eSign Mortgage Documents - Easy and Fast

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

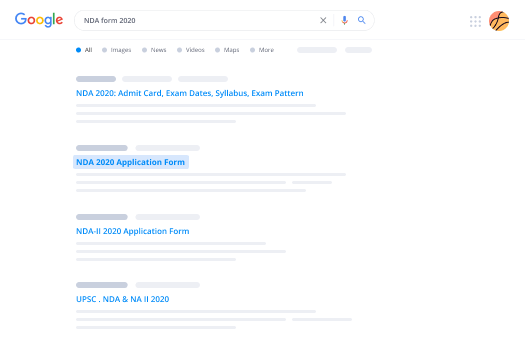

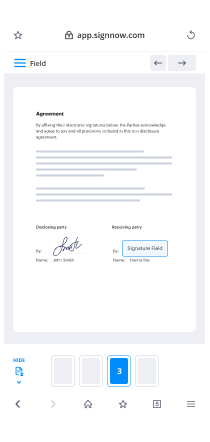

Quick-start guide on how to eSign mortgage documents

Every company requires signatures, and every company wants to enhance the procedure of gathering them. Get professional document management with airSlate SignNow. You can eSign mortgage documents, create fillable templates, customize eSignature invites, deliver signing links, collaborate in teams, and much more. Learn how to simplify the collection of signatures electronically.

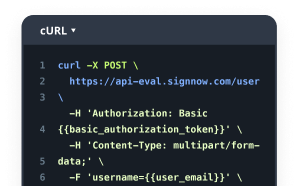

Complete the following steps listed below to eSign mortgage documents within a few minutes:

- Launch your web browser and visit signnow.com.

- Join for a free trial run or log in using your email or Google/Facebook credentials.

- Click on User Avatar -> My Account at the top-right corner of the page.

- Modify your User Profile by adding personal data and adjusting configurations.

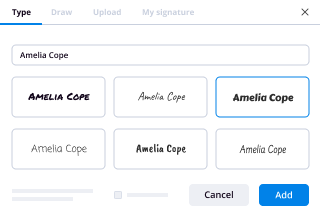

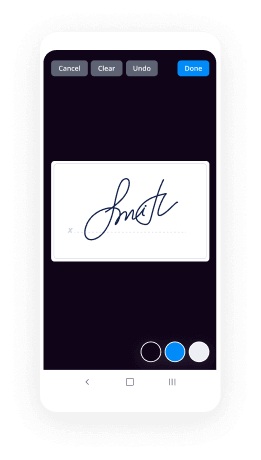

- Create and manage your Default Signature(s).

- Return to the dashboard page.

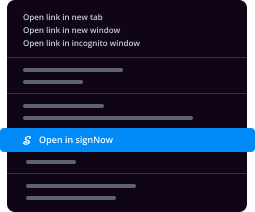

- Hover over the Upload and Create button and select the appropriate option.

- Click on the Prepare and Send button next to the document's title.

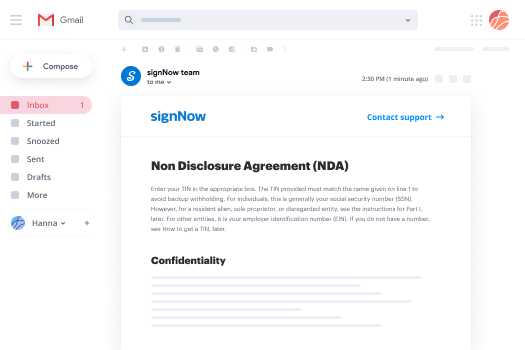

- Input the name and email address of all signers in the pop-up box that opens.

- Make use of the Start adding fields menu to proceed to modify document and self sign them.

- Click SAVE AND INVITE when accomplished.

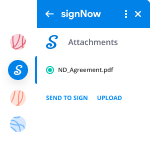

- Continue to customize your eSignature workflow using advanced features.

It can't get any easier to eSign mortgage documents than that. Also, you can install the free airSlate SignNow app to your mobile phone and access your account wherever you happen to be without being tied to your desktop computer or office. Go paperless and start signing documents online.

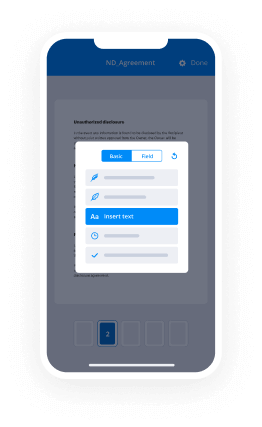

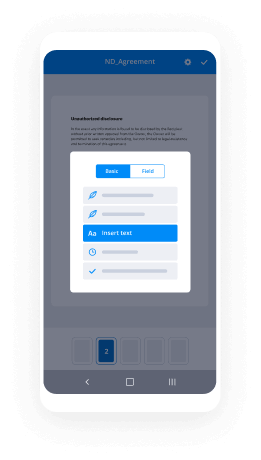

How it works

Rate your experience

What is the esign mortgage documents

The esign mortgage documents are electronic versions of traditional mortgage documents that allow parties involved in a mortgage transaction to complete, sign, and manage the paperwork digitally. This process streamlines the mortgage application and approval workflow, making it more efficient and less time-consuming. By using eSignature technology, borrowers and lenders can sign documents securely and conveniently from anywhere, eliminating the need for physical paperwork and in-person meetings.

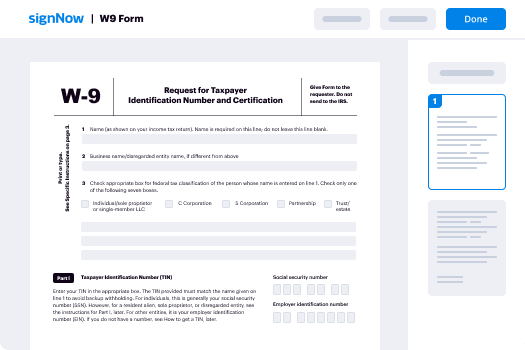

How to use the esign mortgage documents

Using esign mortgage documents involves several straightforward steps. First, users can upload their mortgage documents to the airSlate SignNow platform. Once uploaded, they can fill in necessary information directly within the document. After completing the required fields, users can send the document for signature to other parties involved in the transaction, such as co-borrowers or lenders. Each recipient will receive a notification prompting them to review and sign the document electronically, ensuring a smooth and efficient process.

Steps to complete the esign mortgage documents

To complete esign mortgage documents, follow these steps:

- Log in to your airSlate SignNow account or create a new one.

- Upload the mortgage documents you need to complete.

- Fill in the necessary fields, such as borrower information and loan details.

- Review the document for accuracy.

- Send the document to all required signers for their electronic signatures.

- Monitor the signing status through your airSlate SignNow dashboard.

- Once all parties have signed, download or store the completed document securely.

Legal use of the esign mortgage documents

Esign mortgage documents are legally binding in the United States, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN Act) and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures hold the same legal weight as traditional handwritten signatures. It is essential to ensure that all parties involved consent to the use of electronic signatures and that the documents meet any specific state regulations regarding electronic transactions.

Security & Compliance Guidelines

When using esign mortgage documents, security and compliance are paramount. airSlate SignNow employs advanced encryption methods to protect sensitive information during transmission and storage. Users should ensure that their accounts are secured with strong passwords and two-factor authentication. Additionally, it is important to maintain compliance with relevant regulations, such as the Gramm-Leach-Bliley Act (GLBA), which governs the handling of personal financial information. Regular audits and adherence to best practices can further enhance the security of electronic mortgage documents.

Examples of using the esign mortgage documents

Esign mortgage documents can be utilized in various scenarios, including:

- Completing loan applications remotely.

- Signing mortgage agreements without the need for in-person meetings.

- Facilitating refinancing processes quickly and efficiently.

- Managing document revisions and approvals in real time.

These examples illustrate how electronic signatures can simplify the mortgage process for both borrowers and lenders, enhancing overall efficiency and user experience.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is the process to esign mortgage documents using airSlate SignNow?

To esign mortgage documents with airSlate SignNow, simply upload your documents to the platform, add the necessary fields for signatures, and send them to the relevant parties. Recipients can easily sign the documents electronically from any device, ensuring a smooth and efficient process. This eliminates the need for printing and scanning, making it a convenient choice for all parties involved.

-

How much does it cost to esign mortgage documents with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, with options that allow you to esign mortgage documents at an affordable rate. Additionally, there is a free trial available, so you can explore the features before committing to a plan.

-

What features does airSlate SignNow offer for esigning mortgage documents?

airSlate SignNow provides a range of features designed to streamline the process of esigning mortgage documents. These include customizable templates, real-time tracking of document status, and secure cloud storage. The platform also supports multiple file formats, ensuring that you can work with any document type seamlessly.

-

Is it safe to esign mortgage documents with airSlate SignNow?

Yes, it is safe to esign mortgage documents with airSlate SignNow. The platform employs advanced encryption and security protocols to protect your sensitive information. Additionally, all signatures are legally binding, ensuring that your documents are secure and compliant with industry regulations.

-

Can I integrate airSlate SignNow with other software for esigning mortgage documents?

Absolutely! airSlate SignNow offers integrations with various popular software applications, allowing you to streamline your workflow when esigning mortgage documents. Whether you use CRM systems, cloud storage solutions, or project management tools, you can easily connect them with airSlate SignNow for enhanced efficiency.

-

What are the benefits of using airSlate SignNow to esign mortgage documents?

Using airSlate SignNow to esign mortgage documents offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. The platform simplifies the signing process, allowing you to complete transactions faster and with fewer errors. Additionally, it enhances the overall customer experience by providing a user-friendly interface.

-

Can multiple parties esign mortgage documents simultaneously with airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to esign mortgage documents simultaneously. This feature facilitates quicker transactions, as all involved parties can sign the document at their convenience. It also helps to eliminate delays often associated with traditional signing methods.