Fill and Sign the Wwwflorida Mortgage Lenderscom Form

Valuable advice on preparing your ‘Wwwflorida Mortgage Lenderscom’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features included in this user-friendly and cost-effective platform and transform your method of paperwork management. Whether you need to authorize forms or collect eSignatures, airSlate SignNow effortlessly manages it all, requiring just a few clicks.

Follow these comprehensive steps:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form collection.

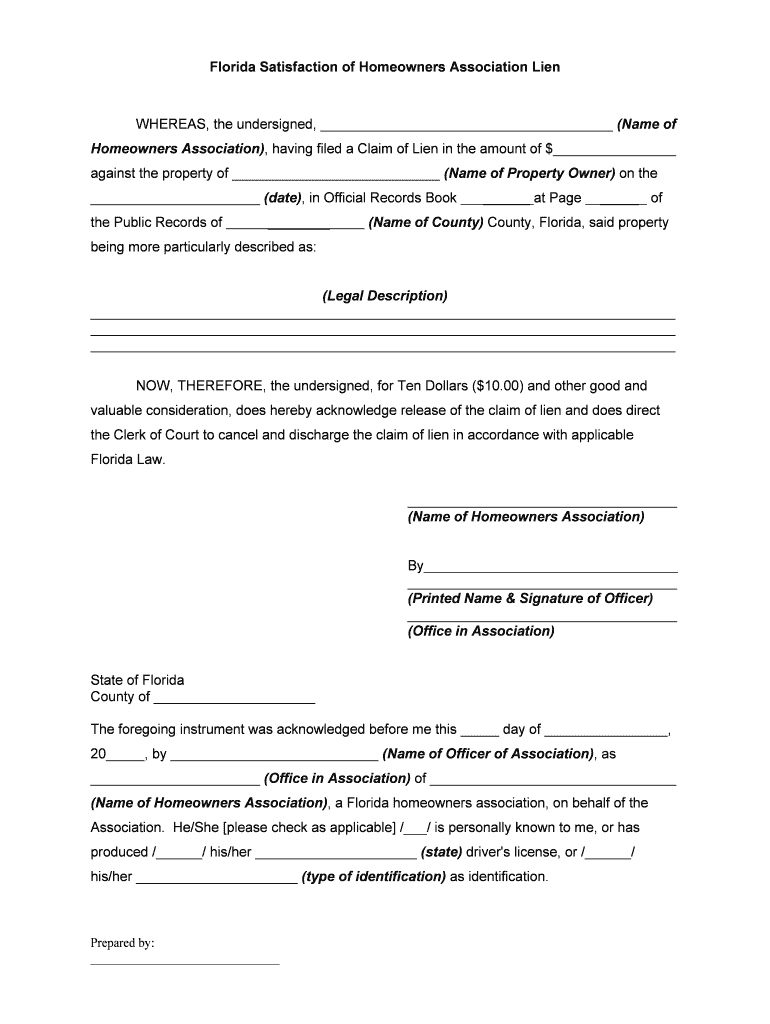

- Open your ‘Wwwflorida Mortgage Lenderscom’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Insert and designate fillable fields for other individuals (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t worry if you need to collaborate with others on your Wwwflorida Mortgage Lenderscom or send it for notarization—our platform provides you with everything you require to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What services do Www florida mortgage lenders com provide?

Www florida mortgage lenders com offers a variety of mortgage lending services tailored to meet the needs of Florida residents. They provide options for home purchases, refinancing, and various loan types, ensuring that customers find the best fit for their financial situation.

-

How can I apply for a mortgage through Www florida mortgage lenders com?

Applying for a mortgage through Www florida mortgage lenders com is straightforward. You can start the application process online by filling out a simple form, which will guide you through the necessary steps to secure your mortgage.

-

What are the typical interest rates offered by Www florida mortgage lenders com?

Interest rates at Www florida mortgage lenders com vary based on market conditions and individual borrower profiles. It's best to check their website or contact their representatives for the most current rates and personalized quotes.

-

Are there any fees associated with using Www florida mortgage lenders com?

Yes, Www florida mortgage lenders com may charge various fees, including application fees, origination fees, and closing costs. It's important to review these fees upfront to understand the total cost of your mortgage.

-

What features does Www florida mortgage lenders com offer to streamline the mortgage process?

Www florida mortgage lenders com provides several features designed to simplify the mortgage process, including online applications, document uploads, and real-time status updates. These tools help ensure a smooth and efficient experience for borrowers.

-

Can I refinance my mortgage through Www florida mortgage lenders com?

Absolutely! Www florida mortgage lenders com offers refinancing options that can help you lower your monthly payments or access equity in your home. Their team can assist you in finding the best refinancing solution for your needs.

-

What benefits can I expect from choosing Www florida mortgage lenders com?

Choosing Www florida mortgage lenders com means you will benefit from competitive rates, personalized service, and a streamlined application process. Their commitment to customer satisfaction ensures that you receive the support you need throughout your mortgage journey.

The best way to complete and sign your wwwflorida mortgage lenderscom form

Find out other wwwflorida mortgage lenderscom form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles