Bureau, authors’ calculations

Industry and agriculture are the basic activities in Alytus, Kaunas, Klaipeda, Panevezys and

Sauliai region. The two extreme cases are the regions without basic industries (Taurage, Telsi,

Utena) and with all the activities as basics (Vilnius regions).

Unfortunately, the data available for Estonian and Lithuanian industries and/or regions does not

allow to make a full and comprehensive analysis of the distribution of economic activity within

these countries.

23

�PART 4 ECONOMETRIC ANALYSIS ON SPATIAL DISTRIBUTIONS OF

ECONOMIC ACTIVITY IN THE BALTIC STATES

4.1.

Determinants of Regional Specialization and Industrial Concentration

Patterns

This section presents the results of our econometric analysis on determinants of regional

specialization and industrial concentration patterns based on Midelfart-Knarvik et al. (2000)

model.

4.1.1. Midelfart-Knarvik et al. (2000) Model

According to the empirical model proposed by Midelfart-Knarvik et al. (2000), location and

specialization patterns are determined by “multivariable interactions between industry and

country characteristics”. The reason for evaluating the interaction between regional and industry

characteristics lies in the fact that firms evaluate the same kind of production factors differently

(Fujita, 1999). Industries will try to locate as close as possible to the place where their most

important inputs are available, and will therefore be over represented in that location. Industries

for which the same production factor is less important will instead be underrepresented.

Midelfart-Knarvik et al. (2000) apply the model to data for 13 EU countries and 36 industries,

from 1970 to 1997. The basic unit of analysis was the activity level measured by the gross value

of output – of industry k in country i at time t. The estimation of the model revealed factors that

have become more important in determining location. For instance, they find that skilled and

scientific labour abundance are becoming more important considerations in determining

industrial location, and that the pull of centrality is becoming more important for industries that

are intensive users of intermediate goods, although less important for industries with high returns

to scale.

To uncover determinants of manufacturing location and explain regional manufacturing

production structures differentials in the five accession countries Traistaru et al. (2002) estimate a

model similar to Midelfart-Knarvik’s et al. (2000). In this paper they analyse patterns of regional

specialization and concentration of manufacturing and their determinants using regional

manufacturing employment data and other variables at NUTS III level for Bulgaria, Estonia,

24

�Hungary, Romania and Slovenia. The maximum period covered is 1990-1999. The regression

analysis supports the prediction that industries in accession countries under investigation tend to

locate where productivity factors are abundant and/or costs are low. Labour intensive industries

tend to locate in regions with labour abundance while research oriented industries are

concentrated in regions with higher shares of researchers in employment. Lager regions have

lager shares of manufacturing activity. Industries with economies of scale are positively and

significantly correlated with shares of industries. Finally, geographic proximity to European core

matters for location of industries in accession countries.

We try to estimate the model similar to Midelfart-Knarvik et al. (2000) and Traistaru et al. (2002)

using available regional data of Latvia in 1997, 1998, and 1999. We use the same hypotheses, i.e.

regional specialization and industrial concentration patterns are determined by the interaction of

regional and industry characteristics. We analyse changes in regional specialization and industry

location by regressing the log share of industry i in region j (sijS) on regional and industry

characteristics, after controlling for the size of regions by means of the log share of population

living in region j (popj) and of the log total manufacturing located in region j (manj), using the

following specification:

ln(sijS) = c + α ln (popj) + β ln (manj) + Σk β [k] )y[k]j – γ [k]) (z[k]i – κ[k]),

where

sijS:

the share of industry i in region j;

the share of population of region j;

popj:

manj:

the share of total manufacturing located in region j;

y[k]j:

the level of kth region characteristics in the jth region;

z[k]i:

the level of the kth industry characteristics in the industry i;

α, β, β [k], γ [k] and κ[k]:

the coefficients to be estimated.

Note:

•

the kth region characteristics is matched with kth industry characteristics;

•

the share of industry i in region j (sijS) is computed using value added data. For

comparison purposes, the same regressions were run with sijS computed using

employment data.

This general simulation model incorporates both factor abundance and new economic

geography models. The first two variables appearing on the right hand side (ln (popj) and ln

(manj)) capture regional size effects – all else equal, we would expect larger countries to have a

larger industrial share in any given industry. These variables are therefore needed to correct for

25

�the disparity in the size of the regions. The remaining terms should capture the interaction

between regional and industry characteristics. Details on regional and industry characteristics are

shown in Table 4.1.

Table 4.1.

Regional and Industry Characteristics

Variable name

Description

REGIONAL CHARACTERISTICS

Market potential (MP)

Average regional wages (deflated at national level) divided by the average

distances from country capital to district towns and cities of the region (in km)

Labour Abundance (LA)

Sum of employment and unemployment, divided by the population in working

age (15-65 years)

Agricultural

Abundance (ALA)

Share of agricultural land in the region

land

INDUSTRIAL CHARACTERISTICS

Scale economies (SE)

1 = low, 2 = medium, 3 = high (definition by Pratten, 1988)

Technology level (TL)

1 = low, 2 = medium, 3 = high (definition by OECD, 1994)

Labour intensity (LI)

Labour Intensity dummy (definition by OECD, 1994) [LI 1]

Alternative: estimated share of employment in industry i based on Latvian Labour

Force Survey raw data [LI 2]

Agricultural input intensity

(AII)

Note:

1 = low, 2 = medium, 3 = high (definition by OECD, 1994)

Since the available classification of industries is quite aggregated we were sometimes forced to ‘average’

the qualitative characteristics proposed by Pratten (1988) and by the OECD (1994).

Source: author’s presentation

Midelfart-Knarvik et al. (2000) also suggest using R&D and Research orientation data, as well as

shares of persons with secondary and higher education in total population and shares of nonmanual relative to manual workers for analysis, but, unfortunately, data for these pairs of

variables was not fully available for Latvia at regional/industry level.

Theory tells us which regional characteristics should be interacted with which industry

characteristics. We focus on just three regional characteristics and four industry characteristics,

giving the six interactions listed in Table 4.2. Two facts drive our choice of these particular

interactions. First, they are emphasised by theory. Second, they all had a significant effect in

other empirical studies.

26

�Table 4.2.

Interaction Variables: Industry/Regional Characteristics Interactions

REGIONAL CHARACTERISTICS

INDUSTRY CHARACTERISTICS

Market potential (MP)

Scale economies (SE)

Market potential (MP)

Technology level (TL)

Labour Abundance (LA)

Labour intensity (LI)

Agricultural land Abundance (ALA)

Agricultural input intensity (AII)

Source: author’s presentation

We first briefly consider the interaction variables. The last two pairs of variables are factor

abundance and factor intensity measures. Theory dictates the obvious pairing of each quantity

measure of factor abundance with a measure of the share of that factor in each industry.

The labour abundance (LA) is used to identify the relative regional abundance this input factor.

The labour abundance factor is interacted with the importance of labour as a production factor

(LI). The interaction variable LALI should be interpreted on the basis of the idea that industries

that highly value some production factors, for example, labour abundance for labour-intensive

firms, tend to locate in areas in which labour is abundant. Since we are focussing only on the

structure of manufacturing, we take into account ‘agriculture abundance’ of each region

measured by land. As for intensity measure we employ agricultural input intensity in an industry

to be interacted with agriculture land abundance of the respective region. We do not have a

separate interaction for capital endowments and intensities, because of rather high degree of

capital mobility.

The first two pairs of variables are interactions suggested by some of the work on new economic

geography. Market potential measures the centrality of each location, it intends to compare

regions inside the same country in the context of a closed economy2, and the two corresponding

industry characteristics capture the following arguments. Interaction between market potential

and economies of scale give an indicator of proximity to markets that captures the idea that

industries with higher economies of scale (and perhaps also, therefore, less intense competition)

may tend to concentrate in relatively central locations (Krugman, 1980; Midelfart-Knarvik,

2000). Interaction between market potential and the technology level captures similar tendency to

concentrate closer to the centre. Unfortunately we could not check the hypothesis of forwards

2

Traistaru et al. (2002) also computes market potential indicator in relation to EU to check whether increasing

integration with the EU has led to reallocation of activity (industries) from central to regions bordering the EU. We

do not employ this indicator here since none of regions of Latvia is bordering with the EU.

27

�linkage (location close to producers of intermediate goods) or backward linkage (location near

their customers to minimise transport costs on final sales) due to rather poor data available.

Notes on estimation:

1. The data requires that we estimate a single relationship over all industries and regions.

Estimating industry by industry is ruled out, since there are only 5 regional observations;

we cannot increase the number of observations by pooling across time due to a short data

period available – a typicall problem for a transition economy. The regressions are run

separately for each year using OLS pooling across industires;

2. The models are estimated using early data due to limited time period covered as well as

search for structural breaks and regional business (production) cycles.

3. Contrary to Midelfart-Knarvik et al. (2000), for various reasons we estimated our models

on level data instead of computing a 4-years moving average. The first reason for this

choice is the limited time period covered by our data set. Secondly, we compare regions

instead of countries: it is plausible that regional differences in business cycle are lower

than differences that may be observed among countries. Finally, this approach may enable

us to better identify structural breaks that may occur in our data set.

When we estimate the equation, we derive estimates of the three key parameters for each

interaction variable - that is, estimates of β [k], γ [k] and κ[k]. We also derive estimates for the

impact of the two scale variables - that is, estimates of α and β. In the discussion of our results,

we concentrate on the β [k]’s that measure the sensitivity of all industries to variations in the

location characteristics. Taking as an example of labour intensity (LI), if LI is an important

determinant of location patterns, then we should see a high value of β [LI]. The estimate of κ [LI]

tells us the level of labour intensity that separates industries in to ‘high’ and ‘low’ labour

intensive industries. The estimate of γ [LA] tells us the level of labour abundance that separates

regions in to ‘abundant’ and ‘scarce’ labour regions. Industries that are highly intensive (relative

to κ [LI]) will be attracted to regions that are relatively abundant (relative to γ [LA]). Likewise,

industries that have low intensity (again, relative to κ [LI]) will be attracted to regions where

labour factors are scarce (again, relative to γ [LA]). To emphasise, this need to consider both high

and low intensities and high and low abundance is a result of the general equilibrium nature of

the system that makes estimating these relationships so complex.

28

�4.1.2. Estimation Results

Results are given in Table 4.3.We present only standardized coefficients here.

The first two rows give results for the two size variables - measures of population share (share in

total population of Latvia) and manufacturing share (share in total Latvian manufacturing). The

next three rows (regional chars.) give the estimated coefficients on y[k], the regional

characteristics. From the estimating regression, we see that this is an estimate of - β [k] κ[k]. If

we divide through by the estimate of β [k] this will provide an estimate of the cut-off point

defining high and low intensity. The next four rows (industry intens.) give the estimated

coefficients on z[k], the industry intensities. Again, from the estimating regression, we see that

this is an estimate of - β [k] γ [k]. Now, if we divide through by the estimate of β [k] we get an

estimate of the cut-off point defining high and low ‘abundance’. Finally, the next six rows

(interactions) give the coefficients on the interaction variables. From the estimating equation, we

see that this is an estimate of β [k] – the sensitivity of industry location to the various country

characteristics. In the discussion that follows we concentrate on these sensitivity estimates, which

capture the changing importance of the various factors driving industrial location patterns.

The columns of the results table also need some clarifications. Column 2 and 3 provide signs of

the respective variables in Midelfart-Knarvik et al. (2000) and Traistaru et al. (2002) estimations

for comparison purposes. These signs determine our expectations of signs of our variables.

Columns 4-10 depict regression results for different time periods, with different dependent

variables (Gross Value Added vs. Employment) and alternative definitions of labour intensity

variable ([LI 1] and [LI 2], see Table 4.1.).

29

�Table 4.3.

Regression Results

Model

Regression 1

1997 GVA [LI 1]

Regression 2

1998 GVA [LI 2]

Regression 3

1998 EMPL [LI 2]

Regression 4

1998 GVA [LI 1]

Regression 5

1998 EMPL [LI 1]

Regression 6

1999 GVA [LI 1]

Regression 7

1999 EMPL [LI 1]

Stand. Coef. (t)

(0,516)

Stand. Coef. (t)

(0,442)

Stand. Coef. (t)

(0,327)

Stand. Coef. (t)

(0,899)

Stand. Coef. (t)

(,997)

Stand. Coef. (t)

(-0,764)

Stand. Coef. (t)

(-0,647)

0,211

(0,410)

-0,568

(-0,704)

0,107

(0,343)

-0,088

(-0,137)

-0,017

(-0,051)

-0,343

(-0,502)

0,752

(1,241)

-0,337

(-0,448)

0,781

(1,293)

-0,683

(-0,914)

-0,592

(-0,441)

excluded

-0,434

(-0,365)

excluded

-0,886

(-1,173)

excluded

-0,744

(-1,314)

0,561

(0,335)

0,358

(1,111)

-0,202

(-0,583)

0,319

(0,213)

0,276

(0,939)

-0,205

(-0,636)

Variable

Constant

SIZE VARIABLES

ln(popi)

ln(mani)

Sign MK

+

Sign Tr

+

0/+

+

0/+

REGIONAL CHARACTERISTICS

Market potential

-

0/-

excluded

excluded

excluded

Labour abundance

+/-

0,050

(0,304)

-0,409

(-0,863)

-0,029

(-0,253)

-0,409

(-0,998)

-0,041

(-0,324)

-0,470

(-1,094)

-0,649

(-0,855)

0,144

(0,855)

-0,614

(-1,072)

-0,168

(-0,863)

0,429

(2,936)***

0,189

(0,495)

-0,074

(-0,308)

-0,119

(-1,121)

0,087

(0,942)

0,213

(1,754)*

-0,084

(-0,501)

-0,190

(-1,773)*

0,094

(0,922)

0,203

(1,525)

-0,046

(-0,248)

-0,024

(-0,156)

0,304

(2,295)**

0,378

(1,082)

-0,034

(-0,146)

-0,166

(-1,084)

0,359

(2,616)***

0,278

(0,758)

0,071

(0,269)

-0,027

(-0,159)

0,339

(2,299)**

0,424

(1,084)

-0,037

(-0,143)

-0,165

(-1,084)

0,359

(2,620)***

0,278

(0,759)

0,071

(0,297)

0,312

(2,825)***

0,242

(1,267)

-0,326

(-0,846)

-0,059

(-0,254)

0,068

(0,892)

0,036

(0,278)

0,481

(4,439)***

-0,094

(-0,556)

0,025

(0,314)

0,080

(0,586)

0,564

(4,762)***

-0,168

(-0,07)

0,197

(1,958)**

0,135

(0,770)

-0,557

(-1,571)

-0,156

(-0,680)

0,293

(2,869)***

0,242

(1,357)

-0,649

(-1,746)*

-0,324

(-1,360)

0,221

(1,961)*

0,153

(0,778)

-0,624

(-1,573)

-0,176

(-0,684)

0,293

(2,871)***

0,243

(1,360)

-0,649

(-1,747)*

-0,324

(-1,361)

ln (sijs)=the share of

gross value added of

ind. j in reg. i

0,213

0,091

115

ln (sijs)=the share of

gross value added of

ind. j in reg. i

0,677

0,625

115

ln (sijs)=the share of

employment of ind. j

in reg. i

0,575

0,512

115

ln (sijs)=the share of

gross value added of

ind. j in reg. i

0,396

0,299

115

ln (sijs)=the share of

employment of ind. j

in reg. i

0,295

0,191

115

ln (sijs)=the share of

gross value added of

ind. j in reg. i

0,245

0,124

115

ln (sijs)=the share of

employment of ind. j

in reg. i

0,295

0,191

115

Agricultural land

abundance

INDUSTRY CHARACTERISTICS

Economies of scale

-

-

Technology level

+

Labour intensity

0

Agricultural input

intensity

INTERACTIONS

Market potential *

Economies of scale

Market potential *

Technology level

Labour abundance *

Labour intensity

Agricultural land

abundance * Agricultural

input intensity

Dependent variable

R2

Adjusted R2

Number of observations

+

+

+

+

Notes:

1) excluded

the variable was excluded by the econometric programme while running the regression

2) * = significant at 10% level, ** = significant at 5% level, *** = significant at 1% level

Source:

authors’ calculations

30

�As shown in Table 4.3., the first two independent variables of the model ln(pop) and ln(man)

soak up regional size differences, as expected. Unfortunately, these variables turned to be not

significant.

Concerning the regional characteristics, the coefficient of market potential variable, that is an

increasing function of the wage level, should be negative meaning that the industry share (sijS) is

lower in these regions where wages are higher – in general industries tend to locate in regions

where wages are lower. On the other hand, the MP variable is also a decreasing function of

distances with the core of the market. The negative sign imply that the industry share (sijS) is

lower in regions that are located near the core. Our results provide both positive and negative

coefficients, but none are really significant. The reason for this contradiction in Latvia could be

the location of most industries around the capital and higher wage in the capital in comparison

to other regions.

The negative labour abundance (LA) coefficients may mean in general that regions are not

labour intensive and may therefore attach a low value to the labour as productivity factor.

Second, labour may be abundant in every region and therefore the relative abundance of this

production factor may not influence the choice of location of industries. Further analyses are

then needed in order to confirm these hypotheses. The significantly positive LA coefficient

means that labour intensive industries tend to locate in regions where labour is relatively

abundant. Again, we have both positive and negative coefficients in our regressions, but not

significant.

We expected a negative agricultural land abundance (ALA) coefficients, meaning land

abundance in every region and therefore the relative abundance of this production factor may

not influence the choice of location of industries. Our coefficients turned to be negative, but not

significant.

Concerning the industry characteristics, Table 4.6. shows that the coefficient of the scale

economies (SE) variable is negative and even significant for Regression 3. The negative

coefficient for SE may be related to our rough classification of industries in three levels of scale

economies. Al