Start Your eSignature Journey: Electronic Signature Software for Accountants

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Speed up your document workflows with eSignature by airSlate SignNow

Take full advantage of valid eSignatures

Create signing orders

Use eSignatures outside airSlate SignNow

Enhance your teamwork

Electronic signature software for accountants professionally

Save time with shareable links

Quick guide on how to electronic signature software for accountants

Every organization requires signatures, and every organization is looking to optimize the procedure of gathering them. Get accurate document managing with airSlate SignNow. You can electronic signature software for accountants, generate fillable web templates, set up eSignature invites, send out signing hyperlinks, collaborate in teams, and a lot more. Learn how to improve the collection of signatures electronically.

Follow the steps below to electronic signature software for accountants in minutes:

- Launch your browser and visit signnow.com.

- Sign up for a free trial or log in utilizing your email or Google/Facebook credentials.

- Click on User Avatar -> My Account at the top-right corner of the webpage.

- Personalize your User Profile with your personal information and adjusting settings.

- Create and manage your Default Signature(s).

- Return to the dashboard webpage.

- Hover over the Upload and Create button and choose the needed option.

- Click on the Prepare and Send option next to the document's title.

- Type the name and email address of all signers in the pop-up window that opens.

- Use the Start adding fields option to proceed to modify document and self sign them.

- Click on SAVE AND INVITE when completed.

- Continue to fine-tune your eSignature workflow using advanced features.

It can't get any simpler to electronic signature software for accountants than that. Also, you can install the free airSlate SignNow app to your mobile phone and access your profile wherever you happen to be without being tied to your computer or workplace. Go digital and start signing contracts online.

How it works

Rate your experience

What is electronic signature software for accountants

Electronic signature software for accountants provides a digital solution for signing and managing financial documents efficiently. This software allows accountants to create, send, and receive legally binding eSignatures, streamlining workflows and reducing the reliance on paper-based processes. By using electronic signatures, accountants can enhance productivity, ensure compliance with regulations, and improve client satisfaction through faster turnaround times.

How to use electronic signature software for accountants

Using electronic signature software for accountants involves a straightforward process. First, users can upload the document that requires signatures. Next, they can specify the signers and their respective signing order, if necessary. Once the document is set up, users can send it for signature via email or a secure link. Signers can access the document, fill in any required fields, and eSign it directly from their devices. After all signatures are collected, the completed document is securely stored and can be easily retrieved for future reference.

Steps to complete the electronic signature software for accountants

Completing a document using electronic signature software involves several key steps:

- Upload the document to the software platform.

- Specify the recipients who need to sign the document.

- Set any required fields for completion, such as dates or initials.

- Send the document for signature.

- Notify signers to review and eSign the document.

- Receive notifications once the document is fully signed.

- Download or store the signed document securely within the platform.

Legal use of electronic signature software for accountants

Electronic signatures are legally recognized in the United States under the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that eSignatures hold the same legal weight as traditional handwritten signatures, provided that certain conditions are met. Accountants must ensure that they use compliant software that maintains the integrity and security of the signed documents, safeguarding against fraud and ensuring authenticity.

Security & Compliance Guidelines

When using electronic signature software, accountants should adhere to several security and compliance guidelines to protect sensitive information:

- Ensure the software uses encryption to protect data during transmission.

- Verify that the platform complies with relevant regulations, such as HIPAA for healthcare-related documents.

- Utilize multi-factor authentication for added security when accessing the software.

- Regularly update software to protect against vulnerabilities.

- Maintain a secure audit trail that tracks all actions taken on the document.

Documents You Can Sign

Accountants can use electronic signature software to sign a variety of documents, including:

- Tax returns and forms

- Engagement letters

- Financial statements

- Contracts and agreements

- Client onboarding documents

This versatility allows accountants to streamline their operations and enhance client interactions by reducing the time spent on document processing.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

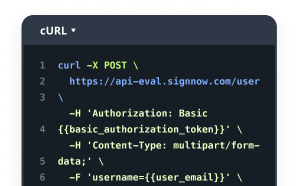

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is electronic signature software for accountants?

Electronic signature software for accountants is a digital tool that allows accountants to sign, send, and manage documents electronically. This software streamlines the signing process, making it faster and more efficient, while ensuring compliance with legal standards.

-

How does airSlate SignNow benefit accountants?

airSlate SignNow provides accountants with a user-friendly platform to manage their document workflows. With features like templates and automated reminders, it enhances productivity and reduces the time spent on paperwork, allowing accountants to focus on their core tasks.

-

Is airSlate SignNow electronic signature software for accountants cost-effective?

Yes, airSlate SignNow offers competitive pricing plans tailored for accountants. By reducing the need for physical paperwork and streamlining processes, this electronic signature software for accountants can lead to signNow cost savings over time.

-

What features does airSlate SignNow offer for accountants?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage. These functionalities are designed to meet the specific needs of accountants, ensuring that they can efficiently manage their electronic signatures and documents.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow electronic signature software for accountants seamlessly integrates with popular accounting software like QuickBooks and Xero. This integration allows for a smoother workflow, enabling accountants to manage documents directly within their existing systems.

-

Is airSlate SignNow secure for sensitive accounting documents?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Accountants can confidently use this electronic signature software for accountants to handle sensitive documents, knowing that their data is protected.

-

How easy is it to use airSlate SignNow for accountants?

airSlate SignNow is designed with user-friendliness in mind, making it easy for accountants to navigate. The intuitive interface allows users to quickly learn how to send and sign documents, minimizing the learning curve associated with new software.