Sign Debit Memo

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

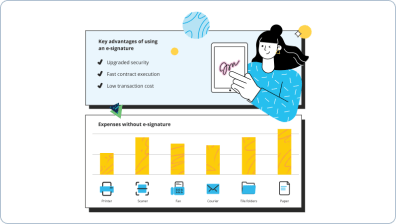

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Excellent document management with airSlate SignNow

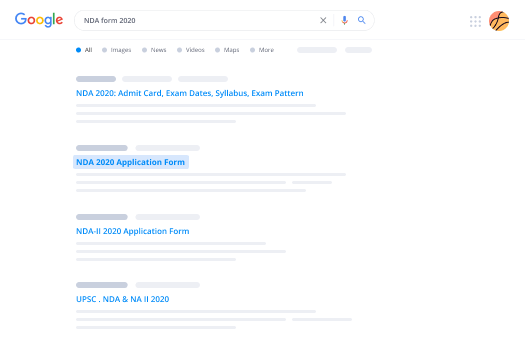

Gain access to a robust form library

Make reusable templates

Collect signatures via secure links

Keep paperwork protected

Improve collaboration

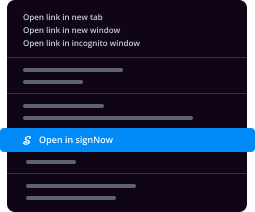

eSign through API integrations

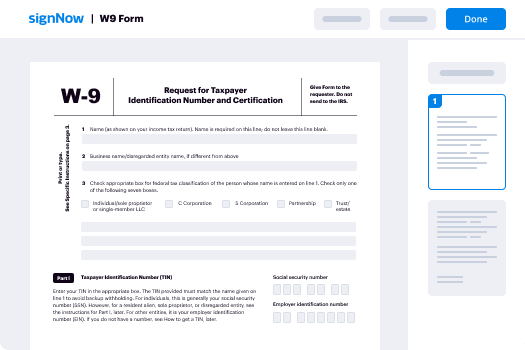

Your complete how-to guide - debit memo

At present, you most likely won't find an organization that doesn't use modern day technological innovation to atomize workflow. A digital signature is no longer the future, but the present. Contemporary businesses with their turnover simply cannot afford to stop web-based platforms that provide superior document processing automation tools, including Sign Debit Memo option.

How to handle Sign Debit Memo airSlate SignNow function:

-

Once you enter our web site, Login or register your account if you don't have one, it will require you a matter of moments.

-

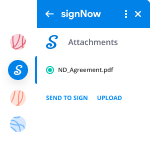

Upload the appropriate record or pick one from your catalogue folders: Documents, Archive, Templates.

-

cloud-based storage compatibility, you may quickly import the needed doc from preferred clouds with practically any gadget.

-

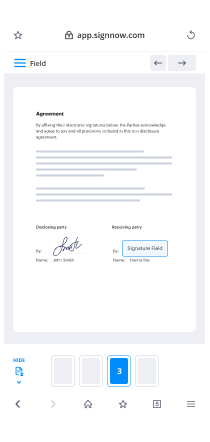

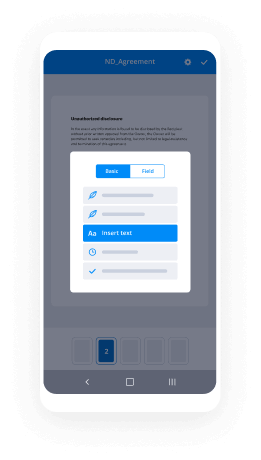

You'll find your data file opened in the up-to-date PDF Editor where you can include adjustments prior to move forward.

-

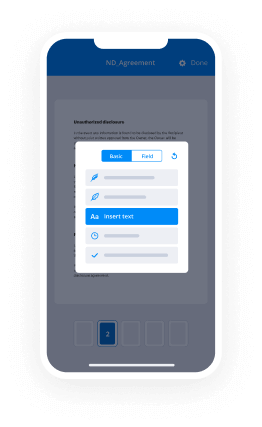

Type text, place images, add annotations or fillable boxes to be finished further.

-

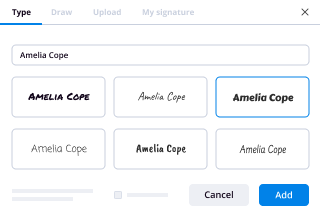

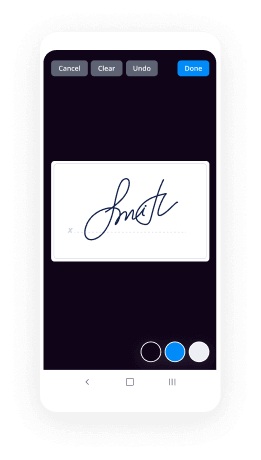

Use My Signature button for self-signing or add Signature Fields to deliver the eSign request to a single or numerous recipients.

-

Tap the DONE button when completed to go on with Sign Debit Memo feature.

airSlate SignNow browser platform is essential to increase the effectiveness and performance of most operational processes. Sign Debit Memo is one of the capabilities that will help. Utilizing the internet-based software these days is a basic need, not just a competitive advantage. Give it a try now!

How it works

Rate your experience

What is the force pay debit memo

A force pay debit memo is a financial document used by businesses to authorize a debit transaction that is processed outside the normal payment cycle. This memo serves as a record of the transaction, detailing the amount debited from an account and the reason for the debit. It is often used to correct billing errors or to process payments that require immediate attention. Understanding the force pay debit memo is essential for maintaining accurate financial records and ensuring compliance with accounting practices.

How to use the force pay debit memo

Using a force pay debit memo involves several key steps. First, the business must accurately fill out the memo, including details such as the account number, transaction date, and the amount to be debited. Once completed, the memo should be reviewed for accuracy before being submitted for approval. After obtaining the necessary approvals, the memo can be processed electronically, allowing for efficient tracking and management of the transaction. Utilizing airSlate SignNow for this process ensures that all parties can eSign the document securely and conveniently.

Steps to complete the force pay debit memo

Completing a force pay debit memo electronically can be streamlined through the following steps:

- Access the force pay debit memo template on airSlate SignNow.

- Fill in the required fields, including account details and transaction specifics.

- Review the information for accuracy to prevent errors.

- Send the memo for signature to all necessary parties.

- Once signed, securely store the completed document for your records.

This electronic workflow not only simplifies the process but also enhances accountability and traceability.

Legal use of the force pay debit memo

The force pay debit memo must be used in accordance with applicable laws and regulations governing financial transactions. In the United States, it is crucial for businesses to ensure that all debit memos are properly authorized and documented to avoid potential legal issues. By using airSlate SignNow, businesses can maintain compliance through secure electronic signatures and a clear audit trail, which is essential for legal and financial accountability.

Key elements of the force pay debit memo

Key elements that should be included in a force pay debit memo are:

- Account Information: The account number and name associated with the transaction.

- Transaction Details: The date of the transaction and the specific amount debited.

- Reason for Debit: A clear explanation of why the debit is necessary.

- Authorization Signatures: Signatures from authorized personnel to validate the transaction.

Incorporating these elements ensures clarity and facilitates a smooth transaction process.

Examples of using the force pay debit memo

Examples of situations where a force pay debit memo may be utilized include:

- Correcting an overpayment made to a vendor.

- Processing a late fee that needs immediate payment.

- Adjusting payroll discrepancies for employees.

- Handling refunds for returned merchandise.

These examples illustrate the practical applications of the force pay debit memo in various business scenarios, highlighting its importance in maintaining financial accuracy.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

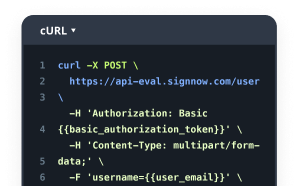

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is a force pay debit memo?

A force pay debit memo is a notification sent by a financial institution to inform a company that their account will be debited for a specific amount. It is usually issued when there are insufficient funds in the account to cover a payment or transaction. The memo serves as a reminder to the company to make arrangements to deposit funds into their account to cover the debit.

-

How can airSlate SignNow help with force pay debit memos?

airSlate SignNow simplifies the creation and management of force pay debit memos by providing an intuitive eSigning platform. Users can easily draft, send, and track these memos, ensuring that all parties are informed and compliant. This efficiency can signNowly reduce billing errors and improve cash flow.

-

Is there a cost associated with using airSlate SignNow for force pay debit memos?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and reflects the value of features like eSigning and document management, which can enhance your handling of force pay debit memos. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing force pay debit memos?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking for force pay debit memos. These tools help ensure that your memos are processed efficiently and securely. Additionally, the platform supports multiple file formats, making it versatile for various business needs.

-

Can I integrate airSlate SignNow with other software for force pay debit memos?

Absolutely! airSlate SignNow offers integrations with popular accounting and CRM software, allowing seamless management of force pay debit memos. This connectivity ensures that your financial data is synchronized across platforms, enhancing overall operational efficiency.

-

What are the benefits of using airSlate SignNow for force pay debit memos?

Using airSlate SignNow for force pay debit memos provides numerous benefits, including increased accuracy, faster processing times, and improved compliance. The platform's user-friendly interface allows for quick adjustments and approvals, which can lead to better cash flow management. Overall, it enhances your billing operations.

-

Is airSlate SignNow secure for handling force pay debit memos?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your force pay debit memos are protected. The platform employs advanced encryption and authentication measures to safeguard sensitive information. You can trust that your documents are secure throughout the signing process.

Debit memo

Trusted eSignature solution - debit memo

Join over 28 million airSlate SignNow users

Get more for debit memo

- Try Seamless eSignatures: how to eSign a document on ...

- Find All You Need to Know: how to eSign a PDF document ...

- Find All You Need to Know: how to eSign a PDF windows

- Enjoy Flexible eSignature Workflows: how to eSign ...

- Start Your eSignature Journey: how to eSign Excel

- Start Your eSignature Journey: how to eSign for free

- Try Seamless eSignatures: how to eSign in Word document

- Start Your eSignature Journey: how to eSign on a Mac

The ins and outs of eSignature