Irs Electronic Signature Requirements

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

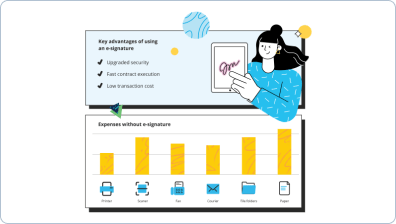

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Make the most of your eSignatures with airSlate SignNow

Boost work with documentation

Edit forms safely

Share files

Make use of Irs electronic signature requirements

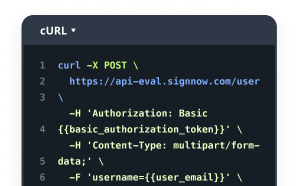

Integrate eSignatures with API

Create simple workflows

Quick-start guide on how to use irs electronic signature requirements feature

Is your organization ready to cut inefficiencies by three-quarters or more? With airSlate SignNow eSignature, weeks of contract negotiation become days, and hours of signature collection become a few minutes. You won't need to learn everything from the ground up due to the user-friendly interface and step-by-step guides.

Follow the steps below to use the irs electronic signature requirements functionality in minutes:

- Open your browser and go to signnow.com.

- Sign up for a free trial or log in using your email or Google/Facebook credentials.

- Click on User Avatar -> My Account at the top-right corner of the page.

- Customize your User Profile with your personal information and adjusting settings.

- Create and manage your Default Signature(s).

- Go back to the dashboard page.

- Hover over the Upload and Create button and select the needed option.

- Click the Prepare and Send button next to the document's name.

- Enter the name and email address of all signers in the pop-up window that opens.

- Use the Start adding fields option to begin to edit document and self sign them.

- Click SAVE AND INVITE when you're done.

- Continue to customize your eSignature workflow using advanced features.

It can't get any easier to use the irs electronic signature requirements feature. It's available on your mobile devices as well. Install the airSlate SignNow application for iOS or Android and manage your custom eSignature workflows even while on the move. Put away printing and scanning, labor-intensive filing, and expensive document delivery.

How it works

Rate your experience

What are the IRS eSignature requirements?

The IRS eSignature requirements refer to the guidelines that govern the use of electronic signatures on tax forms and documents submitted to the Internal Revenue Service. These requirements ensure that electronic signatures are legally valid and secure, allowing taxpayers to sign documents digitally without the need for physical signatures. The IRS accepts electronic signatures for various forms, including Form 2553 and Form 2848, as long as specific conditions are met. Understanding these requirements is crucial for ensuring compliance and avoiding potential issues with tax submissions.

How to use the IRS eSignature requirements

To effectively utilize the IRS eSignature requirements, users must first confirm that their chosen forms are eligible for electronic signatures. Once confirmed, individuals can complete the forms online, using airSlate SignNow to fill out the necessary fields. After completing the form, users can send it for signature electronically. The airSlate SignNow platform provides a straightforward process for requesting signatures, allowing users to manage the entire workflow digitally. This process not only streamlines submissions but also enhances security and tracking.

Steps to complete the IRS eSignature requirements

Completing the IRS eSignature requirements involves several key steps:

- Identify the specific IRS form that requires an electronic signature.

- Access the form through airSlate SignNow or another electronic platform.

- Fill out the form accurately, ensuring all necessary information is included.

- Use the eSignature feature to sign the document electronically.

- Submit the signed document to the IRS through the appropriate electronic filing method.

Following these steps ensures compliance with IRS regulations and facilitates a smooth submission process.

Legal use of the IRS eSignature requirements

The legal use of IRS eSignature requirements hinges on compliance with federal regulations and IRS guidelines. Electronic signatures are considered valid if they meet the criteria established by the IRS, which include the intent to sign, consent to use electronic signatures, and the ability to retain a copy of the signed document. It is essential for users to understand these legalities to ensure that their electronically signed documents are enforceable and accepted by the IRS.

Documents you can sign

Various IRS forms can be signed electronically, including but not limited to:

- Form 2553: Election by a Small Business Corporation

- Form 2848: Power of Attorney and Declaration of Representative

- Form 4506-T: Request for Transcript of Tax Return

These forms are commonly used in tax processes and can be completed and signed using airSlate SignNow, making the filing experience more efficient.

Security & Compliance Guidelines

When utilizing eSignatures for IRS documents, adhering to security and compliance guidelines is vital. Users should ensure that their electronic signature solutions, like airSlate SignNow, comply with the IRS's standards for data protection and privacy. This includes using secure connections, maintaining confidentiality of sensitive information, and ensuring that the electronic signature process is tamper-proof. Regularly reviewing security protocols and compliance measures can help safeguard against potential breaches and ensure the integrity of submitted documents.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is an IRS digital signature?

An IRS digital signature is a secure electronic signature that allows taxpayers to sign documents submitted to the IRS electronically. This method ensures authenticity and integrity, making it a reliable option for filing tax returns and other IRS forms.

-

How does airSlate SignNow support IRS digital signatures?

airSlate SignNow provides a seamless platform for creating and managing IRS digital signatures. Our solution ensures compliance with IRS regulations, allowing users to sign documents securely and efficiently, streamlining the filing process.

-

Is airSlate SignNow cost-effective for businesses needing IRS digital signatures?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to manage IRS digital signatures without breaking the bank, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for IRS digital signatures?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for IRS digital signatures. These tools enhance the signing experience, making it easier for users to manage their documents efficiently.

-

Can I integrate airSlate SignNow with other software for IRS digital signatures?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when using IRS digital signatures. This flexibility ensures that you can incorporate our solution into your existing systems seamlessly.

-

What are the benefits of using airSlate SignNow for IRS digital signatures?

Using airSlate SignNow for IRS digital signatures provides numerous benefits, including enhanced security, improved efficiency, and reduced paperwork. Our platform simplifies the signing process, allowing you to focus on your core business activities.

-

Is it easy to use airSlate SignNow for IRS digital signatures?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface makes it easy for anyone to create and manage IRS digital signatures, regardless of their technical expertise, ensuring a smooth experience.

Irs electronic signature requirements

Trusted eSignature solution - irs electronic signature requirements

Join over 28 million airSlate SignNow users

Get more for irs electronic signature requirements

- Start Your eSignature Journey: insert online signature

- Find All You Need to Know: insert signature in PDF ...

- Start Your eSignature Journey: insert signature online

- Start Your eSignature Journey: instant signature loans ...

- Start Your eSignature Journey: Is an online signature ...

- Start Your eSignature Journey: Is eSign free?

- Start Your eSignature Journey: Is eSign legal?

- Start Your eSignature Journey: learn signature online

The ins and outs of eSignature