Have you ever filed your taxes only to find soon-after that a new payment was received, or that you had forgotten a transaction (or five) during the course of the year? It happens, and more often than you’d think. Sometimes, people will defer invoices or collecting prizes until after the close of the fiscal year so that their accountants or tax professional can accurately complete all tax documents on time. And in other times, the choice to defer or rush prize collections or invoices just is not possible. Thankfully, unlike in many other countries in the world, the United States’ Internal Revenue Service (IRS) allows us to augment and amend our returns so that we may maintain ourselves within the boundaries of the law. To be honest, tax codes change with every Congressional and Senatorial election, and without the availability of amendments when we do not know what has changed, I think we would all have been in trouble more than once.

Most of us know that we can e-file our taxes and sign them electronically, Intuit’s Turbotax has been a long-time standard for e-filing. But are there any limitations to e-filing and eSignatures in regards to standard and amended tax return filings?

When you file a tax return that does not have any income listed, have no ability to have a return on anything earned, and are without tax credits, most services, like Turbotax, will give you the documents themselves to download, print, and sign. These documents will be filled with the data you have already entered and you will need to mail them in for both the federal and state level. However, if you are an expatriate or are overseas in another capacity (such as a Government contractor, service member, or volunteer) with a home of record (HOR) within the United States, this can prove to be a little tricky.

Are there other limitations to e-filing amended returns?

Yes, as of September, 2020, and according to the IRS website, the 1040 and 1040-SR returns can be amended electronically but only for the tax year of 2019. The website also gives references to check IR-2020-107 and IR-2020-182 for more information.

Who can e-file your taxes?

Electronically filed taxes can only be done by an ERO (Electronic Return Originator) via an IRS e-file. An ERO is a business or person that is able to originate federal level income tax returns electronically for the Internal Revenue Service. They are, essentially, a registered tax professional who meets the requirements or the IRS (Internal Revenue Service). Let’s dive a little deeper into what an ERO is, and what qualifies as an acceptable form of signature according to the IRS.

Let’s start with what counts as an acceptable electronic signature, according to the IRS. There are a number of methods the IRS accepts, and as of September 2020, the list is as follows:

- A signature that is handwritten on a pad designed for eSignatures

- A signature, command input, or mark captured on a display via stylus

- A digital image of a signature that was handwritten, which is attached to the electronic record

- A typed name

- A shared secret like a password, secret code, or PIN to sign the e-record

- A digital signature

- A captured graphic form of a mark

Later on we will discuss a little about some of these different forms of electronic signatures.

What are some of the responsibilities and requirements of an ERO when it comes to eSignatures?

For starters, the ERO must use software that has identity verification, which must record specific information. This information includes:

- An image of the signed form

- The time and date of the signature

- The results of the identity verification of the taxpayer

- The method of eSignature that was used for the process

Additionally, for those who remotely file (When the taxpayer is not physically at the IRS authorized ERO’s office):

- The IP (Internet Protocol) Address of the taxpayer’s computer

- The login information, such as the username of the taxpayer

Can anything go wrong when e-filing?

There can be what is known as “Identity Verification Failure”, which is to say that for the authentication questions used to identify the taxpayer, if there is a failure to answer correctly on the first three tries, the taxpayer must provide a wet-signature on paper.

But how do identity verification questions work?

The software the ERO uses can do something called a “soft inquiry” on the taxpayer’s credit history. This “soft inquiry” generates questions based on the taxpayer’s past finances such as previous phone numbers, the name of the bank their mortgage is through, the make, year, or model of the car they have received a loan for, or an address they were previously a resident of.

What are the two methods that a taxpayer may use to sign an e-filed return?

The two methods available to taxpayers for e-filing include in-person e-filing and remote e-filing, but what does that mean? When you e-file, you probably think of going to your website of preference, such as 1040Now and doing everything from the comfort of your home or office, heck, maybe even your mobile device on the bus. That would be what is known as remote e-filing. When you remotely electronically file your taxes, you must use software that meets stricter guidelines than in-person ERO filings. The stricter rules are specifically two forms of verification and record keeping which protect both the taxpayer and the ERO.

The first of these two is your IP address, or the special numbers showing your computer's location or network based on the ISP (Internet Service Provider) to ensure that you can identify the device or physical location in which you performed that year’s return. The second is the login information you used to access the software, typically this is the username that you can identify if necessary.

However and additionally, the taxpayer’s self-select PIN and their AGI of the previous year or the previous year’s self-select PIN is required. The self-select PIN is a five number code you can select as a form of electronic signature.

For in-person e-filing, the normal e-filing rules apply and the taxpayer’s device location isn’t necessary, nor is their username. Although the ERO should always also provide their own eSignature, as is the case with paper forms and adding a wet-signature to the Paid Preparer table at the bottom of page 2 of form 1040.

Now that you know how to place an electronic signature on a tax document, let’s discuss a little more about the rules to amending our IRS forms.

What are the timetables for amending your tax returns?

You might be asking yourself in regards to electronic signatures, “what if I filed an amended return last year?”

Interestingly, the IRS has three years to audit your tax returns, and the statute of limitations does not receive an extension if you are to amend your taxes just 30 days before the three year limit. However, it is recommended to always be honest and file every correction as you learn of a mistake. If, for example, you do file your amendment 30 days before the three year statute of limitations expiration, the IRS then has 30 days from the time they receive it to begin an audit. Additionally, if your amended return shows an increase in owed taxes, you will likely owe fines or penalties, and will owe interest.

Interest is accrued on any taxes that were not paid by the date they were due, and of which, the IRS will compute it themselves. Penalties received can be contested or paid.

Is there another way to electronically sign our tax returns and IRS forms?

The short answer is yes! However, there are some caveats we should be aware of. For example, these forms should be physically mailed into the tax office if they are not completed through an IRS approved ERO.

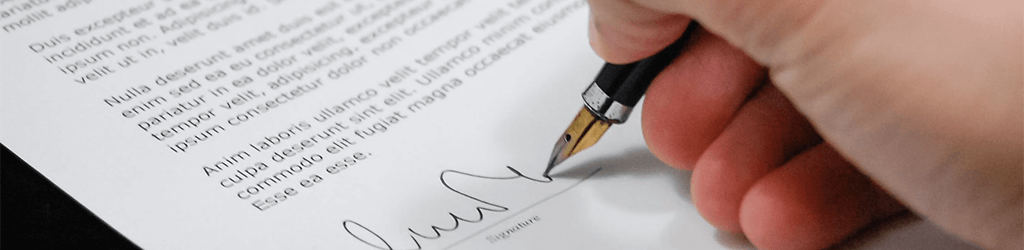

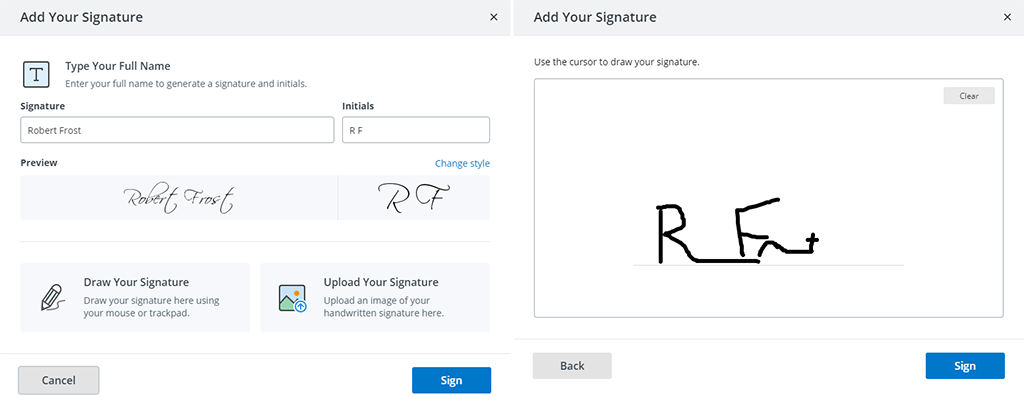

It is possible to use an electronic signature that is drawn or typed, accompanied by a record of information, on a digital device which represents your real signature. In the case of taxes, if you would prefer an electronic format, it is best to use a drawn signature on mobile, with a mouse, or on an electronic signature pad. However, in the situation of taxes, nothing is superior to a wet-ink signature.

And that is just the tip of the iceberg on how to sign a PDF tax return. Let’s dive in

How to sign a PDF tax filing, or any PDF file can be as easy as a few clicks and a few strokes of your finger. When you have a PDF form, you can upload it to airSlate SignNow and add fields to the areas that need entries. We will talk about that later.

Can I fill out a tax form in airSlate SignNow without signing it?

Yes, it is entirely possible. First of all, upload your form or document to airSlate SignNow. Now there are two methods to approaching this situation. First we will discuss one that is a little more prone to requiring a complete restart of the process, and afterward we will discuss another alternative.

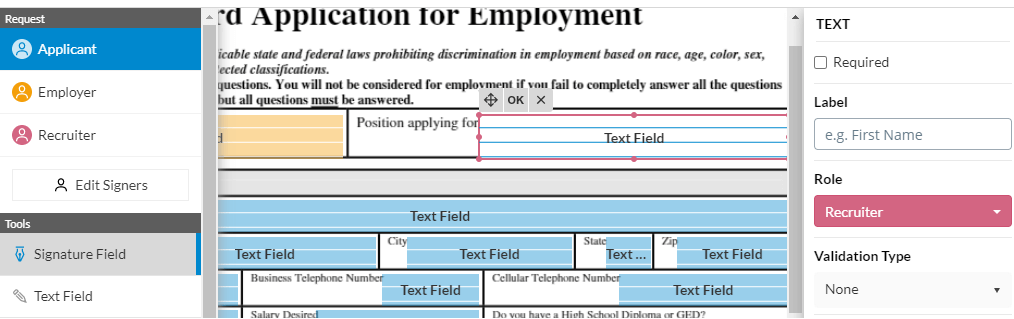

In the first scenario add your fields from under Edit & Sign. Select Text for numerical and alphabetical entries for information such as your address. You can also use the text field to place an “X” in areas such as your filing status.

Signature field from the area entitled Edit & Sign. You can also grab the Today’s Date field if you so choose.

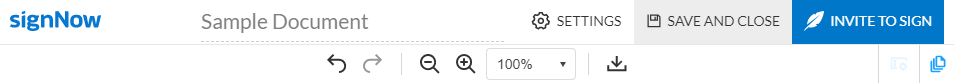

When you are happy with the layout and information you have entered, simply hit Done or Save and Close and reopen the document to download it, to be sure all changes have been applied. However, be mindful that once done and saved, this process is permanent to this copy of the document. If you need to make any changes, you will have to start from scratch.

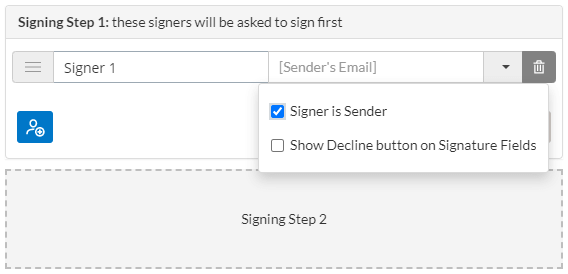

The second method is more robust and is reusable. In this scenario, simply go to the top left corner of the page and hit Edit Signers.

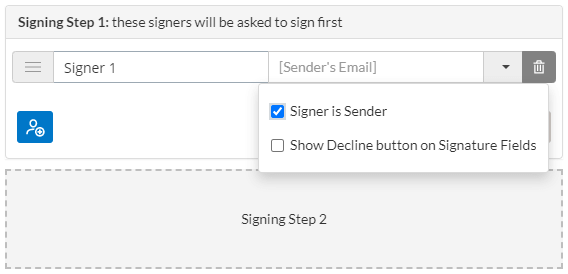

In the new pane, select the arrow next to the trash-can on the row with the signer, and press Sender is Signer. Apply the changes by clicking Save Signers.

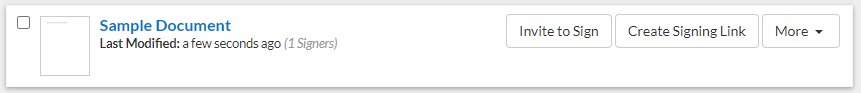

Now layout your Text Fields and other input fields according to your needs; for example you could need to add additional fields for text, several dates, etc. Once you are happy with the layout of the document, press Save and Close. Now you can create a copy of this document from the Homepage or even create a template for it.

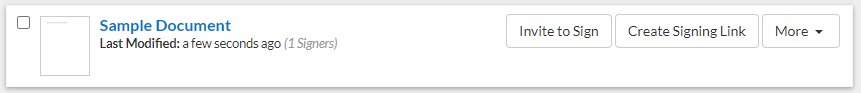

Finally, when you find the Invite to Sign button on this document, click it. Your email will automatically be populated because we set the Signer is Sender parameter earlier. When you have sent the email and received it, filling it in is all you need to worry about. Once done, you can download the document and print it. Voila, that is it!

We have already discussed how to eSign tax returns, how to file taxes with electronic signatures, and touched on where to go to find an ERO with authorization by the IRS to sign your e-file. We have also discussed how to fill out a PDF format IRS form on our platform, and even some tax rules and regulations. Now that we have come so far, let’s go all the way and discuss more of the features we have to offer.

How can I integrate electronic signatures into multi-signer workflows?

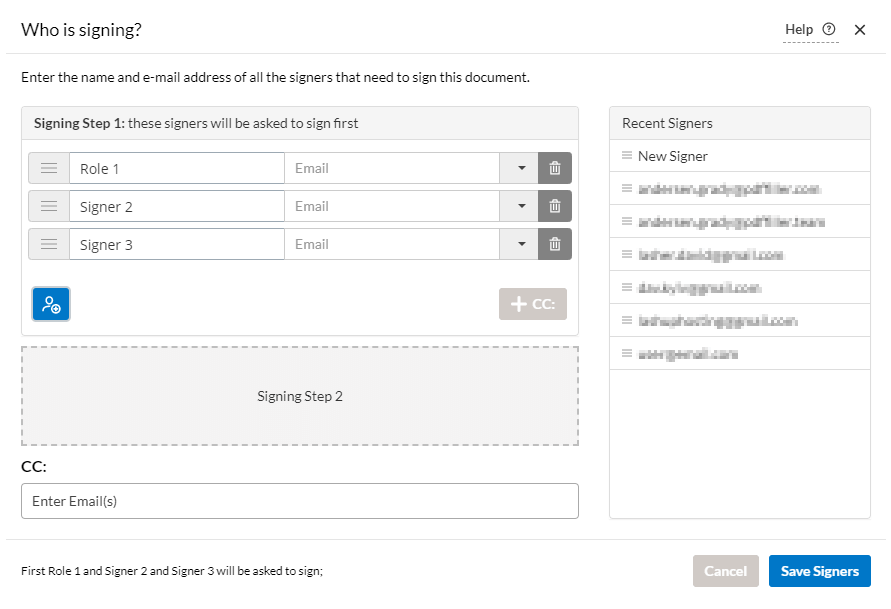

The process is the same as before, but instead of one signature field, we need to add more, and add more signers to our document. If we are not signing this document, do not tick Signer is Sender.

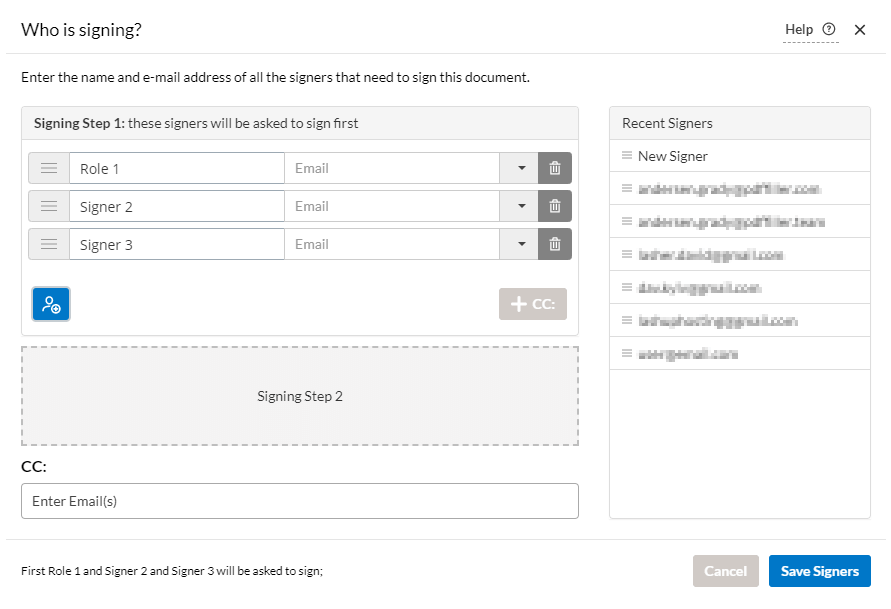

To accomplish this, we need to go to the top-left of the page and press Edit Signers. Here, we will be able to add signers, give them names for their role to make it easier to track, and set the signing order for the document.

To add a signer, press the add signer button and a new bar will appear.

Once you have sorted out your signers, we can go back to the document and start worrying about field assignment.

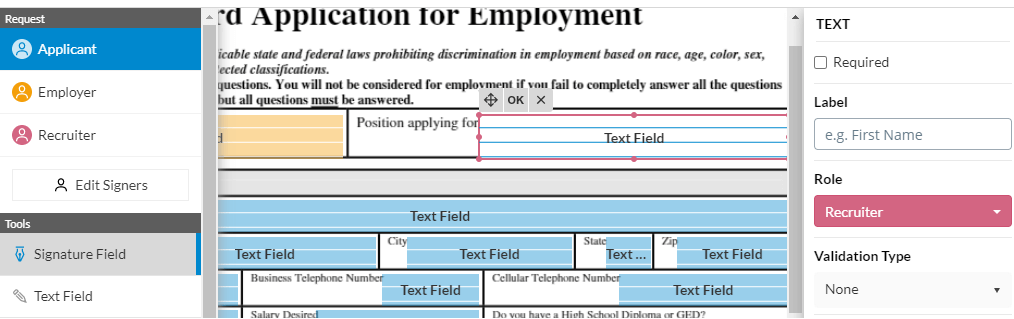

If we select a field which we would like to assign to a specific signer, we simply go to the right-hand panel and under Role, select the role we want to have access to this field.

We will repeat this process until all fields have been appropriately assigned.

When we are finished, we will proceed to click the Invite to Sign button as we did before, but this time we will just need to add more information. Once we have sent the invite, all parties will be notified.

Since we have talked about laws, and have already walked through the process of getting eSignatures, it might be a good time to talk about the ESIGN Act itself.

The law is the law: doing business and staying compliant in the digital age

What is the ESIGN Act?

The ESIGN Act is a law that was passed in the year 2000 as a method to unify State legislation, create a national standard, and to keep the American economy up-to-date with the rest of the world. It describes the process in which eSignatures may be captured, what they cannot be used for, as well various consumer protection measures.

The Act, also known as the Electronic Signatures in Global and National Commerce Act, establishes the legally binding nature of electronic signatures. However, electronic signatures are not a replacement for their wet-ink hard copy counterparts, they are simply supplementary to the existing system of legally-binding agreements. Additionally, there are caveats to the law that should be studied by organizations or individuals wishing to have their staff, clients, customers, or partners electronically sign documents.

Consent must be given and if it is rescinded the individual must receive a paper copy of the contract or agreement. However, withdrawing consent after having signed a contract or agreement does not immediately cause the electronic document to become null and void. This is true unless there is evidence sufficient to prove that the individual signed under duress, which is the case for paper documents as well. Bear in mind that the signee must be made aware of the procedure to withdraw consent, as well; and if the signator withdraws consent to a recently signed electronic document, the provider must, within a reasonable amount of time since the document was signed, release the consumer from their obligations.

There is more information that must be provided to the individuals signing our documents electronically; most notably, the consumer must be made aware and kept up to date on the software and hardware requirements to access their documents. When this information is shared after a change in the hardware and software requirements takes place, and if it puts a significant material risk to the loss of access to the consented documents by the consumer, the consumer must be permitted to withdraw consent without fees, charges, or punishment.

While there are documents that cannot use electronic signature, the list is quite reasonable and logical in nature. The exceptions include:

- Codicils, wills, or testamentary trusts

- State laws in regards to divorce, or other legal domestic family matters

- A State’s Uniform Commercial Code outside of the particular sections 1-107 and 1-207 in Articles 2 and 2A

- Court orders or notices

- Official court documents such as briefs, pleadings, and other documents in connection with court proceedings

- Cancellation or termination of utilities such as heat, water, electricity, etc.

- Credit or material defaults, foreclosures, repossessions, accelerations, eviction notices, curing a rental agreement in regards to a person’s primary residence

- Cancellation or termination of Insurance (Health, Life [except annuities], and other)

- Product recalls, material failure, or other dangerous risks

- Any document required for the transportation or handling of hazardous materials, pesticides, toxic or dangerous materials, etc.

A side-note to help clear confusion on one topic of note; trusts can sign electronically unless they are a testamentary trust e.g., created as per the instructions in a living will.

What does the ESIGN Act say about taxes and electronic signatures?

Interestingly, after what we learned earlier, the Act says nothing at all about IRS limitations, and the word ‘tax’ isn’t even used once in all of its pages. However, from a protective standpoint for the people, the requirements the IRS has set forth for ERO’s does have logic behind it. With the security measures, record keeping, and identity verification requirements, it helps keep citizens safe from Identity theft, fraud, and more.

But do not go and start thinking that electronic signatures are unsecure, or more prone to cases of fraud. Up next, we will go over airSlate SignNow’s stance on security and even later, why millions of companies all over the globe are choosing airSlate SignNow for online document management and streamlining eSignature workflows.

Be rest assured that your data is safe and secure with airSlate SignNow

Sign and send documents for signing with industry-leading security and compliance standards as defined in the United States, Europe, and around the world.

Compliance certifications and regulations

SOC 2 Type II certification

SOC 2 is an auditing procedure, a certification process that ensures your service providers securely manage your data to protect your organization's interests and the privacy of your clients.

HIPAA compliance

airSlate SignNow empowers medical professionals, clinics, and hospitals all around the country by enabling their compliance with the Health Insurance Portability and Accountability Act (HIPAA). airSlate SignNow’s eSignature solution protects the private health information of patients by enhancing the security, authenticity, and reliability of electronic records and signatures.

GDPR compliance

airSlate SignNow complies with the EU's General Data Protection Regulation (GDPR). As a security and compliance centric organization, airSlate SignNow considers its data processing and protection of customer’s privacy duties of utmost importance. Customer’s documents are always encrypted at transit and rest with industry grade encryption. We stand prepared to fulfill customer’s rights granted by the GDPR regulation.

ESIGN and UETA compliance

airSlate SignNow complies with the requirements of the Electronic Signatures in Global and National Commerce Act (ESIGN) and Uniform Electronic Transactions Act (UETA) empowering users across the industries and verticals to manage and sign their documents electronically.

PCI DSS certification

The Payment Card Industry Data Security Standards (PCI DSS) certification safeguards cardholder data. airSlate SignNow complies with PCI DSS ensuring the security of customer’s credit card data in its billing practices.

21 CFR Part 11

Organizational settings and functionality within airSlate SignNow assist our customers in complying with their responsibilities pursuant to 21 CFR Part 11. These features include two-factor authentication, session duration and timeouts due to inactivity, eSignature timestamps, digital certifications, and document History retention.

CCPA compliance

airSlate SignNow complies with the California Consumers Protection Act of 2018, ensuring the protection of personal data and personal privacy when collecting and using customer information.

airSlate SignNow takes security very seriously: protecting data is one of our priorities

Data encryption and storage

All user communications are encrypted with the NSA developed SHA-256 encryption algorithm which protects data transfers between users, or a user and a server, against external access. User documents are stored on Amazon S3 data centers located in the US.

Detailed document History and Audit trail

airSlate SignNow creates and maintains a detailed document history, which shows all document activities and who performed them, including full names, email and IP addresses, and time stamps.

Disaster recovery

airSlate SignNow maintains and regularly tests its Disaster Recovery plan. Our Disaster Recovery Plan ensures continuous operations with minimal interruptions in the case of an emergency. This includes procedures to preserve documents and document security.

Two-factor signer authentication

The document creator can add an extra layer of protection to a document by requiring a signer to enter a password or authenticate their identity via a text message or a phone call.

What makes our customers seem to think that our platform is so easy to use for signers and senders? Let’s dive in and go over a quick snippet into eSigning in airSlate SignNow as a recipient

Signing as a recipient

With airSlate SignNow, there is no need for a signer to have an account to sign a document, or a credit card for that matter. You pay for a service, your customers are paying you.

When your signers receive the email and clicks the link to sign your document, there isn’t a login screen or register requirement. If you put user authentication in place, they will be required to follow the authentication procedures you chose before they can continue.

They will be greeted by your document and a small pane welcoming them. This pane lets them know exactly how many fields they need to fill, and reminds them about who sent it.

When they see the document and empty fields, it will appear something like this mockup. This particular example document has two signers associated with it however, the signer only sees the fields he or she is responsible for. This helps mitigate confusion and frustration on the signer’s end.

As they fill out the required fields, they will be guided through the process automatically by our system. It shows them how many fields they have remaining and where they need to look to find their next field.

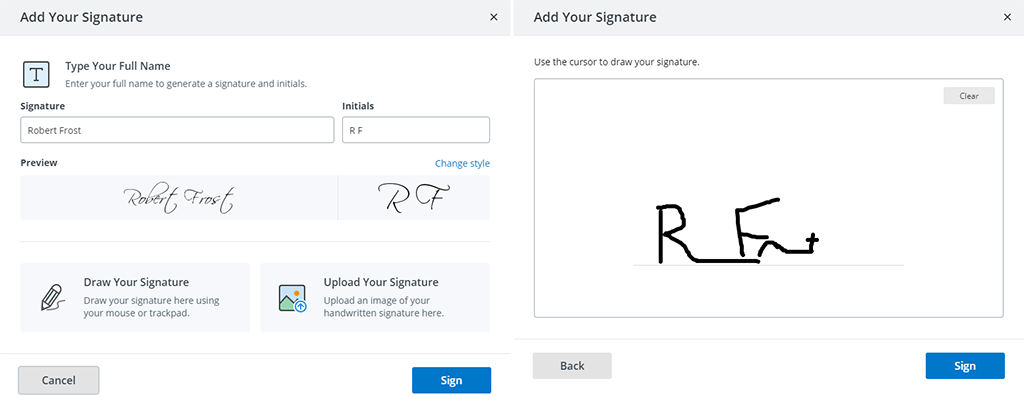

When they have completed the fields throughout your document, they will be greeted with the same signature pane you saw earlier. The process is no different, the system is standardized for ease of use.

When they have signed and completed the document, this is what it will look like on their screen. Well, we really hope you have a better mock-signature than our writer. The next logical step is a big green button that says Done.

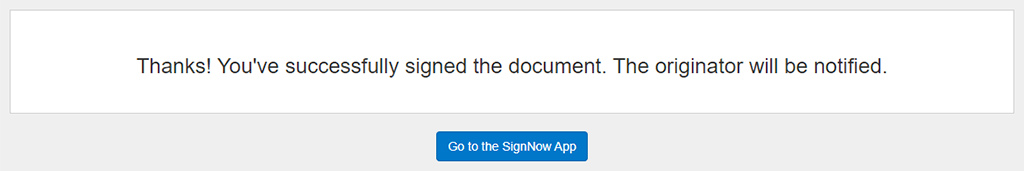

This was it, they have completed the process. And since we didn’t add a redirect link to our invitation to sign, they get this message. If, however, you add a redirect link in the advanced settings, you can send your customers, partners, clients, or whoever you are dealing with to a welcome page, or another selection of your choice. As with anything, it is up to you.

Why airSlate SignNow?

From a number of clients we have compiled their reasons for switching to electronic signatures, their experiences, and why they chose to switch to or started with airSlate SignNow. Some of these clients include:

- GRBM

- Coding Ninjas

- Colliers International

- designs for health

- Pepsi

- Groupama

- NowCerts

- Zionsville Eyecare

- And many more

Use cases and real-life scenarios

Coding Ninjas started off by using one of our competitors but felt they were paying too much money and GRBM was handling so many documents that they managed to save thousands of dollars. NowCerts needed competitive pricing, easy CRM implementation, and ease-of-use for their customers; meanwhile, Pepsi needed to collect numerous notarized affidavits, to collect photos, and gathering the necessary hard copy versions of these was too impractical.

Electronic signatures and the process of going paperless not only saves you time and money when you choose a user friendly platform; it can also make your processes more secure, reliable, and confidential.

designs for health, a nutritional products manufacturer, was having trouble with the service they had been using. It was too complex, too expensive, and furthermore, it was too restrictive on how many documents could be signed in a month; albeit they were paying for a service whose infrastructure should allow for unlimited and unfettered usage. After two years of struggling with our competitor, they needed a solution, and came across airSlate SignNow. Their biggest hurdles were ensuring document confidentiality and integration into their ERP system, which is NetSuite, an airSlate SignNow partner. Our advanced encryption and authentication technology handled the rest. Although they understandably had reservations at first about the switch, it is now used company-wide.

In regards to designs for health, the ease-of-use of airSlate SignNow was a great benefit to them and their team.

Our platform integrates seamlessly with NetSuite, Salesforce, SharePoint, Office 365, Google Apps for Work, and more, which makes life a lot easier. A lot of platforms on the web have only one to three systems they properly integrate with, forcing you to lose control of your data. When your data is strewn across the internet, data security becomes a real concern, and understandably so.

When it comes to document and data management, it is better if companies can choose the cloud and other information technology services they prefer, instead of being boxed in because of the services they use for their workflows.

To sum up and let you get started with an eSignature workflow of your own

Well, we have talked about a lot so far, we hope that it has helped you and that we have answered all of your questions such as: “how to electronically sign an amended tax return filed last year”, “how to eSign a tax return”, “how to sign a tax return in PDF?”, and “how to e-file an eSigned tax return that is amended?”.

While the client use-case scenarios mentioned above sound great, you might be wondering, what can we do for you? We encourage you to check out our free trial, and don’t worry, there is no need to enter your credit card information.