Fill and Sign the Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio Form

Convenient instructions for preparing your ‘Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the comprehensive tools integrated into this user-friendly and affordable platform to transform your method of document management. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all effortlessly, requiring just a few clicks.

Follow this step-by-step tutorial:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our template library.

- Edit your ‘Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio’ in the editor.

- Select Me (Fill Out Now) to finish the form on your end.

- Add and assign fillable fields for others (if necessary).

- Continue with the Send Invite setup to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you must collaborate with others on your Wage And Tax Statement 20 Employer Instructions Ohio Tax Ohio or send it for notarization—our solution provides everything you need to achieve those tasks. Sign up with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

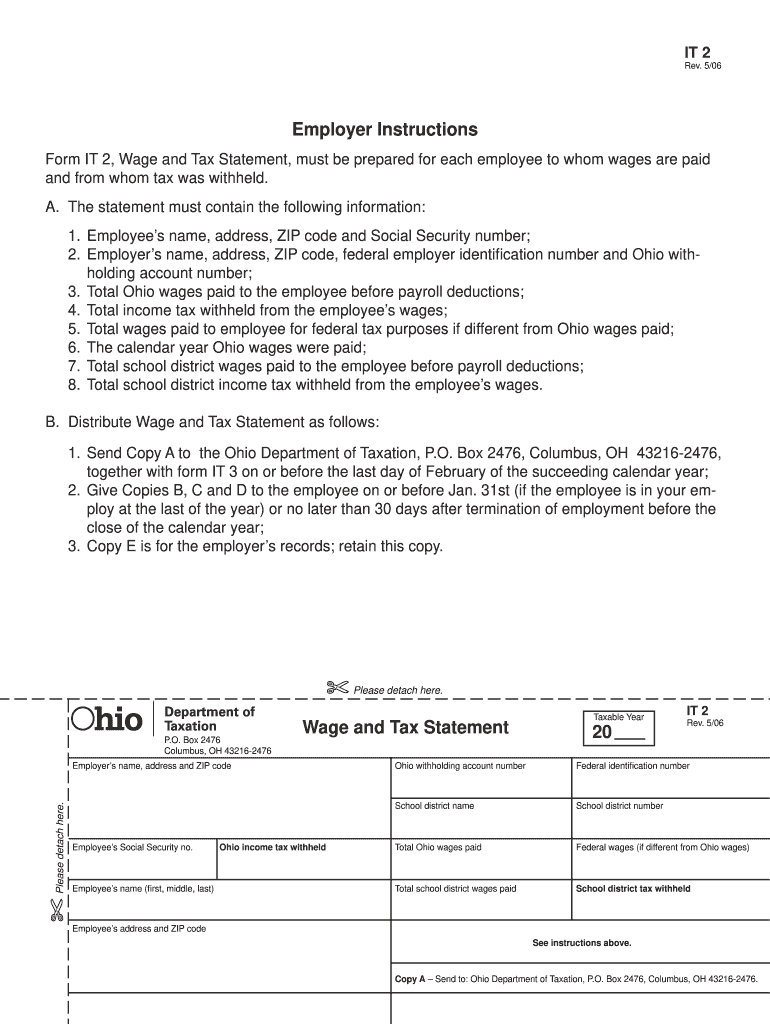

What is the Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio?

The Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio provides essential guidelines for employers on how to accurately report employee wages and tax withholdings to the state. This document ensures compliance with Ohio tax laws and helps avoid penalties during tax season.

-

How can airSlate SignNow help in managing the Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio?

airSlate SignNow simplifies the process of completing and submitting the Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio by offering an intuitive platform for eSigning and document management. With our solution, you can easily fill out, sign, and send required forms quickly and securely.

-

What are the features of airSlate SignNow that assist with Ohio tax documentation?

airSlate SignNow offers features like customizable templates, secure cloud storage, and easy integration with other software to streamline the documentation process for the Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio. These features ensure that you can manage your tax documents efficiently.

-

Is there a cost associated with using airSlate SignNow for Ohio tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, ensuring that you can manage Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio without breaking the bank. Our cost-effective solution provides excellent value for the features offered.

-

Can airSlate SignNow integrate with payroll systems for Ohio tax forms?

Absolutely! airSlate SignNow seamlessly integrates with popular payroll systems, making it easy to manage the Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio alongside your payroll processes. This integration helps ensure accuracy and efficiency when handling tax-related documents.

-

What are the benefits of using airSlate SignNow for tax documentation in Ohio?

Using airSlate SignNow for the Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio offers numerous benefits, including enhanced security, reduced errors, and faster turnaround times. Our platform allows for efficient collaboration and ensures you stay compliant with Ohio tax regulations.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents, employing advanced encryption and secure access controls to protect sensitive information related to the Wage and Tax Statement 20 Employer Instructions Ohio Tax Ohio. You can trust that your data is safe with us.

Find out other wage and tax statement 20 employer instructions ohio tax ohio form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles