Sign North Dakota Banking Notice To Quit Safe

Contact Sales

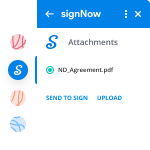

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Discover the easiest way to Sign North Dakota Banking Notice To Quit Safe with our powerful tools that go beyond eSignature. Sign documents and collect data, signatures, and payments from other parties from a single solution.

Robust integration and API capabilities

Enable the airSlate SignNow API and supercharge your workspace systems with eSignature tools. Streamline data routing and record updates with out-of-the-box integrations.

Advanced security and compliance

Set up your eSignature workflows while staying compliant with major eSignature, data protection, and eCommerce laws. Use airSlate SignNow to make every interaction with a document secure and compliant.

Various collaboration tools

Make communication and interaction within your team more transparent and effective. Accomplish more with minimal efforts on your side and add value to the business.

Enjoyable and stress-free signing experience

Delight your partners and employees with a straightforward way of signing documents. Make document approval flexible and precise.

Extensive support

Explore a range of video tutorials and guides on how to Sign North Dakota Banking Notice To Quit Safe. Get all the help you need from our dedicated support team.

Industry sign banking north dakota document secure

Keep your eSignature workflows on track

Make the signing process more streamlined and uniform

Take control of every aspect of the document execution process. eSign, send out for signature, manage, route, and save your documents in a single secure solution.

Add and collect signatures from anywhere

Let your customers and your team stay connected even when offline. Access airSlate SignNow to Sign North Dakota Banking Notice To Quit Safe from any platform or device: your laptop, mobile phone, or tablet.

Ensure error-free results with reusable templates

Templatize frequently used documents to save time and reduce the risk of common errors when sending out copies for signing.

Stay compliant and secure when eSigning

Use airSlate SignNow to Sign North Dakota Banking Notice To Quit Safe and ensure the integrity and security of your data at every step of the document execution cycle.

Enjoy the ease of setup and onboarding process

Have your eSignature workflow up and running in minutes. Take advantage of numerous detailed guides and tutorials, or contact our dedicated support team to make the most out of the airSlate SignNow functionality.

Benefit from integrations and API for maximum efficiency

Integrate with a rich selection of productivity and data storage tools. Create a more encrypted and seamless signing experience with the airSlate SignNow API.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

Trusted esignature solution— what our customers are saying

be ready to get more

Get legally-binding signatures now!

Related searches to Sign North Dakota Banking Notice To Quit Safe

north dakota century code eviction

Frequently asked questions

How do you make a document that has an electronic signature?

How do you make this information that was not in a digital format a computer-readable document for the user? "

"So the question is not only how can you get to an individual from an individual, but how can you get to an individual with a group of individuals. How do you get from one location and say let's go to this location and say let's go to that location. How do you get from, you know, some of the more traditional forms of information that you are used to seeing in a document or other forms. The ability to do that in a digital medium has been a huge challenge. I think we've done it, but there's some work that we have to do on the security side of that. And of course, there's the question of how do you protect it from being read by people that you're not intending to be able to actually read it? "

When asked to describe what he means by a "user-centric" approach to security, Bensley responds that "you're still in a situation where you are still talking about a lot of the security that is done by individuals, but we've done a very good job of making it a user-centric process. You're not going to be able to create a document or something on your own that you can give to an individual. You can't just open and copy over and then give it to somebody else. You still have to do the work of the document being created in the first place and the work of the document being delivered in a secure manner."

How to sign pdf electronically?

(A: You need to be a registered user of Adobe Acrobat in order to create pdf forms on my account. Please sign in here and click the sign in link. You need to be a registered user of Adobe Acrobat in order to create pdf forms on my account.)

A: Thank you.

Q: Do you have any other questions regarding the application process? A: Yes

Q: Thank you so much for your time! It has been great working with you. You have done a wonderful job!

I have sent a pdf copy of my application to the State Department with the following information attached: Name: Name on the passport: Birth date: Age at time of application (if age is over 21): Citizenship: Address in the USA: Phone number (for US embassy): Email address(es): (For USA embassy address, the email must contain a direct link to this website.)

A: Thank you for your letter of request for this application form. It seems to me that I should now submit the form electronically as per our instructions.

Q: How is this form different from the form you have sent to me a few months ago? (A: See below. )

Q: What is new? (A: The above form is now submitted online as part of the application. You will also have to print the form and then cut it out. The above form is now submitted online as part of the application. You will also have to print the form and then cut it out.

Q: Thank you so much for doing this for me!

A: This is an exceptional case. Your application is extremely compelling. I am happy to answer any questions you have. This emai...

How to use electronic signature?

A. A valid electronic signature includes a signature or electronic signature card as defined in NRS (NRS , )

1. A signature or digital signature card is a printed or stored electronic signature that is stored in electronic records maintained by the county clerk for a county, state, or federal office and is not a written signature, an unregistered electronic signature, or an invalid electronic signature.

2. A signature or digital signature card that is not recorded in an electronic database must be presented for signature on demand in accordance with chapter 645, 625, or 626 of NRS.

(Added to NRS by 1997 of NRS by 2007; A 2009, 2484; 2015, 2032)

NRS Signature or digital signature card: Limitations on use, confidentiality and use in evidence; disclosure required for certain purposes.

1. Except as otherwise provided in NRS , a digital or analog signature or digital or analog electronic signature card used to record a signature or digital signature must:

(a) Be used to confirm a signature, but not more often than every 10 working days. The 10-day limit is tolled during periods for state, territorial or local elections when signatures are collected pursuant to chapter 645, 645A, 645B or 645C of NRS, and during the period of time the person collecting signatures is authorized to collect signatures pursuant to NRS

(b) Have a digital or analog security device on that is not more than 20 years after the date of manufacture of the device, that can be activated only by the s...

Get more for Sign North Dakota Banking Notice To Quit Safe

- How Do I Electronic signature Vermont Courts Lease Agreement Form

- Electronic signature Utah Courts Job Offer Mobile

- Electronic signature Utah Courts Job Offer Now

- Electronic signature Utah Courts Job Offer Later

- Electronic signature Courts Form Virginia Online

- Help Me With Electronic signature Vermont Courts Lease Agreement Form

- Electronic signature Utah Courts Job Offer Myself

- Electronic signature Utah Courts Job Offer Free

Find out other Sign North Dakota Banking Notice To Quit Safe

- Tip additional child tax credit american samoa government americansamoa form

- The lower extremity functional scale youngs physical therapy form

- Dmv 1 tr 65560408 form

- The brain activity sleep and boredom worksheet form

- Certificate of residence form monroe community college

- Form 1 mississippi state oil and gas board

- Lampt71a landlordamp39s offer notice private contract oyez form

- Error correction request form nerium

- Ifta lease agreement form

- Mccombs resume template 5210687 form

- Medical oncology hematology patient referral form

- Colorado health care professional credentials application 5509764 form

- Planetary orbit simulator answers pdf form

- Original petition wrongful termination petition form

- 11 cbi sa v2 2 sample success plan kansas department of doc ks form

- Omb number 4040 0003 form

- Marin county superior court form

- Dolphin swim school parramatta form

- 1059 direct deposit form

- Your agency will send the originals of opm form