IRS Signature Requirements in India

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your complete how-to guide - irs signature requirements in india

Improve your workflows: IRS signature requirements in India

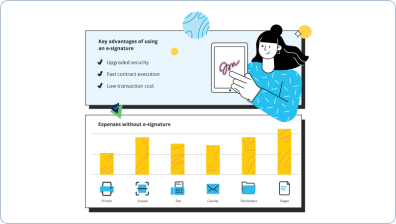

Nowadays, printing hard copies of documents and manual signing is absolutely nothing but wasting time and effort. Millions of people around the world are going digital every single day and replacing wet signatures with electronic ones.

airSlate SignNow makes using the IRS signature requirements in India simple and fast, all without you having to go somewhere from your home. Access an easy-to-use solution with global compliance and high security standards.

IRS signature requirements in India: how to get started

- Create an account. Open signnow.com, click Free trial to get started.

- Choose a doc. Click the blue Upload Documents button and find a PDF from the device or drag and drop one into the designated area.

- Adjust the document. Insert new texts, checkmarks, dates and so on, from the left toolbar.

- Make the PDF file interactive. Add fillable fields, dropdowns, radio button groups, and more.

- Add a payment request. Select Settings > Request Payment.

- Check the your doc. Make sure everything is up-to-date and correct.

- Add signature fields. Add a Signature Field for each recipient you need.

- Sign the document. Click the My Signature tool and choose to draw, type, or capture image of your signature.

- Send the document for signing. Click Invite to Sign and insert recipient email(s) to send an eSignature request.

- Download your form. Select Save and Close > Download (on the right sidebar) to save the file on your device.

Get professional IRS signature requirements in India with airSlate SignNow.

Start your Free trial today and enhance your document workflows!

How it works

Rate your experience

What is the IRS signature requirements in India

The IRS signature requirements in India pertain to the necessary protocols for signing tax-related documents, particularly for U.S. citizens and residents who are required to file taxes while living abroad. These requirements ensure that all signatures on tax forms are authentic and legally binding. Typically, this includes the use of electronic signatures, which are recognized under U.S. law, provided they meet specific criteria. Understanding these requirements is crucial for compliance and can help prevent delays in processing tax returns.

How to use the IRS signature requirements in India

To effectively use the IRS signature requirements in India, individuals must first familiarize themselves with the specific forms that require signatures. Once identified, users can complete these forms electronically using airSlate SignNow. This process involves filling out the necessary information, applying an eSignature, and securely sending the document for approval. Utilizing an electronic signature solution streamlines the process, ensuring that all signatures are captured accurately and stored securely.

Steps to complete the IRS signature requirements in India

Completing the IRS signature requirements involves several key steps:

- Identify the specific IRS forms that require a signature.

- Access the forms through a reliable source or tax software.

- Fill out the forms with accurate information, ensuring all required fields are completed.

- Use airSlate SignNow to apply your electronic signature, which can be done easily on a computer or mobile device.

- Send the completed forms for signature to any additional parties, if necessary.

- Store the signed documents securely for your records.

Legal use of the IRS signature requirements in India

The legal use of IRS signature requirements in India is governed by both U.S. and Indian law. U.S. law recognizes electronic signatures as legally binding, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. For individuals in India, it is important to ensure that any eSignature solution used, such as airSlate SignNow, adheres to these legal standards. This compliance helps to ensure that all signed documents are valid and enforceable.

Security & Compliance Guidelines

When dealing with IRS signature requirements, security and compliance are paramount. Users should ensure that their electronic signature platform, like airSlate SignNow, employs robust security measures, such as encryption and secure storage. Additionally, it is essential to maintain compliance with both IRS regulations and local laws. Regular audits of your eSignature processes and documentation practices can help mitigate risks and ensure ongoing compliance.

Documents You Can Sign

Various documents can be signed under the IRS signature requirements, including tax returns, forms for extensions, and other related tax documents. Using airSlate SignNow, users can easily fill and sign these documents electronically. This capability not only simplifies the signing process but also allows for quick sharing and secure storage of completed forms, ensuring that all necessary documentation is readily accessible when needed.

Sending & Signing Methods (Web / Mobile / App)

airSlate SignNow offers multiple methods for sending and signing documents, catering to user preferences and needs. Users can access the platform via a web browser, mobile app, or desktop application. Each method allows for seamless document management, enabling users to fill out forms, apply eSignatures, and send documents for signature from virtually anywhere. This flexibility is particularly beneficial for those managing their tax obligations while in India.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What are the IRS signature requirements in India for electronic signatures?

The IRS signature requirements in India allow for electronic signatures to be used in various tax-related documents. These signatures must comply with the Information Technology Act, ensuring authenticity and integrity. Using airSlate SignNow, you can easily meet these requirements while streamlining your document signing process.

-

How does airSlate SignNow help with IRS signature requirements in India?

airSlate SignNow provides a user-friendly platform that simplifies the process of obtaining electronic signatures. Our solution ensures compliance with IRS signature requirements in India, allowing businesses to securely sign and send documents. This not only saves time but also enhances the overall efficiency of your operations.

-

What features does airSlate SignNow offer to meet IRS signature requirements in India?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and audit trails that help meet IRS signature requirements in India. These features ensure that your documents are signed legally and securely. Additionally, our platform supports various file formats, making it versatile for different business needs.

-

Is airSlate SignNow cost-effective for businesses needing to comply with IRS signature requirements in India?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to comply with IRS signature requirements in India. Our pricing plans are designed to fit various budgets, ensuring that you can access essential eSigning features without breaking the bank. This affordability makes it an ideal choice for small to medium-sized enterprises.

-

Can airSlate SignNow integrate with other software to help with IRS signature requirements in India?

Absolutely! airSlate SignNow offers seamless integrations with popular software such as CRM systems, document management tools, and accounting software. This capability allows businesses to streamline their workflows while ensuring compliance with IRS signature requirements in India. Integrating our solution enhances productivity and reduces manual errors.

-

What are the benefits of using airSlate SignNow for IRS signature requirements in India?

Using airSlate SignNow for IRS signature requirements in India provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are signed quickly and securely, which is crucial for meeting deadlines. Additionally, the ease of use encourages higher adoption rates among team members.

-

How secure is airSlate SignNow in relation to IRS signature requirements in India?

airSlate SignNow prioritizes security, ensuring that all electronic signatures comply with IRS signature requirements in India. We utilize advanced encryption and authentication methods to protect your documents. This commitment to security helps build trust with your clients and partners, knowing that their sensitive information is safe.

Irs signature requirements in india

Trusted eSignature solution - irs signature requirements in india

Related searches to irs signature requirements in india

Join over 28 million airSlate SignNow users

Get more for irs signature requirements in india

- Unlock Electronic Signature Licitness for Security in ...

- Electronic Signature Licitness for Security in European ...

- Unlock the Electronic Signature Licitness for Security ...

- Unlock the Power of Electronic Signature Licitness for ...

- Maximize electronic signature licitness for R&D in ...

- Unlock the Potential of Electronic Signature Licitness ...

- Unlock the Full Potential of Electronic Signature ...

- Enhance Research and Development in EU with Legally ...

The ins and outs of eSignature