Sign Notice of Credit Limit Increase

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Top-notch form management with airSlate SignNow

Gain access to a rich form collection

Create reusable templates

Collect signatures through secure links

Keep paperwork safe

Enhance collaboration

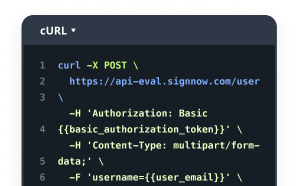

eSign by means of API integrations

Quick guide on how to build, fill in, and sign notice of credit limit increase

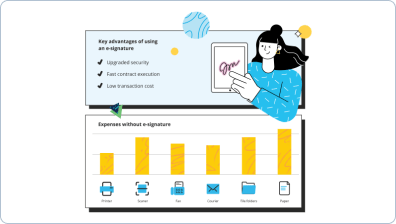

Think of all the paper that you waste to print notice of credit limit increase, not counting the countless other documents that are dozens of pages long that your organization uses weekly. That's a lot of wasted paper. It directly correlates to wasted natural resources and, of course, as well as spending budget. With airSlate SignNow eSignature, you can go paperless, minimizing waste and improving efficiency.

Follow the steps listed below to edit and indication notice of credit limit increase quickly:

- Launch your web browser and access signnow.com.

- Join for a free trial run or log in with your electronic mail or Google/Facebook credentials.

- Select User Avatar -> My Account at the top-right area of the webpage.

- Modify your User Profile with your personal data and altering configurations.

- Make and manage your Default Signature(s).

- Get back to the dashboard webpage.

- Hover over the Upload and Create button and choose the appropriate option.

- Click on the Prepare and Send key next to the document's title.

- Input the email address and name of all signers in the pop-up screen that opens.

- Make use of the Start adding fields option to begin to modify file and self sign them.

- Click on SAVE AND INVITE when accomplished.

- Continue to configure your eSignature workflow employing extra features.

It can't get any easier to sign a notice of credit limit increase than that. If creating, editing, signing and tracking numerous documents and forms seems like an administrative hassle for your teams, give powerful eSignature by airSlate SignNow a try.

How it works

Rate your experience

What is the dimg 2683ocuments

The dimg 2683ocuments serve as essential forms used in various business and financial contexts. They typically relate to credit limit adjustments, providing a formal notice regarding changes in credit policies. Understanding the purpose of these documents is crucial for both businesses and consumers, as they outline the terms and conditions associated with credit limits and any potential increases or decreases.

How to use the dimg 2683ocuments

Using the dimg 2683ocuments involves a straightforward process. Users can fill out the necessary fields online, ensuring that all required information is accurate and complete. Once filled, the document can be sent for eSignature to relevant parties. This electronic workflow simplifies the process, allowing for quick approvals and reducing the need for physical paperwork.

Steps to complete the dimg 2683ocuments

Completing the dimg 2683ocuments can be done efficiently through the following steps:

- Access the document through your airSlate SignNow account.

- Fill in all required fields, including personal and financial information.

- Review the document for accuracy.

- Send the document for signature to the necessary parties.

- Once signed, securely store the completed document in your airSlate SignNow account.

Legal use of the dimg 2683ocuments

The dimg 2683ocuments must adhere to legal standards governing electronic signatures in the United States. This includes compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which validates electronic signatures as legally binding. Ensuring that the document is properly executed and stored is vital for its legal enforceability.

Security & Compliance Guidelines

When handling the dimg 2683ocuments, it is important to follow security and compliance guidelines to protect sensitive information. airSlate SignNow employs advanced encryption methods to secure documents during transmission and storage. Users should also ensure that they are sharing documents only with authorized individuals to maintain confidentiality and integrity.

Sending & Signing Methods (Web / Mobile / App)

The dimg 2683ocuments can be sent and signed using various methods, including web browsers, mobile devices, and dedicated applications. This flexibility allows users to manage documents on-the-go, ensuring that they can complete transactions quickly and efficiently. Each method provides a user-friendly interface for filling out and signing documents electronically.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What are dimg 2683ocuments and how can airSlate SignNow help?

Dimg 2683ocuments refer to digital documents that require electronic signatures. airSlate SignNow simplifies the process of sending and eSigning these documents, making it easy for businesses to manage their paperwork efficiently.

-

What features does airSlate SignNow offer for managing dimg 2683ocuments?

airSlate SignNow provides a range of features for dimg 2683ocuments, including customizable templates, real-time tracking, and secure storage. These features ensure that your documents are handled efficiently and securely throughout the signing process.

-

How does airSlate SignNow ensure the security of my dimg 2683ocuments?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and compliance with industry standards to protect your dimg 2683ocuments, ensuring that they remain confidential and secure during transmission and storage.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while effectively managing your dimg 2683ocuments.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with various applications, enhancing your workflow. You can easily connect it with CRM systems, cloud storage services, and other tools to streamline the management of your dimg 2683ocuments.

-

What are the benefits of using airSlate SignNow for dimg 2683ocuments?

Using airSlate SignNow for dimg 2683ocuments offers numerous benefits, including increased efficiency, reduced turnaround time, and improved accuracy. The platform allows you to manage your documents seamlessly, saving time and resources.

-

Is airSlate SignNow user-friendly for managing dimg 2683ocuments?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to send and eSign dimg 2683ocuments. Its intuitive interface ensures that users can navigate the platform without any technical expertise.

Notice of credit limit increase

Trusted eSignature solution - notice of credit limit increase

Join over 28 million airSlate SignNow users

Get more for notice of credit limit increase

- Start Your eSignature Journey: how to create an ...

- Start Your eSignature Journey: how to create an eSign

- Find All You Need to Know: how to create an online ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Start Your eSignature Journey: how to create eSign

- Try Seamless eSignatures: how to create eSign in Word

- Find All You Need to Know: how to create eSign for PDF

The ins and outs of eSignature